Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Home Prices Climb as Supply Dwindles

Posted: August 13th, 2012

Home prices rose by their largest percentage in at least seven years during the second quarter, propelled by low inventories of properties for sale and high demand for bargain-priced foreclosures, according to two reports Tuesday.

Prices rose by 2.5% in June from a year ago, and by 6% from the previous quarter, said CoreLogic Inc., a Santa Ana, Calif., data firm. The quarterly jump was the largest since 2005.

Finally, It Is Time to Buy a House

Posted: August 13th, 2012

Warren Buffett famously once said: “Be fearful when others are greedy, be greedy when others are fearful.”

And if you’re not instinctively scared of the housing market, then global warming, saturated fat, running with scissors and the bogeyman probably aren’t keeping you awake at night, either.

The fact that everyone is scared to dabble in—much less commit to—housing makes it a close-to-perfect investment based on Mr. Buffett’s principle. But buying real estate is a good long-term investment for many more reasons, some of which have only become apparent in recent weeks.

Rise in Home Sales Points to Rebound

Posted: May 27th, 2012

![]()

Sales of previously owned homes rose at a robust clip in April—and prices jumped—the latest indications that the hard-hit housing market is recovering.

Existing-home sales were up 3.4% from March to a seasonally adjusted annual rate of 4.62 million, the National Association of Realtors trade group said Tuesday. If the pace holds, 2012 could be the strongest year for home sales since 2007, just after the housing boom. The median home price, meanwhile, increased 10.1% from a year earlier to $177,400, the strongest year-to-year gain since January 2006.

Builder Is Constructing REIT for Home Rentals

Posted: May 9th, 2012

![]()

Above, one of the company’s houses in Tolleson, Ariz.

Investors can buy stakes in malls, apartment towers, timber forests and even cellphone towers through real-estate investment trusts. Now, add to the list: single-family homes transformed into rental properties.

Beazer Pre-Owned Rental Homes Inc., which hopes to expand beyond Phoenix and Las Vegas to at least one other, as-yet unidentified market. Within two years, Beazer said the number of rental homes under the new REIT’s control could number in the thousands.

Wall Street Keys On Landlord Business

Posted: April 18th, 2012

![]()

Some of the biggest names on Wall Street are lining up to become landlords to cash-strapped Americans by bidding on pools of foreclosed properties being sold by Fannie Mae.

The idea is that the new owners would rent out the homes at first rather than reselling—potentially aiding a housing-market recovery by reducing the number of properties clogging the market. The fact that big-name investors are interested also suggests they anticipate sizable future profits in housing.

Fannie Mae’s Foreclosure Announcement

Navigating a Tight Rental Market

Posted: January 23rd, 2012

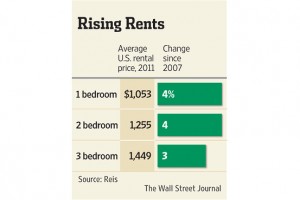

The rental market is the tightest it’s been in more than a decade, with only 5.2% of apartments nationwide vacant at the end of 2011, down from a high of 8% in 2009, according to real-estate data firm Reis.

Demand is up as the housing crisis and tighter lending standards have left many people unable to or wary of purchasing a home. And higher demand means average rents are rising, too.

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

Big Funds Build Case for Housing

Posted: December 30th, 2011

Big money is starting to wager on housing.

Hedge funds run by Caxton Associates LP, SAC Capital Advisors LP, Avenue Capital and Blackstone Group LP have been buying housing-related investments, betting on a rebound. And formerly bearish research firm Zelman & Associates now predicts a housing pickup, as does Goldman Sachs Group Inc.

Multifamily Construction Drives Housing Starts Jump

Posted: December 24th, 2011

![]()

ARTICLE, WSJ

SREP Note: We feel this article is important for investors to note because typically SREP funds acquire and reposition properties for less than their replacement cost.

U.S. home building climbed to the highest level in 19 months during November and construction permits grew, with most of the increase in housing starts coming from multifamily construction.

Home construction last month increased 9.3% to a seasonally adjusted annual rate of 685,000 from October, the Commerce Department said Tuesday. The results were better than forecast. Economists surveyed by Dow Jones Newswires expected housing starts would rise by 0.3% to an annual rate of 630,000.

The increase in November was driven by a 25.3% increase in multi-family homes with at least two units, a volatile part of the market. Construction of single-family homes, which made up about 65% percent of the market, rose only 2.3%.

Do You Really Want To Be a Landlord?

Posted: December 19th, 2011

![]()

ARTICLE, WSJ

Jeannette Boccini thought she had found a great renter, someone who would take extra good care of her townhouse. Then the nightmare began.

The tenant repeatedly harassed the neighbors, complained that the wood chips in the community playground were toxic, and informed Ms. Boccini on Christmas morning that someone was playing Christmas carols too loudly.

But the final straw was the night the tenant showed up at Ms. Boccini’s door to report there was dust all over the mailbox. “I absolutely flipped,” Ms. Boccini says. “I was like, ‘You don’t like it? Get the hell out of my house.’ ”

Like many these days, Ms. Boccini became a landlord not by choice but because of circumstances beyond her control: namely, the real-estate crash.

Housing Lift Proves Fleeting

Posted: October 21st, 2011

![]()

ARTICLE, WALL ST JOURNAL

Sales of previously owned homes slipped in September as Americans were hit by economic uncertainty, high unemployment and tight lending.

Data Thursday highlight how jobs and housing are the main economic drags. Job seekers in California this week.

Existing-home sales dropped 3% to a seasonally adjusted 4.91 million in September, the National Association of Realtors said Thursday. That followed a sales bump in August, as the housing market remains stuck in neutral despite lower prices and interest rates at near-historic lows.

Coming Next: The Landlord’s Rental Market

Posted: September 12th, 2011

![]()

Apartment landlords appear to be among the only commercial property owners able to sign new tenants amid the sluggish economy.

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

WSJ: Why It’s Time to Buy

Posted: June 8th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The short-term outlook isn’t encouraging. Job growth remains weak, foreclosure sales are making up more of the market, and economists are predicting that home prices will fall more in the coming months.But the long-term benefits of home ownership remain very much intact.

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

Cash Buyers Lift Housing

Posted: February 11th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority. WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

Home values are falling at an accelerating rate in many cities across the U.S.

Posted: January 31st, 2011

![]()

ARTICLE, WALL ST JOURNAL

The Wall Street Journal’s latest quarterly survey of housing-market conditions found that prices declined in all of the 28 major metropolitan areas tracked during the fourth quarter when compared to a year earlier.

The size of the year-to-year price declines was greater than the previous quarter’s in all but three of the markets, the latest indication that the housing market faces considerable challenges.

Inventory levels, meanwhile, are rising in many markets as the number of unsold homes piles up.

No McMansions for Millennials

Posted: January 18th, 2011

![]()

ARTICLE, WALL ST. JOURNAL

Gen Y housing preferences are the subject of at least two panels at this week’s convention. A key finding: They want to walk everywhere. Surveys show that 13% carpool to work, while 7% walk, said Melina Duggal, a principal with Orlando-based real estate adviser RCLCO. A whopping 88% want to be in an urban setting, but since cities themselves can be so expensive, places with shopping, dining and transit such as Bethesda and Arlington in the Washington suburbs will do just fine.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Multifamily Sales Defy the Slump

Posted: September 22nd, 2010

ARTICLE, WSJ, 09.22.2010

Home buyers might be sitting on the sidelines, but multifamily-building sales are on the rise, reversing the slowdown that followed the financial market’s collapse two years ago.

The vacancy rate, which peaked at 7.4% at the end of last year, is expected to drop to 5.5% by the end of 2011, according to CBRE Econometric Advisors.

Housing Prices Remain Weak

Posted: May 26th, 2010

![]()

ARTICLE, WSJ, 05.26.2010

“We’re just going to go through an adjustment period,” said Patrick Newport, an IHS Global Insight economist.

“After it settles, I think the market’s going to start growing sustainably because the [labor] market’s starting to create jobs,” he said.

House-Price Drops Leave More Underwater

Posted: May 23rd, 2010

![]()

ARTICLE, 05.23.2010

The downturn in home prices has left about 20% of U.S. homeowners owing more on a mortgage than their homes are worth, according to one new study, signaling additional challenges to the Obama administration’s efforts to stabilize the housing market.

Time for Housing to Clear

Posted: May 21st, 2010

![]()

ARTICLE, WSJ, 05.21.2010

In other words, the housing market may yet be allowed to clear. Painful, but inevitable.

Dumb Money Getting Smarter

Posted: May 5th, 2010

![]()

SEQUOIA STRATEGY, 05.05.2010

“Why was it OK to throw money down a hole when prices were rising, but it’s not now? Shouldn’t we be careful about how we spend money at all times?”

The 10 Must-Have Features in Today’s New Homes

Posted: April 12th, 2010

ARTICLE, WSJ.com, 2.1.2010

Buyers today want cost-effective architecture, plans that focus on spaces and not rooms and homes that are designed ‘green’ from the outset,”

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy