Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Banks see a housing rebound

Posted: October 13th, 2012

JPMorgan, Wells Fargo post big profit gains as home lending booms

America’s long-suffering housing market may be on the mend, two major banks said as they reported big jumps in profits.

JPMorgan Chase & Co. and Wells Fargo & Co., the nation’s largest home lenders, each reported double-digit quarterly earnings growth Friday. The big jump in profit was thanks largely to a surge in their mortgage businesses, fueled by low interest rates and waves of refinancing.

Economists: Housing recovery finally here

Posted: October 10th, 2012

NEW YORK (CNNMoney) — It’s been a long time coming, but economists surveyed by CNNMoney believe the nation’s housing market has finally turned the corner.

Of the 14 economists who answered questions about home prices in the survey, nine believe that prices have already turned higher or will make that turn later this year. Only three months ago, half of the economists surveyed by CNNMoney believed a turnaround in prices would not take place until 2013 or later.

Getting Warmer: Where Rent Prices are Hot (and Where They’re Cool)

Posted: October 10th, 2012

For those looking to live in a locale with an endless summer, it doesn’t come cheap.

On average, renters in Orange County, Calif. pony up more than $1,650 a month for an average two-bedroom apartment, according to new data from Homes.com and ForRent.com. To cover housing costs alone, residents have to rake in about $32 an hour, no small feat in a wage-depressed economy.

Interest rates are low, but it’s still hard to get a mortgage

Posted: October 10th, 2012

WASHINGTON — With 30-year mortgage rates hitting new lows and recent borrowers’ payment performance the best by far in decades, you’d think that banks and other lenders might be loosening up on their hyper-strict underwriting standards.

But new national data from inside the industry suggest this is not happening. In fact, in some key areas, standards appear to be tightening even further, and the time needed to close a loan is getting longer.

Housing recovery blossoms

Posted: October 10th, 2012

NEW YORK (CNNMoney) — The U.S. housing industry — crucial to any jobs recovery — showed more signs of strength, according to two reports issued Wednesday.

The Census Bureau said housing starts and permits rose substantially in August. Separately, sales of previously occupied homes climbed 7.8% from a year ago, according to the National Association of Realtors.

Builders started on new homes at an annual rate of 750,000, up 29.1% compared with a year earlier. They applied to build another 803,000 new homes on an annual basis, a 24.5% jump compared with August 2011.

Economists bullish on housing recovery

Posted: October 10th, 2012

Home prices will see steady increases through 2016 starting this year, according to a quarterly survey of more than 100 economists, real estate experts and investment strategists.

The survey, conducted by research and consulting firm Pulsenomics LLC on behalf of real estate search and valuation portal Zillow between Aug. 30-Sept. 14, 2012, asked 113 participants to project the path of the S&P/Case-Shiller U.S. National Home Price Index over the next five years.

Deutsche Bank claims housing correction complete

Posted: October 10th, 2012

![]()

Recent indicators showed housing has largely corrected back to pre-bubble levels and affordability, according to a note from Deutsche Bank analysts.

Nationally, home prices dropped roughly 40% from the overheated peak in 2006 to a low in 2009. But the analyst said in a note Thursday that prices are still 30% higher than the millennium average. Incomes, while similarly dented by the financial crisis actually recovered more quickly than prices.

U.S. home prices make biggest jump in 6 years

Posted: September 4th, 2012

Nationwide home prices shot up 3.8% in July, making their largest year-over-year leap since 2006, according to real estate data provider CoreLogic.

The gain marks the fifth straight rise in the gauge, part of a positive swing following a year and a half of slumps. The last time prices rose so much was in August 2006, when they jumped 4.1%.

Prices in California bounded up 4.4%. Without distressed sales – including foreclosures and short sales – national prices were up 4.3% compared with last July.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

New American Dream Is Renting to Get Rich

Posted: February 18th, 2012

Examining 250 properties around the U.S., and going through close to 40 client files to project the financial impact of owning real estate versus liquidating it, Arzaga, an adjunct professor in personal finance at the University of California at Berkeley, found that, “100 percent of the time it was better to rent, rather than own.”

That’s right: 100 percent.

December California & So Cal Home Sales Report

Posted: January 23rd, 2012

An estimated 37,734 new and resale houses and condos were sold statewide last month. That was up 15.5 percent from 32,669 in November, and up 4.2 percent from 36,215 for December 2010. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,063. DataQuick’s statistics go back to 1988.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

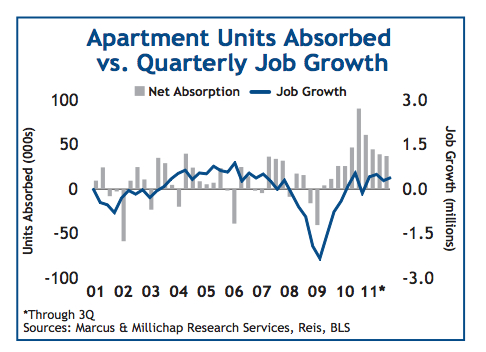

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

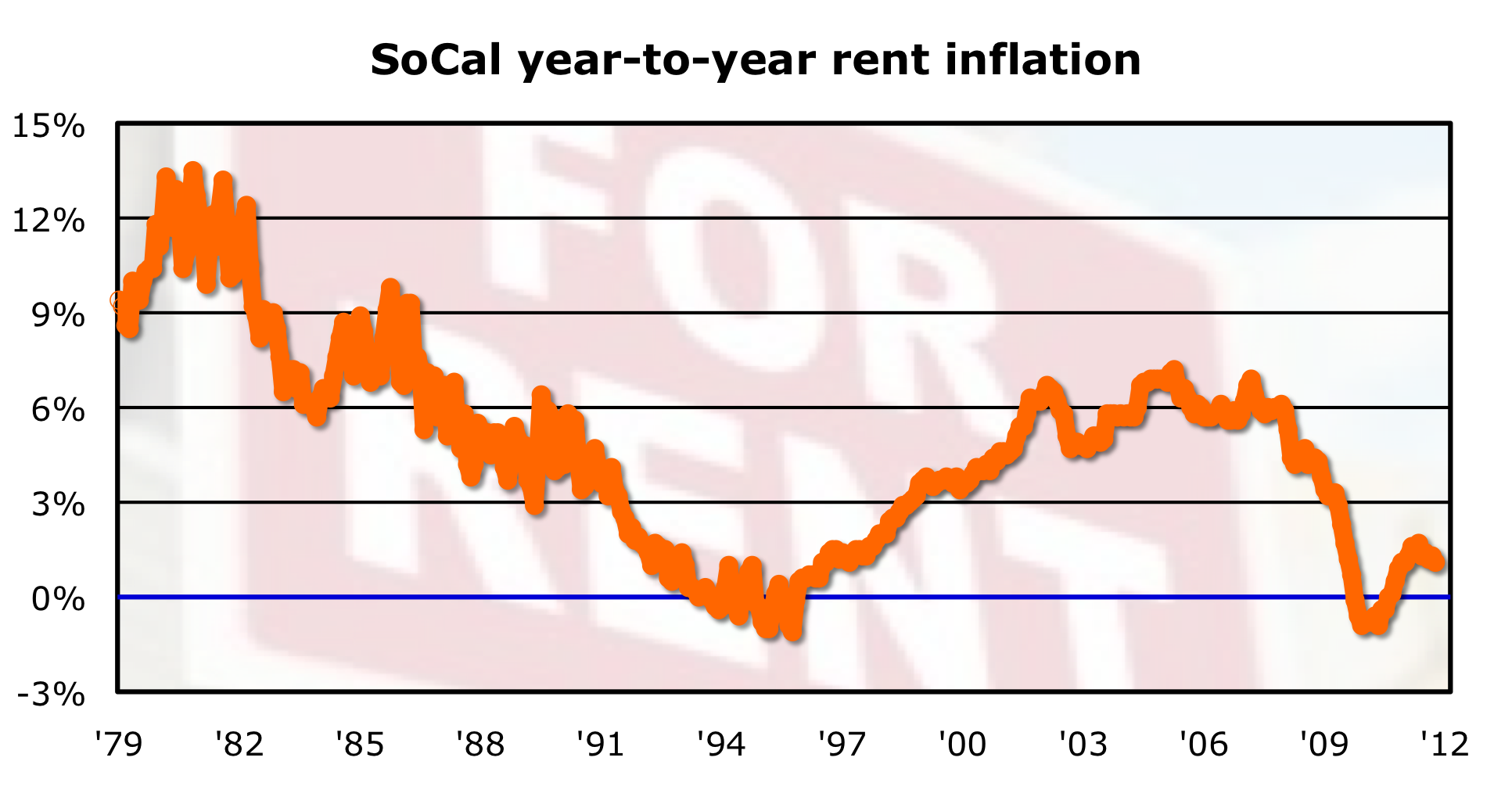

ARTICLE, OC REGISTER

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

UCLA: O.C. home prices to rise 35%

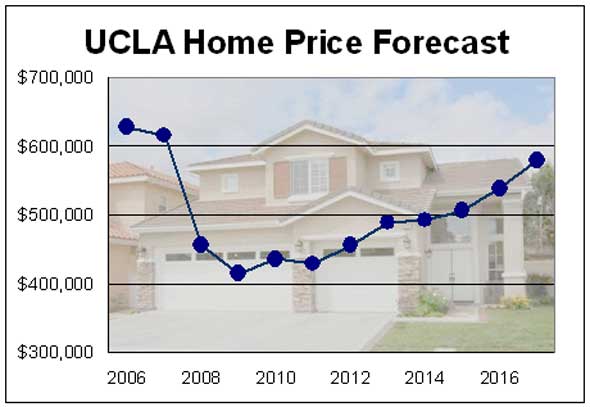

Posted: November 16th, 2011

ARTICLE, OC REGISTER

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

California Foreclosure Activity Back Up

Posted: October 21st, 2011

PRESS RELEASE, DATA QUICK

After dropping to a three-year low in the second quarter of this year, the number of California homeowners being pulled into the foreclosure process snapped back to prior levels over the last three months, a real estate information service reported.

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.

Housing Lift Proves Fleeting

Posted: October 21st, 2011

![]()

ARTICLE, WALL ST JOURNAL

Sales of previously owned homes slipped in September as Americans were hit by economic uncertainty, high unemployment and tight lending.

Data Thursday highlight how jobs and housing are the main economic drags. Job seekers in California this week.

Existing-home sales dropped 3% to a seasonally adjusted 4.91 million in September, the National Association of Realtors said Thursday. That followed a sales bump in August, as the housing market remains stuck in neutral despite lower prices and interest rates at near-historic lows.

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Posted: October 17th, 2011

PRESS RELEASE, DATAQUICK

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Home ownership: Biggest drop since Great Depression

Posted: October 13th, 2011

ARTICLE, CNN MONEY

The percentage of Americans who owned their homes has seen its biggest decline since the Great Depression, according to the U.S. Census Bureau.

The rate of home ownership fell to 65.1% in April 2010, 1.1 percentage points lower than it was in 2000. The decline was the biggest drop since the 1930s, when home ownership plunged 4.2%.

The most recent decade-over-decade drop, however, only tells half the story.

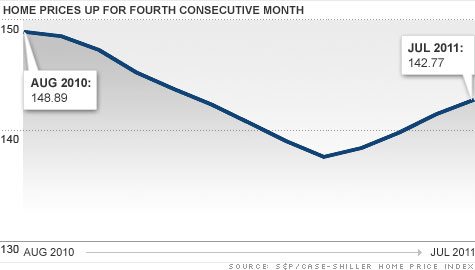

Home prices climb for fourth straight month

Posted: September 27th, 2011

ARTICLE, CNN/MONEY

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose 0.9% in July compared with June, but they’re still 4.1% lower than 12 months ago.

California foreclosures set to surge

Posted: September 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

California default notices spiked 55% in August, and the number may keep rising in the coming months as mortgage servicers shake off the robo-signing freeze, according to RealtyTrac Senior Vice President Rick Sharga.

Southland home sale report

Posted: September 19th, 2011

PRESS RELEASE, DATAQUICK

Southland August Home Sales Climb, Median Price Falls Again

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

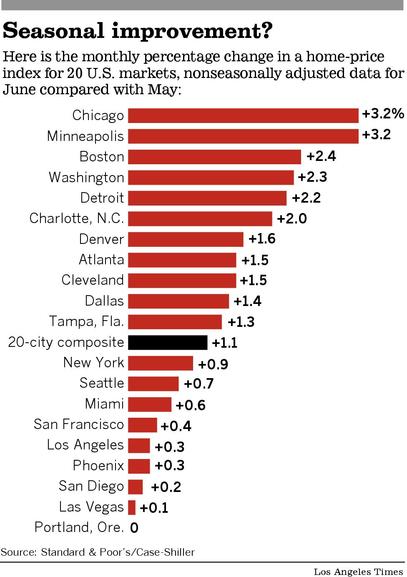

Home prices notch third straight monthly gain

Posted: September 1st, 2011

A key index of home prices in 20 metropolitan areas rose 1.1% from May to June. Real estate experts say the improvement is seasonal and that prices could fall again as sales slow in the fall and winter.

Buying real estate a better deal than renting in 74% of major US cities

Posted: August 18th, 2011

Buying real estate continues to be cheaper than renting in the vast majority of major U.S. cities, according to a quarterly rent vs. buy index from real estate search and marketing site Trulia.

The index compared the median list price and the median annualized rent on a two-bedroom apartment, condominium or townhouse in the country’s 50 most populous cities. According to the index, the cost of buying was less than renting in 37 of the 50 cities (74 percent) as of July 1, 2011. About the same share, 78 percent, favored buying over renting in Trulia’s last index report, released in April.

Foreclosures Fall in Most Cities

Posted: July 28th, 2011

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Southland Home Sales Quicken, Median Price Highest This Year

Posted: July 13th, 2011

PRESS RELEASE, MDA DATAQUICK

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges, a real estate information service reported.

Home prices rise, snapping 8-month drop streak

Posted: July 13th, 2011

ARTICLE, CNN

The downward cycle in home prices broke in April after eight consecutive months of decline, according to a survey released Tuesday.

According to the S&P/Case Shiller 20-city index, prices rose 0.7% compared with March, although they fell 0.1% when adjusted for the strong spring selling season. Prices were down 4% year-over-year.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

2011 seen as ‘turning point’ for home prices

Posted: July 13th, 2011

ARTICLE, INMAN NEWS

More than half of economists, real estate experts and investment strategists polled by MacroMarkets LLC in June said they now expect national home prices to hit a bottom sometime in 2011 and remain stable through 2015.

National rental prices climb in June

Posted: July 13th, 2011

ARTICLE, INMAN NEWS

Rental listing prices nationwide rose 6.7 percent year-over-year in June, according to a report from real estate search site HotPads.

The report was based on the median listing prices of 500,000 rentals on HotPads.com across major U.S. metro areas between June 2010 and June 2011.

More consumers forced to rent due to foreclosure: TransUnion

Posted: June 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

According to the survey, 47% of all property managers reported an increase in rental applicants moving into apartments from foreclosed properties. Sequentially, more than two-third of managers said it is not difficult to find residents in today’s economy even with increases in rent.

Harvard 2011 America’s Rental Housing Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

The troubled homeowner market, along with demographic shifts, has highlighted the vital role that the rental sector plays in providing affordable homes on flexible terms. But while rental housing is the home of choice for a diverse cross-section of Americans, it is also the home of necessity for millions of low-income households.

WSJ: Why It’s Time to Buy

Posted: June 8th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The short-term outlook isn’t encouraging. Job growth remains weak, foreclosure sales are making up more of the market, and economists are predicting that home prices will fall more in the coming months.But the long-term benefits of home ownership remain very much intact.

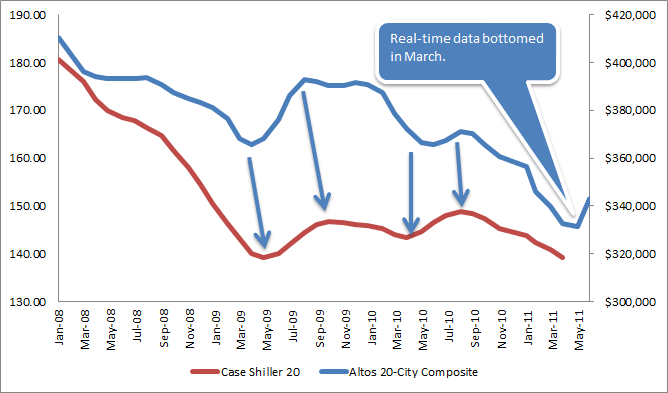

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

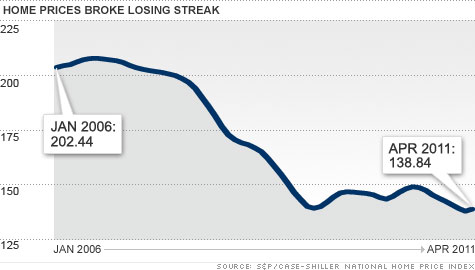

Home prices: ‘Double-dip’ confirmed

Posted: June 2nd, 2011

ARTICLE, CNN

Home prices hit another new low in the first quarter, down 5.1% from a year ago to levels not reached since 2002.

It was the third straight quarterly drop for the S&P/Case-Shiller national home price index, which was released Tuesday.

Prices are now down 32.7% from their peak set five years ago.

“Home prices continue on their downward spiral with no relief in sight,” said David Blitzer, spokesman for Standard and Poor’s.

The index covers 80% of the housing market, and this month’s report confirmed “a double-dip in home prices across much of the nation,” said Blitzer.

The housing market went through a brief recovery period starting in mid-2009, recovering nearly 5% of earlier losses. After homebuyer tax credits expired last April, the slump resumed.

A separate S&P/Case-Shiller index covering 20 major cities also dropped during March, the index’s eighth straight monthly decline

California Mortgage Defaults Drop Again; Foreclosures up

Posted: April 26th, 2011

ARTICLE, MDA DATAQUICK

The number of financially distressed California homeowners who were dragged into the formal foreclosure process declined again last quarter, the result of turmoil and policy changes within the mortgage industry as well as shifts in the economy, a real estate information service reported.

Housing construction ‘encouraging’

Posted: April 22nd, 2011

![]()

ARTICLE, CNN/MONEY

In an encouraging sign for the housing market, new home construction increased more than expected in March, according to a government report Tuesday.

Americans Shun Cheapest Homes in 40 Years as Ownership Fades

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

The most affordable real estate in a generation is failing to lure buyers as Americans like Pauli sour on the idea of home ownership. At the end of 2010, the fourth year of the housing collapse, the share of people who said a home was a safe investment dropped to 64 percent from 70 percent in the first quarter. The December figure was the lowest in a survey that goes back to 2003, when it was 83 percent.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Home prices: The double-dip is near?

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

Record Portion of California Homes Bought With Cash

Posted: March 17th, 2011

ARTICLE, MDA DATAQUICK

The share of Golden State homes purchased with cash rose to a record level last month as investors and others took advantage of lower prices and less competition during the market’s winter doldrums, a real estate information services reported.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

No McMansions for Millennials

Posted: January 18th, 2011

![]()

ARTICLE, WALL ST. JOURNAL

Gen Y housing preferences are the subject of at least two panels at this week’s convention. A key finding: They want to walk everywhere. Surveys show that 13% carpool to work, while 7% walk, said Melina Duggal, a principal with Orlando-based real estate adviser RCLCO. A whopping 88% want to be in an urban setting, but since cities themselves can be so expensive, places with shopping, dining and transit such as Bethesda and Arlington in the Washington suburbs will do just fine.

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

Posted: December 31st, 2010

![]()

ARTICLE, WALL ST JOURNAL, 12.28.2010

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

O.C. home prices to surge 49%, UCLA economists say

Posted: October 28th, 2010

![]()

ARTICLE, OC REGISTER, 10.27.2010

Economists with UCLA’s Anderson Forecast foresee O.C. home prices climbing above $500,000 in 2012 for the first time since April 2008. Prices are expected to appreciate from 6.6% to 9.3% a year through 2015 — and, all told, grow 49% in the next six years.

U.S. companies hoarding almost $1 trillion cash: Moody’s

Posted: October 28th, 2010

ARTICLE, REUTERS, 10.26.2010

U.S. companies are hoarding almost $1 trillion in cash but are unlikely to spend on expanding their business and hiring new employees due to continuing uncertainty about the strength of the economy, Moody’s Investors Service said on Tuesday.

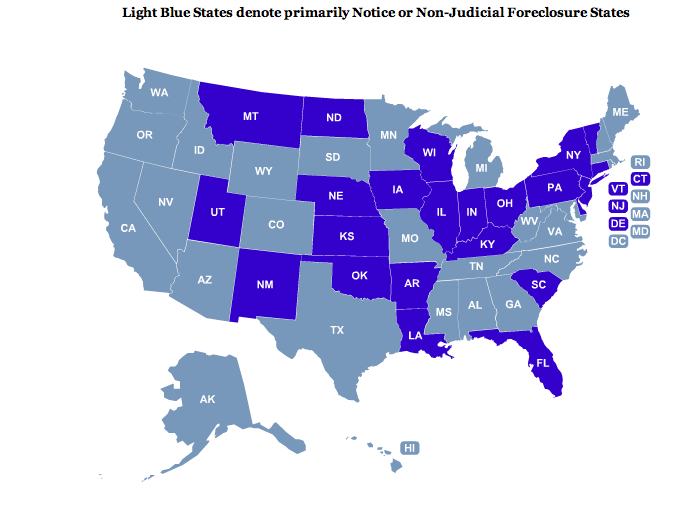

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

Home prices rise in June, but a drop may be looming

Posted: September 3rd, 2010

![]()

ARTICLE, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Marcus & Millichap sees Residential Market Turning Around Soon

Posted: August 11th, 2010

![]()

Article & Video, Fox & M&M Blog, 08.11.2010

Apartment demand has moved well beyond employment gains with the absorption of nearly 46,000 units in the second quarter, the strongest gains since the fourth quarter of 2000. This aggressive lease-up of apartments resulted in a 20 basis point vacancy drop to 7.8 percent, a trend that should continue through the remainder of the year as pent-up demand finally releases. Barring a systemic shock that halts job creation, an additional 65,000 units will be absorbed through the second half of the year, pressing vacancies to 7.4 percent by year-end.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

MIT economist measures how much foreclosures lower housing prices… 27%

Posted: July 28th, 2010

![]()

ARTICLE, MIT NEWS, 07.27.2010

In the study, “Forced Sales and House Prices,” which will be published in the American Economic Review, Pathak, Campbell and Giglio examined 1.8 million home sales in Massachusetts from 1987 to 2009. By looking in granular detail at real-estate prices, the researchers have concluded that a foreclosure reduces the value of a house by 27 percent, on average.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

CHART: Office vacancies rise, rents drop in Southland

Posted: July 20th, 2010

![]()

CHART, LA TIMES, 07.20.2010

Office vacancies rise, rents drop in Southland again

Sacramento-area home sales hit 20-month high in June

Posted: July 20th, 2010

![]()

ARTICLE, SACRAMENTO BEE, 07.20.2010

“It really seems like California housing is parting ways with the national view. We’ve seen a much stronger recovery off the bottom,”

Commercial real estate development stalled until 2012, architects say

Posted: July 19th, 2010

![]()

ARTICLE, LA TIMES, 07.19.2010

With vacancies still on the rise in commercial properties in most parts of the U.S., construction of new buildings is expected to be rare this year and next, the American Institute of Architects said Wednesday.

Biggest Defaulters on Mortgages Are the Rich

Posted: July 9th, 2010

![]()

ARTICLE, NY TIMES, 07.09.2010

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

Executive Summary: Harvard’s State of the Nation’s Housing 2010

Posted: June 16th, 2010

![]()

PAPER, HARVARD UNIVERSITY, 06.16.2010

Even as the worst housing market correction in more than 60 years appeared to turn a corner in 2009, the fallout from sharply lower home prices and high unemployment continued. By year’s end, about one in seven homeowners owed more on their mortgages than their homes were worth, seriously delinquent loans were at record highs, and foreclosures exceeded two

million.

UCLA Anderson Forecast: U.S. recovery a long, slow climb; Calif. recovery weaker than nation’s

Posted: June 16th, 2010

![]()

ARTICLE, UCLA, 06.16.2010

The California economy is expected to grow a bit slower than the nation’s for 2010, and slightly faster thereafter. This slow growth through the forecast period will result in only modest inroads into the state’s high unemployment rate. Los Angeles expected to recover more quickly than rest of the state

Think housing is recovering? Think again.

Posted: May 25th, 2010

![]()

ARTICLE, FORTUNE, 05.25.2010

we’re coming off of an artificial bump from the first time home buyer credit, which expired last month. He predicts the second half of this year will see sluggish economic growth and that housing prices, at best, will be flat for the next few months, while commercial real estate “is likely to see significant declines.”

U.S. Mortgage Program Stalling, Data Shows

Posted: May 17th, 2010

![]()

ARTICLE, NY TIMES, 05.17.2010

“The program is dying,” the blog Calculated Risk concluded after examining the data.

But the number of new trials is beginning to level off, leading to worries that the potential pool of eligible households is rapidly diminishing. Furthermore, many borrowers have a great deal of difficulty making it out of the trial period. The number of canceled trial modifications is nearly as large as the number of permanent modifications.

JPMorgan Chase Warns Investors About Underwater Homeowners Walking Away

Posted: May 17th, 2010

ARTICLE, HUFFINGTON POST, 05.17.2010

About one in eight defaults in February were strategic, according to an April 29 research note by a team of Morgan Stanley analysts led by Vishwanath Tirupattur. Strategic defaults are those in which the homeowner could have continued to make payments but chose not to.

New-home buyers reemerge in Southern California

Posted: May 17th, 2010

![]()

ARTICLE, LA TIMES, 05.13.2010

Location is also key — buyers don’t want extremely long commutes, analysts say.

White flight? Suburbs lose young whites to cities

Posted: May 10th, 2010

ARTICLE, ASSOCIATED PRESS, 05.09.2010

In a reversal, America’s suburbs are now more likely to be home to minorities, the poor and a rapidly growing older population as many younger, educated whites move to cities for jobs and shorter commutes.

‘Strategic’ Mortgage Defaults Jump to 12% of Total

Posted: May 4th, 2010

![]()

ARTICLE, BLOOMBERG, 04.29.2010

About 12 percent of all mortgage defaults in February were “strategic,” up from 4 percent in mid-2007, New York-based Morgan Stanley analysts led by Vishwanath Tirupattur wrote in a report today.

METRO FORECLOSURE HOT SPOTS BUCK NATIONAL TREND IN FIRST QUARTER WITH ANNUAL DECLINES IN FORECLOSURE ACTIVITY

Posted: May 2nd, 2010

![]()

ARTICLE, REALTYTRAC, 05.02.2010

“The decreasing foreclosure activity in some of the nation’s top foreclosure hot spots in the first quarter is largely the result of government intervention and other non-market influences, and not a sure signal that those areas are out of the woods yet when it comes to foreclosures,”

California added 393,000 people in 2009

Posted: April 30th, 2010

![]()

ARTICLE, LA TIMES 04.30.2010

Officials said the state’s housing growth in 2009 underscored the severity of the housing downturn. Only 62,300 new homes were added in California in 2009

California Statewide March Home Sales

Posted: April 19th, 2010

ARTICLE, DATAQUICK 04.15.2010

Indicators of market distress continue to move in different directions. Foreclosure activity is off its peaks reached in the past two years but remains high by historical standards.

Real Interest Rates, Expected Inflation, And Real Estate Returns- A Comparison of the U.S. and Canada

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

In the United States, but not in Canada, nominal interest on residential housing mortgages

is a deductible expense. This suggests that changes in

nominal interest rates should have a more negative impact on Canadian real estate than on real estate in the US. This paper uses real estate investment trusts along with expected inflation in both countries to find empirical evidence to support this theory.

Job Losses in Different Recessions

Posted: April 14th, 2010

CHART: Job Losses in different recessions

The 2nd Wave of Resetting Mortgages

Posted: April 14th, 2010

![]()

CHART: Here, you can clearly see the second wave of adjustable mortgage resets.

Bob Shiller’s History of Home Prices

Posted: April 14th, 2010

![]()

CHART: Robert Shiller’s History of U.S. Home Prices

Don’t Bet the Farm on the Housing Recovery by Robert Shiller of Yale University

Posted: April 12th, 2010

OPINION, By ROBERT J. SHILLER 04.09.2010 Yale University

MUCH hope has been pinned on the recovery in home prices that began about a year ago. A long-lasting housing recovery might provide a balm to households, mortgage lenders and the entire United States economy. But will the recovery be sustained?

Alas, the evidence is equivocal at best.

UCLA Anderson Forecast, March 2010

Posted: April 12th, 2010

![]()

ARTICLE, UCLA/Anderson School of Management 3.24.2010

The UCLA Anderson Forecast renders a “bipolar” diagnosis for the national economy, referencing the dual conditions of slow-but-sure growth in the national gross domestic product, coupled with an unemployment rate predicted to remain in double digits until 2012.

The 10 Must-Have Features in Today’s New Homes

Posted: April 12th, 2010

ARTICLE, WSJ.com, 2.1.2010

Buyers today want cost-effective architecture, plans that focus on spaces and not rooms and homes that are designed ‘green’ from the outset,”

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy