Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Los Angeles Apartment Research Report Los Angeles County, Third Quarter 2015

Posted: September 29th, 2015

(click on the title above for the entire report)

Investors Look Past Construction Risks, Pursue Assets

The Los Angeles county multifamily market remains robust as organizations expand their payrolls. While the pace of hiring is slower than its highest level seen during 2013, growth remains broad-based and consistent with a strengthening economy. The new employees of these firms are seeking apartments at a heightened pace as the swelling prices for single-family homes make homeownership impossible for many metro residents. Builders have used these factors to justify adding multiple projects to the pipeline of activity, particularly in downtown Los Angeles, where several luxury towers are underway, and the San Fernando Valley, where more affordable rents can be obtained. Construction in these two areas will outpace demand this year, prompting increases in vacancy as more than 7,000 units come online. The outlook is much brighter in the Westside Cities and the South Bay/Long Beach markets, where technology firms are placing roots and planned completions are more muted. Despite overdevelopment concerns in some areas, vacancy rates will remain sufficiently tight, allowing a rise in average asking rent.

Market participants are unfazed by the construction outlook for multifamily housing, using historically low interest rates and easy access to commercial credit to bid aggressively on properties throughout the county. The resulting environment has led to deteriorating first-year yields as potential buyers place their best offers first, particularly on trophy assets in the Westside Cities and value-add complexes in the San Fernando Valley and South Bay. The average property now yields 5.1 percent, with many prime areas exchanging ownership in the low-4 percent range. Market participants view the elevated level of construction as a transitory issue, focusing on the structural impediments to homeownership to underpin their thesis. As investors weigh a possible interest rate hike from the Federal Reserve for the first time in nearly a decade, transaction velocity will stay elevated. Buyers seeking to deploy capital into the metro will take advantage of the increase in listings, fostering further deterioration in cap rates.

2015 Annual Apartment Forecast

Employment: More than 104,000 workers will find gainful employment this year, a 2.4 percent growth rate. In the previous year, 97,900 jobs were created, a 2.3 percent rise.

Construction: The pace of deliveries will moderate somewhat as more than 8,600 units come to market this year. In 2014, nearly 10,000 rentals were placed into service.

Vacancy: Growing supply will limit net absorption in apartments this year, ushering in a 50-basis-point increase in vacancy to 3.5 percent by year end. Although the market will weaken this year, the average vacancy rate will remain incredibly tight.

Rents: The average effective rent will move up 4.8 percent to $1,870 per month this year. Last year, the average effective rent climbed 6.4 percent.

Harvard: Joint Center for Housing Studies

Posted: September 29th, 2015

Projecting Trends in Severely Cost-Burdened Renters: 2015–2025

Author(s): Allison Charette

Chris Herbert

Andrew Jakabovics

Ellen Tracy Marya

Daniel T. McCue

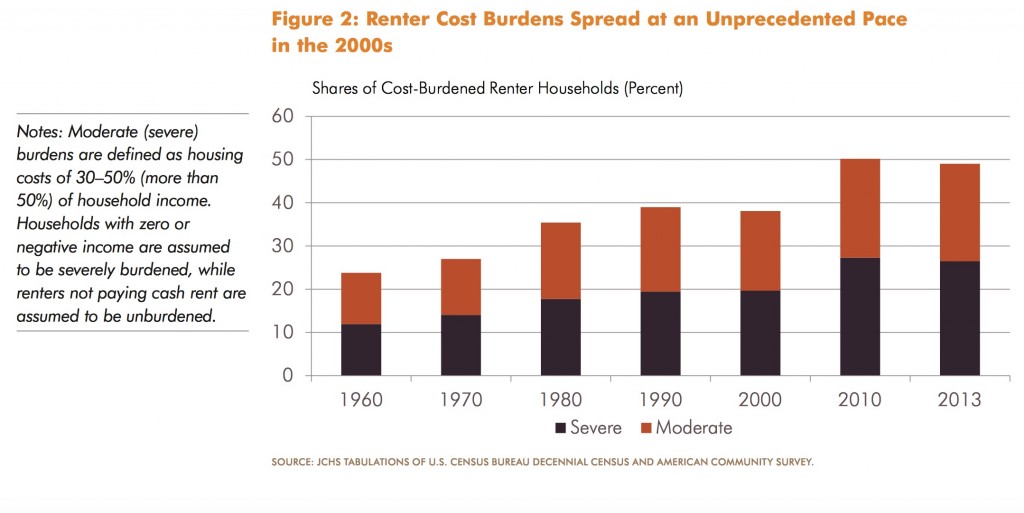

This report by Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners Inc shows that the number of households spending more than 50 percent of their income on rent is expected to rise at least 11 percent from 11.8 million to 13.1 million by 2025. The report projects a growing renter affordability crisis, with the largest increases expected among older adults, Hispanics and single-person households. The findings suggest that even if trends in incomes and rents turn more favorable, a variety of demographic forces—including the rapid growth of minority and senior populations—will exert continued upward pressure on the number of severely cost-burdened renters.

CONCLUSION

Overall, our analysis projects a fairly bleak picture of severe renter burdens across the U.S. for the coming decade. Under nearly all of the scenarios performed, we found that the renter affordability crisis will continue to worsen without intervention. According to our projections, annual income growth would need to exceed annual rent growth by 1 percent in order to reduce the number of severely burdened renters in 10 years. Importantly, that decline would have a net impact on fewer than 200,000 households, only because continued increases in burdens among minorities would be offset by declines among whites. Under the more likely scenario that rents will continue to outpace incomes, the number of severely rent-burdened households would increase by a range of 1.7 – 3 million, depending on the magnitude.

Given these findings, it is critical for policymakers at all levels of government to prioritize the preservation and development of affordable rental housing. Even if the economy continues its slow recovery and income growth improves, there are simply not enough quality, affordable rental units to house the millions of households paying over half their income in rental costs.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Fannie Mae paper: What Drives Consumers’ Intentions to Own or Rent

Posted: August 14th, 2012

What Drives Consumers’ Intentions to Own or Rent

“Our analysis found that consumers consider a mix of demographic and

attitudinal drivers in their future “next move” own-rent preferences. Demographics

such as income, age, marital status, and employment status are

the primary drivers of current homeownership status and the own-rent

intention for outright homeowners (those who don’t have a mortgage).

However, attitudes are the key drivers of the own-rent intention for renters

and homeowners with a mortgage – two groups that account for about 80

percent of housing units in the U.S.”

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

Though Outcomes Argue Otherwise, Rent Control Continues to Win Public Support

Posted: May 3rd, 2012

In various polls conducted over the years, over 90 percent of economists agree that rent control is not merely ineffectual, but actually reduces the quantity and quality of housing available.

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Harvard 2011 State of the Nation’s Housing, Executive Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

With employment growth strengthening, consumer spending up, and rental markets tightening, some of the ingredients for a housing recovery were taking shape in early 2011.Yet in the first quarter of the year,new home sales plumbed record lows, existing sales remained in a slump, and home prices slid.Tight underwriting requirements,on top of uncertainty about the direction of home prices, continue to dampen home buying activity. The weakness of demand is slowing the absorption of vacant properties for sale,hindering the recovery.

Harvard 2011 America’s Rental Housing Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

The troubled homeowner market, along with demographic shifts, has highlighted the vital role that the rental sector plays in providing affordable homes on flexible terms. But while rental housing is the home of choice for a diverse cross-section of Americans, it is also the home of necessity for millions of low-income households.

2010 USC Casden Industrial and Office Forecast

Posted: December 10th, 2010

PAPER, USC LUSK CENTER, 12.10.2010

The annual Casden Real Estate Economics Forecast analyzes economic data, provided by Grubb & Ellis, on rents, vacancies, and transactions for office and industrial markets in Los Angeles, Orange, Riverside and San Bernardino counties.

Apartments First Commercial Investment to Show Signs of Recovery; Demographic and Economic Trends Favor Positive Outlook

Posted: September 12th, 2010

![]()

PAPER, MARCUS & MILLICHAP, 9.10.2010

Improvements in fundamentals will continue through the second half as moderate job growth persists, renter household formation accelerates and new supply drops off. By the end of 2010, vacancy will slip to 7.4 percent, while asking and effective rents will rise further, registering annual gains of 2 percent and 3 percent, respectively.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

Negative Homeowner Equity and Strategic Mortgage Defaults Boost Retail Sales but Pose Another Risk to Recovery

Posted: June 18th, 2010

![]()

PAPER, MARCUS & MILLICHAP, 06.2010

Drastic reductions in home values have driven many homeowners’ equity to negative levels, and returning to break-even will, for most, require several years. Consequently, a significant portion of these upside-down homeowners will walk away from their houses, even if they have the financial means to continue making payments.

Core Logic: Commercial Market Monitor

Posted: June 18th, 2010

![]()

PAPER, FIRST AMERICAN CORE LOGIC, 06.2010

In 2010, over $283 billion in commercial mortgages will mature and need to be refi nanced or sold. This forecast is based upon CoreLogic property

records data and is updated on an ongoing monthly basis. All analyses presented herein examine the corollaries between property ownership and

mortgage holder information.

Executive Summary: Harvard’s State of the Nation’s Housing 2010

Posted: June 16th, 2010

![]()

PAPER, HARVARD UNIVERSITY, 06.16.2010

Even as the worst housing market correction in more than 60 years appeared to turn a corner in 2009, the fallout from sharply lower home prices and high unemployment continued. By year’s end, about one in seven homeowners owed more on their mortgages than their homes were worth, seriously delinquent loans were at record highs, and foreclosures exceeded two

million.

Take This House and Shove It: The Emotional Drivers of Strategic Default

Posted: May 25th, 2010

PAPER, U OF A SCHOOL OF LAW, 05.14.2010

An increasingly influential view is that strategic defaulters make a rational choice to default because they have substantial negative equity. This article, which is based upon the personal accounts of over 350 individuals, argues that this depiction of strategic defaulters as rational actors is woefully incomplete. Negative equity alone does not drive many strategic defaulters’ decisions to intentionally stop paying their mortgages. Rather, their decisions to default are driven primarily by emotion

Would You Have Bought It? Case Study of a Flip: 4832 2nd Ave, Los Angeles CA

Posted: May 9th, 2010

![]()

SEQUOIA STRATEGY, 05.09.2010

It’s not often an REO investment makes the front page of the Sunday edition of a national paper, but that’s exactly what happened on April 25th 2010 in the Los Angeles Times. So we thought it would be a great opportunity to do a quick case study on this particular purchase

Real Interest Rates, Expected Inflation, And Real Estate Returns- A Comparison of the U.S. and Canada

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

In the United States, but not in Canada, nominal interest on residential housing mortgages

is a deductible expense. This suggests that changes in

nominal interest rates should have a more negative impact on Canadian real estate than on real estate in the US. This paper uses real estate investment trusts along with expected inflation in both countries to find empirical evidence to support this theory.

The Implosion of the CDO Market and the Pricing of Subprime Mortgage-Backed Securities

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

Because CDO issuance played an important role in the market for subprime mortgage-backed securities (MBS), this striking rise and fall provides an excellent laboratory for studying the interest rate spreads on the underlying subprime MBS collateral.

Using REITS to asses the risk and return performance of real estate

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

“We find that the analyses based on REITs give notably different results from those based on SCS. In particular, real estate investment returns are higher and more volatile, and both the associated market and idiosyncratic risk are higher.”

Rent-Price Ratios and the Earnings Yield on Housing

Posted: April 16th, 2010

PAPER, USC

Rent-Price Ratios and the Earnings Yield on Housing

AllianceBernstein Housing Recomendation

Posted: April 15th, 2010

![]()

PAPER 12.2009, AllianceBernstein Research Dept.

“..our analysis indicates it is time to begin looking beyond the near term risks and toward the long-term opportunities.”

View The Menace of Strategic Default

Posted: April 3rd, 2010

![]()

ARTICLE, CITY JOURNAL, 04.15.2010

Case-Shiller Housing White Paper Year in Review 2009

Posted: January 16th, 2010

![]()

PAPER, CASE SHILLER YEAR IN REVIEW 2009

Standard & Poor’s chief economist, David Wyss, has provided us with his forecast for the residential housing market. His team expects housing sales and starts to drop over the winter, but to remain well above their early 2009 lows, and to recover in the spring.

Designing Loan Modifications to Address the Mortgage Crisis and the Making Home Affordable Program

Posted: December 3rd, 2009

PAPER, FEDERAL RESERVE BANK OF D.C., 12.15.2009

This paper presents preliminary findings and is being distributed to economists

and other interested readers solely to stimulate discussion and elicit comments.

Subprime Mortgage Modification and Re-Default

Posted: December 3rd, 2009

PAPER, FEDERAL RESERVE BANK OF NY, 12.15.2009

This paper presents preliminary findings and is being distributed to economists

and other interested readers solely to stimulate discussion and elicit comments.

Underwater and Not Walking Away…..

Posted: October 10th, 2009

PAPER, U of A SCHOOL OF LAW, OCTOBER 2009

This article suggests that most homeowners choose not to strategically default as a result of two emotional forces: 1) the desire to avoid the shame and guilt of foreclosure; and 2) exaggerated anxiety over foreclosure’s perceived consequences.

Moral and Social Constraints to Strategic Default on Mortgages

Posted: July 15th, 2009

![]()

![]()

PAPER, BOOTH & KELLOGG SCHOOLS OF BUSINESS, 07.15.2009

“That moral attitudes toward default do not change with the percentage of foreclosures in the area suggests that the correlation between willingness to default and percentage of foreclosures is likely to derive from a contagion effect that reduces the social stigma associated with default as defaults become more common.”

The Rent-Price Index in U.S Housing Markets

Posted: February 16th, 2009

PAPER, STANDARD & POORS 02.2009

In this paper, the relationship between house prices and rents across eight major metropolitan areas in the U.S. is examined, and a rentprice index to provide the framework of our analysis is developed.

Negative Equity and Foreclosure

Posted: June 6th, 2008

PAPER, FEDERAL RESERVE BANK OF BOSTON, 06.05.2008

Christopher L. Foote and Paul S. Willen are senior economists and policy advisors

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy