Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Foreign homebuyers clicking on depressed US housing markets

Posted: December 19th, 2011

![]()

ARTICLE, HOUSING WIRE

Foreigners looking to purchase homes in the U.S. are increasing their online search activity for bargains, as sliding home prices continue to attract investors from around the globe — especially Canada.

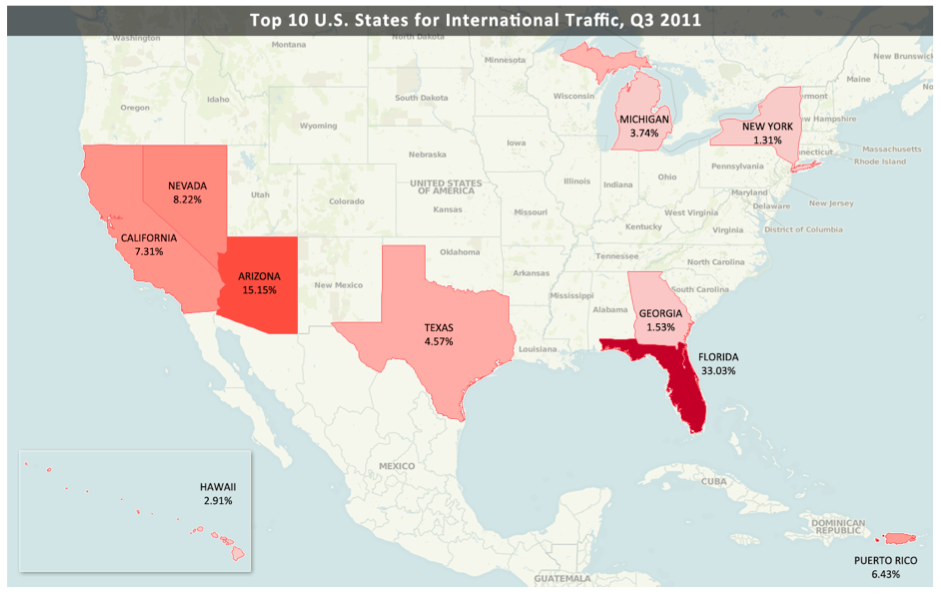

Florida properties remained the lead attraction for foreign investment in the third quarter, followed by Arizona, Nevada and California, according to traffic on the website for Point2, a Canadian-based real estate marketing company. Those housing markets have experienced the steepest declines in home prices from the sector’s peak in June 2006.

Home foreclosure proceedings on the rise again

Posted: October 13th, 2011

ARTICLE, LA TIMES

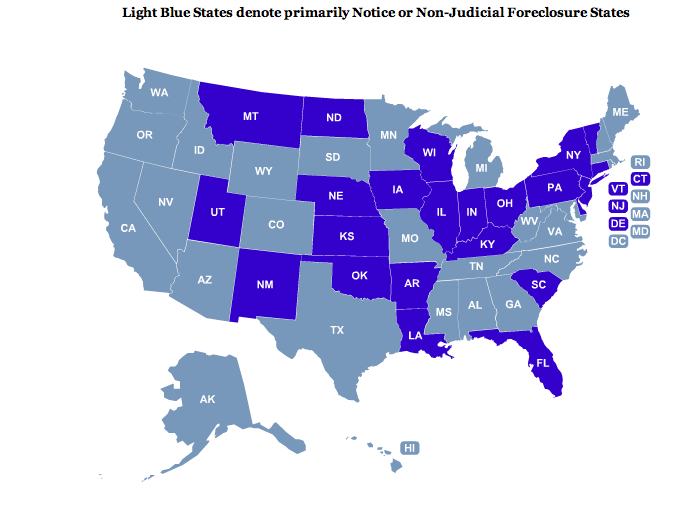

After months of a foreclosure slowdown caused by investigations into improper practices, the nation’s home-repossession machinery is beginning to move again — particularly in states such as California where courts don’t oversee the process.

The number of homes entering the foreclosure process surged 19% in the third quarter compared with the previous quarter in states where foreclosures take place largely outside of the courtroom, according to RealtyTrac, an Irvine information firm. These nonjudicial states include California, Nevada, Arizona, Oregon and Washington.

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

Cash Buyers Lift Housing

Posted: February 11th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority. WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Short sales soar in California, U.S.

Posted: August 13th, 2010

![]()

ARTICLE, LA TIMES, 08.13.2010

Sales of homes for less than the amount of their outstanding mortgage debt have tripled since 2008, particularly in California and the Sunbelt, according to a report released Tuesday.

Known as short sales, the increasingly common transactions for financially troubled homeowners are projected to balloon to 400,000 in 2010, according to Core Logic, a Santa Ana company that provides services to the real estate and mortgage markets. By comparison, existing homes sold at a seasonally adjusted annual rate of 5.37 million units in June, according to the National Assn. of Realtors.

Condos that cost less than cars

Posted: August 3rd, 2010

![]()

ARTICLE, CNN/MONEY, 08.02.2010

The housing bust has made owning a home a lot more affordable — but in some places, prices are extraordinary; you can buy a nice condo for less than the cost of a new family car.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy