Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Pacific Value Opportunities Funds, Q3 Update and Outlook

Posted: October 4th, 2013

To Partners and Friends of the Pacific Value Opportunities Funds:

By far and away the most significant news of the third quarter was the Fed’s surprise mid-September decision not to taper its monthly purchase of some $85 billion of Treasury bonds and mortgage-backed securities, the so-called quantitative easing. Separately, the Fed also announced it has no intention of increasing short-term rates until late 2014 or 2015. Most market watchers were caught off guard, having assumed that the Fed would begin some modest tapering ($10 to $20 billion) given the improving economy, and the obvious need to end bond repurchases at some point. The announcement provided significant relief to bond rates, which had increased significantly during the quarter. The 10-year Treasury yield, which stood at 2.50% at the start of the third quarter and had risen to nearly 3.0% by the first week of September, subsequently declined to 2.64% in the weeks following the Fed’s announcement.

To read the entire post please click on its title.

Pacific Value Opportunities Funds, Q2 Update and Outlook

Posted: July 29th, 2013

To Partners and Friends of Pacific Value Opportunities Funds:

For the most part, the second quarter saw the continuation of decidedly mixed, if not conflicting, macroeconomic trends: modest improvements in domestic employment levels and economic growth, remarkably strong U.S. equity and housing markets, weakening emerging markets, slowing growth in China, middling recovery in the E.U., and significant geopolitical uncertainty in the Middle East (and elsewhere). The U.S. economy remains one of the global bright spots, which seems somewhat hard to imagine, as our recovery and current level of growth can only be described as uninspiring.

Click on the title above for the entire update.

Rising rates have no effect on housing thus far

Posted: July 10th, 2013

Compared to the 1980s, when mortgage rates hovered above 10%, today’s rates remain relatively low. In early May, the 30-year, fixed-rate shot up to 4.46%, before settling back to 4.29% last week, according to Freddie Mac.

However, the recent pace at which they’ve been climbing has many potential homebuyers hesitant to buy a home.

At the end of June, right after rates rose sharply, Trulia ($33.12 -0.2%) surveyed more than 2,000 people to see what their biggest worry would be if they were to buy a home this year.

Of all the consumers surveyed, 41% said their top fear is that mortgage rates would rise before they could actually buy a house. Second to rates, 37% of consumers said they were worried prices would rise before they could buy, and 36% said they wouldn’t find a home for sale that they like.

So how high will rates have to get before consumers become too discouraged to buy a home? Among consumers who intend to buy a home someday, 13% said that mortgage rates of 4% were already too high for them to consider buying a home. Rates had already climbed to 4% at the time of the survey.

Spiking Mortgages Won’t Derail Housing: Trulia Economist

Posted: June 27th, 2013

Even with their recent rise, mortgage rates are still “incredibly low” by historical standards, so they will not halt the housing recovery, Trulia Chief Economist Jed Kolko told CNBC on Tuesday.

Seven Takeaways on Rising Home Sales

Posted: June 27th, 2013

Thursday’s report from the National Association of Realtors that existing-home sales in May rose by 4.2% adds to an upbeat market trend that has unfolded over the past two years. Here are seven takeaways on the sales data:

May’s Interest Rate Spike in Perspective

Posted: June 27th, 2013

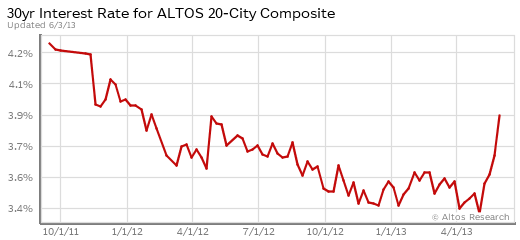

Mortgage interest rates across the US as of June 1, 2013. Source: Altos Research

That’s a big move, people. See last week’s post for our current thinking on the housing impact of higher interest rates. Wow.

If this keeps up in June, I may have to rethink some assumptions about the recovery.

S&P expects home prices to keep rising

Posted: June 27th, 2013

![]()

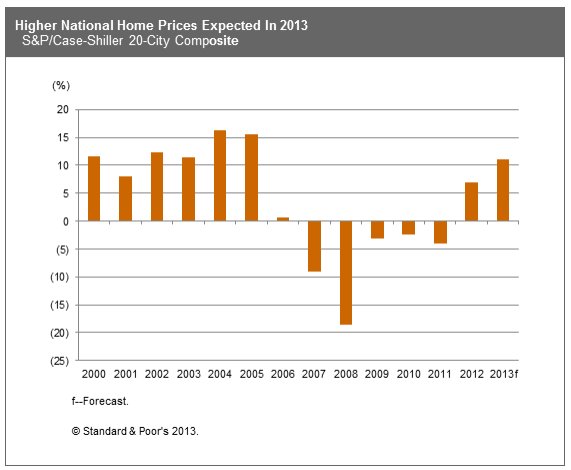

Surging home prices throughout the country have spurred talk of a housing bubble, as many markets are still recovering from the last bubble bursting in 2007.

But Standard & Poor’s Ratings Services states that, although double-digit gains are ultimately unsustainable, we may not have reached bubble status quite yet.

Fears of New Housing Bubble Full of Air

Posted: June 27th, 2013

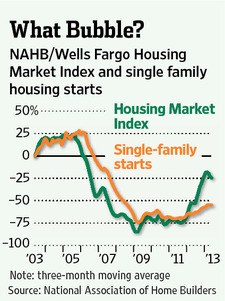

The outbreak of bidding wars for center-hall colonials, split-levels and ranches all over America is more than a little reminiscent of the mid-2000s. Of course, that innocent era, before people understood that home prices can also fall, never had fixed-rate mortgage rates as low as those seen recently. On appearances alone then, it isn’t surprising to hear warnings that another bubble may be brewing.

Zillow Forum on the Future of Housing (Part 3, The Future of Housing Demand)

Posted: May 22nd, 2013

This Housing Upturn Looks Like the Real Thing

Posted: May 22nd, 2013

Ever since the recovery began in 2009, a weak housing market has held back the U.S. economy. The first rebound in home prices was lackluster and after only a year was followed by another dip. But the recent upturn in home prices looks like the real thing. One clear sign of a turning point: In March, homeownership hit a 17-year low, while the 12-month gain in home prices was the biggest in seven years. Those two extremes suggest that the market has hit bottom. The people who are least well financed have been squeezed out, while demand is growing among people who can afford to pay higher home prices. If that trend continues – and there are good reasons to believe it will – a substantial burden will be lifted from the U.S. economy.

CoreLogic home prices jump more than 10%, but it’s no bubble

Posted: May 22nd, 2013

![]()

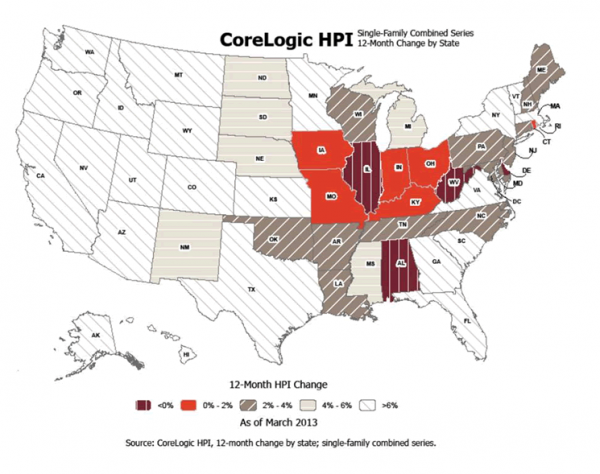

The latest CoreLogic home price index jumped a whopping 10.5% nationally, but analysts say values are still far away from creating a housing bubble.

This change represents the biggest year-over-year increase since March 2006 and the 13th consecutive monthly increase in home prices nationally, CoreLogic ($27.39 -0.215%) said in a press release.

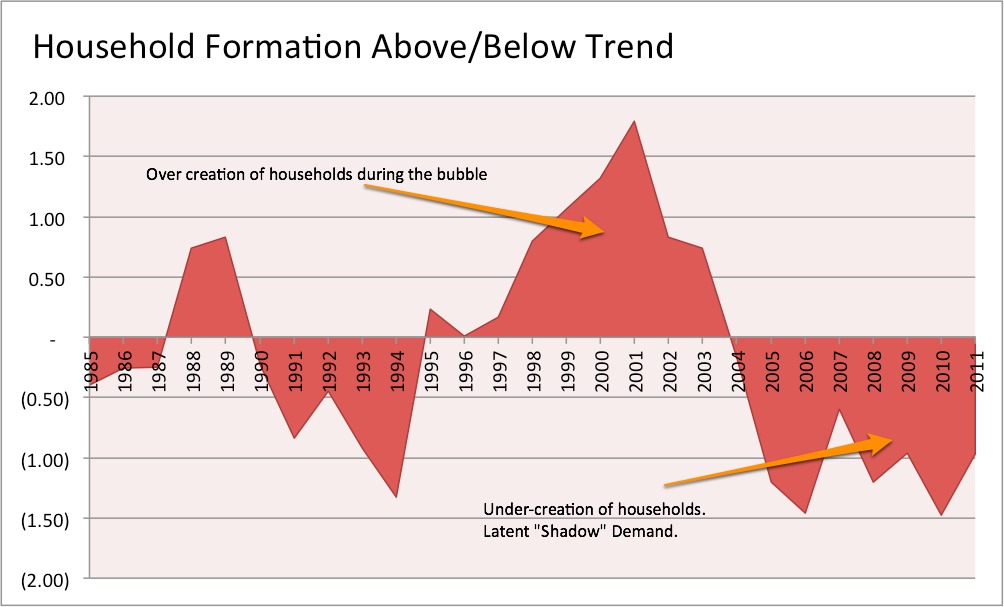

Real Estate Shadow Demand Outweighs its Shadow Inventory

Posted: April 9th, 2013

Quit your yapping about how strong the real estate market is, Simonsen. It’s a fake rally. There is no actual demand.

That’s the bearish argument I’ve been hearing lately. I’m not buying it.

For years we’ve been watching the phenomenon of “Shadow Inventory” of potential homes that need to be sold, and looking for impact on the market. This set of underwater or distressed properties is now shrinking rapidly. The number of homes with underwater mortgages fell by nearly two million last year. According to the Fed, home price gains of 10% will be enough to move 40% of underwater borrowers back above water. These home sellers are highly likely to buy another home in the same or comparable market, off setting new supply with new demand.

Housing’s Shadow Demand

CLICK ON THE TITLE TO READ THE WHOLE STORY

Why Forecasts for the 2013 Housing Market are Too Low

Posted: March 4th, 2013

I’m in Washington DC to talk to the National Association of Business Economics on the state of the housing market. I ran into Lawrence Yun, the chief economist for the National Association of Realtors and he mentioned that he just raised his forecast for 2013 from 4% year over year to 7-8%. That’s pretty bullish. Yun, of course, takes a lot of flack for being an industry cheerleader rather than objective. So he should be bullish, right? I told him he’s still too low.

Click on the title to read the entire article

Investor Q3 Update & Outlook

Posted: October 25th, 2012

The third quarter saw continued improvement in the residential markets, similar to those we have noted in earlier quarterly updates. Nationally, apartment rents increased approximately 0.8% in the third quarter, representing the seventh consecutive quarter of rental growth, while overall vacancy rates dropped to 4.6%. However, the increase in rents represented the slowest rate of growth since the recovery began in 2010. These results are not surprising as improvement in single-family home prices (up 4.6% in August 2012 versus the prior year, the largest year-over-year increase in six years) – buoyed by continued low interest rates, expanding confidence in the economic recovery, and low levels of inventory for sale – absorbed some of the apartment momentum. The surprising strength in the single-family residential market, highlighted by unusually low supply (click to read more) has perhaps been the most interesting story during the quarter…..

Click on the article title above to read further.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Investor Q2 Update and Outlook

Posted: July 27th, 2012

The second quarter witnessed continued and significant progress in the Pacific Opportunities Value Fund I, as we have completed the sale of one asset and near the sale of a second, both single-family homes we acquired and renovated. Moreover, residential rental market fundamentals continue to improve, just as we predicted. In fact, according to REIS, a well regarded real estate data collection firm, second quarter average rents increased in all 82 markets they track, while the nation’s apartment vacancy rate fell to 4.7% (the lowest level seen since 2001).

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Though Outcomes Argue Otherwise, Rent Control Continues to Win Public Support

Posted: May 3rd, 2012

In various polls conducted over the years, over 90 percent of economists agree that rent control is not merely ineffectual, but actually reduces the quantity and quality of housing available.

Warren Buffett on CNBC: I’d Buy Up ‘A Couple Hundred Thousand’ Single-Family Homes If I Could

Posted: April 26th, 2012

![]()

Warren Buffett says along with equities, single-family homes are a very attractive investment right now.

Appearing live on CNBC’s Squawk Box, Buffett tells Becky Quick he’d buy up “a couple hundred thousand” single family homes if it were practical to do so.

If held for a long period of time and purchased at low rates, Buffett says houses are even better than stocks. He advises buyers to take out a 30-year mortgage and refinance if rates go down.

Investor Q1 Update and Outlook

Posted: April 23rd, 2012

UPDATE & OPINION

Market fundamentals for residential rental properties remain fairly robust, reflected by increasing rents and declining vacancies. A recent report issued by USC’s Lusk Center for Real Estate (the 2012 Casden Multifamily Forecast) predicts that average rents will increase 7.9% in 2012 and total growth of 9.6% by the end of 2013. This forecast is consistent with our own overall views of the Southern California market, as we discussed in previous reports. In short, we view apartments and residential rentals as the best place to allocate real estate directed investment funds.

Entreprenuers will save housing

Posted: April 18th, 2012

By G.U. KRUEGER / SPECIAL TO THE REGISTER

Veteran Southern California real estate analyst G.U. Krueger adds his commentary on the housing market to this blog in a spot we call “Thursday Morning Quarterback.” Here’s his latest installment …

New business formations and entrepreneurial activity are one key to housing’s recovery.

In regard to entrepreneurial spirit, California always leads the nation — despite all the negative talk.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

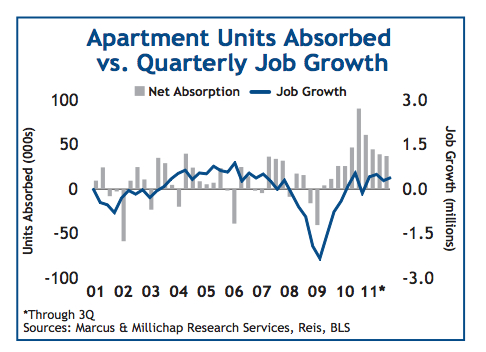

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Harvard 2011 State of the Nation’s Housing, Executive Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

With employment growth strengthening, consumer spending up, and rental markets tightening, some of the ingredients for a housing recovery were taking shape in early 2011.Yet in the first quarter of the year,new home sales plumbed record lows, existing sales remained in a slump, and home prices slid.Tight underwriting requirements,on top of uncertainty about the direction of home prices, continue to dampen home buying activity. The weakness of demand is slowing the absorption of vacant properties for sale,hindering the recovery.

Harvard 2011 America’s Rental Housing Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

The troubled homeowner market, along with demographic shifts, has highlighted the vital role that the rental sector plays in providing affordable homes on flexible terms. But while rental housing is the home of choice for a diverse cross-section of Americans, it is also the home of necessity for millions of low-income households.

WSJ: Why It’s Time to Buy

Posted: June 8th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The short-term outlook isn’t encouraging. Job growth remains weak, foreclosure sales are making up more of the market, and economists are predicting that home prices will fall more in the coming months.But the long-term benefits of home ownership remain very much intact.

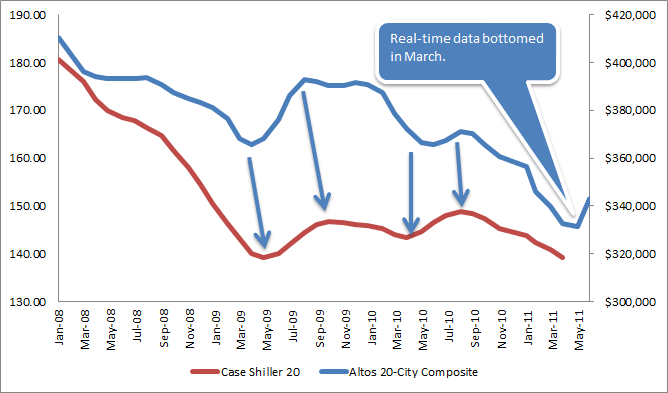

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Home prices: The double-dip is near?

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

2010 USC Casden Industrial and Office Forecast

Posted: December 10th, 2010

PAPER, USC LUSK CENTER, 12.10.2010

The annual Casden Real Estate Economics Forecast analyzes economic data, provided by Grubb & Ellis, on rents, vacancies, and transactions for office and industrial markets in Los Angeles, Orange, Riverside and San Bernardino counties.

Home Prices in U.S. Will `Bounce Along the Bottom,’ Case Says

Posted: December 1st, 2010

ARTICLE, BLOOMBERG, 11.30.2010

U.S. home prices are unlikely to fall much further in the next year even after a “discouraging” report on values in September, said Karl E. Case, the co-creator of the S&P/Case-Shiller Index.

“If I were betting even odds, I’d bet that we don’t have much further decline, but that we bounce along the bottom,” Case, a retired professor of economics at Wellesley College, said today in a Bloomberg Television interview on “Surveillance Midday” with Tom Keene.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

Case Shiller Points to Housing Stability

Posted: October 28th, 2010

![]()

OPINION, SEEKING ALPHA, 10.27.2010

Taken together, these facts strongly suggest that the housing market stabilization we have observed over the last year or so is the real thing, not just a chimera.

Sequoia Investment Partners, September 2010 Investor Market Summary and Forecast

Posted: September 29th, 2010

OPINION, SREP, 10.07.2010

Record-low interest rates persist, with 10-year treasury yield falling below 2.50% and fixed-rate mortgage rates – for both single- and multi-family residences – available in the 4′s.

As a result, we continue to be very bullish on the multi-family residential market, and despite the likely forthcoming wave of additional single-family residential foreclosures, significant opportunities will present themselves in that market as well. Sequoia Real Estate Partners is poised to take advantage of these favorable markets for medium- to longer-term investment.

A Dream House After All: Karl Case Explains Why It’s a Great Time to Buy a Home, or Invest in Housing.

Posted: September 7th, 2010

![]()

OPINION, NY TIMES, 09.07.2010

But housing has perhaps never been a better bargain, and sooner or later buyers will regain faith, inventories will shrink to reasonable levels, prices will rise and we’ll even start building again. The American dream is not dead — it’s just taking a well-deserved rest.

Karl E. Case is a professor emeritus of economics at Wellesley and co-creator of Standard & Poor’s Case-Shiller housing index.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Sequoia Investment Partners, July 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

OPINION, SREP, 07.07.2010

However, in times like these I am always reminded of Warren Buffett’s sage advice to be “greedy when others are fearful, and fearful when others are greedy.” That is, with so much uncertainty comes substantial opportunity, and it is my view that longer-term trends are very favorable for those willing to commit capital to value-add residential real estate, despite the likelihood for continued volatility and anemic economic growth at best during the next couple of years. These trends are as follows: …..

Negative Homeowner Equity and Strategic Mortgage Defaults Boost Retail Sales but Pose Another Risk to Recovery

Posted: June 18th, 2010

![]()

PAPER, MARCUS & MILLICHAP, 06.2010

Drastic reductions in home values have driven many homeowners’ equity to negative levels, and returning to break-even will, for most, require several years. Consequently, a significant portion of these upside-down homeowners will walk away from their houses, even if they have the financial means to continue making payments.

Sequoia Investment Partners, May 2010 Investor Market Summary and Forecast

Posted: May 26th, 2010

OPINION, SEQUOIA INVESTMENT PARTNERS, 05.26.2010

Long story short, professional and some do-it-yourselfers are getting deals and just wait, there’s more to come.

L.A. Should Abandon Rent Control

Posted: May 21st, 2010

![]()

OPINION, LA TIMES, 05.21.2010

Politicians should work with the private sector to encourage affordable housing and rent stability through productive incentives.

By Eric Sussman of Sequoia’s Board of Advisors

Housing Optimists Are “Not Paying Attention” to the Facts, Says Dean Baker

Posted: May 13th, 2010

ARTICLE & VIDEO, YAHOO FINANCE, 05.13.2010

“I think we’re going to see a big fall-off in purchases for the rest of 2010 and even into 2011,” Baker says. “So the idea that somehow the market is stable, that housing prices will rise anytime soon – it’s really hard to make a case for that.”

Would You Have Bought It? Case Study of a Flip: 4832 2nd Ave, Los Angeles CA

Posted: May 9th, 2010

![]()

SEQUOIA STRATEGY, 05.09.2010

It’s not often an REO investment makes the front page of the Sunday edition of a national paper, but that’s exactly what happened on April 25th 2010 in the Los Angeles Times. So we thought it would be a great opportunity to do a quick case study on this particular purchase

The Coming Wave of Option-ARM and Alt-A Mortgage Resets

Posted: April 26th, 2010

![]()

STRATEGY, SEQUOIA RESEARCH, 4.22.2010

“We presently find ourselves in the relative calm between two waves.”

Renting: The new American dream?

Posted: April 20th, 2010

![]()

OPINION, PAUL LA MONICA CNN/MONEY

“This is a frugal recovery. People are more reluctant to buy homes as they would in a normal recovery,” Leamer said. “If you don’t have a job or are worrying about your job, you’re not going to buy a home. That’s the ultimate statement of optimism about the future.” Add that up and it’s reasonable to expect a rental boom that could last for some time.

“I Understand” by Tom Barrack jr. of Colony Capital

Posted: April 15th, 2010

OPINION: However, the most salient and timeless answer echoes from the soft and timid voice of Chance the Gardener, Peter Sellers’ character in the famous movie “Being There.”

Don’t Bet the Farm on the Housing Recovery by Robert Shiller of Yale University

Posted: April 12th, 2010

OPINION, By ROBERT J. SHILLER 04.09.2010 Yale University

MUCH hope has been pinned on the recovery in home prices that began about a year ago. A long-lasting housing recovery might provide a balm to households, mortgage lenders and the entire United States economy. But will the recovery be sustained?

Alas, the evidence is equivocal at best.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy