Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Emerging Trends in Commercial Real Estate Report: “Recovery Anchored in Uncertainty” in 2013

Posted: October 17th, 2012

Commercial real estate’s slow recovery will continue in 2013, according to the Emerging Trends in Real Estate 2013 report released today by PwC and the Urban Land Institute at the ULI Fall Conference taking place in Denver.

The report, generated by surveys and interviews with 900 real estate investors, developers, service providers and lenders, shows expectations that trends that have materialized in recent years will continue in 2013. Namely, gateway cities like San Francisco, New York, Boston and Washington, D.C. continue to be the best bets for investment and development—although there are fledgling concerns that pricing has gotten too heated. As a result, secondary cities may receive more of a boost in the coming months. But growth everywhere will continue to be tepid with gradual improvements in occupancies, rents and values for all property types.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Mixed-use project to get underway this month in downtown L.A.

Posted: January 15th, 2012

The $160-million One Santa Fe complex will consist of apartments, offices, shops and public outdoor spaces on Santa Fe Avenue between 1st and 4th streets.

Construction will begin this month on One Santa Fe, a long-anticipated $160-million apartment, office and retail development in the arts district of downtown Los Angeles.

The 790,000-square-foot complex will rise on four acres of land on Santa Fe Avenue between 1st and 4th streets that was leased from the Los Angeles County Metropolitan Transportation Authority.

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

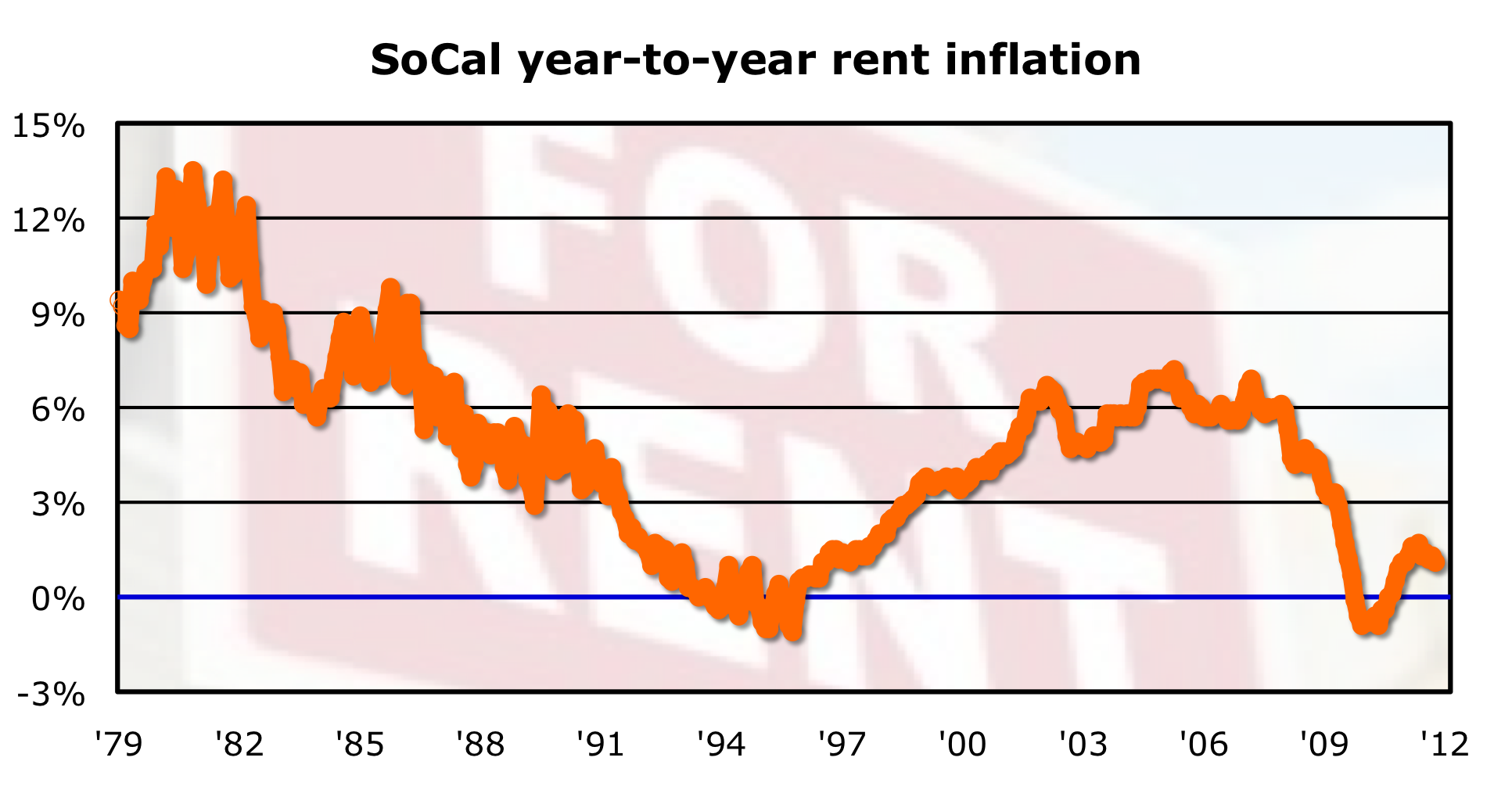

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

Historic United Artists building sells for $11 million. Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Posted: October 17th, 2011

ARTICLE, LA TIMES

A storied Los Angeles theater and office complex built by silent film stars that was later owned by one of the city’s most popular televangelists has been purchased by East Coast investors.

Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Southland office rents, occupancy rates stay low

Posted: October 16th, 2011

ARTICLE, LA TIMES

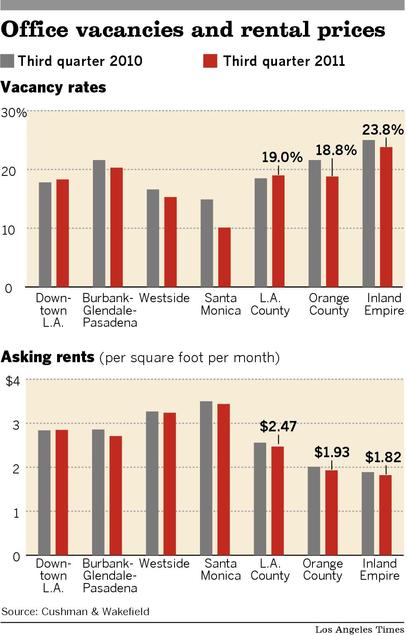

It was another stale quarter for most Southern California office landlords as rents and occupancy remained stalled at low levels, except in neighborhoods favored by technology and digital media companies.

The soft market was a boon for tenants willing to sign leases. But few companies are finding the need to expand their quarters with the economy tepid and hiring at a standstill.

Business bosses “have gone on a personnel diet,” said Jim Kruse of CBRE Group Inc., the real estate brokerage formerly known as CB Richard Ellis. “They are trying to get through and maintain as much market share as they can without putting a lot of cash into operations.”

Dot-coms want the beach in their address

Posted: October 16th, 2011

ARTICLE, LA TIMES

The commercial real estate rental market is booming in Santa Monica, where the office vacancy rate is a fraction of the L.A. County average. Tech and entertainment firms like the lifestyle.

Compared with most of the region’s white-collar office market, the less corporate environs of Santa Monica and Venice are looking sharp.

Technology and entertainment companies that long ago mastered the knack of making money without dressing up are now paying top dollar to rent space in some of Southern California’s most desirable neighborhoods.

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Blackstone Leads Buyout Firms Expanding Into Property

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

Blackstone Group LP and Carlyle Group are leading a record number of private-equity managers aiming to raise real estate funds as the world’s top buyout firms accelerate an expansion beyond corporate takeovers.

Blackstone, the biggest private-equity firm, is planning to raise its next real estate fund, with a target of about $10 billion, later this year. Carlyle is in the process of raising a new fund for U.S. property deals, said a person briefed on the plan who asked not to be named because the fund is private.

The two are among 439 private-equity real estate funds seeking a combined $160 billion, the largest number on record, according to London-based researcher Preqin Ltd. KKR & Co.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Donald Bren’s spending spree

Posted: December 15th, 2010

Irvine Co. billionaire boss Donald Bren has been making some big real estate gambits in recent weeks, a billion-buck-plus bet on an economic recovery ahead …

“It strikes me as a prudent move from a fearless leader. The recovery is underway. Conditions in Orange County indicate that economic growth is accelerating. Mr Bren is clearly convinced that investment at this stage of the recovery will be necessary to capture the rise in demand that is coming. We also believe there is an inevitable expansion of economic activity that will occur in Orange County by the end of 2011 and throughout 2012. …”

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

FDIC sells another $760 million in REO

Posted: September 3rd, 2010

![]()

ARTICLE, REO INSIDER, 09.03.2010

Mariner Real Estate Management (MREM), a real estate investment and management firm based in Kansas, closed a deal to acquire a $760 million portfolio of residential and commercial loans and REO properties from the Federal Deposit Insurance Corp. (FDIC).

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Marcus & Millichap sees Residential Market Turning Around Soon

Posted: August 11th, 2010

![]()

Article & Video, Fox & M&M Blog, 08.11.2010

Apartment demand has moved well beyond employment gains with the absorption of nearly 46,000 units in the second quarter, the strongest gains since the fourth quarter of 2000. This aggressive lease-up of apartments resulted in a 20 basis point vacancy drop to 7.8 percent, a trend that should continue through the remainder of the year as pent-up demand finally releases. Barring a systemic shock that halts job creation, an additional 65,000 units will be absorbed through the second half of the year, pressing vacancies to 7.4 percent by year-end.

Loan-to-Value Ratios Spike Following Wave of Reappraisals

Posted: July 21st, 2010

![]()

ARTICLE, NATL REAL ESTATE INVESTOR, 07.21.2010

Of the 1,125 CMBS loans on properties that were reappraised during the first half of this year, 986 recorded loan-to-value ratios of greater than 100% largely due to falling valuations.

It’s a cause for concern because the unpaid principal balance exceeded the new property appraisals by a wide margin in many cases. The average loan-to-value ratio among the 1,125 CMBS loans in the survey sample was a whopping 160%, up from 72.7% when the loans were securitized. (The 1,125 loans total $15.4 billion in volume.)

CHART: Office vacancies rise, rents drop in Southland

Posted: July 20th, 2010

![]()

CHART, LA TIMES, 07.20.2010

Office vacancies rise, rents drop in Southland again

Office vacancies rise, rents drop in Southland again

Posted: July 20th, 2010

![]()

ARTICLE, LA TIMES, 07.20.2010

An oversupply of space, businesses’ reluctance to add costs and landlords’ eagerness to keep good tenants leads to some of the cheapest lease rates in years. In the Inland Empire, vacancy tops 25%.

Southern California office landlords faced more bad news in the second quarter as occupancy and rents in their buildings fell again.

The persistently soft market has created opportunities for tenant businesses to sign some of the cheapest leases available in several years. The pace of deals has picked up a bit, brokers said, but many companies are still carefully husbanding their finances and avoiding long-term rental commitments.

Penthouse Offices Sit Vacant as High Flying Corporate Opulence Goes Out of Style

Posted: July 19th, 2010

![]() Offices at the top are going empty

Offices at the top are going empty

ARTICLE, LA TIMES, 07.19.2010

Penthouse floors are vacant in some of the best office buildings in Los Angeles County, a sign of the troubled economic times and the gulf between asking prices and what tenants are willing to pay.

Commercial real estate development stalled until 2012, architects say

Posted: July 19th, 2010

![]()

ARTICLE, LA TIMES, 07.19.2010

With vacancies still on the rise in commercial properties in most parts of the U.S., construction of new buildings is expected to be rare this year and next, the American Institute of Architects said Wednesday.

Core Logic: Commercial Market Monitor

Posted: June 18th, 2010

![]()

PAPER, FIRST AMERICAN CORE LOGIC, 06.2010

In 2010, over $283 billion in commercial mortgages will mature and need to be refi nanced or sold. This forecast is based upon CoreLogic property

records data and is updated on an ongoing monthly basis. All analyses presented herein examine the corollaries between property ownership and

mortgage holder information.

Sequoia Investment Partners, May 2010 Investor Market Summary and Forecast

Posted: May 26th, 2010

OPINION, SEQUOIA INVESTMENT PARTNERS, 05.26.2010

Long story short, professional and some do-it-yourselfers are getting deals and just wait, there’s more to come.

Buy a House, Sell REITs

Posted: May 7th, 2010

![]()

ARTICLES, KIPLIGER, 05.07.2010

One of the savviest and most cautious real estate investors says that housing prices have hit bottom but real estate investment trusts could fall a long way.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

Using REITS to asses the risk and return performance of real estate

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

“We find that the analyses based on REITs give notably different results from those based on SCS. In particular, real estate investment returns are higher and more volatile, and both the associated market and idiosyncratic risk are higher.”

Rent-Price Ratios and the Earnings Yield on Housing

Posted: April 16th, 2010

PAPER, USC

Rent-Price Ratios and the Earnings Yield on Housing

“I Understand” by Tom Barrack jr. of Colony Capital

Posted: April 15th, 2010

OPINION: However, the most salient and timeless answer echoes from the soft and timid voice of Chance the Gardener, Peter Sellers’ character in the famous movie “Being There.”

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy