Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Big money betting big on housing

Posted: March 4th, 2013

Investors are betting big on the housing recovery.

Hedge funds and private equity firms have been rushing in to buy up companies and assets in every part of the housing supply chain, including undeveloped land, homebuilders, foreclosed homes, and building parts manufacturers.

One of the most notable moves is coming from hedge fund manager John Paulson, best known for his big (and lucrative) bets against subprime mortgages in 2006 and 2007.

Click on the title to see the entire article

The Pacific Value Opportunities Fund II Opens October 29th.

Posted: October 23rd, 2012

Sequoia Real Estate Partners latest fund, PVOF II opens to investors October 29th. PVOF II comes on the heels of the highly successful PVOF I, which is on track for a very strong annual Return on Equity, and will capitalize on the current supply and demand imbalance in the single-family market for “turn-key” move-in ready homes. Bruce Bartlett, one of Sequoia’s Managing Partners noted “We’re simply taking our years of successful experience and economies of scale improving apartment communities and applying that to single-family homes. We did this in PVOF I and had great results.” The Fund is relatively small, only $10 million, so based on PVOF I’s success, SREP’s strong track record and investor demand, it is expected to fill quickly.

Click here for more info.

Housing is indeed heading higher

Posted: October 22nd, 2012

![]()

As Fortune predicted last year, a robust recovery in home prices is under way.

FORTUNE — In spring 2011 this writer penned a controversial cover story titled “The Return of Real Estate” that predicted a strong rebound in housing. At the time, prices and sales were still tumbling, and the prevailing view among economists and pundits was that the slide would drag on and on. But Fortune’s contrarian forecast proved right. By October of last year, new- and existing-home sales and housing starts had begun an upswing that’s been gathering strength ever since — and prices joined the march in early 2012. The data conclusively confirm what Fortune predicted back then: “Housing is back.”

To see this entire article, click on its TITLE above.

Home sales slowed in September, but 2nd best in two years

Posted: October 22nd, 2012

NEW YORK (CNNMoney) — The pace of previously owned home sales slowed slightly in September, even as the long-battered housing market showed signs of a broader recovery.

Sales of existing homes sold at an annual rate of 4.75 million, according to a closely watched reading reported Friday from the National Association of Realtors. It was off slightly from the 4.83 million pace the previous month, but up 11% from a year earlier. Despite the slip, September’s pace was the second best in more than two years, trailing only the strong August reading.

To see this entire article, click on its TITLE above.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Archstone buys apartment complexes in Venice, Marina del Rey

Posted: October 17th, 2012

Archstone adds to its Southern California portfolio, spending more than $100 million on the two properties that combined provide 275 units.

Colorado apartment landlord Archstone broadened its Southern California empire this month by spending more than $100 million on seaside properties in Venice and Marina del Rey.

Archstone, which operates upscale apartments in coastal markets, bought the Frank, a 70-unit complex on Rose Avenue in Venice, for $56.2 million. It also purchased the Bay Club, which has 205 units — and 207 boat slips — on Tahiti Way in Marina del Rey for $43.95 million.

Banks see a housing rebound

Posted: October 13th, 2012

JPMorgan, Wells Fargo post big profit gains as home lending booms

America’s long-suffering housing market may be on the mend, two major banks said as they reported big jumps in profits.

JPMorgan Chase & Co. and Wells Fargo & Co., the nation’s largest home lenders, each reported double-digit quarterly earnings growth Friday. The big jump in profit was thanks largely to a surge in their mortgage businesses, fueled by low interest rates and waves of refinancing.

Economists: Housing recovery finally here

Posted: October 10th, 2012

NEW YORK (CNNMoney) — It’s been a long time coming, but economists surveyed by CNNMoney believe the nation’s housing market has finally turned the corner.

Of the 14 economists who answered questions about home prices in the survey, nine believe that prices have already turned higher or will make that turn later this year. Only three months ago, half of the economists surveyed by CNNMoney believed a turnaround in prices would not take place until 2013 or later.

Getting Warmer: Where Rent Prices are Hot (and Where They’re Cool)

Posted: October 10th, 2012

For those looking to live in a locale with an endless summer, it doesn’t come cheap.

On average, renters in Orange County, Calif. pony up more than $1,650 a month for an average two-bedroom apartment, according to new data from Homes.com and ForRent.com. To cover housing costs alone, residents have to rake in about $32 an hour, no small feat in a wage-depressed economy.

Housing recovery blossoms

Posted: October 10th, 2012

NEW YORK (CNNMoney) — The U.S. housing industry — crucial to any jobs recovery — showed more signs of strength, according to two reports issued Wednesday.

The Census Bureau said housing starts and permits rose substantially in August. Separately, sales of previously occupied homes climbed 7.8% from a year ago, according to the National Association of Realtors.

Builders started on new homes at an annual rate of 750,000, up 29.1% compared with a year earlier. They applied to build another 803,000 new homes on an annual basis, a 24.5% jump compared with August 2011.

Economists bullish on housing recovery

Posted: October 10th, 2012

Home prices will see steady increases through 2016 starting this year, according to a quarterly survey of more than 100 economists, real estate experts and investment strategists.

The survey, conducted by research and consulting firm Pulsenomics LLC on behalf of real estate search and valuation portal Zillow between Aug. 30-Sept. 14, 2012, asked 113 participants to project the path of the S&P/Case-Shiller U.S. National Home Price Index over the next five years.

Deutsche Bank claims housing correction complete

Posted: October 10th, 2012

![]()

Recent indicators showed housing has largely corrected back to pre-bubble levels and affordability, according to a note from Deutsche Bank analysts.

Nationally, home prices dropped roughly 40% from the overheated peak in 2006 to a low in 2009. But the analyst said in a note Thursday that prices are still 30% higher than the millennium average. Incomes, while similarly dented by the financial crisis actually recovered more quickly than prices.

U.S. home prices make biggest jump in 6 years

Posted: September 4th, 2012

Nationwide home prices shot up 3.8% in July, making their largest year-over-year leap since 2006, according to real estate data provider CoreLogic.

The gain marks the fifth straight rise in the gauge, part of a positive swing following a year and a half of slumps. The last time prices rose so much was in August 2006, when they jumped 4.1%.

Prices in California bounded up 4.4%. Without distressed sales – including foreclosures and short sales – national prices were up 4.3% compared with last July.

Home prices signal recovery may be here

Posted: August 28th, 2012

NEW YORK (CNNMoney) — A sharp boost in home prices during the spring could signal a recovery in the long-suffering U.S. housing market, according to an industry report issued Tuesday.

The S&P/Case-Shiller national home price index, which covers more than 80% of the housing market in the United States, climbed 6.9% in the three months ended June 30 compared to the first three months of 2012.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Home Prices Climb as Supply Dwindles

Posted: August 13th, 2012

Home prices rose by their largest percentage in at least seven years during the second quarter, propelled by low inventories of properties for sale and high demand for bargain-priced foreclosures, according to two reports Tuesday.

Prices rose by 2.5% in June from a year ago, and by 6% from the previous quarter, said CoreLogic Inc., a Santa Ana, Calif., data firm. The quarterly jump was the largest since 2005.

Finally, It Is Time to Buy a House

Posted: August 13th, 2012

Warren Buffett famously once said: “Be fearful when others are greedy, be greedy when others are fearful.”

And if you’re not instinctively scared of the housing market, then global warming, saturated fat, running with scissors and the bogeyman probably aren’t keeping you awake at night, either.

The fact that everyone is scared to dabble in—much less commit to—housing makes it a close-to-perfect investment based on Mr. Buffett’s principle. But buying real estate is a good long-term investment for many more reasons, some of which have only become apparent in recent weeks.

Wall Street’s hottest investment idea: Your house

Posted: August 13th, 2012

![]()

FORTUNE –Your house might be a better investment than you think. At least Wall Street seems to think so.

For a while now the conventional wisdom on real estate has been that while home prices might not fall much more, they aren’t likely to go up anytime soon either. The best personal finance advice, then, when it came to buying a house, was to buy as little as possible.

Apparently, though, on Wall Street that common wisdom about home prices is not held by all, or even many. In the past six months or so, a number of investment firms, hedge funds, private equity partnerships and real estate investors have turned into voracious buyers of single-family homes. And not just any homes, but foreclosures. Investment banks, who also want in on the action, are lining up financing options to keep the purchases going.

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

Demographics, New Assumptions Drive Commercial Real Estate

Posted: June 12th, 2012

A turning point has been reached in the economy and both demographics and the assumptions that traditionally drove the commercial real estate industry are shifting.

But while economists speaking on a panel at the Strategic Real Estate Conference held in New York this week agreed that this is a time of incredible change, they also see opportunity.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

Rise in Home Sales Points to Rebound

Posted: May 27th, 2012

![]()

Sales of previously owned homes rose at a robust clip in April—and prices jumped—the latest indications that the hard-hit housing market is recovering.

Existing-home sales were up 3.4% from March to a seasonally adjusted annual rate of 4.62 million, the National Association of Realtors trade group said Tuesday. If the pace holds, 2012 could be the strongest year for home sales since 2007, just after the housing boom. The median home price, meanwhile, increased 10.1% from a year earlier to $177,400, the strongest year-to-year gain since January 2006.

Homeownership likely to be delayed for ‘Generation Now’ members

Posted: May 27th, 2012

Most consumers in their 20s are stuck in a holding pattern, a retail industry consultant says. ‘Everything is delayed for them,’ she says.

CHICAGO — Maxine Lauer calls the group of consumers 15 to 34 “Generation Now” because they want what they want and they want it now.

Trouble is, “now” isn’t happening for them, especially for those in the middle of that range, their 20s, who might reasonably be expected to be thinking about buying their first homes.

Generally, though, that’s not something they’re doing, because most of them just can’t, said Lauer, whose Sphere Trending retail industry consulting firm in Waterford, Mich., has studied their attitudes in depth. Basically, she said, they’re stuck in a holding pattern.

“Everything is delayed for them,” Lauer said. “Homeownership is delayed, and they will rent longer. They’re delaying marriage, delaying kids. It’s because their peak earning years are being delayed.”

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Builder Is Constructing REIT for Home Rentals

Posted: May 9th, 2012

![]()

Above, one of the company’s houses in Tolleson, Ariz.

Investors can buy stakes in malls, apartment towers, timber forests and even cellphone towers through real-estate investment trusts. Now, add to the list: single-family homes transformed into rental properties.

Beazer Pre-Owned Rental Homes Inc., which hopes to expand beyond Phoenix and Las Vegas to at least one other, as-yet unidentified market. Within two years, Beazer said the number of rental homes under the new REIT’s control could number in the thousands.

Warren Buffett on CNBC: I’d Buy Up ‘A Couple Hundred Thousand’ Single-Family Homes If I Could

Posted: April 26th, 2012

![]()

Warren Buffett says along with equities, single-family homes are a very attractive investment right now.

Appearing live on CNBC’s Squawk Box, Buffett tells Becky Quick he’d buy up “a couple hundred thousand” single family homes if it were practical to do so.

If held for a long period of time and purchased at low rates, Buffett says houses are even better than stocks. He advises buyers to take out a 30-year mortgage and refinance if rates go down.

March California Home Sale Press Release

Posted: April 24th, 2012

An estimated 37,481 new and resale houses and condos were sold statewide last month. That was up 26.5 percent from 29,630 in February, and up 2.9 percent from 36,417 for March 2011.

The median price paid for a home last month was $251,000, up 5.0 percent from $239,000 in February, and up 0.8 percent from $249,000 for March a year ago.

Southland Home Sales Up; Median Price Almost Back to Year-Ago Level

Posted: April 20th, 2012

La Jolla, CA—Southern California home sales shot up last month from February amid the usual surge in early-spring shopping, but the gain over a year earlier was modest. Sales of $500,000-plus homes, though a bit lower than last year, jumped 36 percent from February, helping to lift the region’s overall median sale price to a six-month high – and to about where it was in March 2011, a real estate information service reported.

Wall Street Keys On Landlord Business

Posted: April 18th, 2012

![]()

Some of the biggest names on Wall Street are lining up to become landlords to cash-strapped Americans by bidding on pools of foreclosed properties being sold by Fannie Mae.

The idea is that the new owners would rent out the homes at first rather than reselling—potentially aiding a housing-market recovery by reducing the number of properties clogging the market. The fact that big-name investors are interested also suggests they anticipate sizable future profits in housing.

Fannie Mae’s Foreclosure Announcement

Entreprenuers will save housing

Posted: April 18th, 2012

By G.U. KRUEGER / SPECIAL TO THE REGISTER

Veteran Southern California real estate analyst G.U. Krueger adds his commentary on the housing market to this blog in a spot we call “Thursday Morning Quarterback.” Here’s his latest installment …

New business formations and entrepreneurial activity are one key to housing’s recovery.

In regard to entrepreneurial spirit, California always leads the nation — despite all the negative talk.

Qualifying for a mortgage has gotten much tougher, analysis shows

Posted: April 15th, 2012

![]()

The average successful applicant for a conventional home purchase mortgage in February had a FICO score of 764, well above what was once the norm, and a down payment of 22%.

WASHINGTON — How do you stack up as a potential mortgage candidate in this year’s increasingly tough underwriting environment? Do you have the right stuff — credit score, debt-to-income ratio, equity or down payment — to get you through the minefield?

A new statistical analysis, based on a large sample of all mortgage applications approved and denied in recent months, offers valuable benchmarks for anyone thinking about financing a home purchase or refinancing an existing loan. The study taps into data from the loan processing software used for roughly one-fifth of all new mortgage applications nationwide, supplied by the technology firm Ellie Mae Inc.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

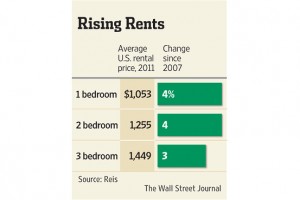

Rents Keep Rising, Even as Housing Prices Fall

Posted: February 27th, 2012

![]()

The housing market remains a potent drag on the economy as home prices continue to slip, foreclosed homes fill some neighborhoods and millions of construction workers scramble for jobs.

But one group is sitting pretty: landlords.

Unlike home prices, rents have been rising, up 2.4 percent in January from a year earlier, according to recent data, not adjusted for inflation, released by the Labor Department.

With few rental buildings erected over the last few years, available units are going fast.

New American Dream Is Renting to Get Rich

Posted: February 18th, 2012

Examining 250 properties around the U.S., and going through close to 40 client files to project the financial impact of owning real estate versus liquidating it, Arzaga, an adjunct professor in personal finance at the University of California at Berkeley, found that, “100 percent of the time it was better to rent, rather than own.”

That’s right: 100 percent.

Mortgage deal could bring billions in relief

Posted: February 10th, 2012

In the largest deal to date aimed at addressing the housing meltdown, federal and state officials on Thursday announced a $26 billion foreclosure settlement with five of the largest home lenders.

The deal settles potential state charges about allegations of improper foreclosures based on robosigning, seizures made without proper paperwork.

Investors flood Southern California housing market in December

Posted: January 23rd, 2012

A record number of investors and second-home buyers flooded the Southern California real estate market in December, though not enough to give sales in the region a bump over the same month a year earlier.

With the investor dominance, low-cost homes reigned. That helped push the region’s median home price back down to its lowest level in 12 months, according to San Diego real estate firm DataQuick.

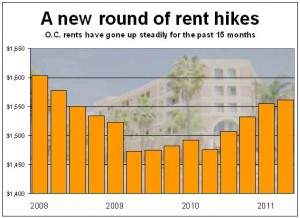

O.C. Apartments see largest rent hikes in 4.5 years

Posted: January 23rd, 2012

Another round of rent hikes occurred at Orange County’s large apartment complexes last fall, reflecting an ever-tightening market as vacancies continued to fall.

The average asking rent for a large-complex unit in Orange County was $1,561 a month, according to apartment tracker RealFacts.

Navigating a Tight Rental Market

Posted: January 23rd, 2012

The rental market is the tightest it’s been in more than a decade, with only 5.2% of apartments nationwide vacant at the end of 2011, down from a high of 8% in 2009, according to real-estate data firm Reis.

Demand is up as the housing crisis and tighter lending standards have left many people unable to or wary of purchasing a home. And higher demand means average rents are rising, too.

December California & So Cal Home Sales Report

Posted: January 23rd, 2012

An estimated 37,734 new and resale houses and condos were sold statewide last month. That was up 15.5 percent from 32,669 in November, and up 4.2 percent from 36,215 for December 2010. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,063. DataQuick’s statistics go back to 1988.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Foreclosures expected to rise, pushing home prices lower

Posted: January 15th, 2012

Banks are getting more aggressive with the 3.5 million U.S. homes with seriously delinquent mortgages, setting the stage for a big wave of foreclosure action this year.

By E. Scott Reckard, Los Angeles Times

California and other states are likely to see an enormous wave of long-delayed foreclosure action in the coming year as banks deal more aggressively with 3.5 million seriously delinquent mortgages.

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

Big Funds Build Case for Housing

Posted: December 30th, 2011

Big money is starting to wager on housing.

Hedge funds run by Caxton Associates LP, SAC Capital Advisors LP, Avenue Capital and Blackstone Group LP have been buying housing-related investments, betting on a rebound. And formerly bearish research firm Zelman & Associates now predicts a housing pickup, as does Goldman Sachs Group Inc.

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

Scheduled foreclosure auctions soar in California

Posted: December 24th, 2011

Banks in November scheduled more than 26,000 homes to be sold at California foreclosure auctions, a 63% increase from October and a sign that a surge in discounted, bank-owned properties is on track to hit the market next year.

Multifamily Construction Drives Housing Starts Jump

Posted: December 24th, 2011

![]()

ARTICLE, WSJ

SREP Note: We feel this article is important for investors to note because typically SREP funds acquire and reposition properties for less than their replacement cost.

U.S. home building climbed to the highest level in 19 months during November and construction permits grew, with most of the increase in housing starts coming from multifamily construction.

Home construction last month increased 9.3% to a seasonally adjusted annual rate of 685,000 from October, the Commerce Department said Tuesday. The results were better than forecast. Economists surveyed by Dow Jones Newswires expected housing starts would rise by 0.3% to an annual rate of 630,000.

The increase in November was driven by a 25.3% increase in multi-family homes with at least two units, a volatile part of the market. Construction of single-family homes, which made up about 65% percent of the market, rose only 2.3%.

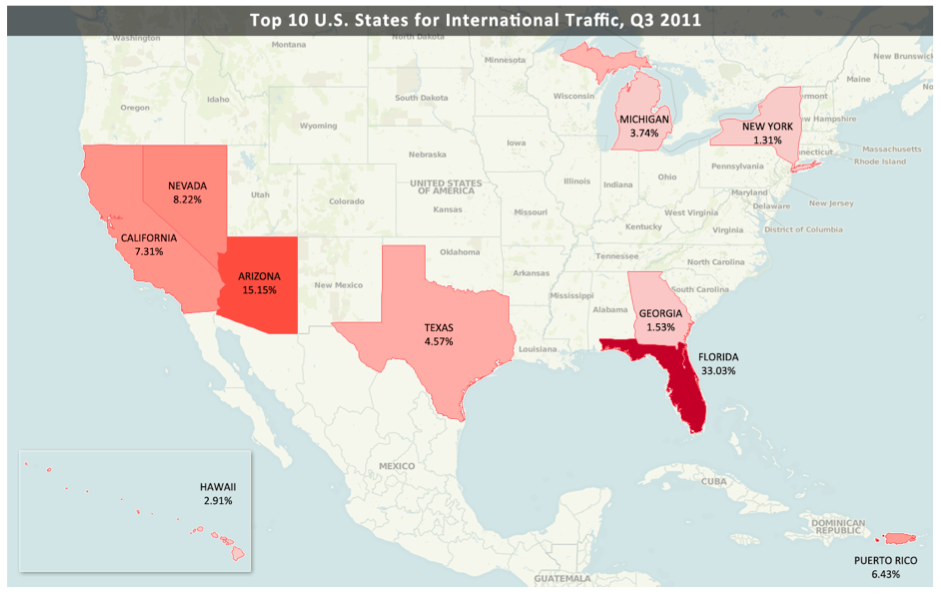

Foreign homebuyers clicking on depressed US housing markets

Posted: December 19th, 2011

![]()

ARTICLE, HOUSING WIRE

Foreigners looking to purchase homes in the U.S. are increasing their online search activity for bargains, as sliding home prices continue to attract investors from around the globe — especially Canada.

Florida properties remained the lead attraction for foreign investment in the third quarter, followed by Arizona, Nevada and California, according to traffic on the website for Point2, a Canadian-based real estate marketing company. Those housing markets have experienced the steepest declines in home prices from the sector’s peak in June 2006.

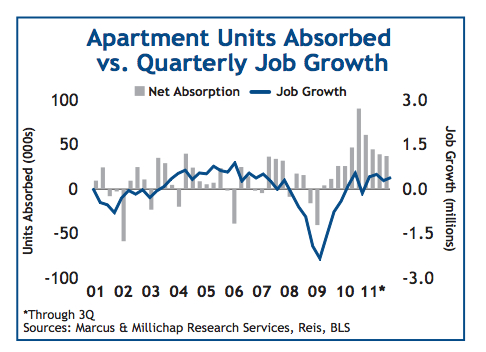

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

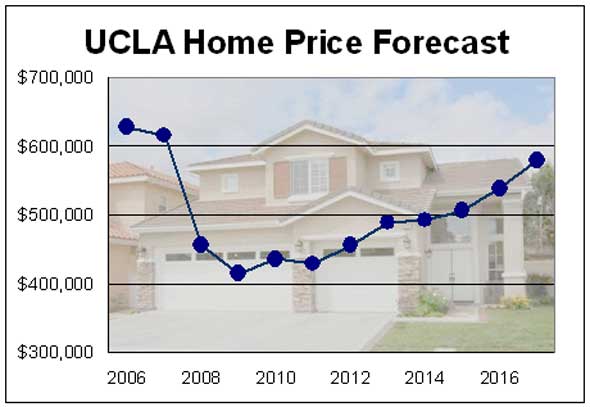

UCLA: O.C. home prices to rise 35%

Posted: November 16th, 2011

ARTICLE, OC REGISTER

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

California Foreclosure Activity Back Up

Posted: October 21st, 2011

PRESS RELEASE, DATA QUICK

After dropping to a three-year low in the second quarter of this year, the number of California homeowners being pulled into the foreclosure process snapped back to prior levels over the last three months, a real estate information service reported.

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.

Housing Lift Proves Fleeting

Posted: October 21st, 2011

![]()

ARTICLE, WALL ST JOURNAL

Sales of previously owned homes slipped in September as Americans were hit by economic uncertainty, high unemployment and tight lending.

Data Thursday highlight how jobs and housing are the main economic drags. Job seekers in California this week.

Existing-home sales dropped 3% to a seasonally adjusted 4.91 million in September, the National Association of Realtors said Thursday. That followed a sales bump in August, as the housing market remains stuck in neutral despite lower prices and interest rates at near-historic lows.

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Posted: October 17th, 2011

PRESS RELEASE, DATAQUICK

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Home ownership: Biggest drop since Great Depression

Posted: October 13th, 2011

ARTICLE, CNN MONEY

The percentage of Americans who owned their homes has seen its biggest decline since the Great Depression, according to the U.S. Census Bureau.

The rate of home ownership fell to 65.1% in April 2010, 1.1 percentage points lower than it was in 2000. The decline was the biggest drop since the 1930s, when home ownership plunged 4.2%.

The most recent decade-over-decade drop, however, only tells half the story.

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

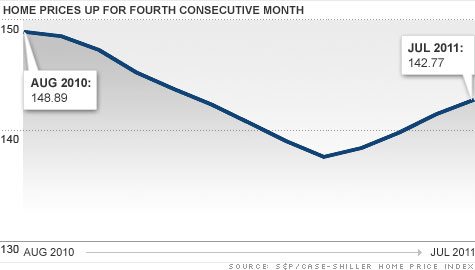

Home prices climb for fourth straight month

Posted: September 27th, 2011

ARTICLE, CNN/MONEY

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose 0.9% in July compared with June, but they’re still 4.1% lower than 12 months ago.

California foreclosures set to surge

Posted: September 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

California default notices spiked 55% in August, and the number may keep rising in the coming months as mortgage servicers shake off the robo-signing freeze, according to RealtyTrac Senior Vice President Rick Sharga.

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

FHA multifamily loan originations at record high

Posted: September 12th, 2011

ARTILCE, REUTERS

The Federal Housing Administration has backed a record $10.5 billion in multifamily rental housing loans during its 2011 fiscal year, the agency said on Tuesday.

The rise in loans for multifamily units reflects an underlying trend in demand for rental property.

Shadow inventory improves but still threatens housing recovery

Posted: August 24th, 2011

“It’s good news that things are starting to slow down and we’re getting closer to the end of the problem,” said Diane Westerback, Managing Director of Global Surveillance Analytics for S&P. “It could mean a gradual recovery for the market.”

Number of troubled mortgages on rise again

Posted: August 24th, 2011

![]()

ARTICLE, CNN/MONEY

In another hit to the beleaguered housing market, a report out Monday found that the number of delinquent mortgage borrowers — those who have missed at least one payment — rose during the second quarter.

The delinquency rate grew only slightly, up 0.12 percentage points to 8.44%, but that reverses the steady improvement of the past two years.

The increase, as reported by the Mortgage Bankers Association (MBA), may not sound like much, but it could mean that the recovery in the housing market will take even longer than thought.

Investing in Undervalued Housing Markets

Posted: August 22nd, 2011

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

Foreclosure reforms may be coming to a head

Posted: August 18th, 2011

Getting banks, investors and borrowers together to work out a solution that benefits them all is the most promising idea to emerge since the housing market first crashed.

Buying real estate a better deal than renting in 74% of major US cities

Posted: August 18th, 2011

Buying real estate continues to be cheaper than renting in the vast majority of major U.S. cities, according to a quarterly rent vs. buy index from real estate search and marketing site Trulia.

The index compared the median list price and the median annualized rent on a two-bedroom apartment, condominium or townhouse in the country’s 50 most populous cities. According to the index, the cost of buying was less than renting in 37 of the 50 cities (74 percent) as of July 1, 2011. About the same share, 78 percent, favored buying over renting in Trulia’s last index report, released in April.

Foreclosures fall for 10th straight month

Posted: August 18th, 2011

ARTICLE, CNN

Foreclosure filings dropped once again in July, hitting their lowest level since November 2007, as processing delays and foreclosure prevention measures enabled a larger number of delinquent borrowers to remain in their homes.

Filings were down 4% compared to June and were 35% lower than July 2010, marking the tenth straight month of year-over-year declines, according to RealtyTrac, a leading online marketer of foreclosed properties.

Mortgage Rates Keep Falling

Posted: August 18th, 2011

ARTICLE, CNN

Just when it seemed mortgage rates weren’t going to get any lower, they started testing new lows.

In the tumultuous days following Standard & Poor’s debt downgrades, rates on 30-year fixed mortgages fell to 4.32%, down from 4.39% last week and closed in on a record low of 4.17% set last November, according to Freddie Mac’s Primary Mortgage Market Survey.

Rates on 15-year fixed mortgages set a new record for the second week in a row, falling to 3.5%, down from 3.54% last week.

Southland Housing Market’s Vital Signs Remain Weak

Posted: August 18th, 2011

Southern California home sales fell last month to the lowest level for a July in four years, though the decline from a year earlier was the smallest in 13 months. The drop in sales from June was more pronounced, especially for $500,000-plus homes, as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, a real estate information service reported.

California July Home Sales

Posted: August 18th, 2011

PRESS RELEASE, DATAQUICK

An estimated 34,695 new and resale houses and condos were sold statewide last month. That was down 11.0 percent from 38,975 in June, and down 1.4 percent from 35,202 for July 2010. A decline from June to July is normal for the season. California sales for the month of July have varied from a low of 30,596 in 1995 to a high of 71,186 in 2004, while the average is 46,577. DataQuick’s statistics go back to 1988.

Foreclosures Fall in Most Cities

Posted: July 28th, 2011

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Southland Home Sales Quicken, Median Price Highest This Year

Posted: July 13th, 2011

PRESS RELEASE, MDA DATAQUICK

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges, a real estate information service reported.

Home prices rise, snapping 8-month drop streak

Posted: July 13th, 2011

ARTICLE, CNN

The downward cycle in home prices broke in April after eight consecutive months of decline, according to a survey released Tuesday.

According to the S&P/Case Shiller 20-city index, prices rose 0.7% compared with March, although they fell 0.1% when adjusted for the strong spring selling season. Prices were down 4% year-over-year.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

National rental prices climb in June

Posted: July 13th, 2011

ARTICLE, INMAN NEWS

Rental listing prices nationwide rose 6.7 percent year-over-year in June, according to a report from real estate search site HotPads.

The report was based on the median listing prices of 500,000 rentals on HotPads.com across major U.S. metro areas between June 2010 and June 2011.

More consumers forced to rent due to foreclosure: TransUnion

Posted: June 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

According to the survey, 47% of all property managers reported an increase in rental applicants moving into apartments from foreclosed properties. Sequentially, more than two-third of managers said it is not difficult to find residents in today’s economy even with increases in rent.

Forecast: Homebuilders to focus on Calif. cities

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“What we’ve seen is this shift toward multifamily housing demand,” said the forecast’s author, Jerry Nickelsburg. “You can see that in the demographics.”

Since apartment units require far fewer workers than single-family homes, the post-recovery homebuilding sector will employ fewer people than before the downturn, Nickelsburg said.

‘Shadow Inventory’ Shrinks in U.S. as More Foreclosed Homes Sell

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“It’s showing there are improvements in some segments of the market,” he said in a telephone interview from McLean, Virginia. “It doesn’t mean housing distress is over, but it does show that the pipeline of distress is beginning to ease.”

May Southern California Home Sales Report

Posted: June 26th, 2011

ARTICLE, MDA DATAQUICK

Southern California home sales held at a three-year low last month amid a sluggish move-up market and record-low sales of newly built homes. The median sale price fell year-over-year by the largest amount in 20 months as buyer uncertainty, tight credit and lackluster hiring continued to restrain housing demand, Dataquick reported.

San Pedro apartment tower sells for $80.1 million, almost $100 million less than cost.

Posted: June 8th, 2011

The Vue, at 5th and Palos Verdes streets, was completed at a cost of $175 million in 2008 before the real estate crisis. The building was acquired by San Francisco investors after the developers lost it to foreclosure.

ARTICLE, LA TIMES

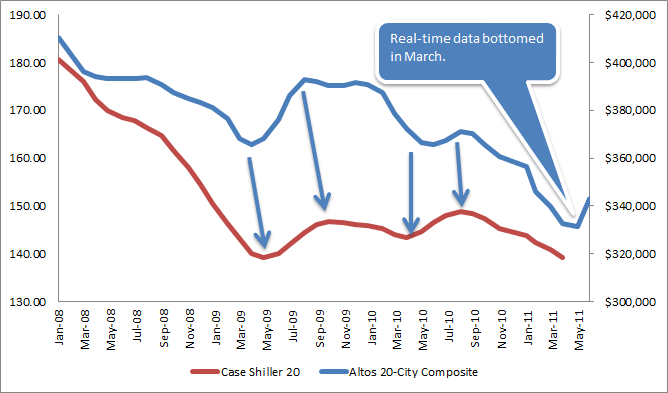

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

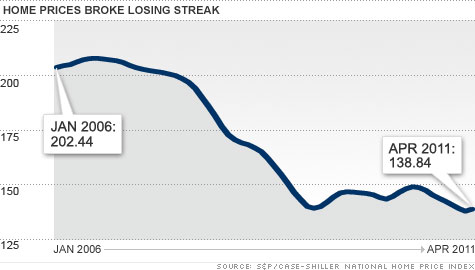

Home prices: ‘Double-dip’ confirmed

Posted: June 2nd, 2011

ARTICLE, CNN

Home prices hit another new low in the first quarter, down 5.1% from a year ago to levels not reached since 2002.

It was the third straight quarterly drop for the S&P/Case-Shiller national home price index, which was released Tuesday.

Prices are now down 32.7% from their peak set five years ago.

“Home prices continue on their downward spiral with no relief in sight,” said David Blitzer, spokesman for Standard and Poor’s.

The index covers 80% of the housing market, and this month’s report confirmed “a double-dip in home prices across much of the nation,” said Blitzer.

The housing market went through a brief recovery period starting in mid-2009, recovering nearly 5% of earlier losses. After homebuyer tax credits expired last April, the slump resumed.

A separate S&P/Case-Shiller index covering 20 major cities also dropped during March, the index’s eighth straight monthly decline

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

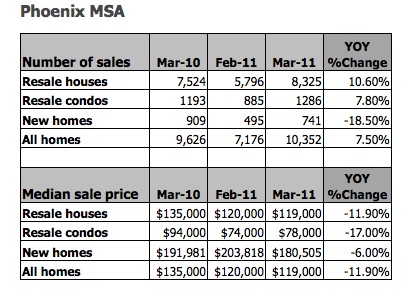

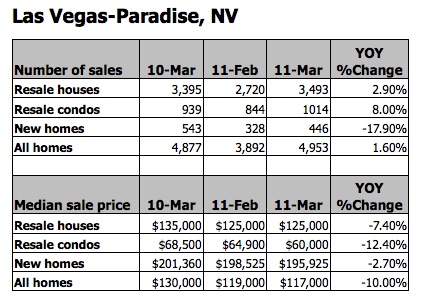

March Home Sales Phoenix & Las Vegas

Posted: May 10th, 2011

Housing construction ‘encouraging’

Posted: April 22nd, 2011

![]()

ARTICLE, CNN/MONEY

In an encouraging sign for the housing market, new home construction increased more than expected in March, according to a government report Tuesday.

Americans Shun Cheapest Homes in 40 Years as Ownership Fades

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

The most affordable real estate in a generation is failing to lure buyers as Americans like Pauli sour on the idea of home ownership. At the end of 2010, the fourth year of the housing collapse, the share of people who said a home was a safe investment dropped to 64 percent from 70 percent in the first quarter. The December figure was the lowest in a survey that goes back to 2003, when it was 83 percent.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Home prices: The double-dip is near?

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

Phoenix Region December Home Sales

Posted: February 11th, 2011

ARTICLE, MDA DATAQUICK

Phoenix-area December home sales rose more than usual from November and posted only a slight year-over-year sales decline as the market saw gains in investor activity, foreclosure resales and sub-$100,000 transactions. The median sale price fell on a year-over-year basis for the sixth consecutive month, to the lowest level in just over 12 years, a real estate information service reported.

Cash Buyers Lift Housing

Posted: February 11th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority. WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

California December Home Sales Report

Posted: January 31st, 2011

ARTICLE, MDA DATAQUICK

An estimated 36,215 new and resale houses and condos were sold statewide last month. That was up 15.3 percent from 31,403 in November, and down 13.4 percent from 41,837 for December 2009. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,338. DataQuick’s statistics go back to 1988.

The median price paid for a home last month was $254,000, down 0.4 percent from $255,000 in November, and down 3.8 percent from $264,000 for December a year ago. The year-over-year decrease was the third in a row after eleven months of increases. The bottom of the current cycle was $221,000 in April 2009, while the peak was at $484,000 in early 2007.

Home values are falling at an accelerating rate in many cities across the U.S.

Posted: January 31st, 2011

![]()

ARTICLE, WALL ST JOURNAL

The Wall Street Journal’s latest quarterly survey of housing-market conditions found that prices declined in all of the 28 major metropolitan areas tracked during the fourth quarter when compared to a year earlier.

The size of the year-to-year price declines was greater than the previous quarter’s in all but three of the markets, the latest indication that the housing market faces considerable challenges.

Inventory levels, meanwhile, are rising in many markets as the number of unsold homes piles up.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

No McMansions for Millennials

Posted: January 18th, 2011

![]()

ARTICLE, WALL ST. JOURNAL

Gen Y housing preferences are the subject of at least two panels at this week’s convention. A key finding: They want to walk everywhere. Surveys show that 13% carpool to work, while 7% walk, said Melina Duggal, a principal with Orlando-based real estate adviser RCLCO. A whopping 88% want to be in an urban setting, but since cities themselves can be so expensive, places with shopping, dining and transit such as Bethesda and Arlington in the Washington suburbs will do just fine.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

Posted: December 31st, 2010

![]()

ARTICLE, WALL ST JOURNAL, 12.28.2010

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

U.S. Housing Market Double-Dip Unlikely Next Year, Wharton’s Wachter Says

Posted: December 31st, 2010

ARTICLE, BLOOMBERG, 12.31.2010

The U.S. housing market probably will avoid a “double-dip” next year as a recovery depends on job growth, said Susan Wachter, a real estate professor at the University of Pennsylvania’s Wharton School.

“Nationally, we’ll see a bumpy ride instead of a double- dip,” Wachter said in an interview from Philadelphia today on Bloomberg Television. “Jobs are key.”

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

Luxury home prices are still heading down

Posted: December 14th, 2010

![]()

While Southland housing values overall have rebounded from recent lows, those in the upper end of the market may not yet have hit bottom. Some experts don’t see a turnaround for at least another year.

Bank of America ramps up foreclosure restarts

Posted: December 13th, 2010

![]()

ARTICLE, HOUSING WIRE, 12.13.2010

Bank of America (BAC [1]: 12.79 -0.08%) cleared attorneys to proceed with 16,000 foreclosure cases in December as it completes a revamp of its procedures.

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

Percent of Americans likely to rent their next home grows, survey indicates

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

The percentage of Americans who said their next home would probably be a rental has grown to 33% from 30% since a similar survey came out in April. And 60% of those who rent said they’d continue to do that rather than buy a house if they were to move, up 6 points from April.

‘Shadow’ supply of 2.1 million homes potentially looms

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

This “shadow inventory” of residential real estate — in which the property is either in foreclosure, has a loan 90 days past due or has been taken back by a lender and is not listed for sale — stood at an eight-month supply at the end of August, according to the Santa Ana mortgage research firm CoreLogic, which released the data. That was an increase from 1.9 million, a five-month supply, a year earlier.

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Delinquency Rate on U.S. Mortgages Declines

Posted: November 18th, 2010

![]()

ARTICLE, NY TIMES, 11.18.2010

The mortgage delinquency rate in the United States declined last quarter amid hints of improvement in the job market, but headwinds from defaults and a rising rate of new foreclosure applications keep the housing outlook muddied, the Mortgage Bankers Association said on Thursday.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

Case Shiller Points to Housing Stability

Posted: October 28th, 2010

![]()

OPINION, SEEKING ALPHA, 10.27.2010

Taken together, these facts strongly suggest that the housing market stabilization we have observed over the last year or so is the real thing, not just a chimera.

O.C. home prices to surge 49%, UCLA economists say

Posted: October 28th, 2010

![]()

ARTICLE, OC REGISTER, 10.27.2010

Economists with UCLA’s Anderson Forecast foresee O.C. home prices climbing above $500,000 in 2012 for the first time since April 2008. Prices are expected to appreciate from 6.6% to 9.3% a year through 2015 — and, all told, grow 49% in the next six years.

Index Shows That U.S. Home Prices Weakened in August

Posted: October 28th, 2010

ARTICLE, ASSOC. PRESS, 10.26.2010

The Standard & Poor’s Case-Shiller 20-city home price index fell 0.2 percent in August from July. Fifteen of the cities showed monthly price declines. Prices are expected to drop further in the coming months.

New home sales rise 6.6 pct. after dismal summer

Posted: October 28th, 2010

ARTICLE, ASSOC. PRESS, 10.27.2010

Sales of new homes improved last month after the worst summer in nearly five decades, but not enough to lift the struggling economy.

The Commerce Department says new home sales in September grew 6.6 percent from a month earlier to a seasonally adjusted annual sales pace of 307,000.

Fed boss: Regulators looking into foreclosure mess

Posted: October 25th, 2010

ARTICLE, ASSOC.PRESS, 10.24.2010

Preliminary results of the in-depth review into the practices of the nation’s largest mortgage companies are expected to be released next month, Bernanke said in remarks to a housing-finance conference in Arlington, Va.

“We are looking intensively at the firms’ policies, procedures and internal controls related to foreclosures and seeking to determine whether systematic weaknesses are leading to improper foreclosures,” Bernanke said. “We take violation of proper procedures very seriously,” he added.

Short Sales Resisted as Foreclosures Are Revived

Posted: October 25th, 2010

![]()

ARTICLE, NY TIMES, 10.24.2010

Bank of America and GMAC are firing up their formidable foreclosure machines again today, after a brief pause………..But some major lenders took a quick inventory of their foreclosure practices and insisted their processes were sound. They now seem intent on resuming foreclosures. And that could have a profound effect on many homeowners.

Testimony won’t stop foreclosures at Wells Fargo

Posted: October 15th, 2010

ARTICLE, ASSOC. PRESS, 10.15.2010

Wells has not halted foreclosures and says it has discovered no problems in the legal documents used to process them. The company said earlier in the week that it would review pending foreclosures for potential defects.

“Our records show that Wells Fargo’s foreclosure affidavits are accurate,” said company spokeswoman Vickee Adams. When the company finds employees that don’t follow procedure, it takes “corrective action.” She declined to comment on whether the Fort Mill, S.C.-based employee, Xee Moua, still works for Wells.

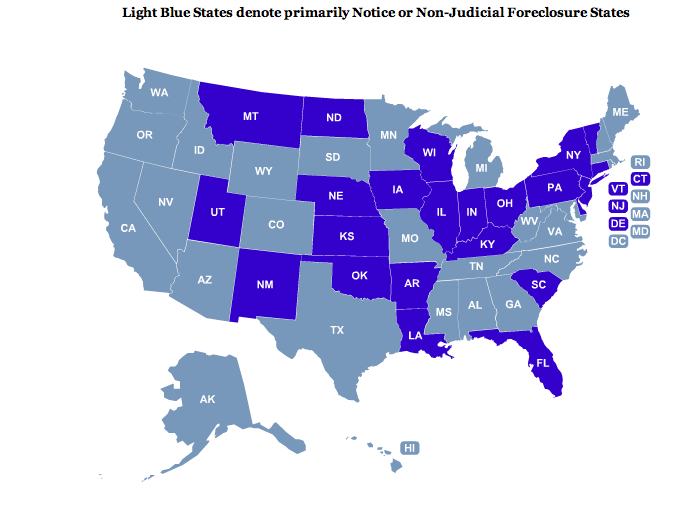

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Foreclosures Halted In 23 States: Plantiffs’ Lawyers Rejoice (California, Nevada and Arizona not affected)

Posted: October 7th, 2010

![]()

ARTICLE, CBS NEWS, 10.05.2010

GMAC Mortgage, JP Morgan Chase and Bank of America have suspended foreclosures in 23 states to evaluate if there were errors due to “robo-signing“. “Robo-signers” are bank middle managers who sign the paperwork that allowed banks to repossess homes that are in default, without properly reviewing the underlying documents they were signing.

Bay Area Home Sales Drop to 1992 Level; Median Price Slips Again

Posted: September 24th, 2010

ARTICLE, MDA DATAQUICK, 09.16.2010

Bay Area home sales fell less sharply last month than in July but still dropped to an 18-year low as potential buyers fretted about job security or took their time to assess the changing market. The median sale price remained higher than a year earlier but dipped month-to-month again, a real estate information service reported.

U.S. Housing Starts in August Topped Forecasts

Posted: September 21st, 2010

![]()

ARTICLE, NY TIMES, 09.21.2010

Housing starts in the United States increased more than expected in August to their highest level in four months and permits for residential construction also rose, government data showed on Tuesday, suggesting that the embattled market was starting to stabilize following the end of a tax credit.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

Where to Buy a Home for Less Than $800 a Month

Posted: September 15th, 2010

![]()

ARTICLE, U.S. NEWS & WORLD REPORT, 09.15.2010

Lower property values and dirt-cheap mortgage rates have combined to restore affordability to many real estate markets that were once wildly overpriced. “Right now, housing is about as affordable as it has been since at least the 1970s,” says Patrick Newport, a U.S. economist for IHS Global Insight.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

How Wall Street Reform Benefits Foreclosure Buyers

Posted: September 13th, 2010

![]()

ARTICLE, REALTYTRAC, 09.13.2010

In many markets there’s a fusion of discounted acquisition costs, historically-low interest levels, falling vacancy rates and rising rental rates. This doesn’t mean specific real estate investments are attractive everywhere or for all buyers, but in areas where such trends exist and seem likely to continue this may well be an unusually good time to consider short sales and foreclosures, two ways to acquire discounted real estate.

Prado Group joint venture acquires San Francisco apartment portfolio

Posted: September 8th, 2010

![]()

ARTICLE, REO INSIDER, 09.08.20120

The 250-unit apartment portfolio was purchased for $30.3 million, according to a news release from the San Francisco-based Prado Group, a real estate development and investment management firm.

A Dream House After All: Karl Case Explains Why It’s a Great Time to Buy a Home, or Invest in Housing.

Posted: September 7th, 2010

![]()

OPINION, NY TIMES, 09.07.2010

But housing has perhaps never been a better bargain, and sooner or later buyers will regain faith, inventories will shrink to reasonable levels, prices will rise and we’ll even start building again. The American dream is not dead — it’s just taking a well-deserved rest.

Karl E. Case is a professor emeritus of economics at Wellesley and co-creator of Standard & Poor’s Case-Shiller housing index.

Chart: Latest Case Shiller Data

Posted: September 3rd, 2010

![]()

CHART, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

Home prices rise in June, but a drop may be looming

Posted: September 3rd, 2010

![]()

ARTICLE, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

FDIC sells another $760 million in REO

Posted: September 3rd, 2010

![]()

ARTICLE, REO INSIDER, 09.03.2010

Mariner Real Estate Management (MREM), a real estate investment and management firm based in Kansas, closed a deal to acquire a $760 million portfolio of residential and commercial loans and REO properties from the Federal Deposit Insurance Corp. (FDIC).

U.S. Home Sales at Lowest Level in More Than a Decade

Posted: August 25th, 2010

![]()

ARTICLE, 08.24.2010

The National Association of Realtors said Tuesday that the seasonally adjusted annual sales rate of 3.83 million was 25.5 percent below the level of July a year ago.

“Prices will have to drop again in most markets before buyers come back in force,” Mr. Kelman said, “and so sales volume will probably be in the tank at least until next spring.”

Private venture to buy $1.7bn portfolio of REO properties and nonperforming loans

Posted: August 18th, 2010

![]()

ARTICLE, REO INSIDER, 08.18.2010

PMO Loan Acquisition Venture, a partnership among several firms, will purchase a $1.7bn portfolio of nonperforming loans and REO properties previously owned by AmTrust Bank before it failed in December 2009.

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Homebuilder confidence sinks for 3rd month

Posted: August 16th, 2010

![]()

ARTICLE, ASSOCIATED PRESS, 08.16.2010

Homebuilder confidence dropped for the third straight month in August as the struggling economy and a flood of cheap foreclosed properties kept people from buying new homes.

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Short sales soar in California, U.S.

Posted: August 13th, 2010

![]()

ARTICLE, LA TIMES, 08.13.2010

Sales of homes for less than the amount of their outstanding mortgage debt have tripled since 2008, particularly in California and the Sunbelt, according to a report released Tuesday.

Known as short sales, the increasingly common transactions for financially troubled homeowners are projected to balloon to 400,000 in 2010, according to Core Logic, a Santa Ana company that provides services to the real estate and mortgage markets. By comparison, existing homes sold at a seasonally adjusted annual rate of 5.37 million units in June, according to the National Assn. of Realtors.

Santa Clara County house prices climb 12% from 2009: SCCAOR

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

The average sales price for a home in Santa Clara County in California reached $710,475 in July, a 12% increase from the same month a year ago, according to the Santa Clara County Association of Realtors (SCCAOR).

Santa Clara County is located “in the heart of Silicon Valley,” and includes the cities of Santa Clara and San Jose. Prices in the county also increased over last month — up 2.2% from June to July, according to the report.

Marcus & Millichap sees Residential Market Turning Around Soon

Posted: August 11th, 2010

![]()

Article & Video, Fox & M&M Blog, 08.11.2010

Apartment demand has moved well beyond employment gains with the absorption of nearly 46,000 units in the second quarter, the strongest gains since the fourth quarter of 2000. This aggressive lease-up of apartments resulted in a 20 basis point vacancy drop to 7.8 percent, a trend that should continue through the remainder of the year as pent-up demand finally releases. Barring a systemic shock that halts job creation, an additional 65,000 units will be absorbed through the second half of the year, pressing vacancies to 7.4 percent by year-end.

Builder betting on rebound by 2014

Posted: August 10th, 2010

ARTICLE, OC REGISTER, 08.10.2010

New home sales will be well above average by 2014, if not sooner, the president and CEO of Standard Pacific Homes predicted during a recent conference call with financial analysts.

Flooded with housing inventory, Freddie Mac REO sales surge despite foreclosure alternatives

Posted: August 10th, 2010

![]()

ARTICLE, REO INSIDER, 08.10.2010

The number of Freddie Mac “foreclosure alternatives” completed in the first half of 2010 increased 123% from the same period in 2009, but for all its efforts, the government-sponsored enterprise (GSE) is still taking on record numbers of housing inventory.

Condos that cost less than cars

Posted: August 3rd, 2010

![]()

ARTICLE, CNN/MONEY, 08.02.2010

The housing bust has made owning a home a lot more affordable — but in some places, prices are extraordinary; you can buy a nice condo for less than the cost of a new family car.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

MIT economist measures how much foreclosures lower housing prices… 27%

Posted: July 28th, 2010

![]()

ARTICLE, MIT NEWS, 07.27.2010

In the study, “Forced Sales and House Prices,” which will be published in the American Economic Review, Pathak, Campbell and Giglio examined 1.8 million home sales in Massachusetts from 1987 to 2009. By looking in granular detail at real-estate prices, the researchers have concluded that a foreclosure reduces the value of a house by 27 percent, on average.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

U.S. Home Construction Declined 5% in June

Posted: July 20th, 2010

![]()

ARTICLE, NY TIMES, 07.20.2010

“Financial distress on the part of many households, ongoing labor market weakness and vicious competition from an enormous overhang of existing homes all point to a very tough slog for homebuilders in the months and quarters ahead,” Joshua Shapiro, the chief United States economist for MFR Inc., said

Sacramento-area home sales hit 20-month high in June

Posted: July 20th, 2010

![]()

ARTICLE, SACRAMENTO BEE, 07.20.2010

“It really seems like California housing is parting ways with the national view. We’ve seen a much stronger recovery off the bottom,”

Foreclosure Hot Spots

Posted: July 19th, 2010

Biggest Defaulters on Mortgages Are the Rich

Posted: July 9th, 2010

![]()

ARTICLE, NY TIMES, 07.09.2010

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

Home prices up 3.8% in April – but don’t celebrate

Posted: June 29th, 2010

![]()

ARTICLE, CNN/MONEY, 06.29.2010

That good news is tempered by a couple of factors. First, the one-year comparison was against a low-ebb mark. In April 2009, prices were just above a five-year low. Overall, prices are off 30% from their peak

Mortgage rates sink to lowest level on record

Posted: June 24th, 2010

![]()

ARTICLE, ASSOC PRESS, 06.24.2010

The average rate for 30-year fixed loans sank to 4.69 percent, from 4.75 percent last week, mortgage company Freddie Mac said Thursday.

That’s the lowest point since Freddie Mac began tracking rates in 1971.

Sales of U.S. New Homes Plunged to Record Low in May

Posted: June 23rd, 2010

![]()

ARTICLE, BLOOMBERG, 06.23.2010

The median sales price decreased 9.6 percent from the same month last year, to $200,900, today’s report showed.

Purchases dropped in all four U.S. regions last month, led by a record 53 percent drop in the West.

Housing Double-Dip to Slow Economic Recovery: Whitney

Posted: June 21st, 2010

![]()

ARTICLE, CNBC, 06.21.2010

While stopping short of predicting a full-blown double dip in the broad economy, Whitney said one is certainly in store for the housing market.

Housing Market Slows as Buyers Get Picky

Posted: June 17th, 2010

![]()

ARTICLE, NY TIMES, 06.16.2010

Exacting buyers are upending the battered real estate market, agents and other experts say, leading to last-minute demands for multiple concessions, bruised feelings on all sides and many more collapsed deals than usual.

Executive Summary: Harvard’s State of the Nation’s Housing 2010

Posted: June 16th, 2010

![]()

PAPER, HARVARD UNIVERSITY, 06.16.2010