Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

Big Developers Dabble in Apartment Market

Posted: December 24th, 2011

![]()

SREP Note: SREP Funds typically acquire and reposition properties for less than the cost of replacement.

ARTICLE, WSJ

Some of the leading U.S. developers of malls and office properties are moving into the apartment business, where demand for new projects is stronger than any other commercial-real-estate sector.

Fueled by the decline in home ownership, the boom in apartment building is attracting commercial-property companies such as Boston Properties Inc., Mack-Cali Realty Corp., SL Green Realty Corp., Simon Property Group Inc. and Macerich Co. They all have either acquired, completed or broken ground on apartment buildings in recent months, or plan to do so next year.

The Return of Rehab

Posted: December 24th, 2011

ARTICLE, MULTIFAMILY EXECUTIVE

Value-add deals resume as rents trend higher.

With the benefit of hindsight, the idea of “trending rents” was viewed as a deadly sin throughout the downturn.

The irrational exuberance of the last boom period inspired some wildly inaccurate underwriting on rent growth, which often culminated in delinquencies and default. Over the last year, however, value-add rehabs have come back into the spotlight as rent growth resumed in earnest. And that rebound in fundamentals over the last year has been so swift it’s defied upside expectations and inspired further confidence to again start banking on rent growth.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

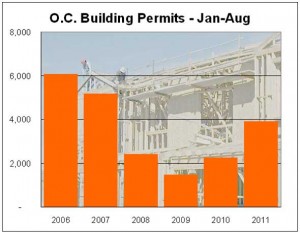

Apartments push O.C. homebuilding up 74%

Posted: September 27th, 2011

ARTICLE, OC REGISTER

Homebuilders have received permits to build 3,901 housing units in Orange County this year so far, up 73.7% from the same period in 2010, Construction Industry Research Board figures show.

In dollar terms, the estimated value of proposed homebuilding this year totaled $694 million through August, a 38.3% jump from 2010 levels for that period.

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

More consumers forced to rent due to foreclosure: TransUnion

Posted: June 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

According to the survey, 47% of all property managers reported an increase in rental applicants moving into apartments from foreclosed properties. Sequentially, more than two-third of managers said it is not difficult to find residents in today’s economy even with increases in rent.

Harvard 2011 America’s Rental Housing Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

The troubled homeowner market, along with demographic shifts, has highlighted the vital role that the rental sector plays in providing affordable homes on flexible terms. But while rental housing is the home of choice for a diverse cross-section of Americans, it is also the home of necessity for millions of low-income households.

Renew your lease – rents could rise 10%

Posted: March 20th, 2011

![]()

ARTICLE, CNN/MONEY

Renters beware: Double-digit rent hikes may be coming soon.

Already, rental vacancy rates have dipped below the 10% mark, where they had been lodged for most of the past three years.

“The demand for rental housing has already started to increase,” said Peggy Alford, president of Rent.com.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

Percent of Americans likely to rent their next home grows, survey indicates

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

The percentage of Americans who said their next home would probably be a rental has grown to 33% from 30% since a similar survey came out in April. And 60% of those who rent said they’d continue to do that rather than buy a house if they were to move, up 6 points from April.

Multifamily Sales Defy the Slump

Posted: September 22nd, 2010

ARTICLE, WSJ, 09.22.2010

Home buyers might be sitting on the sidelines, but multifamily-building sales are on the rise, reversing the slowdown that followed the financial market’s collapse two years ago.

The vacancy rate, which peaked at 7.4% at the end of last year, is expected to drop to 5.5% by the end of 2011, according to CBRE Econometric Advisors.

Sequoia Investment Partners, July 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

OPINION, SREP, 07.07.2010

However, in times like these I am always reminded of Warren Buffett’s sage advice to be “greedy when others are fearful, and fearful when others are greedy.” That is, with so much uncertainty comes substantial opportunity, and it is my view that longer-term trends are very favorable for those willing to commit capital to value-add residential real estate, despite the likelihood for continued volatility and anemic economic growth at best during the next couple of years. These trends are as follows: …..

In foreclosure crisis, demand for family homes in Phoenix rises

Posted: May 3rd, 2010

![]()

ARTICLE, ARIZONA REPUBLIC, 05.03.2010

Since September, the number of available rental homes in metropolitan Phoenix has dropped by 40 percent, and probably even more than that when it comes to three- to four-bedroom homes in desirable neighborhoods.

The sharp drop is another ripple effect of the foreclosure crisis.

Rent-Price Ratios and the Earnings Yield on Housing

Posted: April 16th, 2010

PAPER, USC

Rent-Price Ratios and the Earnings Yield on Housing

“I Understand” by Tom Barrack jr. of Colony Capital

Posted: April 15th, 2010

OPINION: However, the most salient and timeless answer echoes from the soft and timid voice of Chance the Gardener, Peter Sellers’ character in the famous movie “Being There.”

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Southern California apartment rents are expected to keep falling

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

A study shows the average cost dropping as much as 3.5% in L.A. County this year, 2.4% in Orange County and less than 1% in San Bernardino and Riverside counties but inching up in San Diego County.

The Rent-Price Index in U.S Housing Markets

Posted: February 16th, 2009

PAPER, STANDARD & POORS 02.2009

In this paper, the relationship between house prices and rents across eight major metropolitan areas in the U.S. is examined, and a rentprice index to provide the framework of our analysis is developed.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy