Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

Builder Is Constructing REIT for Home Rentals

Posted: May 9th, 2012

![]()

Above, one of the company’s houses in Tolleson, Ariz.

Investors can buy stakes in malls, apartment towers, timber forests and even cellphone towers through real-estate investment trusts. Now, add to the list: single-family homes transformed into rental properties.

Beazer Pre-Owned Rental Homes Inc., which hopes to expand beyond Phoenix and Las Vegas to at least one other, as-yet unidentified market. Within two years, Beazer said the number of rental homes under the new REIT’s control could number in the thousands.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

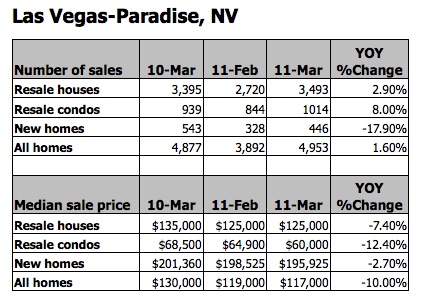

Foreign homebuyers clicking on depressed US housing markets

Posted: December 19th, 2011

![]()

ARTICLE, HOUSING WIRE

Foreigners looking to purchase homes in the U.S. are increasing their online search activity for bargains, as sliding home prices continue to attract investors from around the globe — especially Canada.

Florida properties remained the lead attraction for foreign investment in the third quarter, followed by Arizona, Nevada and California, according to traffic on the website for Point2, a Canadian-based real estate marketing company. Those housing markets have experienced the steepest declines in home prices from the sector’s peak in June 2006.

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

Foreclosures Fall in Most Cities

Posted: July 28th, 2011

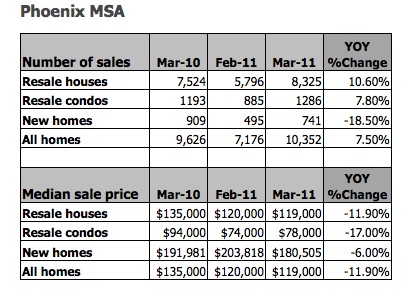

March Home Sales Phoenix & Las Vegas

Posted: May 10th, 2011

Freddie Mac sells record number of REO in 1Q

Posted: May 10th, 2011

![]()

ARTICLE, HOUSINGWIRE

Freddie Mac sold roughly 31,000 previously foreclosed and repossessed homes in the first quarter, a new record for the company as both government-sponsored enterprises shed inventory from the end of last year.

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Phoenix Region December Home Sales

Posted: February 11th, 2011

ARTICLE, MDA DATAQUICK

Phoenix-area December home sales rose more than usual from November and posted only a slight year-over-year sales decline as the market saw gains in investor activity, foreclosure resales and sub-$100,000 transactions. The median sale price fell on a year-over-year basis for the sixth consecutive month, to the lowest level in just over 12 years, a real estate information service reported.

Home values are falling at an accelerating rate in many cities across the U.S.

Posted: January 31st, 2011

![]()

ARTICLE, WALL ST JOURNAL

The Wall Street Journal’s latest quarterly survey of housing-market conditions found that prices declined in all of the 28 major metropolitan areas tracked during the fourth quarter when compared to a year earlier.

The size of the year-to-year price declines was greater than the previous quarter’s in all but three of the markets, the latest indication that the housing market faces considerable challenges.

Inventory levels, meanwhile, are rising in many markets as the number of unsold homes piles up.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Short Sales Resisted as Foreclosures Are Revived

Posted: October 25th, 2010

![]()

ARTICLE, NY TIMES, 10.24.2010

Bank of America and GMAC are firing up their formidable foreclosure machines again today, after a brief pause………..But some major lenders took a quick inventory of their foreclosure practices and insisted their processes were sound. They now seem intent on resuming foreclosures. And that could have a profound effect on many homeowners.

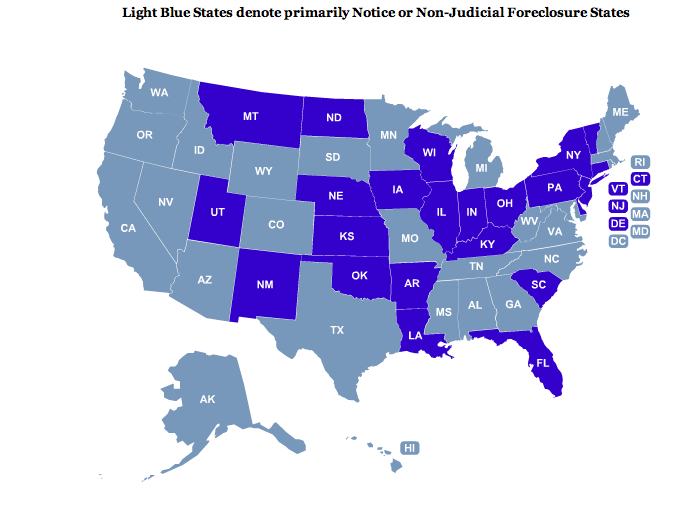

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Foreclosures Halted In 23 States: Plantiffs’ Lawyers Rejoice (California, Nevada and Arizona not affected)

Posted: October 7th, 2010

![]()

ARTICLE, CBS NEWS, 10.05.2010

GMAC Mortgage, JP Morgan Chase and Bank of America have suspended foreclosures in 23 states to evaluate if there were errors due to “robo-signing“. “Robo-signers” are bank middle managers who sign the paperwork that allowed banks to repossess homes that are in default, without properly reviewing the underlying documents they were signing.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

Where to Buy a Home for Less Than $800 a Month

Posted: September 15th, 2010

![]()

ARTICLE, U.S. NEWS & WORLD REPORT, 09.15.2010

Lower property values and dirt-cheap mortgage rates have combined to restore affordability to many real estate markets that were once wildly overpriced. “Right now, housing is about as affordable as it has been since at least the 1970s,” says Patrick Newport, a U.S. economist for IHS Global Insight.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Short sales soar in California, U.S.

Posted: August 13th, 2010

![]()

ARTICLE, LA TIMES, 08.13.2010

Sales of homes for less than the amount of their outstanding mortgage debt have tripled since 2008, particularly in California and the Sunbelt, according to a report released Tuesday.

Known as short sales, the increasingly common transactions for financially troubled homeowners are projected to balloon to 400,000 in 2010, according to Core Logic, a Santa Ana company that provides services to the real estate and mortgage markets. By comparison, existing homes sold at a seasonally adjusted annual rate of 5.37 million units in June, according to the National Assn. of Realtors.

Bad Debts Rise as Bust Erodes Home Equity

Posted: August 12th, 2010

![]()

ARTICLE, NY TIMES, 08.11.2010

The delinquency rate on home equity loans is higher than all other types of consumer loans, including auto loans, boat loans, personal loans and even bank cards like Visa and MasterCard, according to the American Bankers Association…… Even when a lender forces a borrower to settle through legal action, it can rarely extract more than 10 cents on the dollar. “People got 90 cents for free,” Mr. Combs said. “It rewards immorality, to some extent.”

Vulture investors: They’re back – and making a bundle

Posted: August 5th, 2010

![]()

ARTICLE, CNN/MONEY, 08.02.2010

These are the glory days of the residential real estate investor. Low prices, rock-bottom interest rates and stable rental markets have created huge buying opportunities.

“It’s awesome right now. I don’t think we’ll ever see another time like this,” said Tanya Marchiol of Team Investments, which has operations in about 10 states but focuses mostly on the Phoenix market.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

Foreclosure Hot Spots

Posted: July 19th, 2010

Take This House and Shove It: The Emotional Drivers of Strategic Default

Posted: May 25th, 2010

PAPER, U OF A SCHOOL OF LAW, 05.14.2010

An increasingly influential view is that strategic defaulters make a rational choice to default because they have substantial negative equity. This article, which is based upon the personal accounts of over 350 individuals, argues that this depiction of strategic defaulters as rational actors is woefully incomplete. Negative equity alone does not drive many strategic defaulters’ decisions to intentionally stop paying their mortgages. Rather, their decisions to default are driven primarily by emotion

Foreclosures plateau – finally. Repossessions soar

Posted: May 13th, 2010

![]()

ARTICLE, CNN/MONEY, 05.13.2010

But the number of homes repossessed during April is at an all-time high of 92,432. That is a 45% increase over April 2009. If repossessions continue at this pace, more than 1.1 million homes will be lost in 2010.

60 Minutes: Walking Away (Strategic Defaults/Foreclosures)

Posted: May 10th, 2010

![]()

VIDEO, 60 MINUTES, 05.09.2010

60 Minutes looks at the growing trend of “Strategic Default,” which is when a homeowner who is financially capable of making their mortgage payments finds themselves so far under water that they simply do the math and make the decision to walk away.

Underwater and Not Walking Away…..

Posted: October 10th, 2009

PAPER, U of A SCHOOL OF LAW, OCTOBER 2009

This article suggests that most homeowners choose not to strategically default as a result of two emotional forces: 1) the desire to avoid the shame and guilt of foreclosure; and 2) exaggerated anxiety over foreclosure’s perceived consequences.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy