Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Housing is indeed heading higher

Posted: October 22nd, 2012

![]()

As Fortune predicted last year, a robust recovery in home prices is under way.

FORTUNE — In spring 2011 this writer penned a controversial cover story titled “The Return of Real Estate” that predicted a strong rebound in housing. At the time, prices and sales were still tumbling, and the prevailing view among economists and pundits was that the slide would drag on and on. But Fortune’s contrarian forecast proved right. By October of last year, new- and existing-home sales and housing starts had begun an upswing that’s been gathering strength ever since — and prices joined the march in early 2012. The data conclusively confirm what Fortune predicted back then: “Housing is back.”

To see this entire article, click on its TITLE above.

Emerging Trends in Commercial Real Estate Report: “Recovery Anchored in Uncertainty” in 2013

Posted: October 17th, 2012

Commercial real estate’s slow recovery will continue in 2013, according to the Emerging Trends in Real Estate 2013 report released today by PwC and the Urban Land Institute at the ULI Fall Conference taking place in Denver.

The report, generated by surveys and interviews with 900 real estate investors, developers, service providers and lenders, shows expectations that trends that have materialized in recent years will continue in 2013. Namely, gateway cities like San Francisco, New York, Boston and Washington, D.C. continue to be the best bets for investment and development—although there are fledgling concerns that pricing has gotten too heated. As a result, secondary cities may receive more of a boost in the coming months. But growth everywhere will continue to be tepid with gradual improvements in occupancies, rents and values for all property types.

Economists bullish on housing recovery

Posted: October 10th, 2012

Home prices will see steady increases through 2016 starting this year, according to a quarterly survey of more than 100 economists, real estate experts and investment strategists.

The survey, conducted by research and consulting firm Pulsenomics LLC on behalf of real estate search and valuation portal Zillow between Aug. 30-Sept. 14, 2012, asked 113 participants to project the path of the S&P/Case-Shiller U.S. National Home Price Index over the next five years.

UCLA: Calif. homebuilding to double by ’14

Posted: October 10th, 2012

UCLA economists think homebuilding is ready to enjoy a statewide renaissance – with housing units construction more than doubling in two years.

Their latest UCLA/Anderson California forecast calls for 23,500 home permits pulled by the state’s developers this year – essentially flat vs. 2011. Next year, homebuilding would grow 44 percent and in ’14 jump by an additional 78 percent to 60,200 – highest since 2007. California multifamily construction should by UCLA’s math grow 19 percent this year; 29 percent next year; and double for 2014 to 69,100 – highest in more than a decade.

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

Demographics, New Assumptions Drive Commercial Real Estate

Posted: June 12th, 2012

A turning point has been reached in the economy and both demographics and the assumptions that traditionally drove the commercial real estate industry are shifting.

But while economists speaking on a panel at the Strategic Real Estate Conference held in New York this week agreed that this is a time of incredible change, they also see opportunity.

Rents soar as foreclosure victims, young workers seek housing

Posted: May 7th, 2012

Few new units and tight standards for home loans add to the pressure. The average monthly U.S. rent is at an all-time high, and a 10% jump in Los Angeles County over the next two years is forecast.

Entreprenuers will save housing

Posted: April 18th, 2012

By G.U. KRUEGER / SPECIAL TO THE REGISTER

Veteran Southern California real estate analyst G.U. Krueger adds his commentary on the housing market to this blog in a spot we call “Thursday Morning Quarterback.” Here’s his latest installment …

New business formations and entrepreneurial activity are one key to housing’s recovery.

In regard to entrepreneurial spirit, California always leads the nation — despite all the negative talk.

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Foreclosures expected to rise, pushing home prices lower

Posted: January 15th, 2012

Banks are getting more aggressive with the 3.5 million U.S. homes with seriously delinquent mortgages, setting the stage for a big wave of foreclosure action this year.

By E. Scott Reckard, Los Angeles Times

California and other states are likely to see an enormous wave of long-delayed foreclosure action in the coming year as banks deal more aggressively with 3.5 million seriously delinquent mortgages.

Ex-Doomsayer: ‘It’s a great time to buy a home’

Posted: January 15th, 2012

A former housing market skeptic has become a housing market booster, telling a gathering of real estate insiders Thursday that now is “a great time to buy a home.”

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

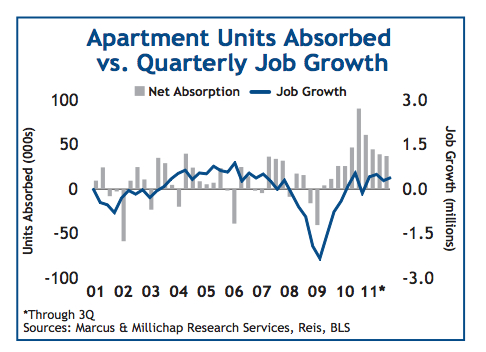

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

California foreclosures set to surge

Posted: September 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

California default notices spiked 55% in August, and the number may keep rising in the coming months as mortgage servicers shake off the robo-signing freeze, according to RealtyTrac Senior Vice President Rick Sharga.

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

2011 seen as ‘turning point’ for home prices

Posted: July 13th, 2011

ARTICLE, INMAN NEWS

More than half of economists, real estate experts and investment strategists polled by MacroMarkets LLC in June said they now expect national home prices to hit a bottom sometime in 2011 and remain stable through 2015.

Forecast: Homebuilders to focus on Calif. cities

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“What we’ve seen is this shift toward multifamily housing demand,” said the forecast’s author, Jerry Nickelsburg. “You can see that in the demographics.”

Since apartment units require far fewer workers than single-family homes, the post-recovery homebuilding sector will employ fewer people than before the downturn, Nickelsburg said.

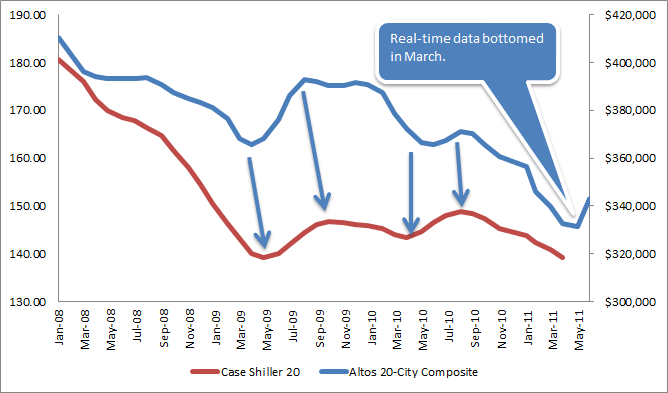

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

Housing construction ‘encouraging’

Posted: April 22nd, 2011

![]()

ARTICLE, CNN/MONEY

In an encouraging sign for the housing market, new home construction increased more than expected in March, according to a government report Tuesday.

Blackstone Leads Buyout Firms Expanding Into Property

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

Blackstone Group LP and Carlyle Group are leading a record number of private-equity managers aiming to raise real estate funds as the world’s top buyout firms accelerate an expansion beyond corporate takeovers.

Blackstone, the biggest private-equity firm, is planning to raise its next real estate fund, with a target of about $10 billion, later this year. Carlyle is in the process of raising a new fund for U.S. property deals, said a person briefed on the plan who asked not to be named because the fund is private.

The two are among 439 private-equity real estate funds seeking a combined $160 billion, the largest number on record, according to London-based researcher Preqin Ltd. KKR & Co.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Renew your lease – rents could rise 10%

Posted: March 20th, 2011

![]()

ARTICLE, CNN/MONEY

Renters beware: Double-digit rent hikes may be coming soon.

Already, rental vacancy rates have dipped below the 10% mark, where they had been lodged for most of the past three years.

“The demand for rental housing has already started to increase,” said Peggy Alford, president of Rent.com.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

No McMansions for Millennials

Posted: January 18th, 2011

![]()

ARTICLE, WALL ST. JOURNAL

Gen Y housing preferences are the subject of at least two panels at this week’s convention. A key finding: They want to walk everywhere. Surveys show that 13% carpool to work, while 7% walk, said Melina Duggal, a principal with Orlando-based real estate adviser RCLCO. A whopping 88% want to be in an urban setting, but since cities themselves can be so expensive, places with shopping, dining and transit such as Bethesda and Arlington in the Washington suburbs will do just fine.

KB Home unexpectedly reports profit, has eye on California

Posted: January 14th, 2011

ARTICLE, LA TIMES

Despite a challenging period for the nation’s home builders, Los Angeles-based KB Home unexpectedly reported a profit for its fiscal fourth quarter and predicted that California would be a key part of its strategy in 2011.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

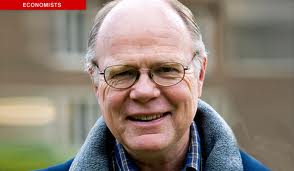

Home Prices in U.S. Will `Bounce Along the Bottom,’ Case Says

Posted: December 1st, 2010

ARTICLE, BLOOMBERG, 11.30.2010

U.S. home prices are unlikely to fall much further in the next year even after a “discouraging” report on values in September, said Karl E. Case, the co-creator of the S&P/Case-Shiller Index.

“If I were betting even odds, I’d bet that we don’t have much further decline, but that we bounce along the bottom,” Case, a retired professor of economics at Wellesley College, said today in a Bloomberg Television interview on “Surveillance Midday” with Tom Keene.

In Bond Frenzy, Investors Bet on Inflation

Posted: October 28th, 2010

![]()

ARTICLE, NY TIMES, 10.25.2010

The investors who took part in the $10 billion auction are betting that inflation, now at about 1 percent annually, will rise to a level that more than compensates for the premium they paid.

A Dream House After All: Karl Case Explains Why It’s a Great Time to Buy a Home, or Invest in Housing.

Posted: September 7th, 2010

![]()

OPINION, NY TIMES, 09.07.2010

But housing has perhaps never been a better bargain, and sooner or later buyers will regain faith, inventories will shrink to reasonable levels, prices will rise and we’ll even start building again. The American dream is not dead — it’s just taking a well-deserved rest.

Karl E. Case is a professor emeritus of economics at Wellesley and co-creator of Standard & Poor’s Case-Shiller housing index.

U.S. Home Sales at Lowest Level in More Than a Decade

Posted: August 25th, 2010

![]()

ARTICLE, 08.24.2010

The National Association of Realtors said Tuesday that the seasonally adjusted annual sales rate of 3.83 million was 25.5 percent below the level of July a year ago.

“Prices will have to drop again in most markets before buyers come back in force,” Mr. Kelman said, “and so sales volume will probably be in the tank at least until next spring.”

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Builder betting on rebound by 2014

Posted: August 10th, 2010

ARTICLE, OC REGISTER, 08.10.2010

New home sales will be well above average by 2014, if not sooner, the president and CEO of Standard Pacific Homes predicted during a recent conference call with financial analysts.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

What the bond guru sees coming

Posted: July 20th, 2010

ARTICLE, MONEY, 07.20.2010

The important thing to recognize is that if you’re looking for 10% returns (from stocks or bonds) to pay for college or to retire on, they’re not going to be there. We’ve been an asset-growth-based economy for so long. We’ve skimmed off the top, living off second and third mortgages on homes, and capital gains on stocks and even on bonds. Now instead of having money work for you, you’ve got to work for your money.

Wall St. Hiring in Anticipation of an Economic Recovery

Posted: July 11th, 2010

![]()

ARTICLE, NY TIMES, 06.11.2010

While much of the country remains fixated on the bleak employment picture, hiring is beginning to pick up in the place that led the economy into recession — Wall Street.

Sequoia Investment Partners, July 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

OPINION, SREP, 07.07.2010

However, in times like these I am always reminded of Warren Buffett’s sage advice to be “greedy when others are fearful, and fearful when others are greedy.” That is, with so much uncertainty comes substantial opportunity, and it is my view that longer-term trends are very favorable for those willing to commit capital to value-add residential real estate, despite the likelihood for continued volatility and anemic economic growth at best during the next couple of years. These trends are as follows: …..

Sequoia Investment Partners, June 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

PRESS RELEASE, SREP, 06.30.2010

Sequoia Investment Partners is very pleased to announce its new partnership with Fountain Management to create Sequoia Real Estate Partners, LLC.

Home prices up 3.8% in April – but don’t celebrate

Posted: June 29th, 2010

![]()

ARTICLE, CNN/MONEY, 06.29.2010

That good news is tempered by a couple of factors. First, the one-year comparison was against a low-ebb mark. In April 2009, prices were just above a five-year low. Overall, prices are off 30% from their peak

Housing Double-Dip to Slow Economic Recovery: Whitney

Posted: June 21st, 2010

![]()

ARTICLE, CNBC, 06.21.2010

While stopping short of predicting a full-blown double dip in the broad economy, Whitney said one is certainly in store for the housing market.

Executive Summary: Harvard’s State of the Nation’s Housing 2010

Posted: June 16th, 2010

![]()

PAPER, HARVARD UNIVERSITY, 06.16.2010

Even as the worst housing market correction in more than 60 years appeared to turn a corner in 2009, the fallout from sharply lower home prices and high unemployment continued. By year’s end, about one in seven homeowners owed more on their mortgages than their homes were worth, seriously delinquent loans were at record highs, and foreclosures exceeded two

million.

UCLA Anderson Forecast: U.S. recovery a long, slow climb; Calif. recovery weaker than nation’s

Posted: June 16th, 2010

![]()

ARTICLE, UCLA, 06.16.2010

The California economy is expected to grow a bit slower than the nation’s for 2010, and slightly faster thereafter. This slow growth through the forecast period will result in only modest inroads into the state’s high unemployment rate. Los Angeles expected to recover more quickly than rest of the state

Don’t get buffeted by changing winds. The housing recovery is real.

Posted: May 28th, 2010

![]()

ARTICLE, KIPLINGER, 05.2702010

The housing market rebound that began a year ago is very much intact, so don’t get sidetracked or confused by recent and almost unprecedented volatility due mostly to on-again, off-again tax incentives.

Sequoia Investment Partners, May 2010 Investor Market Summary and Forecast

Posted: May 26th, 2010

OPINION, SEQUOIA INVESTMENT PARTNERS, 05.26.2010

Long story short, professional and some do-it-yourselfers are getting deals and just wait, there’s more to come.

Is the Housing Market on the Rebound?

Posted: May 26th, 2010

ARTICLE, TIME, 05.26.2010

A recent study of 92 economists by financial-products firm MacroMarkets found that on average housing prices are expected to drop slightly in 2010 and begin rising again next year. That means that for the first time in years someone who buys a house this spring will most likely see their home appreciate in the next year. And rising housing prices, just like falling ones, tend to feed on themselves.

Think housing is recovering? Think again.

Posted: May 25th, 2010

![]()

ARTICLE, FORTUNE, 05.25.2010

we’re coming off of an artificial bump from the first time home buyer credit, which expired last month. He predicts the second half of this year will see sluggish economic growth and that housing prices, at best, will be flat for the next few months, while commercial real estate “is likely to see significant declines.”

U.S. Home Building Gains, but New Permits Fall

Posted: May 18th, 2010

![]()

ARTICLE, NY TIMES, 05.18.2010

Home building rose in April, government figures showed on Tuesday, as activity was possibly spurred by an $8,000 government tax credit for new buyers. But the data suggested that builders might also be slowing down their future construction plans.

Foreclosures plateau – finally. Repossessions soar

Posted: May 13th, 2010

![]()

ARTICLE, CNN/MONEY, 05.13.2010

But the number of homes repossessed during April is at an all-time high of 92,432. That is a 45% increase over April 2009. If repossessions continue at this pace, more than 1.1 million homes will be lost in 2010.

Housing Optimists Are “Not Paying Attention” to the Facts, Says Dean Baker

Posted: May 13th, 2010

ARTICLE & VIDEO, YAHOO FINANCE, 05.13.2010

“I think we’re going to see a big fall-off in purchases for the rest of 2010 and even into 2011,” Baker says. “So the idea that somehow the market is stable, that housing prices will rise anytime soon – it’s really hard to make a case for that.”

Buy a House, Sell REITs

Posted: May 7th, 2010

![]()

ARTICLES, KIPLIGER, 05.07.2010

One of the savviest and most cautious real estate investors says that housing prices have hit bottom but real estate investment trusts could fall a long way.

AllianceBernstein Housing Recomendation

Posted: April 15th, 2010

![]()

PAPER 12.2009, AllianceBernstein Research Dept.

“..our analysis indicates it is time to begin looking beyond the near term risks and toward the long-term opportunities.”

UCLA Anderson Forecast, March 2010

Posted: April 12th, 2010

![]()

ARTICLE, UCLA/Anderson School of Management 3.24.2010

The UCLA Anderson Forecast renders a “bipolar” diagnosis for the national economy, referencing the dual conditions of slow-but-sure growth in the national gross domestic product, coupled with an unemployment rate predicted to remain in double digits until 2012.

Housing Forecast: More Foreclosures, Home-Price Declines

Posted: January 27th, 2010

ARTICLE, TIME/CNN, 01.07.2010

The decimated housing market may get considerably worse before it gets better, according to housing-industry professionals, who expect foreclosures and home-price declines to continue pressuring the sector through at least the first half of 2010.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy