Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Flipping is On Its Way Back, Thanks to the Hipster Flippers

Posted: October 17th, 2012

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Demographics, New Assumptions Drive Commercial Real Estate

Posted: June 12th, 2012

A turning point has been reached in the economy and both demographics and the assumptions that traditionally drove the commercial real estate industry are shifting.

But while economists speaking on a panel at the Strategic Real Estate Conference held in New York this week agreed that this is a time of incredible change, they also see opportunity.

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

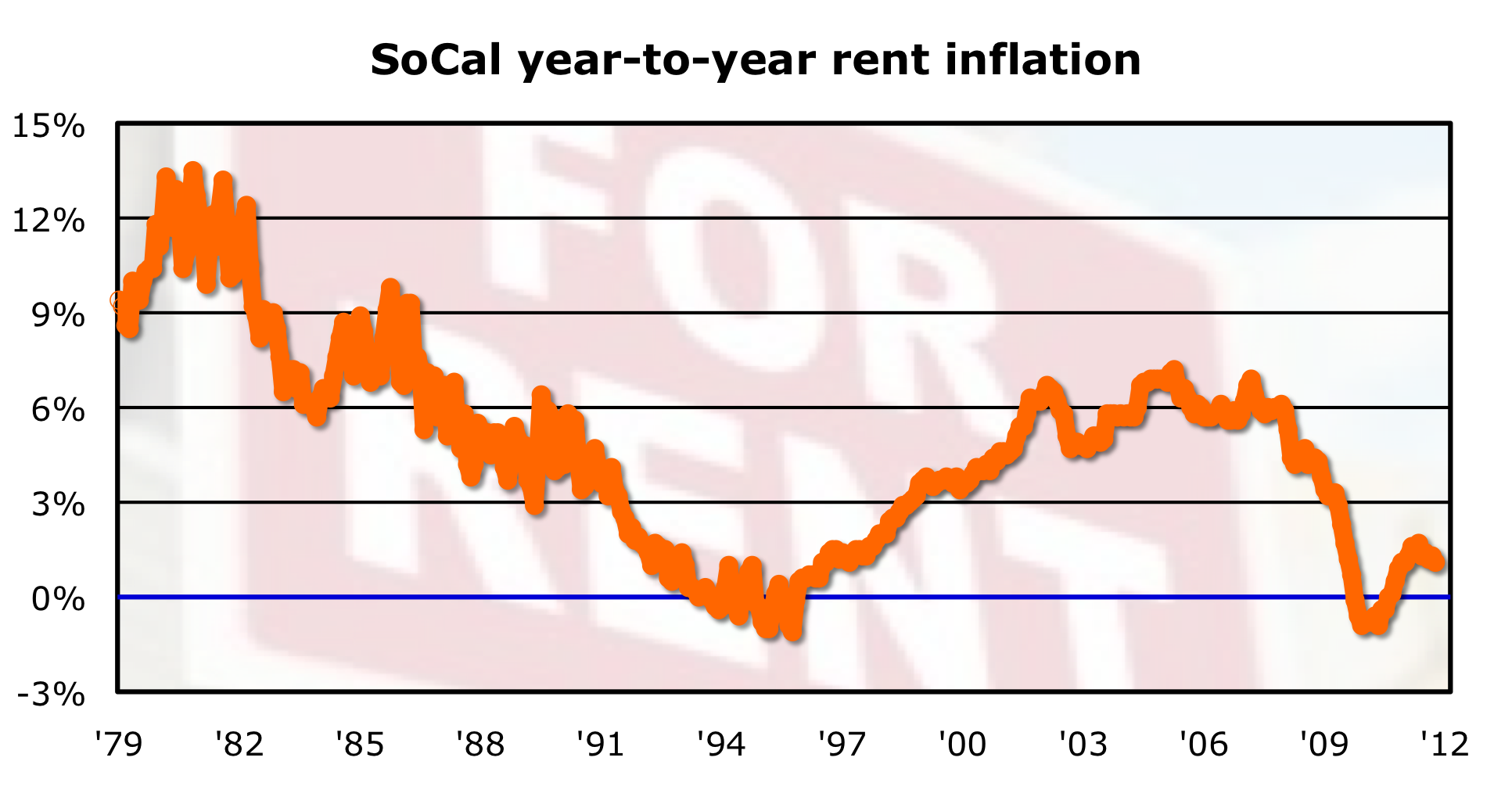

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

Historic United Artists building sells for $11 million. Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Posted: October 17th, 2011

ARTICLE, LA TIMES

A storied Los Angeles theater and office complex built by silent film stars that was later owned by one of the city’s most popular televangelists has been purchased by East Coast investors.

Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Dot-coms want the beach in their address

Posted: October 16th, 2011

ARTICLE, LA TIMES

The commercial real estate rental market is booming in Santa Monica, where the office vacancy rate is a fraction of the L.A. County average. Tech and entertainment firms like the lifestyle.

Compared with most of the region’s white-collar office market, the less corporate environs of Santa Monica and Venice are looking sharp.

Technology and entertainment companies that long ago mastered the knack of making money without dressing up are now paying top dollar to rent space in some of Southern California’s most desirable neighborhoods.

Home ownership: Biggest drop since Great Depression

Posted: October 13th, 2011

ARTICLE, CNN MONEY

The percentage of Americans who owned their homes has seen its biggest decline since the Great Depression, according to the U.S. Census Bureau.

The rate of home ownership fell to 65.1% in April 2010, 1.1 percentage points lower than it was in 2000. The decline was the biggest drop since the 1930s, when home ownership plunged 4.2%.

The most recent decade-over-decade drop, however, only tells half the story.

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

Southland home sale report

Posted: September 19th, 2011

PRESS RELEASE, DATAQUICK

Southland August Home Sales Climb, Median Price Falls Again

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

California leading employment indicator shows growth to come

Posted: August 5th, 2010

![]()

ARTICLE, LA TIMES, 08.05.2010

…..an employment indicator released Wednesday by Chapman University’s A. Gary Anderson Center for Economic Research shows that employment in California will continue to tick up this year. It indicates that year-over-year job growth will turn positive in the fourth quarter this year, something that hasn’t happened consistently in the state since 2007.

Home prices tick up 1.3% in May

Posted: July 27th, 2010

![]()

ARTICLE, LA TIMES, 07.27.2010

Home prices tick up 1.3% in May

It was the second straight monthly increase, according to the Standard & Poor’s/Case-Shiller index of 20 U.S. cities, but experts warn it is not likely to last. Los Angeles, San Diego and San Francisco are among the gainers.

CHART: Office vacancies rise, rents drop in Southland

Posted: July 20th, 2010

![]()

CHART, LA TIMES, 07.20.2010

Office vacancies rise, rents drop in Southland again

Office vacancies rise, rents drop in Southland again

Posted: July 20th, 2010

![]()

ARTICLE, LA TIMES, 07.20.2010

An oversupply of space, businesses’ reluctance to add costs and landlords’ eagerness to keep good tenants leads to some of the cheapest lease rates in years. In the Inland Empire, vacancy tops 25%.

Southern California office landlords faced more bad news in the second quarter as occupancy and rents in their buildings fell again.

The persistently soft market has created opportunities for tenant businesses to sign some of the cheapest leases available in several years. The pace of deals has picked up a bit, brokers said, but many companies are still carefully husbanding their finances and avoiding long-term rental commitments.

Deeds-in-lieu gain favor with lenders as alternative to foreclosure

Posted: June 29th, 2010

![]()

ARTICLE, LA TIMES, 06.28.2010

….a simple message: Let’s bypass all the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home and we’ll call it a deal. We won’t come after you to collect any deficiency between what you owe us on the mortgage and what we obtain from the home sale. We might even be able to wrap up the whole transaction in as little as 30 to 45 days. How about it?

L.A. Should Abandon Rent Control

Posted: May 21st, 2010

![]()

OPINION, LA TIMES, 05.21.2010

Politicians should work with the private sector to encourage affordable housing and rent stability through productive incentives.

By Eric Sussman of Sequoia’s Board of Advisors

New-home buyers reemerge in Southern California

Posted: May 17th, 2010

![]()

ARTICLE, LA TIMES, 05.13.2010

Location is also key — buyers don’t want extremely long commutes, analysts say.

Would You Have Bought It? Case Study of a Flip: 4832 2nd Ave, Los Angeles CA

Posted: May 9th, 2010

![]()

SEQUOIA STRATEGY, 05.09.2010

It’s not often an REO investment makes the front page of the Sunday edition of a national paper, but that’s exactly what happened on April 25th 2010 in the Los Angeles Times. So we thought it would be a great opportunity to do a quick case study on this particular purchase

Los Angeles House Flipping Hot Spots

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Map of zip codes with the most flipping activity

Flipping houses is back in South Los Angeles

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Along with low prices, real estate investors are drawn to the area because of its proximity to the ports of Los Angeles and Long Beach, Los Angeles International Airport and other job centers, including factories.

In Sour Home Market, Buying Often Beats Renting

Posted: April 22nd, 2010

![]()

ARTICLE, NY TIMES 4.20.2010

In some once bubbly markets, prices have fallen so far that buying a home appears to be a bargain, based on a New York Times analysis of prices and rents in 54 metropolitan areas.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy

![abc_news_logo[1]](http://sequoiainvestmentpartners.com/blog/wp-content/uploads/2012/10/abc_news_logo1.jpg)