Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

UCLA: Calif. homebuilding to double by ’14

Posted: October 10th, 2012

UCLA economists think homebuilding is ready to enjoy a statewide renaissance – with housing units construction more than doubling in two years.

Their latest UCLA/Anderson California forecast calls for 23,500 home permits pulled by the state’s developers this year – essentially flat vs. 2011. Next year, homebuilding would grow 44 percent and in ’14 jump by an additional 78 percent to 60,200 – highest since 2007. California multifamily construction should by UCLA’s math grow 19 percent this year; 29 percent next year; and double for 2014 to 69,100 – highest in more than a decade.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Ex-Doomsayer: ‘It’s a great time to buy a home’

Posted: January 15th, 2012

A former housing market skeptic has become a housing market booster, telling a gathering of real estate insiders Thursday that now is “a great time to buy a home.”

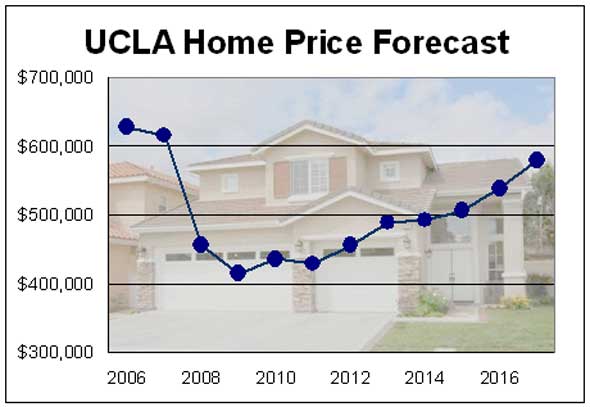

UCLA: O.C. home prices to rise 35%

Posted: November 16th, 2011

ARTICLE, OC REGISTER

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Forecast: Homebuilders to focus on Calif. cities

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“What we’ve seen is this shift toward multifamily housing demand,” said the forecast’s author, Jerry Nickelsburg. “You can see that in the demographics.”

Since apartment units require far fewer workers than single-family homes, the post-recovery homebuilding sector will employ fewer people than before the downturn, Nickelsburg said.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

O.C. home prices to surge 49%, UCLA economists say

Posted: October 28th, 2010

![]()

ARTICLE, OC REGISTER, 10.27.2010

Economists with UCLA’s Anderson Forecast foresee O.C. home prices climbing above $500,000 in 2012 for the first time since April 2008. Prices are expected to appreciate from 6.6% to 9.3% a year through 2015 — and, all told, grow 49% in the next six years.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

What the bond guru sees coming

Posted: July 20th, 2010

ARTICLE, MONEY, 07.20.2010

The important thing to recognize is that if you’re looking for 10% returns (from stocks or bonds) to pay for college or to retire on, they’re not going to be there. We’ve been an asset-growth-based economy for so long. We’ve skimmed off the top, living off second and third mortgages on homes, and capital gains on stocks and even on bonds. Now instead of having money work for you, you’ve got to work for your money.

Report: Calif. inland economic growth to lag coast

Posted: June 16th, 2010

![]()

ARTICLE, BUSINESS WEEK, 06.16.2010

Slow economic growth and high unemployment will persist for the foreseeable future in California’s inland counties, even as increasingly robust signs of recovery begin appearing throughout the state’s coastal areas, according to an economic forecast released Tuesday.

UCLA Anderson Forecast: U.S. recovery a long, slow climb; Calif. recovery weaker than nation’s

Posted: June 16th, 2010

![]()

ARTICLE, UCLA, 06.16.2010

The California economy is expected to grow a bit slower than the nation’s for 2010, and slightly faster thereafter. This slow growth through the forecast period will result in only modest inroads into the state’s high unemployment rate. Los Angeles expected to recover more quickly than rest of the state

Renting: The new American dream?

Posted: April 20th, 2010

![]()

OPINION, PAUL LA MONICA CNN/MONEY

“This is a frugal recovery. People are more reluctant to buy homes as they would in a normal recovery,” Leamer said. “If you don’t have a job or are worrying about your job, you’re not going to buy a home. That’s the ultimate statement of optimism about the future.” Add that up and it’s reasonable to expect a rental boom that could last for some time.

Real Interest Rates, Expected Inflation, And Real Estate Returns- A Comparison of the U.S. and Canada

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

In the United States, but not in Canada, nominal interest on residential housing mortgages

is a deductible expense. This suggests that changes in

nominal interest rates should have a more negative impact on Canadian real estate than on real estate in the US. This paper uses real estate investment trusts along with expected inflation in both countries to find empirical evidence to support this theory.

The Implosion of the CDO Market and the Pricing of Subprime Mortgage-Backed Securities

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

Because CDO issuance played an important role in the market for subprime mortgage-backed securities (MBS), this striking rise and fall provides an excellent laboratory for studying the interest rate spreads on the underlying subprime MBS collateral.

Using REITS to asses the risk and return performance of real estate

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

“We find that the analyses based on REITs give notably different results from those based on SCS. In particular, real estate investment returns are higher and more volatile, and both the associated market and idiosyncratic risk are higher.”

UCLA Anderson Forecast, March 2010

Posted: April 12th, 2010

![]()

ARTICLE, UCLA/Anderson School of Management 3.24.2010

The UCLA Anderson Forecast renders a “bipolar” diagnosis for the national economy, referencing the dual conditions of slow-but-sure growth in the national gross domestic product, coupled with an unemployment rate predicted to remain in double digits until 2012.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy