Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Hipster Real Estate Developers Building for Millennials

Posted: October 4th, 2015

Young real estate developers are using young investors’ money to put young people in young neighborhoods.

John Chaffetz is showing off an apartment building that his development firm, Timberlane Partners, just bought for $7.2 million. He admits it doesn’t look so hot. “This has been treated like a prison camp,” he says of the 32-unit building in Los Angeles’s Echo Park neighborhood. Steel bars stick out of a cinder-block fence, threatening to impale someone. The front door is an ugly metal gate.

But an organic supermarket opened around the corner in November, and a Blue Bottle Coffee just arrived down the block. There’s a farmers market nearby each Friday, and five minutes up Sunset Boulevard is the Silver Lake neighborhood, a nest of hipster cafes and places to buy rare cheese and handmade clothes. Timberlane plans to tear down the building’s security fencing, put terracotta back on the roof, and repair windows that date to its pre-1930 construction. “The goal,” Chaffetz says, “is for this to look like a Moroccan boutique hotel.”

If you’re the sort of twentysomething who needs rhubarb bitters in her cocktail, you’re not going to live just anywhere—and Timberlane co-founders Chaffetz, 32, and Dave Enslow, 37, are counting on that. Much of their Seattle- and Los Angeles-based firm’s strategy is straight out of the developer playbook: buy neglected apartment buildings in promising neighborhoods, renovate, raise rents, and fill them with young professionals. But when fixing up a property, Timberlane takes extra care to provide touches it can market specifically to the perceived whims of millennial tenants. Historically accurate details are a priority. Midcentury Palm Springs architecture inspired the revamp of one dated building, replacing “a lobby that looked like a 1982 funeral home,” Chaffetz says. The company will typically expose brick walls and refinish hardwood floors rather than slap down carpet. It adds amenities for healthier lifestyles. At one site, Timberlane sacrificed five apartments to create a 3,000-square-foot gym with a yoga studio and climbing wall. A building on a popular Seattle bike path got a large bicycle storage and repair room. Where older renters might value ease of parking, millennials want walkable neighborhoods. “They want to drop off their car on a Friday and not see it again until Monday,” Enslow says.

Harvard: Joint Center for Housing Studies

Posted: September 29th, 2015

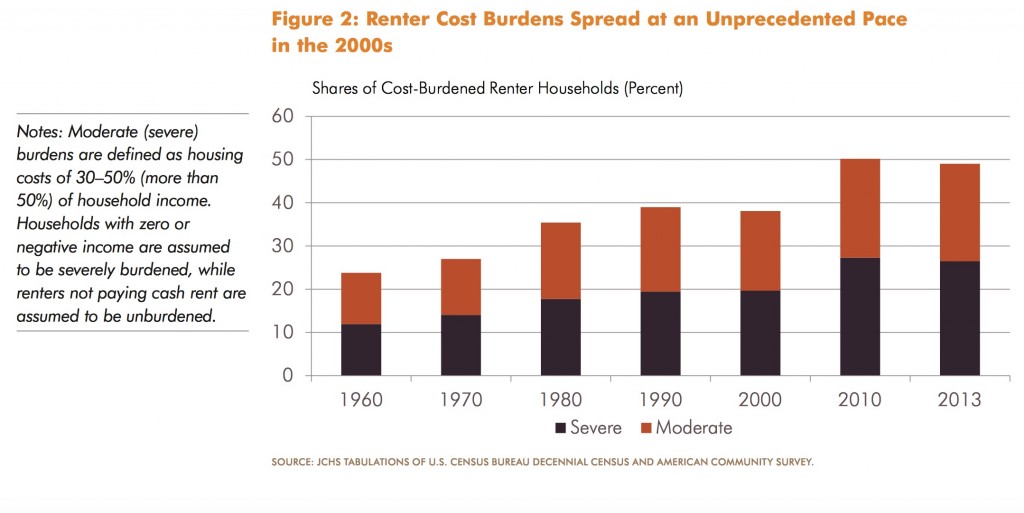

Projecting Trends in Severely Cost-Burdened Renters: 2015–2025

Author(s): Allison Charette

Chris Herbert

Andrew Jakabovics

Ellen Tracy Marya

Daniel T. McCue

This report by Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners Inc shows that the number of households spending more than 50 percent of their income on rent is expected to rise at least 11 percent from 11.8 million to 13.1 million by 2025. The report projects a growing renter affordability crisis, with the largest increases expected among older adults, Hispanics and single-person households. The findings suggest that even if trends in incomes and rents turn more favorable, a variety of demographic forces—including the rapid growth of minority and senior populations—will exert continued upward pressure on the number of severely cost-burdened renters.

CONCLUSION

Overall, our analysis projects a fairly bleak picture of severe renter burdens across the U.S. for the coming decade. Under nearly all of the scenarios performed, we found that the renter affordability crisis will continue to worsen without intervention. According to our projections, annual income growth would need to exceed annual rent growth by 1 percent in order to reduce the number of severely burdened renters in 10 years. Importantly, that decline would have a net impact on fewer than 200,000 households, only because continued increases in burdens among minorities would be offset by declines among whites. Under the more likely scenario that rents will continue to outpace incomes, the number of severely rent-burdened households would increase by a range of 1.7 – 3 million, depending on the magnitude.

Given these findings, it is critical for policymakers at all levels of government to prioritize the preservation and development of affordable rental housing. Even if the economy continues its slow recovery and income growth improves, there are simply not enough quality, affordable rental units to house the millions of households paying over half their income in rental costs.

Buyout Firms Join U.S. Apartment Hunt as Rentals Surge: Real M&A

Posted: September 29th, 2015

Buyout firms are apartment hunting again.

An affiliate of private equity firm Lone Star Funds agreed this week to acquire apartment real estate investment trust Home Properties Inc. for about $7.6 billion including debt. It marks the largest takeover of a U.S. apartment REIT since the buyout boom of 2007, and more may be on the way.

Current PVOF II properties

Posted: January 24th, 2014

The Beverly Alvarado has been placed on the market.

Posted: January 24th, 2014

Before and After 28359 San Nicolas Dr.

Posted: November 21st, 2013

Luxury House ‘Flippers’ Get a Lift

Posted: October 10th, 2013

Sequoia Real Estate Partners is quoted in this article

By

NICK TIMIRAOS

Nick Sinatra, the owner of a small real-estate investment firm, believes he has found the next big opportunity in the housing market: renovating and flipping million-dollar properties.

Well-heeled investors think Mr. Sinatra is on to something. On Wednesday his company, American Coastal Properties LLC, is set to announce that it has received $50 million from private-equity firm Colony Capital LLC and the Pritzker/Vlock Family Office. While the investment is relatively small for Colony, it could allow ACP to double the number of homes is renovates annually.

The investment by Colony in a boutique firm like ACP is the latest example of how big money is chasing returns in a corner of the housing market typically dominated by mom-and-pop shops.

Please Join Us Thursday October 17th at Our Most Recent Project.

Posted: October 7th, 2013

Please join us October 17th for an Open House cocktail reception and preview our latest project, 28359 San Nicolas Dr. Rancho Palos Verdes, CA. 6-9 pm.

Pacific Value Opportunities Funds, Q3 Update and Outlook

Posted: October 4th, 2013

To Partners and Friends of the Pacific Value Opportunities Funds:

By far and away the most significant news of the third quarter was the Fed’s surprise mid-September decision not to taper its monthly purchase of some $85 billion of Treasury bonds and mortgage-backed securities, the so-called quantitative easing. Separately, the Fed also announced it has no intention of increasing short-term rates until late 2014 or 2015. Most market watchers were caught off guard, having assumed that the Fed would begin some modest tapering ($10 to $20 billion) given the improving economy, and the obvious need to end bond repurchases at some point. The announcement provided significant relief to bond rates, which had increased significantly during the quarter. The 10-year Treasury yield, which stood at 2.50% at the start of the third quarter and had risen to nearly 3.0% by the first week of September, subsequently declined to 2.64% in the weeks following the Fed’s announcement.

To read the entire post please click on its title.

Snapshot of the PVOF II portfolio

Posted: October 3rd, 2013

Click on the title above to see the portfolio

U.S. Home Prices Climb at Fastest Clip in 7 Years

Posted: October 2nd, 2013

U.S. home prices rose by their fastest pace in more than seven years during July, according to an index released Tuesday, though more recent data suggest price gains could soon moderate.

Prices in 20 major U.S. cities increased 12.4% in July compared to the same month last year, according to the Standard & Poor’s/Case-Shiller index.

August Southland Home Sale Press Release

Posted: October 2nd, 2013

Southland Median Sale Price Steady Month-to-Month, Up Sharply Year-Over-Year

Southern California home sales were the highest for an August in seven years as strong activity above $300,000 compensated for a dip in sales below that level, as well as fewer cash and investor purchases. The median sale price held steady compared with June and July but rose 24.6 percent from a year earlier, marking the eighth consecutive month with a year-over-year gain over 20 percent, a real estate information service reported.

When Appraisal Hassles Tank a Home Sale

Posted: October 2nd, 2013

In hot markets where bidding wars are common, the property-appraisal process has been short-circuiting transactions, spurring some would-be buyers to walk away.

A few forces are at work. First, many homes are being appraised at a lower price than what buyers have offered on a house. That is because home values are improving so fast in competitive, high-priced markets that “comps,” recent sales of nearby homes with comparable characteristics, haven’t kept up. When the appraisal comes in low, the buyers either lose the loan or must quickly make up the difference with a higher down payment.

Pacific Value Opportunities Funds, Q2 Update and Outlook

Posted: July 29th, 2013

To Partners and Friends of Pacific Value Opportunities Funds:

For the most part, the second quarter saw the continuation of decidedly mixed, if not conflicting, macroeconomic trends: modest improvements in domestic employment levels and economic growth, remarkably strong U.S. equity and housing markets, weakening emerging markets, slowing growth in China, middling recovery in the E.U., and significant geopolitical uncertainty in the Middle East (and elsewhere). The U.S. economy remains one of the global bright spots, which seems somewhat hard to imagine, as our recovery and current level of growth can only be described as uninspiring.

Click on the title above for the entire update.

Foreclosure filings drop to five-year low in U.S. recovery

Posted: July 22nd, 2013

Foreclosure filings in the U.S. fell to a five-year low last month as lenders sought to avoid seizing property and a housing recovery showed signs of taking hold.

The number of default, auction and seizure notices sent to homeowners in April totaled 188,780, down 14 percent from a year earlier and 5 percent from the previous month, according to RealtyTrac Inc. It was the lowest tally since July 2007, before the onset of the biggest housing crash in seven decades, the Irvine, California-based data seller said today in a report.

Lifetime middle-class renters make multi-family attractive to investors.

Posted: July 22nd, 2013

![]()

In today’s economy, Americans making anywhere from $30,000 to $70,000 a year continue to struggle to qualify for mortgages in the midst of economic and job uncertainty, says Alan Feldman, CEO of Resource Real Estate.

After analyzing this particular segment of the marketplace, Feldman realized this group is more likely to rent, making multifamily properties a natural investment for his firm.

Southland Home Sales Drop; Record Yr/Yr Gain for Median Sale Price

Posted: July 22nd, 2013

Southern California home sales fell in June amid a still-tight supply of homes for sale, rising mortgage rates and a letup in investor buying. The median sale price rose at a record year-over-year pace to the highest level – $385,000 – in more than five years, a real estate information service reported.

The Rise of the Young Buyer

Posted: July 21st, 2013

Two years ago, when he was 26, Matt Winter paid a little over $1 million for a four-bedroom, Mediterranean-style house in Culver City, an artsy, formerly industrial section of Los Angeles. This month, the now 28-year-old Mr. Winter, who runs his own interior design firm, paid about $1.7 million for his second home, a three-bedroom, Spanish-revival in Westwood, a neighborhood near UCLA.

A new generation is skipping the “starter home” and betting heavily on high-end real estate. Lauren Schuker Blum reports on Lunch Break.

SREP on Fox Business Network

Posted: July 10th, 2013

Our Managing Partner, Bruce Bartlett, was interviewed this morning on Fox Business Network’s Varney & Co. by Stuart Varney.

Luxury Real-Estate Flippers

Posted: June 28th, 2013

Sequoia Real Estate Partners was interviewed for this article and it contains photos of SREP properties.

By Sanette Tanaka

There is a new breed of quick-change artist on the real-estate front: luxury flippers who focus on high-end properties.

Million-Dollar Flips

Popular before the housing bust, house flipping-where a property is bought, renovated and sold quickly to make a profit-is seeing a comeback nationwide. Rising prices and tight inventory are driving more investors to the upper end of the market. Flips of homes priced at $1 million or more shot up 35% in 2012 compared with 2011, according to market researcher RealtyTrac.

Harvard: The State of the Nation’s Housing 2013

Posted: June 27th, 2013

The long-awaited housing recovery finally took hold in 2012, heralded by rising home prices and further rental market tightening. While still at historically low levels, housing construction also turned the corner, giving the economy a much-needed boost. But even as the most glaring problems recede, millions of homeowners are delinquent on their mortgages or owe more than their homes are worth. Worse still, the number of households with severe housing cost burdens has set a new record.

Click on the title above for the Executive Summary

Spiking Mortgages Won’t Derail Housing: Trulia Economist

Posted: June 27th, 2013

Even with their recent rise, mortgage rates are still “incredibly low” by historical standards, so they will not halt the housing recovery, Trulia Chief Economist Jed Kolko told CNBC on Tuesday.

Micro-apartments: The anti-McMansions

Posted: June 27th, 2013

Move over McMansions: These days, pint-sized, micro-apartments are all the rage.

Typically ranging between 180 and 300 square-feet, these tiny apartments are becoming increasingly popular among the young-and-single set and even some retirees, seeking affordable places to live in the nation’s costliest cities.

Seven Takeaways on Rising Home Sales

Posted: June 27th, 2013

Thursday’s report from the National Association of Realtors that existing-home sales in May rose by 4.2% adds to an upbeat market trend that has unfolded over the past two years. Here are seven takeaways on the sales data:

Motivated home buyers skip the bidding wars

Posted: June 27th, 2013

Southern California real estate agents are using reconnaissance and back-channel networks to find houses that haven’t yet hit the market. Some even offer bizarre gifts.

Ryan Mathys spent weeks prospecting.

He drove up and down the little avenue in Solana Beach, taking notes and knocking on doors. He scoured public records. He blanketed the seaside neighborhood in northern San Diego County with inquiries.

All the detective work had a dollars-and-cents purpose: to find homes the owners would be willing to sell.

Southern California housing prices are rising sharply, and there’s a shortage of houses available for sale.

New Homes Hit Record as Builders Cap Supply

Posted: June 27th, 2013

Home buyers are paying more for newly built homes than they ever have, as U.S. home builders continue pushing up prices and limiting the number of properties hitting the market.

Luxury housing boom in U.S. is still playing out

Posted: June 27th, 2013

ATLANTA — The U.S. luxury home market is being driven to new heights by relatively low prices, low interest rates and a more stable economy than in many countries, experts say.

Buyer interest is recovering quickly, said Kofi Nartey of the Agency in Beverly Hills, who was part of a panel of real estate agents speaking at the National Assn. of Real Estate Editors conference in Atlanta. “That tends to be the trend with the generation now. We get a lot of immediate gratification and bounce back.”

Flippers Ride Housing Wave In California, Homes Bought and Resold Quickly Reach Highest Levels Since 2005

Posted: June 27th, 2013

![]()

Rising home prices have fueled the return of a practice that some blamed for inflating the bubble: house flipping.

In California, the number of homes sold in recent months that had been flipped—or bought and resold within six months—has reached the highest levels since late 2005, according to PropertyRadar, a real-estate data firm. About 6,000 homes have been flipped in the state this year through April, or more than 5% of all homes sold statewide.

While flipping is re-emerging nationwide, brokers say it is happening most in California, where home prices have risen sharply over the past year. Six of the 10 largest price gains in major U.S. cities over the past year have been in California, according to Zillow. In April, home values rose by 25% from a year earlier in San Jose, San Francisco and Sacramento, and by 18% in Los Angeles.

Click on the article title to read more

Zillow Forum on the Future of Housing (Part 3, The Future of Housing Demand)

Posted: May 22nd, 2013

Industrial Tenants Are Expanding in Southern California

Posted: May 22nd, 2013

For the past five years, industrial tenants have enjoyed a dominant position in Southern California because space was plentiful and landlords were eager to keep their buildings full. Those days are coming to an end as occupancy rates edge higher and landlords push rents.

Home prices rise by most in seven years

Posted: May 22nd, 2013

Visit NBCNews.com for breaking news, world news, and news about the economy

Single-family home prices rose more than expected in February, posting their best annual rise since May 2006 in a fresh sign the housing recovery remains on track, a closely watched survey showed on Tuesday.

The S&P/Case Shiller composite index of 20 metropolitan areas gained 1.2 percent on a seasonally adjusted basis compared to January, topping forecasts for 0.9 percent.

Velocity of Southern California homes sales hits fastest pace since 2006

Posted: May 22nd, 2013

Southern California homes sold at the fastest pace for an April in seven years, according to a report from DataQuick.

The surge in demand follows a thawing in pent-up demand for move-up homes and high levels of investor purchases.

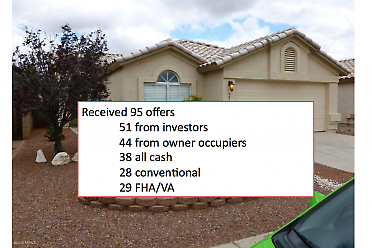

Believe it or not … Phoenix is facing a housing shortage

Posted: May 22nd, 2013

![]()

A Phoenix home with 95 bids is just one example of a housing market entering a new and unprecedented phase. Experts with Arizona State University’s W.P. Carey School of Business say the city is heading for a significant housing shortage.

Densification: Huge Majority of New LA Housing is Apartments and Condos

Posted: May 22nd, 2013

In case you doubted that Los Angeles is densifying, new state data reveals that a huge majority of new housing units are multifamily (meaning apartments and condos), as opposed to single-family. In Los Angeles County, between 2011 and 2013, 87.1 percent of new residential construction was multifamily, according to California Planning & Development Report’s crunching of the numbers from the state Department of Finance.

1Q2013 California Foreclosures Press Release

Posted: May 22nd, 2013

The number of California homeowners entering the foreclosure process plunged to the lowest level in more than seven years last quarter. The unusually sharp drop in the number of mortgage default notices filed by lenders stems mainly from rising home values, a strengthening economy and government efforts to reduce foreclosures, a real estate information service reported.

Pacific Value Opportunities Fund I, Q1 Update and Outlook

Posted: April 16th, 2013

We are set to close the sale of the Commonwealth asset on April 15th, just days away, and anticipate making a sizeable distribution early next week. We are still evaluating offers on the Fund’s largest asset, the multi-family asset at 245 N. Alvarado, and hope to enter escrow within the next few weeks at a sales price in excess of $10 million (our investment, all-in, approximates $8.2 million. That would be ideal, but we have created significant equity in the property in any case. The Fund’s sole remaining asset, a single-family residence in Wilmington, remains leased ($2,600/month). Our cost basis in this particular asset approximates $233,000, and according to Zillow, the house is worth in excess of $380,000. We will likely list the asset for sale sometime this summer or fall.

Obviously, the news surrounding the Fund and the remaining portfolio is good, and we hope to monetize all Fund assets before year end, a period we anticipate will remain strong for residential assets.

Pacific Value Opportunities Fund II, Q1 Update and Outlook

Posted: April 10th, 2013

Since operations for the Pacific Value Opportunities Fund II began in January, the Fund has acquired four properties, is seeking to acquire two others from Chase Bank (the Fund was the winning bidder for the properties, but the owners have filed bankruptcy), is negotiating to complete two short sales from other banks, and is actively making offers on other properties from Van Nuys to Newport Beach to Norwalk.

Click on the title above for details on the properties acquired

The home bidding wars are back!

Posted: April 9th, 2013

NEW YORK (CNNMoney)

The bidding wars are back. Seemingly overnight, many of the nation’s major housing markets have gone from stagnant to sizzling, with for-sale listings drawing offers from a large number of house hunters.

In March, 75% of agents with broker Redfin said their clients’ offers were countered by rival bids, up from 56% who said so in late 2011.

The competition has been most intense in California, where 9 out of 10 homes sold in San Francisco, Sacramento and cities in Southern California drew competing bids during the month. And at least two-third of listings in Boston, Washington D.C., Seattle and New York generated bidding wars.

“The only question is not whether a new listing will get multiple bids but how many it will get,” said Kris Vogt, who manages 14 Coldwell Banker offices in the Sacramento area. One home in an Elk Grove, Calif., subdivision recently received 62 separate bids. The final sale price was for more than $150,000, well above its $129,000 asking price.

CLICK ON THE TITLE TO READ THE WHOLE ARTICLE

Housing Prices Are on a Tear

Posted: April 8th, 2013

![]()

The U.S. housing market has broken out of a deep slump, and prices are shooting up faster than anyone thought possible a year ago. For many homeowners, that is a cause for celebration.

But the speed at which prices are rising is prompting murmurs of concern that the Federal Reserve’s campaign to reduce interest rates could be giving the housing market a sugar high.

Prices of existing homes rose 10% in February nationally from a year ago. They have been rising during the seasonally slow winter months—and they show signs of jumping further as the spring buying season gets under way. What’s going on?

Prices of existing homes rose 10% in February nationally from a year ago.

CLICK ON THE ARTICLE TITLE FOR THE FULL STORY

January Southland Home Sale Press Release

Posted: March 4th, 2013

Southland Begins 2013 With Sales and Price Gains Vs. Year Earlier

La Jolla, CA—Southern California’s housing market started 2013 with the highest January home sales in six years as sales to investors and cash buyers hovered near record levels and move-up activity remained relatively brisk. The median price paid for a Southland home dipped slightly from December, as it normally does, but jumped 23.5 percent above the year-ago level, a real estate information service reported.

Click on the title to see the entire article

Rental, For-Sale Markets Buck Odds, Rise Together

Posted: March 4th, 2013

The apartment and for-sale housing markets usually compete with each other. Historically, the math has been simple and brutal: If the percentage of people who own homes goes up, then the percentage of people who rent goes down. Good news for housing sales often means bad news for the apartment sector, if the number of households that need homes stays stable.

But what’s happening today is different, according to the economists at the National Association of Realtors (NAR). “Rental demand and housing sales are rising at the same time,” says NAR spokesperson Walter Maloney.

Click on the title to see the entire article

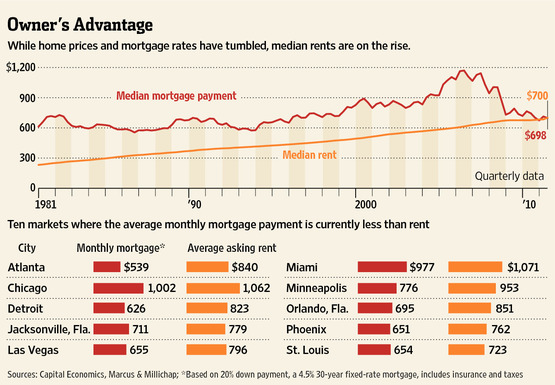

Home Prices Hit a Milestone

Posted: December 27th, 2012

Record-low mortgage rates mean that homeowners have a smaller financial burden for their residences than at any time since the early 1980s.

But here’s the bad news: Rising rents are squeezing many families and leaving them with less to spend.

Several factors have pushed rents up. Rental and apartment housing is in short supply but demand has grown after several years of foreclosures and population growth.

Click on the title to read the entire article

Tenants Feel Pinch of Rising Rents

Posted: December 27th, 2012

![]()

Jake Brumm, with his family in the house they rent in El Cajon, Calif., says landlords ‘have the upper hand.’

Record-low mortgage rates mean that homeowners have a smaller financial burden for their residences than at any time since the early 1980s.

But here’s the bad news: Rising rents are squeezing many families and leaving them with less to spend.

Several factors have pushed rents up. Rental and apartment housing is in short supply but demand has grown after several years of foreclosures and population growth.

Click on the title to read the entire article

Apartments catering to Gen Y being built in downtown Glendale

Posted: December 16th, 2012

An apartment complex with small units intended to appeal to young people eager to get away from roommates and parents into a place of their own is nearing completion in downtown Glendale.

The $34-million mixed-use project named Eleve Lofts & Skydeck is designed for the tastes and needs of Generation Y — people between the ages of 20 and 34, said Alan Dibartolomeo of AMF Development.

Research by the Huntington Beach company found that many young adults would prefer to live in a small place alone than to live in a larger space with a roommate, even if it costs more to do so.

AMF razed a former Circuit City electronics warehouse store on the corner of Maryland Avenue and Broadway in Glendale’s urban shopping district to make way for Eleve. It will have three underground parking levels, shops and restaurants at street level, and six stories of apartments with 208 units above the retail spaces.

Click the title to read the complete article

The Best Housing Markets for Buyers and Sellers

Posted: December 15th, 2012

The real estate market has been slowly improving since it reached record lows in 2008 and 2009. Existing-home sales rose 2.1% in October and the national median price for an existing home is 11.1% higher than it was one year ago. According to the Federal Reserve’s beige book, the housing industry has experienced substantial improvement and has been a bright spot for the economy this year.

Berkshire Bets on Housing Recovery

Posted: November 2nd, 2012

Warren Buffett’s Berkshire Hathaway has made another bet on a recovery in the US housing market, agreeing to lend the conglomerate’s trusted brand to a new venture with Brookfield Asset Management.

Berkshire’s HomeServices of America unit will be the majority owner of a network of franchised real estate agencies, which will begin to offer services next year under the name Berkshire Hathaway HomeServices.

Brookfield will contribute a network of more than 53,000 individual estate agents responsible for $72 billion of residential real estate sales last year. The group acquired the business last year from Prudential Financial, but did not retain the rights to the Prudential name, which are taken back as existing franchise agreements expire.

Mr. Buffett told CNBC this month that he remains bullish on the US economy, which he expects to continue “inching ahead” even as global growth slows.

To read the entire article, click on its title above

Home prices continue upward trend in August

Posted: November 1st, 2012

Home prices in August rose across a broad swath of large American cities, adding further evidence that a housing recovery is taking shape.

The Standard & Poor’s/Case-Shiller home price index for the 20 largest metropolitan areas in the country rose 0.9% from July and 2% from August 2011. It was the fifth consecutive month-over-month increase and the third consecutive year-over-year bump.

Nineteen areas tracked by the index posted gains over July and 17 posted year-over-year increases.

To read the entire article, click on its title above

Flipping houses is once again a booming business

Posted: November 1st, 2012

Not long ago, John Irvin was selling women’s shoes in the Nordstrom at the Pentagon City mall, pulling down about $20 an hour.

Now he flips houses in Northern Virginia — scooping up short sales, rehabbing them and aiming for a quick sell. He has sold three homes and says he netted more than $30,000 in profit each time.

“If I do one house every quarter, I’m making $125,000 a year — at 25 years old,” Irvin said. “All my other friends, they have a 9-to-5 job. They make probably half of what I’m making right now. It’s kind of like hitting the lottery.”

To read the entire article, click on its title above

Property Flippers Are Back as Housing’s New Middle Men

Posted: October 31st, 2012

![]()

http://video.cnbc.com/gallery/?video=3000122706

Who can forget the heady days of the housing boom when property flippers would follow condo developers around like hungry wolves, waiting to pounce on new projects before one grain of earth had moved?

Property auctions for single family homes weren’t any different, as novice buyers were scooping up multiple properties only to flip them for a profit in a matter of weeks.

Those days are gone; the price appreciation is gone, and the funding is gone…but apparently the flippers are back. Some of them never left. Close to 100,000 properties were flipped in the first six months of this year, according to RealtyTrac, which defines flipping as a home bought and sold within six months. That is a 25 percent jump from a year ago. But flipping is not what it used to be.

Home ‘flippers’ grab an increasing share of Sacramento housing market

Posted: October 31st, 2012

Homebuyers in today’s market are likely to encounter a lot of fresh paint and spruced-up bathrooms.

That’s because flipped houses, renovated and quickly resold for profit, make up a larger share of the Sacramento region’s housing market than at any time in the past decade, including the height of the housing boom.

About one in 12 homes sold in Sacramento County last month was flipped, meaning it was bought and resold within a six-month period, according to real estate information service DataQuick.

“Flipping was up significantly from a year ago,” said DataQuick analyst Andrew LePage.

Investor Q3 Update & Outlook

Posted: October 25th, 2012

The third quarter saw continued improvement in the residential markets, similar to those we have noted in earlier quarterly updates. Nationally, apartment rents increased approximately 0.8% in the third quarter, representing the seventh consecutive quarter of rental growth, while overall vacancy rates dropped to 4.6%. However, the increase in rents represented the slowest rate of growth since the recovery began in 2010. These results are not surprising as improvement in single-family home prices (up 4.6% in August 2012 versus the prior year, the largest year-over-year increase in six years) – buoyed by continued low interest rates, expanding confidence in the economic recovery, and low levels of inventory for sale – absorbed some of the apartment momentum. The surprising strength in the single-family residential market, highlighted by unusually low supply (click to read more) has perhaps been the most interesting story during the quarter…..

Click on the article title above to read further.

The Pacific Value Opportunities Fund I is showing remarkable gains

Posted: October 23rd, 2012

Sequoia Real Estate Partners’ Pacific Value Opportunities Fund I has begun to liquidate its mix of value-added (improved) investments in both apartments and single family homes. Based on properties already sold, or in escrow, and valuations from independent sources the PVOF I, which was started in 2010, is on track to generate an annual fund return north of 25%, the vast majority of which goes to its investors. Fund Managers currently anticipate 100% of all invested capital and profits to be distributed to investors by the end of 2013. For more specifics click on the title of this article above.

The Pacific Value Opportunities Fund II Opens October 29th.

Posted: October 23rd, 2012

Sequoia Real Estate Partners latest fund, PVOF II opens to investors October 29th. PVOF II comes on the heels of the highly successful PVOF I, which is on track for a very strong annual Return on Equity, and will capitalize on the current supply and demand imbalance in the single-family market for “turn-key” move-in ready homes. Bruce Bartlett, one of Sequoia’s Managing Partners noted “We’re simply taking our years of successful experience and economies of scale improving apartment communities and applying that to single-family homes. We did this in PVOF I and had great results.” The Fund is relatively small, only $10 million, so based on PVOF I’s success, SREP’s strong track record and investor demand, it is expected to fill quickly.

Click here for more info.

Housing is indeed heading higher

Posted: October 22nd, 2012

![]()

As Fortune predicted last year, a robust recovery in home prices is under way.

FORTUNE — In spring 2011 this writer penned a controversial cover story titled “The Return of Real Estate” that predicted a strong rebound in housing. At the time, prices and sales were still tumbling, and the prevailing view among economists and pundits was that the slide would drag on and on. But Fortune’s contrarian forecast proved right. By October of last year, new- and existing-home sales and housing starts had begun an upswing that’s been gathering strength ever since — and prices joined the march in early 2012. The data conclusively confirm what Fortune predicted back then: “Housing is back.”

To see this entire article, click on its TITLE above.

Home sales slowed in September, but 2nd best in two years

Posted: October 22nd, 2012

NEW YORK (CNNMoney) — The pace of previously owned home sales slowed slightly in September, even as the long-battered housing market showed signs of a broader recovery.

Sales of existing homes sold at an annual rate of 4.75 million, according to a closely watched reading reported Friday from the National Association of Realtors. It was off slightly from the 4.83 million pace the previous month, but up 11% from a year earlier. Despite the slip, September’s pace was the second best in more than two years, trailing only the strong August reading.

To see this entire article, click on its TITLE above.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Flipping is On Its Way Back, Thanks to the Hipster Flippers

Posted: October 17th, 2012

Archstone buys apartment complexes in Venice, Marina del Rey

Posted: October 17th, 2012

Archstone adds to its Southern California portfolio, spending more than $100 million on the two properties that combined provide 275 units.

Colorado apartment landlord Archstone broadened its Southern California empire this month by spending more than $100 million on seaside properties in Venice and Marina del Rey.

Archstone, which operates upscale apartments in coastal markets, bought the Frank, a 70-unit complex on Rose Avenue in Venice, for $56.2 million. It also purchased the Bay Club, which has 205 units — and 207 boat slips — on Tahiti Way in Marina del Rey for $43.95 million.

Median home price in Southland climbs as supply is squeezed

Posted: October 17th, 2012

Southern California’s median home price climbed to a high not seen in more than four years even as sales plummeted — the latest sign that the housing market is becoming increasingly competitive, with fewer homes available.

Sales declined for the first time in nine months as California experienced a shortage of affordable properties, according to real estate research firm DataQuick. In particular, foreclosed homes hit a nearly five-year low.

The region’s median price was $315,000 last month, up 1.9% from August and 12.5% from September, DataQuick reported.

UCLA: Calif. homebuilding to double by ’14

Posted: October 10th, 2012

UCLA economists think homebuilding is ready to enjoy a statewide renaissance – with housing units construction more than doubling in two years.

Their latest UCLA/Anderson California forecast calls for 23,500 home permits pulled by the state’s developers this year – essentially flat vs. 2011. Next year, homebuilding would grow 44 percent and in ’14 jump by an additional 78 percent to 60,200 – highest since 2007. California multifamily construction should by UCLA’s math grow 19 percent this year; 29 percent next year; and double for 2014 to 69,100 – highest in more than a decade.

U.S. home prices make biggest jump in 6 years

Posted: September 4th, 2012

Nationwide home prices shot up 3.8% in July, making their largest year-over-year leap since 2006, according to real estate data provider CoreLogic.

The gain marks the fifth straight rise in the gauge, part of a positive swing following a year and a half of slumps. The last time prices rose so much was in August 2006, when they jumped 4.1%.

Prices in California bounded up 4.4%. Without distressed sales – including foreclosures and short sales – national prices were up 4.3% compared with last July.

Home prices signal recovery may be here

Posted: August 28th, 2012

NEW YORK (CNNMoney) — A sharp boost in home prices during the spring could signal a recovery in the long-suffering U.S. housing market, according to an industry report issued Tuesday.

The S&P/Case-Shiller national home price index, which covers more than 80% of the housing market in the United States, climbed 6.9% in the three months ended June 30 compared to the first three months of 2012.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Fannie Mae paper: What Drives Consumers’ Intentions to Own or Rent

Posted: August 14th, 2012

What Drives Consumers’ Intentions to Own or Rent

“Our analysis found that consumers consider a mix of demographic and

attitudinal drivers in their future “next move” own-rent preferences. Demographics

such as income, age, marital status, and employment status are

the primary drivers of current homeownership status and the own-rent

intention for outright homeowners (those who don’t have a mortgage).

However, attitudes are the key drivers of the own-rent intention for renters

and homeowners with a mortgage – two groups that account for about 80

percent of housing units in the U.S.”

Home Prices Climb as Supply Dwindles

Posted: August 13th, 2012

Home prices rose by their largest percentage in at least seven years during the second quarter, propelled by low inventories of properties for sale and high demand for bargain-priced foreclosures, according to two reports Tuesday.

Prices rose by 2.5% in June from a year ago, and by 6% from the previous quarter, said CoreLogic Inc., a Santa Ana, Calif., data firm. The quarterly jump was the largest since 2005.

Finally, It Is Time to Buy a House

Posted: August 13th, 2012

Warren Buffett famously once said: “Be fearful when others are greedy, be greedy when others are fearful.”

And if you’re not instinctively scared of the housing market, then global warming, saturated fat, running with scissors and the bogeyman probably aren’t keeping you awake at night, either.

The fact that everyone is scared to dabble in—much less commit to—housing makes it a close-to-perfect investment based on Mr. Buffett’s principle. But buying real estate is a good long-term investment for many more reasons, some of which have only become apparent in recent weeks.

Before and After 3118 Palo Verde Ave. Long Beach

Posted: August 7th, 2012

Before and after photos of our most recent REO flip. Construction was 1 month.

Investor Q2 Update and Outlook

Posted: July 27th, 2012

The second quarter witnessed continued and significant progress in the Pacific Opportunities Value Fund I, as we have completed the sale of one asset and near the sale of a second, both single-family homes we acquired and renovated. Moreover, residential rental market fundamentals continue to improve, just as we predicted. In fact, according to REIS, a well regarded real estate data collection firm, second quarter average rents increased in all 82 markets they track, while the nation’s apartment vacancy rate fell to 4.7% (the lowest level seen since 2001).

Phoenix Rising

Posted: June 13th, 2012

![]()

A San Francisco-based company that buys foreclosed homes and rents them out is finding that the stampede of private cash into the nascent single-family rental sector is changing its business plan: It already is cashing out.

Demographics, New Assumptions Drive Commercial Real Estate

Posted: June 12th, 2012

A turning point has been reached in the economy and both demographics and the assumptions that traditionally drove the commercial real estate industry are shifting.

But while economists speaking on a panel at the Strategic Real Estate Conference held in New York this week agreed that this is a time of incredible change, they also see opportunity.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Southern California housing data signal turnaround

Posted: May 17th, 2012

The region’s median home price rose 3.6% from a year earlier to $290,000 in April, real estate research firm DataQuick of San Diego reported. Construction of new homes jumped last month. Above, a window frame is worked on at a home in San Diego. (Sam Hodgson, Bloomberg / April 20, 2012)

Southern California’s housing market showed signs of turning the corner in April as foreclosures made up the smallest share of sales in four years and the region’s median home price increased for the first time since late 2010.

Among other evidence of improvement, foreclosures dropped significantly in California and other Western states last month, a continuation of a trend that began last fall, according to data firm ForeclosureRadar. A separate report by the nation’s mortgage bankers released Wednesday showed that national delinquencies and foreclosures hit a four-year low, driven largely by declines in states in the West.

Another record low for mortgage rates

Posted: May 13th, 2012

NEW YORK (CNNMoney) — Mortgage interest rates hit new lows this week as both the 30-year and the 15-year fixed-rates fell, according to a weekly survey by Freddie Mac. It was the second consecutive week that rates broke records.

Builder Is Constructing REIT for Home Rentals

Posted: May 9th, 2012

![]()

Above, one of the company’s houses in Tolleson, Ariz.

Investors can buy stakes in malls, apartment towers, timber forests and even cellphone towers through real-estate investment trusts. Now, add to the list: single-family homes transformed into rental properties.

Beazer Pre-Owned Rental Homes Inc., which hopes to expand beyond Phoenix and Las Vegas to at least one other, as-yet unidentified market. Within two years, Beazer said the number of rental homes under the new REIT’s control could number in the thousands.

Rents soar as foreclosure victims, young workers seek housing

Posted: May 7th, 2012

Few new units and tight standards for home loans add to the pressure. The average monthly U.S. rent is at an all-time high, and a 10% jump in Los Angeles County over the next two years is forecast.

Though Outcomes Argue Otherwise, Rent Control Continues to Win Public Support

Posted: May 3rd, 2012

In various polls conducted over the years, over 90 percent of economists agree that rent control is not merely ineffectual, but actually reduces the quantity and quality of housing available.

Housing’s Attractive Formation

Posted: May 1st, 2012

![]()

The kids are finally getting out of the house.

More of America’s excess housing inventory got sucked up in the first quarter, the Census Department reported Monday. The share of rental units that were empty fell to 8.8%, from 9.7% a year earlier and the lowest level since 2002. The homeowner vacancy rate (the share of nonrental homes that are empty and waiting to be sold) slipped to 2.2% from 2.6%—still high relative to the prebubble years, but the lowest rate since 2006.

The accuracy of those figures is an open question: On the one hand, there is an unknown amount of shadow inventory that is being kept off the market, while on the other there is evidence that the quarterly vacancy figures are overstated. But the pickup in household formation that is driving vacancy rates lower appears real, according to independent housing economist Thomas Lawler.

KKR Joins Rivals With Real-Estate Push

Posted: May 1st, 2012

Kohlberg Kravis Roberts & Co., one of the original buyout shops, has long resisted getting into real estate. But after years of watching rivals invest billions of dollars in property, KKR finally is making its own big push.

The firm’s $196 million acquisition last week of a Chicago-area shopping mall kicked off what is expected to be a flurry of deals in the months ahead.

Warren Buffett on CNBC: I’d Buy Up ‘A Couple Hundred Thousand’ Single-Family Homes If I Could

Posted: April 26th, 2012

![]()

Warren Buffett says along with equities, single-family homes are a very attractive investment right now.

Appearing live on CNBC’s Squawk Box, Buffett tells Becky Quick he’d buy up “a couple hundred thousand” single family homes if it were practical to do so.

If held for a long period of time and purchased at low rates, Buffett says houses are even better than stocks. He advises buyers to take out a 30-year mortgage and refinance if rates go down.

Investor Q1 Update and Outlook

Posted: April 23rd, 2012

UPDATE & OPINION

Market fundamentals for residential rental properties remain fairly robust, reflected by increasing rents and declining vacancies. A recent report issued by USC’s Lusk Center for Real Estate (the 2012 Casden Multifamily Forecast) predicts that average rents will increase 7.9% in 2012 and total growth of 9.6% by the end of 2013. This forecast is consistent with our own overall views of the Southern California market, as we discussed in previous reports. In short, we view apartments and residential rentals as the best place to allocate real estate directed investment funds.

Wall Street Keys On Landlord Business

Posted: April 18th, 2012

![]()

Some of the biggest names on Wall Street are lining up to become landlords to cash-strapped Americans by bidding on pools of foreclosed properties being sold by Fannie Mae.

The idea is that the new owners would rent out the homes at first rather than reselling—potentially aiding a housing-market recovery by reducing the number of properties clogging the market. The fact that big-name investors are interested also suggests they anticipate sizable future profits in housing.

Fannie Mae’s Foreclosure Announcement

Southern California rental market getting more expensive

Posted: April 13th, 2012

The average L.A. County rent is predicted to soar nearly 10% by the end of 2013. Rising rents could help usher in a housing market recovery if enough renters take the plunge into buying.

The average Los Angeles County rent is predicted to soar nearly 10% over the next two years, leading a resurgence of the costly Southland apartment lifestyle.

Southern California’s economic recovery may be halting and tepid, but young workers gaining new employment, a demand for apartment living and scarce construction of units are creating a rental squeeze in the region, according to a report released Wednesday by USC’s Lusk Center for Real Estate.

The one number to watch for a housing recovery

Posted: April 13th, 2012

![]()

If you’re waiting for home prices to go up, then you’re missing signs the troubled housing market has finally turned around.

FORTUNE – Over the past few months, many economists have concluded that that the U.S. housing market has reached a turning point and is healing. This may sound hard to believe, since home prices have continued their downward trend. In 2011, prices fell by 4% following nearly a 30% decline since the property bubble peaked in June 2006. They ended the year at a 10-year low.

Fannie REO inventory declines 27% in 2011

Posted: March 4th, 2012

![]()

The year-end inventory of foreclosed homes at Fannie Mae fell for the first time since the housing downturn.

In 2011, Fannie reduced its REO inventory 27% to roughly 118,500, according to its fourth quarter financial filing. Levels increased every year since 2007.

For the first time since the collapse, Fannie sold more REO than it repossessed. In 2011, the government-sponsored enterprise acquired nearly 200,000 properties and sold more than 243,000, the most in the company’s history.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

Rents Keep Rising, Even as Housing Prices Fall

Posted: February 27th, 2012

![]()

The housing market remains a potent drag on the economy as home prices continue to slip, foreclosed homes fill some neighborhoods and millions of construction workers scramble for jobs.

But one group is sitting pretty: landlords.

Unlike home prices, rents have been rising, up 2.4 percent in January from a year earlier, according to recent data, not adjusted for inflation, released by the Labor Department.

With few rental buildings erected over the last few years, available units are going fast.

Don’t rush into REITs

Posted: February 7th, 2012

“It is a hunt for yield,” says Mark Luschini, chief investment strategist at Janney Montgomery Scott, noting that investors don’t seem to care where they have to go to collect income as long as they’re being paid.

Therein lies the problem.

Investors flood Southern California housing market in December

Posted: January 23rd, 2012

A record number of investors and second-home buyers flooded the Southern California real estate market in December, though not enough to give sales in the region a bump over the same month a year earlier.

With the investor dominance, low-cost homes reigned. That helped push the region’s median home price back down to its lowest level in 12 months, according to San Diego real estate firm DataQuick.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Mixed-use project to get underway this month in downtown L.A.

Posted: January 15th, 2012

The $160-million One Santa Fe complex will consist of apartments, offices, shops and public outdoor spaces on Santa Fe Avenue between 1st and 4th streets.

Construction will begin this month on One Santa Fe, a long-anticipated $160-million apartment, office and retail development in the arts district of downtown Los Angeles.

The 790,000-square-foot complex will rise on four acres of land on Santa Fe Avenue between 1st and 4th streets that was leased from the Los Angeles County Metropolitan Transportation Authority.

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

Big Funds Build Case for Housing

Posted: December 30th, 2011

Big money is starting to wager on housing.

Hedge funds run by Caxton Associates LP, SAC Capital Advisors LP, Avenue Capital and Blackstone Group LP have been buying housing-related investments, betting on a rebound. And formerly bearish research firm Zelman & Associates now predicts a housing pickup, as does Goldman Sachs Group Inc.

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

Big Developers Dabble in Apartment Market

Posted: December 24th, 2011

![]()

SREP Note: SREP Funds typically acquire and reposition properties for less than the cost of replacement.

ARTICLE, WSJ

Some of the leading U.S. developers of malls and office properties are moving into the apartment business, where demand for new projects is stronger than any other commercial-real-estate sector.

Fueled by the decline in home ownership, the boom in apartment building is attracting commercial-property companies such as Boston Properties Inc., Mack-Cali Realty Corp., SL Green Realty Corp., Simon Property Group Inc. and Macerich Co. They all have either acquired, completed or broken ground on apartment buildings in recent months, or plan to do so next year.

The Return of Rehab

Posted: December 24th, 2011

ARTICLE, MULTIFAMILY EXECUTIVE

Value-add deals resume as rents trend higher.

With the benefit of hindsight, the idea of “trending rents” was viewed as a deadly sin throughout the downturn.

The irrational exuberance of the last boom period inspired some wildly inaccurate underwriting on rent growth, which often culminated in delinquencies and default. Over the last year, however, value-add rehabs have come back into the spotlight as rent growth resumed in earnest. And that rebound in fundamentals over the last year has been so swift it’s defied upside expectations and inspired further confidence to again start banking on rent growth.

Do You Really Want To Be a Landlord?

Posted: December 19th, 2011

![]()

ARTICLE, WSJ

Jeannette Boccini thought she had found a great renter, someone who would take extra good care of her townhouse. Then the nightmare began.

The tenant repeatedly harassed the neighbors, complained that the wood chips in the community playground were toxic, and informed Ms. Boccini on Christmas morning that someone was playing Christmas carols too loudly.

But the final straw was the night the tenant showed up at Ms. Boccini’s door to report there was dust all over the mailbox. “I absolutely flipped,” Ms. Boccini says. “I was like, ‘You don’t like it? Get the hell out of my house.’ ”

Like many these days, Ms. Boccini became a landlord not by choice but because of circumstances beyond her control: namely, the real-estate crash.

Stalled Hollywood Condo Project Reborn as Luxury Rentals

Posted: December 19th, 2011

ARTICLE, LA TIMES

A failed Hollywood condominium development that once symbolized the housing market collapse has been reborn as a $120-million upscale apartment and retail complex.

Construction on the former Madrone came to a halt around the end of 2009 even though the shell of the project was mostly complete. Developer John Laing Homes filed for bankruptcy and the scaffolding-swathed husk of the Madrone was left to weather the elements behind locked gates.

Stronger Lure for Prospective Home Buyers

Posted: December 6th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Home prices and mortgage rates have fallen so far that the monthly cost of owning a home is more affordable than at any point in the past 15 years and is less expensive than renting in a growing number of cities.

Where Housing Is Headed

Apartment occupancy stable, rents on rise

Posted: December 6th, 2011

ARTICLE, LA TIMES

“Apartment demand is benefiting from slight job growth as well as an expanding pool of potential renters,” said Gleb Nechayev, a senior economist for CBRE Group Inc.

Vacancy is down slightly from a year ago and off nearly 2 percentage points from the 2009 peak, the brokerage report said.

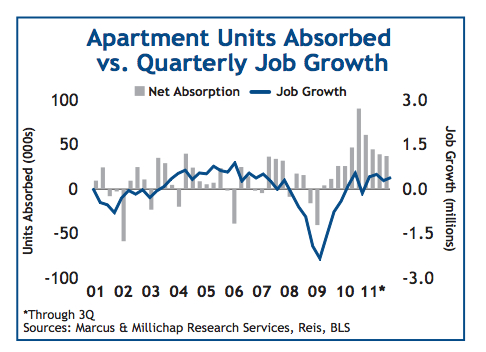

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

PVOF: Before & After, 245 N. Alvarado, Los Angeles CA

Posted: October 3rd, 2011

The Repositioning of a 60 unit building near downtown Los Angeles.

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

Bloomberg names Eric Sussman one of the Nation’s Top 10 Business School Professors

Posted: October 1st, 2011

The most popular business school professors are good teachers, plain and simple. They’re not rock stars, CEOs or celebrity researchers. Their names may not look familiar. But they’ve earned a place in the hearts and minds of their students by bringing to life accounting, finance and management, learning their names and helping them find jobs. Their students come first and it shows.

FHA multifamily loan originations at record high

Posted: September 12th, 2011

ARTILCE, REUTERS

The Federal Housing Administration has backed a record $10.5 billion in multifamily rental housing loans during its 2011 fiscal year, the agency said on Tuesday.

The rise in loans for multifamily units reflects an underlying trend in demand for rental property.

Investing in Undervalued Housing Markets

Posted: August 22nd, 2011

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Harvard 2011 America’s Rental Housing Summary

Posted: June 8th, 2011

PAPER, HARVARD UNIVERSITY

The troubled homeowner market, along with demographic shifts, has highlighted the vital role that the rental sector plays in providing affordable homes on flexible terms. But while rental housing is the home of choice for a diverse cross-section of Americans, it is also the home of necessity for millions of low-income households.

WSJ: Why It’s Time to Buy

Posted: June 8th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The short-term outlook isn’t encouraging. Job growth remains weak, foreclosure sales are making up more of the market, and economists are predicting that home prices will fall more in the coming months.But the long-term benefits of home ownership remain very much intact.

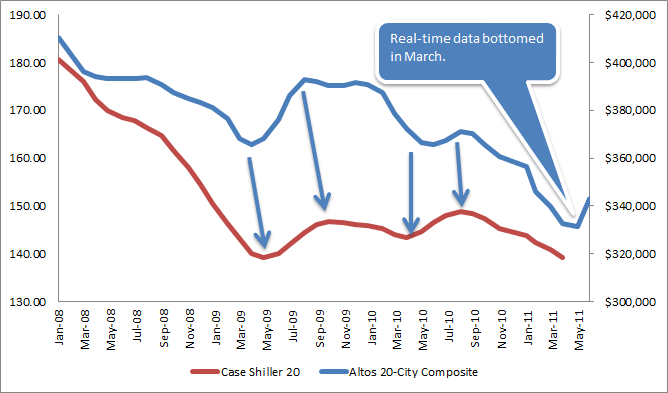

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

Blackstone Leads Buyout Firms Expanding Into Property

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

Blackstone Group LP and Carlyle Group are leading a record number of private-equity managers aiming to raise real estate funds as the world’s top buyout firms accelerate an expansion beyond corporate takeovers.

Blackstone, the biggest private-equity firm, is planning to raise its next real estate fund, with a target of about $10 billion, later this year. Carlyle is in the process of raising a new fund for U.S. property deals, said a person briefed on the plan who asked not to be named because the fund is private.

The two are among 439 private-equity real estate funds seeking a combined $160 billion, the largest number on record, according to London-based researcher Preqin Ltd. KKR & Co.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Renew your lease – rents could rise 10%

Posted: March 20th, 2011

![]()

ARTICLE, CNN/MONEY

Renters beware: Double-digit rent hikes may be coming soon.

Already, rental vacancy rates have dipped below the 10% mark, where they had been lodged for most of the past three years.

“The demand for rental housing has already started to increase,” said Peggy Alford, president of Rent.com.

Cash Buyers Lift Housing

Posted: February 11th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority. WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

No McMansions for Millennials

Posted: January 18th, 2011

![]()

ARTICLE, WALL ST. JOURNAL

Gen Y housing preferences are the subject of at least two panels at this week’s convention. A key finding: They want to walk everywhere. Surveys show that 13% carpool to work, while 7% walk, said Melina Duggal, a principal with Orlando-based real estate adviser RCLCO. A whopping 88% want to be in an urban setting, but since cities themselves can be so expensive, places with shopping, dining and transit such as Bethesda and Arlington in the Washington suburbs will do just fine.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Donald Bren’s spending spree

Posted: December 15th, 2010

Irvine Co. billionaire boss Donald Bren has been making some big real estate gambits in recent weeks, a billion-buck-plus bet on an economic recovery ahead …

“It strikes me as a prudent move from a fearless leader. The recovery is underway. Conditions in Orange County indicate that economic growth is accelerating. Mr Bren is clearly convinced that investment at this stage of the recovery will be necessary to capture the rise in demand that is coming. We also believe there is an inevitable expansion of economic activity that will occur in Orange County by the end of 2011 and throughout 2012. …”

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

Welcome to Zombieland: Ladera Oaks California

Posted: December 7th, 2010

ARTICLE, CNN/MONEY, 12.06.2010

Welcome to Zombieland: Ladera Oaks California

Home Prices in U.S. Will `Bounce Along the Bottom,’ Case Says

Posted: December 1st, 2010

ARTICLE, BLOOMBERG, 11.30.2010

U.S. home prices are unlikely to fall much further in the next year even after a “discouraging” report on values in September, said Karl E. Case, the co-creator of the S&P/Case-Shiller Index.

“If I were betting even odds, I’d bet that we don’t have much further decline, but that we bounce along the bottom,” Case, a retired professor of economics at Wellesley College, said today in a Bloomberg Television interview on “Surveillance Midday” with Tom Keene.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

Commercial Real Estate Turn Around

Posted: October 28th, 2010

![]()

VIDEO, CNBC, 10.26.2010

The bigger opportunity right now in the marketplace is for private investors who are not so concerned about the different sectors but are interested in infill locations that are close to jobs.

Case Shiller Points to Housing Stability

Posted: October 28th, 2010

![]()

OPINION, SEEKING ALPHA, 10.27.2010

Taken together, these facts strongly suggest that the housing market stabilization we have observed over the last year or so is the real thing, not just a chimera.

Sequoia Investment Partners, September 2010 Investor Market Summary and Forecast

Posted: September 29th, 2010

OPINION, SREP, 10.07.2010

Record-low interest rates persist, with 10-year treasury yield falling below 2.50% and fixed-rate mortgage rates – for both single- and multi-family residences – available in the 4′s.

As a result, we continue to be very bullish on the multi-family residential market, and despite the likely forthcoming wave of additional single-family residential foreclosures, significant opportunities will present themselves in that market as well. Sequoia Real Estate Partners is poised to take advantage of these favorable markets for medium- to longer-term investment.

Multifamily Sales Defy the Slump

Posted: September 22nd, 2010

ARTICLE, WSJ, 09.22.2010

Home buyers might be sitting on the sidelines, but multifamily-building sales are on the rise, reversing the slowdown that followed the financial market’s collapse two years ago.

The vacancy rate, which peaked at 7.4% at the end of last year, is expected to drop to 5.5% by the end of 2011, according to CBRE Econometric Advisors.

Where to Buy a Home for Less Than $800 a Month

Posted: September 15th, 2010

![]()

ARTICLE, U.S. NEWS & WORLD REPORT, 09.15.2010

Lower property values and dirt-cheap mortgage rates have combined to restore affordability to many real estate markets that were once wildly overpriced. “Right now, housing is about as affordable as it has been since at least the 1970s,” says Patrick Newport, a U.S. economist for IHS Global Insight.

How Wall Street Reform Benefits Foreclosure Buyers

Posted: September 13th, 2010

![]()

ARTICLE, REALTYTRAC, 09.13.2010