Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Getting Warmer: Where Rent Prices are Hot (and Where They’re Cool)

Posted: October 10th, 2012

For those looking to live in a locale with an endless summer, it doesn’t come cheap.

On average, renters in Orange County, Calif. pony up more than $1,650 a month for an average two-bedroom apartment, according to new data from Homes.com and ForRent.com. To cover housing costs alone, residents have to rake in about $32 an hour, no small feat in a wage-depressed economy.

Entreprenuers will save housing

Posted: April 18th, 2012

By G.U. KRUEGER / SPECIAL TO THE REGISTER

Veteran Southern California real estate analyst G.U. Krueger adds his commentary on the housing market to this blog in a spot we call “Thursday Morning Quarterback.” Here’s his latest installment …

New business formations and entrepreneurial activity are one key to housing’s recovery.

In regard to entrepreneurial spirit, California always leads the nation — despite all the negative talk.

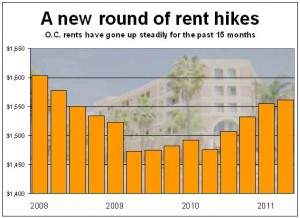

O.C. Apartments see largest rent hikes in 4.5 years

Posted: January 23rd, 2012

Another round of rent hikes occurred at Orange County’s large apartment complexes last fall, reflecting an ever-tightening market as vacancies continued to fall.

The average asking rent for a large-complex unit in Orange County was $1,561 a month, according to apartment tracker RealFacts.

Ex-Doomsayer: ‘It’s a great time to buy a home’

Posted: January 15th, 2012

A former housing market skeptic has become a housing market booster, telling a gathering of real estate insiders Thursday that now is “a great time to buy a home.”

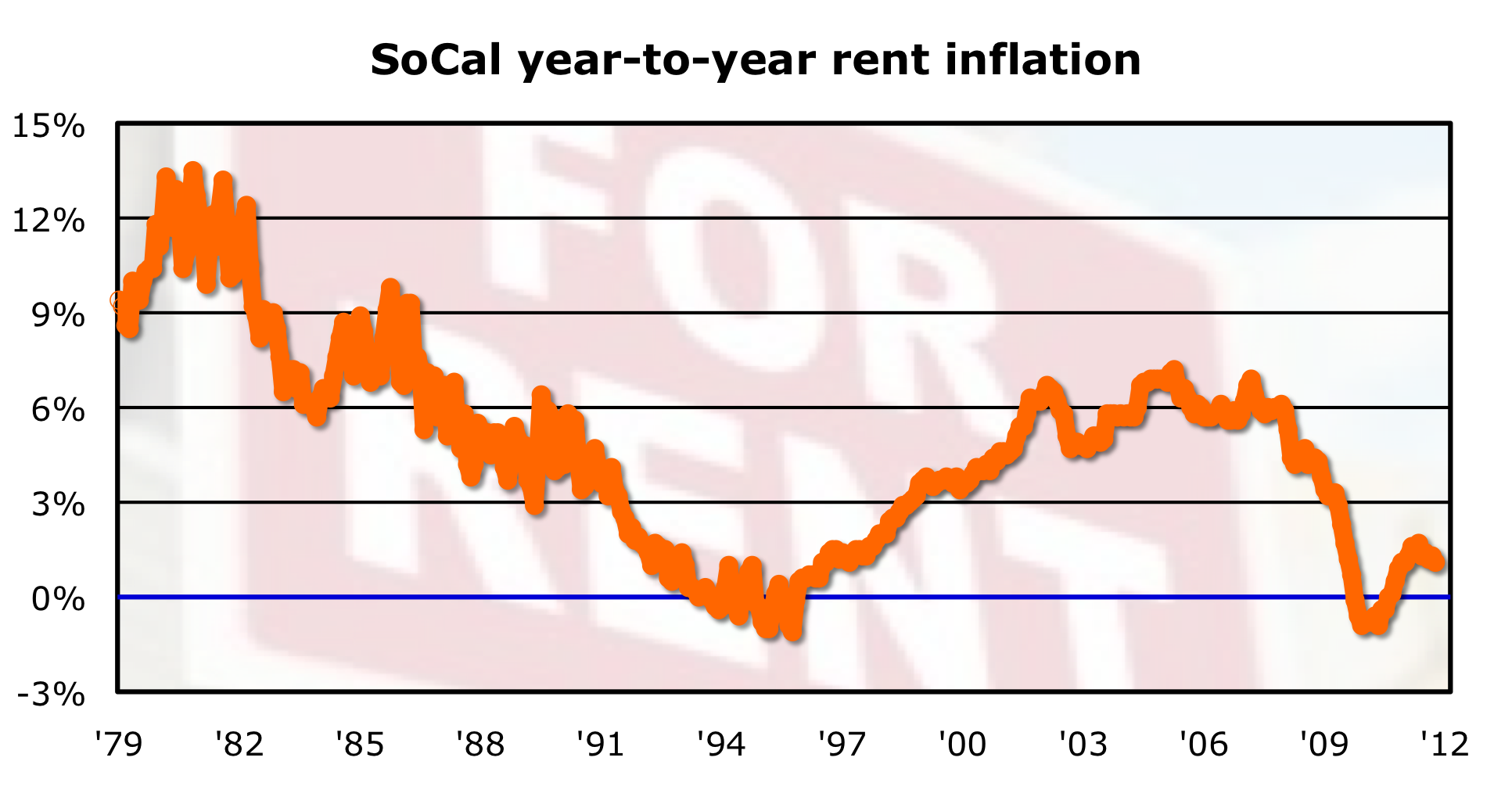

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

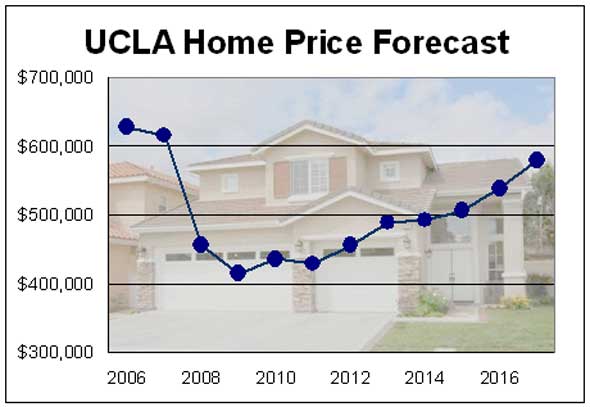

UCLA: O.C. home prices to rise 35%

Posted: November 16th, 2011

ARTICLE, OC REGISTER

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

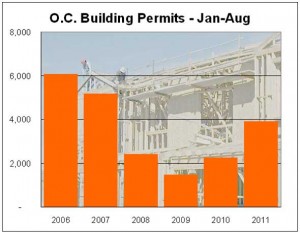

Apartments push O.C. homebuilding up 74%

Posted: September 27th, 2011

ARTICLE, OC REGISTER

Homebuilders have received permits to build 3,901 housing units in Orange County this year so far, up 73.7% from the same period in 2010, Construction Industry Research Board figures show.

In dollar terms, the estimated value of proposed homebuilding this year totaled $694 million through August, a 38.3% jump from 2010 levels for that period.

Southland Housing Market’s Vital Signs Remain Weak

Posted: August 18th, 2011

Southern California home sales fell last month to the lowest level for a July in four years, though the decline from a year earlier was the smallest in 13 months. The drop in sales from June was more pronounced, especially for $500,000-plus homes, as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, a real estate information service reported.

Time to foreclose on Orange County home: 373 days

Posted: August 18th, 2011

ARTICLE, OC REGISTER

It took just a little more than a year — an average of 373 days – for banks to foreclose on Orange County homes as of July, a report by ForeclosureRadar.com shows. That’s up 32% from July 2010.

.

Highlights of the report for Orange County:

Notices of default — the start of the foreclosure process – were down 20% from last July and 7% from June.

Notices of trustee sale, or foreclosure auctions, declined 19% from last July but went up 2% from June.

The number of banked owned homes increased by 16% from last July and 1% from June. As of July, there were 7,259 homes in Orange County owned by lenders.

The 373 days to foreclose compares to 283 days in July 2010 and 344 days in June. The high for 2011 year so far was 398 days in May.

Donald Bren’s spending spree

Posted: December 15th, 2010

Irvine Co. billionaire boss Donald Bren has been making some big real estate gambits in recent weeks, a billion-buck-plus bet on an economic recovery ahead …

“It strikes me as a prudent move from a fearless leader. The recovery is underway. Conditions in Orange County indicate that economic growth is accelerating. Mr Bren is clearly convinced that investment at this stage of the recovery will be necessary to capture the rise in demand that is coming. We also believe there is an inevitable expansion of economic activity that will occur in Orange County by the end of 2011 and throughout 2012. …”

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Builder betting on rebound by 2014

Posted: August 10th, 2010

ARTICLE, OC REGISTER, 08.10.2010

New home sales will be well above average by 2014, if not sooner, the president and CEO of Standard Pacific Homes predicted during a recent conference call with financial analysts.

Apartment owners see light at the end of the tunnel

Posted: August 10th, 2010

INTERVIEW, OC REGISTER, 08.10.2010

Q: When will the market turn around?

A: The market has to bottom first. Effective rents in O.C. started getting choppy as far back 2007 and peaked in Q4’07 at $1,685 per month. They were at $1,508 per month for Q2’10, so we would have to see almost 12 percent rent growth to get back to the prior peak. The market data would suggest that we have bottomed and should start to see some growth going forward.

In Sour Home Market, Buying Often Beats Renting

Posted: April 22nd, 2010

![]()

ARTICLE, NY TIMES 4.20.2010

In some once bubbly markets, prices have fallen so far that buying a home appears to be a bargain, based on a New York Times analysis of prices and rents in 54 metropolitan areas.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

More Incremental Gains for Southland Real Estate Market

Posted: April 19th, 2010

ARTICLE, DATAQUICK, 4.13.2010

Home sales and prices continued their steady but pokey climb up from the bottom in Southern California last month as buyers scrambled to take advantage of low prices and low mortgage interest rates.

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Southern California apartment rents are expected to keep falling

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

A study shows the average cost dropping as much as 3.5% in L.A. County this year, 2.4% in Orange County and less than 1% in San Bernardino and Riverside counties but inching up in San Diego County.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy