Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

The Pacific Value Opportunities Fund II Opens October 29th.

Posted: October 23rd, 2012

Sequoia Real Estate Partners latest fund, PVOF II opens to investors October 29th. PVOF II comes on the heels of the highly successful PVOF I, which is on track for a very strong annual Return on Equity, and will capitalize on the current supply and demand imbalance in the single-family market for “turn-key” move-in ready homes. Bruce Bartlett, one of Sequoia’s Managing Partners noted “We’re simply taking our years of successful experience and economies of scale improving apartment communities and applying that to single-family homes. We did this in PVOF I and had great results.” The Fund is relatively small, only $10 million, so based on PVOF I’s success, SREP’s strong track record and investor demand, it is expected to fill quickly.

Click here for more info.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Flipping is On Its Way Back, Thanks to the Hipster Flippers

Posted: October 17th, 2012

Archstone buys apartment complexes in Venice, Marina del Rey

Posted: October 17th, 2012

Archstone adds to its Southern California portfolio, spending more than $100 million on the two properties that combined provide 275 units.

Colorado apartment landlord Archstone broadened its Southern California empire this month by spending more than $100 million on seaside properties in Venice and Marina del Rey.

Archstone, which operates upscale apartments in coastal markets, bought the Frank, a 70-unit complex on Rose Avenue in Venice, for $56.2 million. It also purchased the Bay Club, which has 205 units — and 207 boat slips — on Tahiti Way in Marina del Rey for $43.95 million.

Banks see a housing rebound

Posted: October 13th, 2012

JPMorgan, Wells Fargo post big profit gains as home lending booms

America’s long-suffering housing market may be on the mend, two major banks said as they reported big jumps in profits.

JPMorgan Chase & Co. and Wells Fargo & Co., the nation’s largest home lenders, each reported double-digit quarterly earnings growth Friday. The big jump in profit was thanks largely to a surge in their mortgage businesses, fueled by low interest rates and waves of refinancing.

UCLA: Calif. homebuilding to double by ’14

Posted: October 10th, 2012

UCLA economists think homebuilding is ready to enjoy a statewide renaissance – with housing units construction more than doubling in two years.

Their latest UCLA/Anderson California forecast calls for 23,500 home permits pulled by the state’s developers this year – essentially flat vs. 2011. Next year, homebuilding would grow 44 percent and in ’14 jump by an additional 78 percent to 60,200 – highest since 2007. California multifamily construction should by UCLA’s math grow 19 percent this year; 29 percent next year; and double for 2014 to 69,100 – highest in more than a decade.

U.S. home prices make biggest jump in 6 years

Posted: September 4th, 2012

Nationwide home prices shot up 3.8% in July, making their largest year-over-year leap since 2006, according to real estate data provider CoreLogic.

The gain marks the fifth straight rise in the gauge, part of a positive swing following a year and a half of slumps. The last time prices rose so much was in August 2006, when they jumped 4.1%.

Prices in California bounded up 4.4%. Without distressed sales – including foreclosures and short sales – national prices were up 4.3% compared with last July.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Before and After 3118 Palo Verde Ave. Long Beach

Posted: August 7th, 2012

Before and after photos of our most recent REO flip. Construction was 1 month.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Rents soar as foreclosure victims, young workers seek housing

Posted: May 7th, 2012

Few new units and tight standards for home loans add to the pressure. The average monthly U.S. rent is at an all-time high, and a 10% jump in Los Angeles County over the next two years is forecast.

March California Home Sale Press Release

Posted: April 24th, 2012

An estimated 37,481 new and resale houses and condos were sold statewide last month. That was up 26.5 percent from 29,630 in February, and up 2.9 percent from 36,417 for March 2011.

The median price paid for a home last month was $251,000, up 5.0 percent from $239,000 in February, and up 0.8 percent from $249,000 for March a year ago.

Southland Home Sales Up; Median Price Almost Back to Year-Ago Level

Posted: April 20th, 2012

La Jolla, CA—Southern California home sales shot up last month from February amid the usual surge in early-spring shopping, but the gain over a year earlier was modest. Sales of $500,000-plus homes, though a bit lower than last year, jumped 36 percent from February, helping to lift the region’s overall median sale price to a six-month high – and to about where it was in March 2011, a real estate information service reported.

Wall Street Keys On Landlord Business

Posted: April 18th, 2012

![]()

Some of the biggest names on Wall Street are lining up to become landlords to cash-strapped Americans by bidding on pools of foreclosed properties being sold by Fannie Mae.

The idea is that the new owners would rent out the homes at first rather than reselling—potentially aiding a housing-market recovery by reducing the number of properties clogging the market. The fact that big-name investors are interested also suggests they anticipate sizable future profits in housing.

Fannie Mae’s Foreclosure Announcement

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

Rents Keep Rising, Even as Housing Prices Fall

Posted: February 27th, 2012

![]()

The housing market remains a potent drag on the economy as home prices continue to slip, foreclosed homes fill some neighborhoods and millions of construction workers scramble for jobs.

But one group is sitting pretty: landlords.

Unlike home prices, rents have been rising, up 2.4 percent in January from a year earlier, according to recent data, not adjusted for inflation, released by the Labor Department.

With few rental buildings erected over the last few years, available units are going fast.

Mortgage deal could bring billions in relief

Posted: February 10th, 2012

In the largest deal to date aimed at addressing the housing meltdown, federal and state officials on Thursday announced a $26 billion foreclosure settlement with five of the largest home lenders.

The deal settles potential state charges about allegations of improper foreclosures based on robosigning, seizures made without proper paperwork.

Investors flood Southern California housing market in December

Posted: January 23rd, 2012

A record number of investors and second-home buyers flooded the Southern California real estate market in December, though not enough to give sales in the region a bump over the same month a year earlier.

With the investor dominance, low-cost homes reigned. That helped push the region’s median home price back down to its lowest level in 12 months, according to San Diego real estate firm DataQuick.

December California & So Cal Home Sales Report

Posted: January 23rd, 2012

An estimated 37,734 new and resale houses and condos were sold statewide last month. That was up 15.5 percent from 32,669 in November, and up 4.2 percent from 36,215 for December 2010. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,063. DataQuick’s statistics go back to 1988.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Foreclosures expected to rise, pushing home prices lower

Posted: January 15th, 2012

Banks are getting more aggressive with the 3.5 million U.S. homes with seriously delinquent mortgages, setting the stage for a big wave of foreclosure action this year.

By E. Scott Reckard, Los Angeles Times

California and other states are likely to see an enormous wave of long-delayed foreclosure action in the coming year as banks deal more aggressively with 3.5 million seriously delinquent mortgages.

Ex-Doomsayer: ‘It’s a great time to buy a home’

Posted: January 15th, 2012

A former housing market skeptic has become a housing market booster, telling a gathering of real estate insiders Thursday that now is “a great time to buy a home.”

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

Scheduled foreclosure auctions soar in California

Posted: December 24th, 2011

Banks in November scheduled more than 26,000 homes to be sold at California foreclosure auctions, a 63% increase from October and a sign that a surge in discounted, bank-owned properties is on track to hit the market next year.

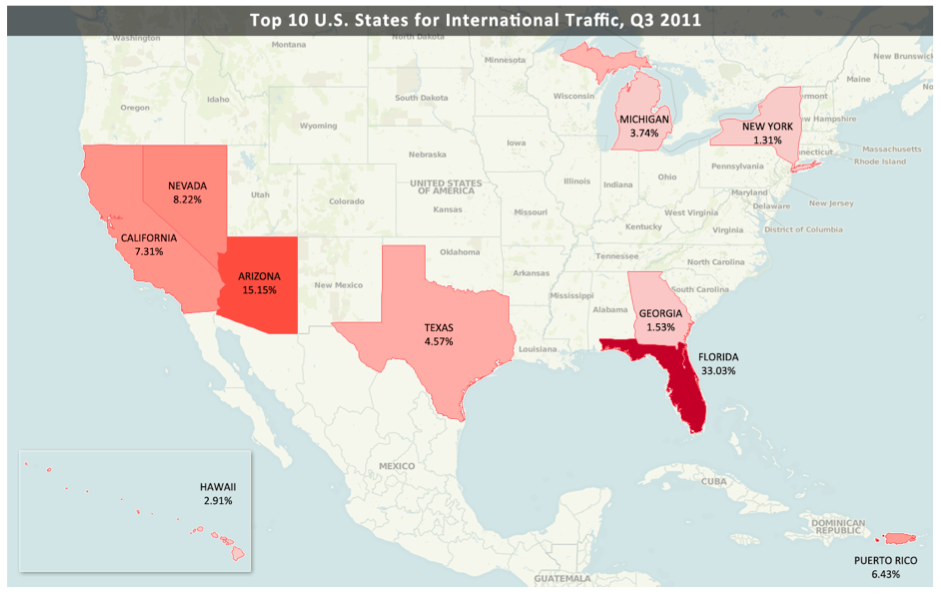

Foreign homebuyers clicking on depressed US housing markets

Posted: December 19th, 2011

![]()

ARTICLE, HOUSING WIRE

Foreigners looking to purchase homes in the U.S. are increasing their online search activity for bargains, as sliding home prices continue to attract investors from around the globe — especially Canada.

Florida properties remained the lead attraction for foreign investment in the third quarter, followed by Arizona, Nevada and California, according to traffic on the website for Point2, a Canadian-based real estate marketing company. Those housing markets have experienced the steepest declines in home prices from the sector’s peak in June 2006.

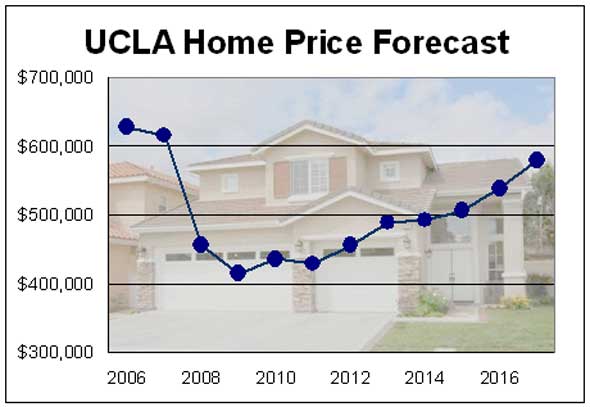

UCLA: O.C. home prices to rise 35%

Posted: November 16th, 2011

ARTICLE, OC REGISTER

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

California housing starts up 10% on multifamily strength

Posted: October 31st, 2011

![]()

California housing starts rose 10% in September from a year earlier as apartment and condominium construction surged, offsetting a decline in single-family homes, according to data from the California Building Industry Association.

Permits for single-family homes fell 16% from September 2010, totaling 1,463, while multifamily permits rose 45% from a year earlier, to 1,828, statistics compiled by the Construction Industry Research Board show.

California Foreclosure Activity Back Up

Posted: October 21st, 2011

PRESS RELEASE, DATA QUICK

After dropping to a three-year low in the second quarter of this year, the number of California homeowners being pulled into the foreclosure process snapped back to prior levels over the last three months, a real estate information service reported.

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.

Housing Lift Proves Fleeting

Posted: October 21st, 2011

![]()

ARTICLE, WALL ST JOURNAL

Sales of previously owned homes slipped in September as Americans were hit by economic uncertainty, high unemployment and tight lending.

Data Thursday highlight how jobs and housing are the main economic drags. Job seekers in California this week.

Existing-home sales dropped 3% to a seasonally adjusted 4.91 million in September, the National Association of Realtors said Thursday. That followed a sales bump in August, as the housing market remains stuck in neutral despite lower prices and interest rates at near-historic lows.

Historic United Artists building sells for $11 million. Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Posted: October 17th, 2011

ARTICLE, LA TIMES

A storied Los Angeles theater and office complex built by silent film stars that was later owned by one of the city’s most popular televangelists has been purchased by East Coast investors.

Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Home foreclosure proceedings on the rise again

Posted: October 13th, 2011

ARTICLE, LA TIMES

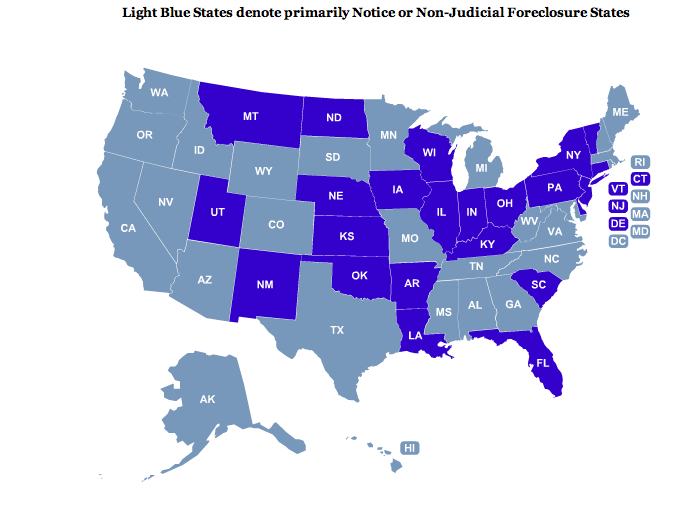

After months of a foreclosure slowdown caused by investigations into improper practices, the nation’s home-repossession machinery is beginning to move again — particularly in states such as California where courts don’t oversee the process.

The number of homes entering the foreclosure process surged 19% in the third quarter compared with the previous quarter in states where foreclosures take place largely outside of the courtroom, according to RealtyTrac, an Irvine information firm. These nonjudicial states include California, Nevada, Arizona, Oregon and Washington.

California foreclosures set to surge

Posted: September 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

California default notices spiked 55% in August, and the number may keep rising in the coming months as mortgage servicers shake off the robo-signing freeze, according to RealtyTrac Senior Vice President Rick Sharga.

Southland home sale report

Posted: September 19th, 2011

PRESS RELEASE, DATAQUICK

Southland August Home Sales Climb, Median Price Falls Again

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

Home prices notch third straight monthly gain

Posted: September 1st, 2011

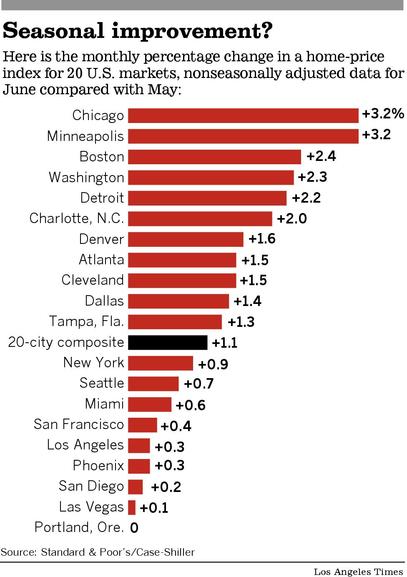

A key index of home prices in 20 metropolitan areas rose 1.1% from May to June. Real estate experts say the improvement is seasonal and that prices could fall again as sales slow in the fall and winter.

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

Foreclosures fall for 10th straight month

Posted: August 18th, 2011

ARTICLE, CNN

Foreclosure filings dropped once again in July, hitting their lowest level since November 2007, as processing delays and foreclosure prevention measures enabled a larger number of delinquent borrowers to remain in their homes.

Filings were down 4% compared to June and were 35% lower than July 2010, marking the tenth straight month of year-over-year declines, according to RealtyTrac, a leading online marketer of foreclosed properties.

Southland Housing Market’s Vital Signs Remain Weak

Posted: August 18th, 2011

Southern California home sales fell last month to the lowest level for a July in four years, though the decline from a year earlier was the smallest in 13 months. The drop in sales from June was more pronounced, especially for $500,000-plus homes, as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, a real estate information service reported.

Time to foreclose on Orange County home: 373 days

Posted: August 18th, 2011

ARTICLE, OC REGISTER

It took just a little more than a year — an average of 373 days – for banks to foreclose on Orange County homes as of July, a report by ForeclosureRadar.com shows. That’s up 32% from July 2010.

.

Highlights of the report for Orange County:

Notices of default — the start of the foreclosure process – were down 20% from last July and 7% from June.

Notices of trustee sale, or foreclosure auctions, declined 19% from last July but went up 2% from June.

The number of banked owned homes increased by 16% from last July and 1% from June. As of July, there were 7,259 homes in Orange County owned by lenders.

The 373 days to foreclose compares to 283 days in July 2010 and 344 days in June. The high for 2011 year so far was 398 days in May.

California July Home Sales

Posted: August 18th, 2011

PRESS RELEASE, DATAQUICK

An estimated 34,695 new and resale houses and condos were sold statewide last month. That was down 11.0 percent from 38,975 in June, and down 1.4 percent from 35,202 for July 2010. A decline from June to July is normal for the season. California sales for the month of July have varied from a low of 30,596 in 1995 to a high of 71,186 in 2004, while the average is 46,577. DataQuick’s statistics go back to 1988.

Foreclosures Fall in Most Cities

Posted: July 28th, 2011

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Southland Home Sales Quicken, Median Price Highest This Year

Posted: July 13th, 2011

PRESS RELEASE, MDA DATAQUICK

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges, a real estate information service reported.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

San Francisco’s rent riot

Posted: July 13th, 2011

![]()

ARTICLE, FORTUNE

Whether we’re living through another tech bubble remains hotly contested, but there’s no denying its impact on one market: rental apartments in San Francisco. With Twitter, Zynga, and numerous other local startups hiring in droves, all those newbies need somewhere to live.

Forecast: Homebuilders to focus on Calif. cities

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“What we’ve seen is this shift toward multifamily housing demand,” said the forecast’s author, Jerry Nickelsburg. “You can see that in the demographics.”

Since apartment units require far fewer workers than single-family homes, the post-recovery homebuilding sector will employ fewer people than before the downturn, Nickelsburg said.

California May Home Sales Report

Posted: June 26th, 2011

ARTICLE, MDA DATAQUICK

An estimated 35,536 new and resale houses and condos were sold statewide last month. That was up 0.9 percent from 35,202 sales in April, and down 13.3 percent from 40,965 sales in May 2010. California sales for the month of May have varied from a low of 32,223 in 1995 to a high of 67,958 in 2004, while the average is 46,840.

Freddie Mac sells record number of REO in 1Q

Posted: May 10th, 2011

![]()

ARTICLE, HOUSINGWIRE

Freddie Mac sold roughly 31,000 previously foreclosed and repossessed homes in the first quarter, a new record for the company as both government-sponsored enterprises shed inventory from the end of last year.

California Mortgage Defaults Drop Again; Foreclosures up

Posted: April 26th, 2011

ARTICLE, MDA DATAQUICK

The number of financially distressed California homeowners who were dragged into the formal foreclosure process declined again last quarter, the result of turmoil and policy changes within the mortgage industry as well as shifts in the economy, a real estate information service reported.

Home price index hits recession-era bottom in February

Posted: April 26th, 2011

ARTICLE, LA TIMES

The Standard & Poor’s/Case-Shiller index for 20 major U.S. cities, released Tuesday, showed prices dropped 3.3% from February 2010 and 1.1% from January amid weak demand for abodes and as foreclosures and other so-called distressed properties made up a large part of the market.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Record Portion of California Homes Bought With Cash

Posted: March 17th, 2011

ARTICLE, MDA DATAQUICK

The share of Golden State homes purchased with cash rose to a record level last month as investors and others took advantage of lower prices and less competition during the market’s winter doldrums, a real estate information services reported.

Cash Buyers Lift Housing

Posted: February 11th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority. WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

California December Home Sales Report

Posted: January 31st, 2011

ARTICLE, MDA DATAQUICK

An estimated 36,215 new and resale houses and condos were sold statewide last month. That was up 15.3 percent from 31,403 in November, and down 13.4 percent from 41,837 for December 2009. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,338. DataQuick’s statistics go back to 1988.

The median price paid for a home last month was $254,000, down 0.4 percent from $255,000 in November, and down 3.8 percent from $264,000 for December a year ago. The year-over-year decrease was the third in a row after eleven months of increases. The bottom of the current cycle was $221,000 in April 2009, while the peak was at $484,000 in early 2007.

Home values are falling at an accelerating rate in many cities across the U.S.

Posted: January 31st, 2011

![]()

ARTICLE, WALL ST JOURNAL

The Wall Street Journal’s latest quarterly survey of housing-market conditions found that prices declined in all of the 28 major metropolitan areas tracked during the fourth quarter when compared to a year earlier.

The size of the year-to-year price declines was greater than the previous quarter’s in all but three of the markets, the latest indication that the housing market faces considerable challenges.

Inventory levels, meanwhile, are rising in many markets as the number of unsold homes piles up.

Foreclosure Filings in U.S. May Jump 20% From Record 2010 as Crisis Peaks

Posted: January 18th, 2011

ARTICLE, BLOOMBERG

The number of U.S. homes receiving a foreclosure filing will climb about 20 percent in 2011, reaching a peak for the housing crisis, as unemployment remains high and banks resume seizures after a slowdown, RealtyTrac Inc. said.

KB Home unexpectedly reports profit, has eye on California

Posted: January 14th, 2011

ARTICLE, LA TIMES

Despite a challenging period for the nation’s home builders, Los Angeles-based KB Home unexpectedly reported a profit for its fiscal fourth quarter and predicted that California would be a key part of its strategy in 2011.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Donald Bren’s spending spree

Posted: December 15th, 2010

Irvine Co. billionaire boss Donald Bren has been making some big real estate gambits in recent weeks, a billion-buck-plus bet on an economic recovery ahead …

“It strikes me as a prudent move from a fearless leader. The recovery is underway. Conditions in Orange County indicate that economic growth is accelerating. Mr Bren is clearly convinced that investment at this stage of the recovery will be necessary to capture the rise in demand that is coming. We also believe there is an inevitable expansion of economic activity that will occur in Orange County by the end of 2011 and throughout 2012. …”

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

Luxury home prices are still heading down

Posted: December 14th, 2010

![]()

While Southland housing values overall have rebounded from recent lows, those in the upper end of the market may not yet have hit bottom. Some experts don’t see a turnaround for at least another year.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

‘Shadow’ supply of 2.1 million homes potentially looms

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

This “shadow inventory” of residential real estate — in which the property is either in foreclosure, has a loan 90 days past due or has been taken back by a lender and is not listed for sale — stood at an eight-month supply at the end of August, according to the Santa Ana mortgage research firm CoreLogic, which released the data. That was an increase from 1.9 million, a five-month supply, a year earlier.

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

O.C. home prices to surge 49%, UCLA economists say

Posted: October 28th, 2010

![]()

ARTICLE, OC REGISTER, 10.27.2010

Economists with UCLA’s Anderson Forecast foresee O.C. home prices climbing above $500,000 in 2012 for the first time since April 2008. Prices are expected to appreciate from 6.6% to 9.3% a year through 2015 — and, all told, grow 49% in the next six years.

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Foreclosures Halted In 23 States: Plantiffs’ Lawyers Rejoice (California, Nevada and Arizona not affected)

Posted: October 7th, 2010

![]()

ARTICLE, CBS NEWS, 10.05.2010

GMAC Mortgage, JP Morgan Chase and Bank of America have suspended foreclosures in 23 states to evaluate if there were errors due to “robo-signing“. “Robo-signers” are bank middle managers who sign the paperwork that allowed banks to repossess homes that are in default, without properly reviewing the underlying documents they were signing.

Bay Area Home Sales Drop to 1992 Level; Median Price Slips Again

Posted: September 24th, 2010

ARTICLE, MDA DATAQUICK, 09.16.2010

Bay Area home sales fell less sharply last month than in July but still dropped to an 18-year low as potential buyers fretted about job security or took their time to assess the changing market. The median sale price remained higher than a year earlier but dipped month-to-month again, a real estate information service reported.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

Prado Group joint venture acquires San Francisco apartment portfolio

Posted: September 8th, 2010

![]()

ARTICLE, REO INSIDER, 09.08.20120

The 250-unit apartment portfolio was purchased for $30.3 million, according to a news release from the San Francisco-based Prado Group, a real estate development and investment management firm.

Home prices rise in June, but a drop may be looming

Posted: September 3rd, 2010

![]()

ARTICLE, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Short sales soar in California, U.S.

Posted: August 13th, 2010

![]()

ARTICLE, LA TIMES, 08.13.2010

Sales of homes for less than the amount of their outstanding mortgage debt have tripled since 2008, particularly in California and the Sunbelt, according to a report released Tuesday.

Known as short sales, the increasingly common transactions for financially troubled homeowners are projected to balloon to 400,000 in 2010, according to Core Logic, a Santa Ana company that provides services to the real estate and mortgage markets. By comparison, existing homes sold at a seasonally adjusted annual rate of 5.37 million units in June, according to the National Assn. of Realtors.

Santa Clara County house prices climb 12% from 2009: SCCAOR

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

The average sales price for a home in Santa Clara County in California reached $710,475 in July, a 12% increase from the same month a year ago, according to the Santa Clara County Association of Realtors (SCCAOR).

Santa Clara County is located “in the heart of Silicon Valley,” and includes the cities of Santa Clara and San Jose. Prices in the county also increased over last month — up 2.2% from June to July, according to the report.

Builder betting on rebound by 2014

Posted: August 10th, 2010

ARTICLE, OC REGISTER, 08.10.2010

New home sales will be well above average by 2014, if not sooner, the president and CEO of Standard Pacific Homes predicted during a recent conference call with financial analysts.

Apartment owners see light at the end of the tunnel

Posted: August 10th, 2010

INTERVIEW, OC REGISTER, 08.10.2010

Q: When will the market turn around?

A: The market has to bottom first. Effective rents in O.C. started getting choppy as far back 2007 and peaked in Q4’07 at $1,685 per month. They were at $1,508 per month for Q2’10, so we would have to see almost 12 percent rent growth to get back to the prior peak. The market data would suggest that we have bottomed and should start to see some growth going forward.

California leading employment indicator shows growth to come

Posted: August 5th, 2010

![]()

ARTICLE, LA TIMES, 08.05.2010

…..an employment indicator released Wednesday by Chapman University’s A. Gary Anderson Center for Economic Research shows that employment in California will continue to tick up this year. It indicates that year-over-year job growth will turn positive in the fourth quarter this year, something that hasn’t happened consistently in the state since 2007.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

MIT economist measures how much foreclosures lower housing prices… 27%

Posted: July 28th, 2010

![]()

ARTICLE, MIT NEWS, 07.27.2010

In the study, “Forced Sales and House Prices,” which will be published in the American Economic Review, Pathak, Campbell and Giglio examined 1.8 million home sales in Massachusetts from 1987 to 2009. By looking in granular detail at real-estate prices, the researchers have concluded that a foreclosure reduces the value of a house by 27 percent, on average.

Home prices tick up 1.3% in May

Posted: July 27th, 2010

![]()

ARTICLE, LA TIMES, 07.27.2010

Home prices tick up 1.3% in May

It was the second straight monthly increase, according to the Standard & Poor’s/Case-Shiller index of 20 U.S. cities, but experts warn it is not likely to last. Los Angeles, San Diego and San Francisco are among the gainers.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

CHART: Office vacancies rise, rents drop in Southland

Posted: July 20th, 2010

![]()

CHART, LA TIMES, 07.20.2010

Office vacancies rise, rents drop in Southland again

Office vacancies rise, rents drop in Southland again

Posted: July 20th, 2010

![]()

ARTICLE, LA TIMES, 07.20.2010

An oversupply of space, businesses’ reluctance to add costs and landlords’ eagerness to keep good tenants leads to some of the cheapest lease rates in years. In the Inland Empire, vacancy tops 25%.

Southern California office landlords faced more bad news in the second quarter as occupancy and rents in their buildings fell again.

The persistently soft market has created opportunities for tenant businesses to sign some of the cheapest leases available in several years. The pace of deals has picked up a bit, brokers said, but many companies are still carefully husbanding their finances and avoiding long-term rental commitments.

Sacramento-area home sales hit 20-month high in June

Posted: July 20th, 2010

![]()

ARTICLE, SACRAMENTO BEE, 07.20.2010

“It really seems like California housing is parting ways with the national view. We’ve seen a much stronger recovery off the bottom,”

Foreclosure Hot Spots

Posted: July 19th, 2010

California foreclosures spike in June

Posted: July 19th, 2010

ARTICLE, OC REGISTER, 07.19.2010

After being down across the board in May, the filing of new foreclosure notices in California rose in June, while foreclosure sales dropped, reports ForeclosureRadar.com.

Penthouse Offices Sit Vacant as High Flying Corporate Opulence Goes Out of Style

Posted: July 19th, 2010

![]() Offices at the top are going empty

Offices at the top are going empty

ARTICLE, LA TIMES, 07.19.2010

Penthouse floors are vacant in some of the best office buildings in Los Angeles County, a sign of the troubled economic times and the gulf between asking prices and what tenants are willing to pay.

U.S. home foreclosures reach record high in second quarter

Posted: July 19th, 2010

![]()

ARTICLE, LA TIMES, 07.19.2010

Bank repossessions increased 38% in the second quarter from the same period a year earlier for a record total of 269,952, according to data to be released Thursday by RealtyTrac.

Biggest Defaulters on Mortgages Are the Rich

Posted: July 9th, 2010

![]()

ARTICLE, NY TIMES, 07.09.2010

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

Deeds-in-lieu gain favor with lenders as alternative to foreclosure

Posted: June 29th, 2010

![]()

ARTICLE, LA TIMES, 06.28.2010

….a simple message: Let’s bypass all the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home and we’ll call it a deal. We won’t come after you to collect any deficiency between what you owe us on the mortgage and what we obtain from the home sale. We might even be able to wrap up the whole transaction in as little as 30 to 45 days. How about it?

Fannie Mae gets tough on homeowners who walk away

Posted: June 24th, 2010

![]()

ARTICLE, LA TIMES, 06.24.2010

The mortgage giant plans to go to court against those who can afford to make their payments but decide it’s not worth it. It also will limit their access to future loans.

Sales of U.S. New Homes Plunged to Record Low in May

Posted: June 23rd, 2010

![]()

ARTICLE, BLOOMBERG, 06.23.2010

The median sales price decreased 9.6 percent from the same month last year, to $200,900, today’s report showed.

Purchases dropped in all four U.S. regions last month, led by a record 53 percent drop in the West.

Housing Market Slows as Buyers Get Picky

Posted: June 17th, 2010

![]()

ARTICLE, NY TIMES, 06.16.2010

Exacting buyers are upending the battered real estate market, agents and other experts say, leading to last-minute demands for multiple concessions, bruised feelings on all sides and many more collapsed deals than usual.

Report: Calif. inland economic growth to lag coast

Posted: June 16th, 2010

![]()

ARTICLE, BUSINESS WEEK, 06.16.2010

Slow economic growth and high unemployment will persist for the foreseeable future in California’s inland counties, even as increasingly robust signs of recovery begin appearing throughout the state’s coastal areas, according to an economic forecast released Tuesday.

UCLA Anderson Forecast: U.S. recovery a long, slow climb; Calif. recovery weaker than nation’s

Posted: June 16th, 2010

![]()

ARTICLE, UCLA, 06.16.2010

The California economy is expected to grow a bit slower than the nation’s for 2010, and slightly faster thereafter. This slow growth through the forecast period will result in only modest inroads into the state’s high unemployment rate. Los Angeles expected to recover more quickly than rest of the state

Owners Bet on Raising the Rent, and Lost

Posted: May 29th, 2010

![]()

ARTICLE, NY TIMES, 5.29.2010

“The landscape has changed dramatically,” P. J. Johnston, a spokesman for the owners, said in an interview. “The economy has taken a major hit. Many properties are facing default.”

But just like Riverton and Stuyvesant Town, the owners of Parkmerced sought to take advantage of a roaring market to replace rent-regulated residents with tenants able to pay far higher rates.

Take This House and Shove It: The Emotional Drivers of Strategic Default

Posted: May 25th, 2010

PAPER, U OF A SCHOOL OF LAW, 05.14.2010

An increasingly influential view is that strategic defaulters make a rational choice to default because they have substantial negative equity. This article, which is based upon the personal accounts of over 350 individuals, argues that this depiction of strategic defaulters as rational actors is woefully incomplete. Negative equity alone does not drive many strategic defaulters’ decisions to intentionally stop paying their mortgages. Rather, their decisions to default are driven primarily by emotion

The bottom is near — yet so far — for Inland Empire apartments, report says

Posted: May 23rd, 2010

![]()

latimes.com

ARTICLE, LA TIMES, 05.23.2010

Apartment occupancy and rents in the Inland Empire will continue to fall this year before recovering in 2011 and 2012, commercial real estate brokerage Marcus & Millichap said in a report Thursday.

Mortgage delinquencies, foreclosures break records

Posted: May 19th, 2010

![]()

ARTICLE, ASSOC. PRESS, 05.19.2010

More than 10 percent of homeowners had missed at least one mortgage payment in the January-March period, the Mortgage Bankers Association said Wednesday. That number was up from 9.5 percent in the fourth quarter of last year and 9.1 percent a year earlier.

New-home buyers reemerge in Southern California

Posted: May 17th, 2010

![]()

ARTICLE, LA TIMES, 05.13.2010

Location is also key — buyers don’t want extremely long commutes, analysts say.

Foreclosures plateau – finally. Repossessions soar

Posted: May 13th, 2010

![]()

ARTICLE, CNN/MONEY, 05.13.2010

But the number of homes repossessed during April is at an all-time high of 92,432. That is a 45% increase over April 2009. If repossessions continue at this pace, more than 1.1 million homes will be lost in 2010.

60 Minutes: Walking Away (Strategic Defaults/Foreclosures)

Posted: May 10th, 2010

![]()

VIDEO, 60 MINUTES, 05.09.2010

60 Minutes looks at the growing trend of “Strategic Default,” which is when a homeowner who is financially capable of making their mortgage payments finds themselves so far under water that they simply do the math and make the decision to walk away.

Yale’s Robert Shiller Discusses Strategic Defaults

Posted: May 10th, 2010

![]()

VIDEO, 60 MINUTES, 05.09.2010

Yale Economics Professor Robert Shiller developed the widely used Case-Shiller Home Price Index. He talks with Morley Safer of “60 Minutes” about trends in real estate and whether mortgage walkaways are “going viral.”

White flight? Suburbs lose young whites to cities

Posted: May 10th, 2010

ARTICLE, ASSOCIATED PRESS, 05.09.2010

In a reversal, America’s suburbs are now more likely to be home to minorities, the poor and a rapidly growing older population as many younger, educated whites move to cities for jobs and shorter commutes.

Buy a House, Sell REITs

Posted: May 7th, 2010

![]()

ARTICLES, KIPLIGER, 05.07.2010

One of the savviest and most cautious real estate investors says that housing prices have hit bottom but real estate investment trusts could fall a long way.

METRO FORECLOSURE HOT SPOTS BUCK NATIONAL TREND IN FIRST QUARTER WITH ANNUAL DECLINES IN FORECLOSURE ACTIVITY

Posted: May 2nd, 2010

![]()

ARTICLE, REALTYTRAC, 05.02.2010

“The decreasing foreclosure activity in some of the nation’s top foreclosure hot spots in the first quarter is largely the result of government intervention and other non-market influences, and not a sure signal that those areas are out of the woods yet when it comes to foreclosures,”

California added 393,000 people in 2009

Posted: April 30th, 2010

![]()

ARTICLE, LA TIMES 04.30.2010

Officials said the state’s housing growth in 2009 underscored the severity of the housing downturn. Only 62,300 new homes were added in California in 2009

The Coming Wave of Option-ARM and Alt-A Mortgage Resets

Posted: April 26th, 2010

![]()

STRATEGY, SEQUOIA RESEARCH, 4.22.2010

“We presently find ourselves in the relative calm between two waves.”

Flipping houses is back in South Los Angeles

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Along with low prices, real estate investors are drawn to the area because of its proximity to the ports of Los Angeles and Long Beach, Los Angeles International Airport and other job centers, including factories.

In Sour Home Market, Buying Often Beats Renting

Posted: April 22nd, 2010

![]()

ARTICLE, NY TIMES 4.20.2010

In some once bubbly markets, prices have fallen so far that buying a home appears to be a bargain, based on a New York Times analysis of prices and rents in 54 metropolitan areas.

Distressed Home Sales on the Rise

Posted: April 21st, 2010

![]()

ARTICLE, FIRST CORE AMERICAN LOGIC, 04.08.2010

The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales –

accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

Just when you thought it was safe: Foreclosures spike

Posted: April 20th, 2010

![]()

ARTICLE, CNN/MONEY 04.15.2010

In the first three months of 2010 foreclosure filings rose 7%, to more than 930,000, compared with the previous quarter, according to the online foreclosure marketing firm RealtyTrac. That is a 16% jump over the first three months of 2009.

California Statewide March Home Sales

Posted: April 19th, 2010

ARTICLE, DATAQUICK 04.15.2010

Indicators of market distress continue to move in different directions. Foreclosure activity is off its peaks reached in the past two years but remains high by historical standards.

U.S. Foreclosure Filings Rise 16% as Bank Seizures Set Record

Posted: April 16th, 2010

ARTICLE, BLOOMBERG 4.15.2010

Foreclosure filings in the U.S. rose 16 percent in the first quarter from a year earlier and bank seizures hit a record as lenders stepped up action against delinquent homeowners, according to RealtyTrac Inc.

Foreclosure activity up sharply despite loan modification program

Posted: April 16th, 2010

![]()

ARTICLE, LA TIMES 04.15.2010

The number of U.S. households caught in the foreclosure process during the first quarter jumped 7% from the prior quarter as activity increased sharply in March, a real estate firm will report Thursday.

New wave of foreclosures by end of 2010 is feared

Posted: April 12th, 2010

![]()

ARTICLE, LA TIMES 02.16.2010

Experts fear that a new wave of foreclosures will hit this year as prolonged unemployment makes it difficult for millions of homeowners to pay their mortgages — and many of them aren’t likely to get much help from a federal program aimed at keeping them in their houses.

Southern California apartment rents are expected to keep falling

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

A study shows the average cost dropping as much as 3.5% in L.A. County this year, 2.4% in Orange County and less than 1% in San Bernardino and Riverside counties but inching up in San Diego County.

UCLA Anderson Forecast, March 2010

Posted: April 12th, 2010

![]()

ARTICLE, UCLA/Anderson School of Management 3.24.2010

The UCLA Anderson Forecast renders a “bipolar” diagnosis for the national economy, referencing the dual conditions of slow-but-sure growth in the national gross domestic product, coupled with an unemployment rate predicted to remain in double digits until 2012.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy

![abc_news_logo[1]](http://sequoiainvestmentpartners.com/blog/wp-content/uploads/2012/10/abc_news_logo1.jpg)