Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

The Pacific Value Opportunities Fund II Opens October 29th.

Posted: October 23rd, 2012

Sequoia Real Estate Partners latest fund, PVOF II opens to investors October 29th. PVOF II comes on the heels of the highly successful PVOF I, which is on track for a very strong annual Return on Equity, and will capitalize on the current supply and demand imbalance in the single-family market for “turn-key” move-in ready homes. Bruce Bartlett, one of Sequoia’s Managing Partners noted “We’re simply taking our years of successful experience and economies of scale improving apartment communities and applying that to single-family homes. We did this in PVOF I and had great results.” The Fund is relatively small, only $10 million, so based on PVOF I’s success, SREP’s strong track record and investor demand, it is expected to fill quickly.

Click here for more info.

Housing is indeed heading higher

Posted: October 22nd, 2012

![]()

As Fortune predicted last year, a robust recovery in home prices is under way.

FORTUNE — In spring 2011 this writer penned a controversial cover story titled “The Return of Real Estate” that predicted a strong rebound in housing. At the time, prices and sales were still tumbling, and the prevailing view among economists and pundits was that the slide would drag on and on. But Fortune’s contrarian forecast proved right. By October of last year, new- and existing-home sales and housing starts had begun an upswing that’s been gathering strength ever since — and prices joined the march in early 2012. The data conclusively confirm what Fortune predicted back then: “Housing is back.”

To see this entire article, click on its TITLE above.

Home sales slowed in September, but 2nd best in two years

Posted: October 22nd, 2012

NEW YORK (CNNMoney) — The pace of previously owned home sales slowed slightly in September, even as the long-battered housing market showed signs of a broader recovery.

Sales of existing homes sold at an annual rate of 4.75 million, according to a closely watched reading reported Friday from the National Association of Realtors. It was off slightly from the 4.83 million pace the previous month, but up 11% from a year earlier. Despite the slip, September’s pace was the second best in more than two years, trailing only the strong August reading.

To see this entire article, click on its TITLE above.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Banks see a housing rebound

Posted: October 13th, 2012

JPMorgan, Wells Fargo post big profit gains as home lending booms

America’s long-suffering housing market may be on the mend, two major banks said as they reported big jumps in profits.

JPMorgan Chase & Co. and Wells Fargo & Co., the nation’s largest home lenders, each reported double-digit quarterly earnings growth Friday. The big jump in profit was thanks largely to a surge in their mortgage businesses, fueled by low interest rates and waves of refinancing.

Home prices signal recovery may be here

Posted: August 28th, 2012

NEW YORK (CNNMoney) — A sharp boost in home prices during the spring could signal a recovery in the long-suffering U.S. housing market, according to an industry report issued Tuesday.

The S&P/Case-Shiller national home price index, which covers more than 80% of the housing market in the United States, climbed 6.9% in the three months ended June 30 compared to the first three months of 2012.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Finally, It Is Time to Buy a House

Posted: August 13th, 2012

Warren Buffett famously once said: “Be fearful when others are greedy, be greedy when others are fearful.”

And if you’re not instinctively scared of the housing market, then global warming, saturated fat, running with scissors and the bogeyman probably aren’t keeping you awake at night, either.

The fact that everyone is scared to dabble in—much less commit to—housing makes it a close-to-perfect investment based on Mr. Buffett’s principle. But buying real estate is a good long-term investment for many more reasons, some of which have only become apparent in recent weeks.

Wall Street’s hottest investment idea: Your house

Posted: August 13th, 2012

![]()

FORTUNE –Your house might be a better investment than you think. At least Wall Street seems to think so.

For a while now the conventional wisdom on real estate has been that while home prices might not fall much more, they aren’t likely to go up anytime soon either. The best personal finance advice, then, when it came to buying a house, was to buy as little as possible.

Apparently, though, on Wall Street that common wisdom about home prices is not held by all, or even many. In the past six months or so, a number of investment firms, hedge funds, private equity partnerships and real estate investors have turned into voracious buyers of single-family homes. And not just any homes, but foreclosures. Investment banks, who also want in on the action, are lining up financing options to keep the purchases going.

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

Builder Is Constructing REIT for Home Rentals

Posted: May 9th, 2012

![]()

Above, one of the company’s houses in Tolleson, Ariz.

Investors can buy stakes in malls, apartment towers, timber forests and even cellphone towers through real-estate investment trusts. Now, add to the list: single-family homes transformed into rental properties.

Beazer Pre-Owned Rental Homes Inc., which hopes to expand beyond Phoenix and Las Vegas to at least one other, as-yet unidentified market. Within two years, Beazer said the number of rental homes under the new REIT’s control could number in the thousands.

Rents soar as foreclosure victims, young workers seek housing

Posted: May 7th, 2012

Few new units and tight standards for home loans add to the pressure. The average monthly U.S. rent is at an all-time high, and a 10% jump in Los Angeles County over the next two years is forecast.

March California Home Sale Press Release

Posted: April 24th, 2012

An estimated 37,481 new and resale houses and condos were sold statewide last month. That was up 26.5 percent from 29,630 in February, and up 2.9 percent from 36,417 for March 2011.

The median price paid for a home last month was $251,000, up 5.0 percent from $239,000 in February, and up 0.8 percent from $249,000 for March a year ago.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

Q&A: What Homeowners Need to Know on the Deal

Posted: February 10th, 2012

![]()

The $25 billion foreclosure settlement unveiled Thursday is expected to help many borrowers who are struggling to make their loan payments, owe more than their homes are worth or have lost their homes to foreclosure.

But the rules of the deal are complicated and banks have three years to meet their obligations.

The questions and answers below should help borrowers figure out if they qualify for help and what to expect from the process.

Who does the settlement cover?

Mortgage deal could bring billions in relief

Posted: February 10th, 2012

In the largest deal to date aimed at addressing the housing meltdown, federal and state officials on Thursday announced a $26 billion foreclosure settlement with five of the largest home lenders.

The deal settles potential state charges about allegations of improper foreclosures based on robosigning, seizures made without proper paperwork.

December California & So Cal Home Sales Report

Posted: January 23rd, 2012

An estimated 37,734 new and resale houses and condos were sold statewide last month. That was up 15.5 percent from 32,669 in November, and up 4.2 percent from 36,215 for December 2010. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,063. DataQuick’s statistics go back to 1988.

Foreclosures expected to rise, pushing home prices lower

Posted: January 15th, 2012

Banks are getting more aggressive with the 3.5 million U.S. homes with seriously delinquent mortgages, setting the stage for a big wave of foreclosure action this year.

By E. Scott Reckard, Los Angeles Times

California and other states are likely to see an enormous wave of long-delayed foreclosure action in the coming year as banks deal more aggressively with 3.5 million seriously delinquent mortgages.

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

Scheduled foreclosure auctions soar in California

Posted: December 24th, 2011

Banks in November scheduled more than 26,000 homes to be sold at California foreclosure auctions, a 63% increase from October and a sign that a surge in discounted, bank-owned properties is on track to hit the market next year.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

California Foreclosure Activity Back Up

Posted: October 21st, 2011

PRESS RELEASE, DATA QUICK

After dropping to a three-year low in the second quarter of this year, the number of California homeowners being pulled into the foreclosure process snapped back to prior levels over the last three months, a real estate information service reported.

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.

Housing Lift Proves Fleeting

Posted: October 21st, 2011

![]()

ARTICLE, WALL ST JOURNAL

Sales of previously owned homes slipped in September as Americans were hit by economic uncertainty, high unemployment and tight lending.

Data Thursday highlight how jobs and housing are the main economic drags. Job seekers in California this week.

Existing-home sales dropped 3% to a seasonally adjusted 4.91 million in September, the National Association of Realtors said Thursday. That followed a sales bump in August, as the housing market remains stuck in neutral despite lower prices and interest rates at near-historic lows.

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Posted: October 17th, 2011

PRESS RELEASE, DATAQUICK

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

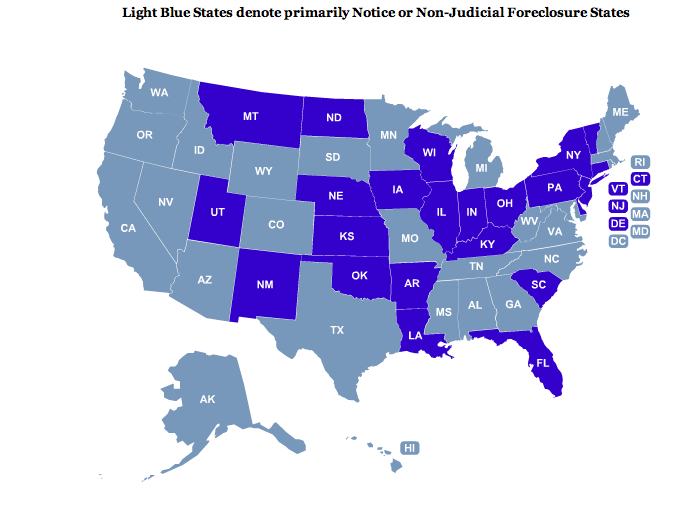

Home foreclosure proceedings on the rise again

Posted: October 13th, 2011

ARTICLE, LA TIMES

After months of a foreclosure slowdown caused by investigations into improper practices, the nation’s home-repossession machinery is beginning to move again — particularly in states such as California where courts don’t oversee the process.

The number of homes entering the foreclosure process surged 19% in the third quarter compared with the previous quarter in states where foreclosures take place largely outside of the courtroom, according to RealtyTrac, an Irvine information firm. These nonjudicial states include California, Nevada, Arizona, Oregon and Washington.

Home ownership: Biggest drop since Great Depression

Posted: October 13th, 2011

ARTICLE, CNN MONEY

The percentage of Americans who owned their homes has seen its biggest decline since the Great Depression, according to the U.S. Census Bureau.

The rate of home ownership fell to 65.1% in April 2010, 1.1 percentage points lower than it was in 2000. The decline was the biggest drop since the 1930s, when home ownership plunged 4.2%.

The most recent decade-over-decade drop, however, only tells half the story.

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

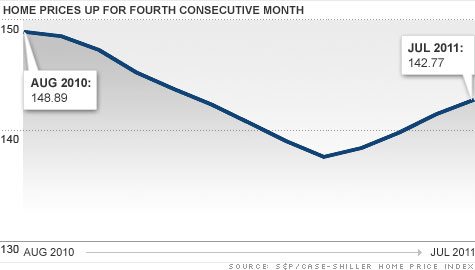

Home prices climb for fourth straight month

Posted: September 27th, 2011

ARTICLE, CNN/MONEY

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose 0.9% in July compared with June, but they’re still 4.1% lower than 12 months ago.

California foreclosures set to surge

Posted: September 26th, 2011

![]()

ARTICLE, HOUSINGWIRE

California default notices spiked 55% in August, and the number may keep rising in the coming months as mortgage servicers shake off the robo-signing freeze, according to RealtyTrac Senior Vice President Rick Sharga.

Shadow inventory improves but still threatens housing recovery

Posted: August 24th, 2011

“It’s good news that things are starting to slow down and we’re getting closer to the end of the problem,” said Diane Westerback, Managing Director of Global Surveillance Analytics for S&P. “It could mean a gradual recovery for the market.”

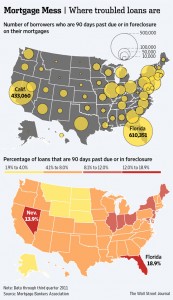

Number of troubled mortgages on rise again

Posted: August 24th, 2011

![]()

ARTICLE, CNN/MONEY

In another hit to the beleaguered housing market, a report out Monday found that the number of delinquent mortgage borrowers — those who have missed at least one payment — rose during the second quarter.

The delinquency rate grew only slightly, up 0.12 percentage points to 8.44%, but that reverses the steady improvement of the past two years.

The increase, as reported by the Mortgage Bankers Association (MBA), may not sound like much, but it could mean that the recovery in the housing market will take even longer than thought.

Investing in Undervalued Housing Markets

Posted: August 22nd, 2011

Linkage in Income, Home Prices Shifts

Posted: August 22nd, 2011

ARTICLE, WALL ST. JOURNAL

Home prices in some of the nation’s hardest-hit metro areas have fallen far below pre-bubble levels, stirring concerns that properties in those markets are undervalued.

In a recent analysis, real-estate firm Zillow Inc. studied the correlation between home prices and annual incomes over the 15-year period that ended in 2000, before home prices began to surge.

Foreclosure reforms may be coming to a head

Posted: August 18th, 2011

Getting banks, investors and borrowers together to work out a solution that benefits them all is the most promising idea to emerge since the housing market first crashed.

Buying real estate a better deal than renting in 74% of major US cities

Posted: August 18th, 2011

Buying real estate continues to be cheaper than renting in the vast majority of major U.S. cities, according to a quarterly rent vs. buy index from real estate search and marketing site Trulia.

The index compared the median list price and the median annualized rent on a two-bedroom apartment, condominium or townhouse in the country’s 50 most populous cities. According to the index, the cost of buying was less than renting in 37 of the 50 cities (74 percent) as of July 1, 2011. About the same share, 78 percent, favored buying over renting in Trulia’s last index report, released in April.

Southland Housing Market’s Vital Signs Remain Weak

Posted: August 18th, 2011

Southern California home sales fell last month to the lowest level for a July in four years, though the decline from a year earlier was the smallest in 13 months. The drop in sales from June was more pronounced, especially for $500,000-plus homes, as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, a real estate information service reported.

Time to foreclose on Orange County home: 373 days

Posted: August 18th, 2011

ARTICLE, OC REGISTER

It took just a little more than a year — an average of 373 days – for banks to foreclose on Orange County homes as of July, a report by ForeclosureRadar.com shows. That’s up 32% from July 2010.

.

Highlights of the report for Orange County:

Notices of default — the start of the foreclosure process – were down 20% from last July and 7% from June.

Notices of trustee sale, or foreclosure auctions, declined 19% from last July but went up 2% from June.

The number of banked owned homes increased by 16% from last July and 1% from June. As of July, there were 7,259 homes in Orange County owned by lenders.

The 373 days to foreclose compares to 283 days in July 2010 and 344 days in June. The high for 2011 year so far was 398 days in May.

California July Home Sales

Posted: August 18th, 2011

PRESS RELEASE, DATAQUICK

An estimated 34,695 new and resale houses and condos were sold statewide last month. That was down 11.0 percent from 38,975 in June, and down 1.4 percent from 35,202 for July 2010. A decline from June to July is normal for the season. California sales for the month of July have varied from a low of 30,596 in 1995 to a high of 71,186 in 2004, while the average is 46,577. DataQuick’s statistics go back to 1988.

Foreclosures Fall in Most Cities

Posted: July 28th, 2011

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Where Will the Homeownership Rate Go From Here?

Posted: July 19th, 2011

PAPER, UCLA ANDERSON SCHOOL OF MANAGEMENT

“Based on these and other estimates, our most optimistic scenario suggests that homeownership rates may have bottomed out by early 2011 after falling nearly three percentage points from their peak in 2006. A less optimistic scenario based on our model estimates, however, suggests that homeownership rates will decline further — by as much as one to two percentage points — over the course of the next few years.”

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

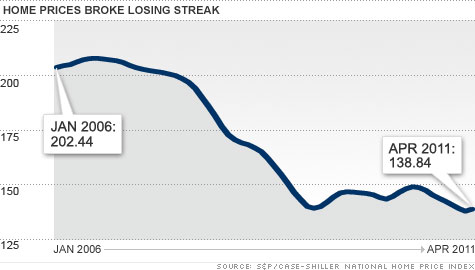

Home prices rise, snapping 8-month drop streak

Posted: July 13th, 2011

ARTICLE, CNN

The downward cycle in home prices broke in April after eight consecutive months of decline, according to a survey released Tuesday.

According to the S&P/Case Shiller 20-city index, prices rose 0.7% compared with March, although they fell 0.1% when adjusted for the strong spring selling season. Prices were down 4% year-over-year.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

‘Shadow Inventory’ Shrinks in U.S. as More Foreclosed Homes Sell

Posted: June 26th, 2011

ARTICLE, BLOOMBERG

“It’s showing there are improvements in some segments of the market,” he said in a telephone interview from McLean, Virginia. “It doesn’t mean housing distress is over, but it does show that the pipeline of distress is beginning to ease.”

May Southern California Home Sales Report

Posted: June 26th, 2011

ARTICLE, MDA DATAQUICK

Southern California home sales held at a three-year low last month amid a sluggish move-up market and record-low sales of newly built homes. The median sale price fell year-over-year by the largest amount in 20 months as buyer uncertainty, tight credit and lackluster hiring continued to restrain housing demand, Dataquick reported.

California May Home Sales Report

Posted: June 26th, 2011

ARTICLE, MDA DATAQUICK

An estimated 35,536 new and resale houses and condos were sold statewide last month. That was up 0.9 percent from 35,202 sales in April, and down 13.3 percent from 40,965 sales in May 2010. California sales for the month of May have varied from a low of 32,223 in 1995 to a high of 67,958 in 2004, while the average is 46,840.

WSJ: Why It’s Time to Buy

Posted: June 8th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The short-term outlook isn’t encouraging. Job growth remains weak, foreclosure sales are making up more of the market, and economists are predicting that home prices will fall more in the coming months.But the long-term benefits of home ownership remain very much intact.

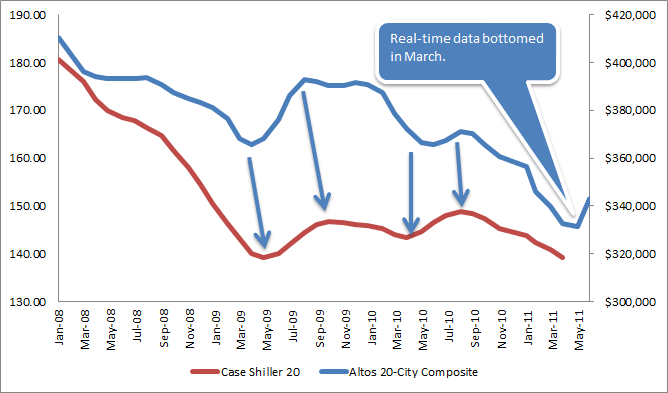

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

Freddie Mac sells record number of REO in 1Q

Posted: May 10th, 2011

![]()

ARTICLE, HOUSINGWIRE

Freddie Mac sold roughly 31,000 previously foreclosed and repossessed homes in the first quarter, a new record for the company as both government-sponsored enterprises shed inventory from the end of last year.

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

California Mortgage Defaults Drop Again; Foreclosures up

Posted: April 26th, 2011

ARTICLE, MDA DATAQUICK

The number of financially distressed California homeowners who were dragged into the formal foreclosure process declined again last quarter, the result of turmoil and policy changes within the mortgage industry as well as shifts in the economy, a real estate information service reported.

Blackstone Leads Buyout Firms Expanding Into Property

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

Blackstone Group LP and Carlyle Group are leading a record number of private-equity managers aiming to raise real estate funds as the world’s top buyout firms accelerate an expansion beyond corporate takeovers.

Blackstone, the biggest private-equity firm, is planning to raise its next real estate fund, with a target of about $10 billion, later this year. Carlyle is in the process of raising a new fund for U.S. property deals, said a person briefed on the plan who asked not to be named because the fund is private.

The two are among 439 private-equity real estate funds seeking a combined $160 billion, the largest number on record, according to London-based researcher Preqin Ltd. KKR & Co.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

30% of mortgages are underwater

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

Home prices dropped 2.6% nationwide during the last three months of 2010, pushing more borrowers underwater, according to a quarterly real estate market survey from Zillow.com.

Now 27% of homeowners with mortgages owe more than their homes are worth. That’s up from 23.2% a quarter earlier.

That will surely lead to higher foreclosure rates soon.

Home prices: The double-dip is near?

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

California December Home Sales Report

Posted: January 31st, 2011

ARTICLE, MDA DATAQUICK

An estimated 36,215 new and resale houses and condos were sold statewide last month. That was up 15.3 percent from 31,403 in November, and down 13.4 percent from 41,837 for December 2009. California sales for the month of December have varied from a low of 25,585 in 2007 to a high of 66,503 in 2003, while the average is 44,338. DataQuick’s statistics go back to 1988.

The median price paid for a home last month was $254,000, down 0.4 percent from $255,000 in November, and down 3.8 percent from $264,000 for December a year ago. The year-over-year decrease was the third in a row after eleven months of increases. The bottom of the current cycle was $221,000 in April 2009, while the peak was at $484,000 in early 2007.

Home values are falling at an accelerating rate in many cities across the U.S.

Posted: January 31st, 2011

![]()

ARTICLE, WALL ST JOURNAL

The Wall Street Journal’s latest quarterly survey of housing-market conditions found that prices declined in all of the 28 major metropolitan areas tracked during the fourth quarter when compared to a year earlier.

The size of the year-to-year price declines was greater than the previous quarter’s in all but three of the markets, the latest indication that the housing market faces considerable challenges.

Inventory levels, meanwhile, are rising in many markets as the number of unsold homes piles up.

KB Home unexpectedly reports profit, has eye on California

Posted: January 14th, 2011

ARTICLE, LA TIMES

Despite a challenging period for the nation’s home builders, Los Angeles-based KB Home unexpectedly reported a profit for its fiscal fourth quarter and predicted that California would be a key part of its strategy in 2011.

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

Posted: December 31st, 2010

![]()

ARTICLE, WALL ST JOURNAL, 12.28.2010

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

U.S. Housing Market Double-Dip Unlikely Next Year, Wharton’s Wachter Says

Posted: December 31st, 2010

ARTICLE, BLOOMBERG, 12.31.2010

The U.S. housing market probably will avoid a “double-dip” next year as a recovery depends on job growth, said Susan Wachter, a real estate professor at the University of Pennsylvania’s Wharton School.

“Nationally, we’ll see a bumpy ride instead of a double- dip,” Wachter said in an interview from Philadelphia today on Bloomberg Television. “Jobs are key.”

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

Luxury home prices are still heading down

Posted: December 14th, 2010

![]()

While Southland housing values overall have rebounded from recent lows, those in the upper end of the market may not yet have hit bottom. Some experts don’t see a turnaround for at least another year.

Bank of America ramps up foreclosure restarts

Posted: December 13th, 2010

![]()

ARTICLE, HOUSING WIRE, 12.13.2010

Bank of America (BAC [1]: 12.79 -0.08%) cleared attorneys to proceed with 16,000 foreclosure cases in December as it completes a revamp of its procedures.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Delinquency Rate on U.S. Mortgages Declines

Posted: November 18th, 2010

![]()

ARTICLE, NY TIMES, 11.18.2010

The mortgage delinquency rate in the United States declined last quarter amid hints of improvement in the job market, but headwinds from defaults and a rising rate of new foreclosure applications keep the housing outlook muddied, the Mortgage Bankers Association said on Thursday.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

New home sales rise 6.6 pct. after dismal summer

Posted: October 28th, 2010

ARTICLE, ASSOC. PRESS, 10.27.2010

Sales of new homes improved last month after the worst summer in nearly five decades, but not enough to lift the struggling economy.

The Commerce Department says new home sales in September grew 6.6 percent from a month earlier to a seasonally adjusted annual sales pace of 307,000.

Fed boss: Regulators looking into foreclosure mess

Posted: October 25th, 2010

ARTICLE, ASSOC.PRESS, 10.24.2010

Preliminary results of the in-depth review into the practices of the nation’s largest mortgage companies are expected to be released next month, Bernanke said in remarks to a housing-finance conference in Arlington, Va.

“We are looking intensively at the firms’ policies, procedures and internal controls related to foreclosures and seeking to determine whether systematic weaknesses are leading to improper foreclosures,” Bernanke said. “We take violation of proper procedures very seriously,” he added.

Short Sales Resisted as Foreclosures Are Revived

Posted: October 25th, 2010

![]()

ARTICLE, NY TIMES, 10.24.2010

Bank of America and GMAC are firing up their formidable foreclosure machines again today, after a brief pause………..But some major lenders took a quick inventory of their foreclosure practices and insisted their processes were sound. They now seem intent on resuming foreclosures. And that could have a profound effect on many homeowners.

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Home Prices in U.S. Cooled in July After Tax Credit Expired

Posted: September 28th, 2010

ARTICLE, BLOOMBERG, 09.28.2010

The S&P/Case-Shiller index of property values increased 3.2 percent from July 2009, the smallest year-over-year gain since March, the group said today in New York. The gauge is a three- month average, which means the July data are still being influenced by transactions in May and June that may have benefitted from the government homebuyer incentive.

Bay Area Home Sales Drop to 1992 Level; Median Price Slips Again

Posted: September 24th, 2010

ARTICLE, MDA DATAQUICK, 09.16.2010

Bay Area home sales fell less sharply last month than in July but still dropped to an 18-year low as potential buyers fretted about job security or took their time to assess the changing market. The median sale price remained higher than a year earlier but dipped month-to-month again, a real estate information service reported.

U.S. Housing Starts in August Topped Forecasts

Posted: September 21st, 2010

![]()

ARTICLE, NY TIMES, 09.21.2010

Housing starts in the United States increased more than expected in August to their highest level in four months and permits for residential construction also rose, government data showed on Tuesday, suggesting that the embattled market was starting to stabilize following the end of a tax credit.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

Where to Buy a Home for Less Than $800 a Month

Posted: September 15th, 2010

![]()

ARTICLE, U.S. NEWS & WORLD REPORT, 09.15.2010

Lower property values and dirt-cheap mortgage rates have combined to restore affordability to many real estate markets that were once wildly overpriced. “Right now, housing is about as affordable as it has been since at least the 1970s,” says Patrick Newport, a U.S. economist for IHS Global Insight.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

How Wall Street Reform Benefits Foreclosure Buyers

Posted: September 13th, 2010

![]()

ARTICLE, REALTYTRAC, 09.13.2010

In many markets there’s a fusion of discounted acquisition costs, historically-low interest levels, falling vacancy rates and rising rental rates. This doesn’t mean specific real estate investments are attractive everywhere or for all buyers, but in areas where such trends exist and seem likely to continue this may well be an unusually good time to consider short sales and foreclosures, two ways to acquire discounted real estate.

Prado Group joint venture acquires San Francisco apartment portfolio

Posted: September 8th, 2010

![]()

ARTICLE, REO INSIDER, 09.08.20120

The 250-unit apartment portfolio was purchased for $30.3 million, according to a news release from the San Francisco-based Prado Group, a real estate development and investment management firm.

FDIC sells another $760 million in REO

Posted: September 3rd, 2010

![]()

ARTICLE, REO INSIDER, 09.03.2010

Mariner Real Estate Management (MREM), a real estate investment and management firm based in Kansas, closed a deal to acquire a $760 million portfolio of residential and commercial loans and REO properties from the Federal Deposit Insurance Corp. (FDIC).

Private venture to buy $1.7bn portfolio of REO properties and nonperforming loans

Posted: August 18th, 2010

![]()

ARTICLE, REO INSIDER, 08.18.2010

PMO Loan Acquisition Venture, a partnership among several firms, will purchase a $1.7bn portfolio of nonperforming loans and REO properties previously owned by AmTrust Bank before it failed in December 2009.

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Homebuilder confidence sinks for 3rd month

Posted: August 16th, 2010

![]()

ARTICLE, ASSOCIATED PRESS, 08.16.2010

Homebuilder confidence dropped for the third straight month in August as the struggling economy and a flood of cheap foreclosed properties kept people from buying new homes.

REO levels in July reach second highest point ever: RealtyTrac

Posted: August 13th, 2010

![]()

ARTICLE, REO INSIDER, 08.13.2010

In July, 92,858 properties went back to the banks as REO, the second highest monthly total since RealtyTrac, an online foreclosure marketplace, began tracking them in April 2005.

Short sales soar in California, U.S.

Posted: August 13th, 2010

![]()

ARTICLE, LA TIMES, 08.13.2010

Sales of homes for less than the amount of their outstanding mortgage debt have tripled since 2008, particularly in California and the Sunbelt, according to a report released Tuesday.

Known as short sales, the increasingly common transactions for financially troubled homeowners are projected to balloon to 400,000 in 2010, according to Core Logic, a Santa Ana company that provides services to the real estate and mortgage markets. By comparison, existing homes sold at a seasonally adjusted annual rate of 5.37 million units in June, according to the National Assn. of Realtors.

Bad Debts Rise as Bust Erodes Home Equity

Posted: August 12th, 2010

![]()

ARTICLE, NY TIMES, 08.11.2010

The delinquency rate on home equity loans is higher than all other types of consumer loans, including auto loans, boat loans, personal loans and even bank cards like Visa and MasterCard, according to the American Bankers Association…… Even when a lender forces a borrower to settle through legal action, it can rarely extract more than 10 cents on the dollar. “People got 90 cents for free,” Mr. Combs said. “It rewards immorality, to some extent.”

Flooded with housing inventory, Freddie Mac REO sales surge despite foreclosure alternatives

Posted: August 10th, 2010

![]()

ARTICLE, REO INSIDER, 08.10.2010

The number of Freddie Mac “foreclosure alternatives” completed in the first half of 2010 increased 123% from the same period in 2009, but for all its efforts, the government-sponsored enterprise (GSE) is still taking on record numbers of housing inventory.

Vulture investors: They’re back – and making a bundle

Posted: August 5th, 2010

![]()

ARTICLE, CNN/MONEY, 08.02.2010

These are the glory days of the residential real estate investor. Low prices, rock-bottom interest rates and stable rental markets have created huge buying opportunities.

“It’s awesome right now. I don’t think we’ll ever see another time like this,” said Tanya Marchiol of Team Investments, which has operations in about 10 states but focuses mostly on the Phoenix market.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

Nobody Home

Posted: July 28th, 2010

PAPER, MIT & HARVARD, 07.28.2010

Foreclosure discounts are particularly large on

average at 27% of the value of a house. The pattern of death-related discounts suggests that they may

result from poor home maintenance by older sellers, while foreclosure discounts appear to be related

to the threat of vandalism in low-priced neighborhoods.

MIT economist measures how much foreclosures lower housing prices… 27%

Posted: July 28th, 2010

![]()

ARTICLE, MIT NEWS, 07.27.2010

In the study, “Forced Sales and House Prices,” which will be published in the American Economic Review, Pathak, Campbell and Giglio examined 1.8 million home sales in Massachusetts from 1987 to 2009. By looking in granular detail at real-estate prices, the researchers have concluded that a foreclosure reduces the value of a house by 27 percent, on average.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

Sacramento-area home sales hit 20-month high in June

Posted: July 20th, 2010

![]()

ARTICLE, SACRAMENTO BEE, 07.20.2010

“It really seems like California housing is parting ways with the national view. We’ve seen a much stronger recovery off the bottom,”

California foreclosures spike in June

Posted: July 19th, 2010

ARTICLE, OC REGISTER, 07.19.2010

After being down across the board in May, the filing of new foreclosure notices in California rose in June, while foreclosure sales dropped, reports ForeclosureRadar.com.

U.S. home foreclosures reach record high in second quarter

Posted: July 19th, 2010

![]()

ARTICLE, LA TIMES, 07.19.2010

Bank repossessions increased 38% in the second quarter from the same period a year earlier for a record total of 269,952, according to data to be released Thursday by RealtyTrac.

Biggest Defaulters on Mortgages Are the Rich

Posted: July 9th, 2010

![]()

ARTICLE, NY TIMES, 07.09.2010

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

Sequoia Investment Partners, July 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

OPINION, SREP, 07.07.2010

However, in times like these I am always reminded of Warren Buffett’s sage advice to be “greedy when others are fearful, and fearful when others are greedy.” That is, with so much uncertainty comes substantial opportunity, and it is my view that longer-term trends are very favorable for those willing to commit capital to value-add residential real estate, despite the likelihood for continued volatility and anemic economic growth at best during the next couple of years. These trends are as follows: …..

Deeds-in-lieu gain favor with lenders as alternative to foreclosure

Posted: June 29th, 2010

![]()

ARTICLE, LA TIMES, 06.28.2010

….a simple message: Let’s bypass all the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home and we’ll call it a deal. We won’t come after you to collect any deficiency between what you owe us on the mortgage and what we obtain from the home sale. We might even be able to wrap up the whole transaction in as little as 30 to 45 days. How about it?

Fannie Mae gets tough on homeowners who walk away

Posted: June 24th, 2010

![]()

ARTICLE, LA TIMES, 06.24.2010

The mortgage giant plans to go to court against those who can afford to make their payments but decide it’s not worth it. It also will limit their access to future loans.

Negative Homeowner Equity and Strategic Mortgage Defaults Boost Retail Sales but Pose Another Risk to Recovery

Posted: June 18th, 2010

![]()

PAPER, MARCUS & MILLICHAP, 06.2010

Drastic reductions in home values have driven many homeowners’ equity to negative levels, and returning to break-even will, for most, require several years. Consequently, a significant portion of these upside-down homeowners will walk away from their houses, even if they have the financial means to continue making payments.

Report: Calif. inland economic growth to lag coast

Posted: June 16th, 2010

![]()

ARTICLE, BUSINESS WEEK, 06.16.2010

Slow economic growth and high unemployment will persist for the foreseeable future in California’s inland counties, even as increasingly robust signs of recovery begin appearing throughout the state’s coastal areas, according to an economic forecast released Tuesday.

Lengthening the Limbo

Posted: June 1st, 2010

![]()

CHART, NY TIMES, 06.01.2010

The average number of days in each state that it takes to go from default to foreclosure and how that’s changed since 2008.

Owners Stop Paying Mortgages, and Stop Fretting

Posted: June 1st, 2010

![]()

ARTICLE, NY TIMES, 06.01.2010

Foreclosure has allowed them to stabilize the family business. Go to Outback occasionally for a steak. Take their gas-guzzling airboat out for the weekend. Visit the Hard Rock Casino.

“Instead of the house dragging us down, it’s become a life raft,” said Mr. Pemberton, who stopped paying the mortgage on their house here last summer. “It’s really been a blessing.”

A growing number of the people whose homes are in foreclosure are refusing to slink away in shame. They are fashioning a sort of homemade mortgage modification, one that brings their payments all the way down to zero. They use the money they save to get back on their feet or just get by.

Owners Bet on Raising the Rent, and Lost

Posted: May 29th, 2010

![]()

ARTICLE, NY TIMES, 5.29.2010

“The landscape has changed dramatically,” P. J. Johnston, a spokesman for the owners, said in an interview. “The economy has taken a major hit. Many properties are facing default.”

But just like Riverton and Stuyvesant Town, the owners of Parkmerced sought to take advantage of a roaring market to replace rent-regulated residents with tenants able to pay far higher rates.

Sequoia Investment Partners, May 2010 Investor Market Summary and Forecast

Posted: May 26th, 2010

OPINION, SEQUOIA INVESTMENT PARTNERS, 05.26.2010

Long story short, professional and some do-it-yourselfers are getting deals and just wait, there’s more to come.

Home Prices Show Softness Again

Posted: May 26th, 2010

![]()

ARTICLE, FORBES, 05.26.2010

The housing market is looking far better than it was a year ago, but there are troubling signs in renewed price weakness.

“It looks a little like a double-dip already,” economist Robert Shiller, the co-creator of the Case-Shiller index, said in an interview with the Associated Press. “There is a very real possibility of some more decline.”

Housing Prices Remain Weak

Posted: May 26th, 2010

![]()

ARTICLE, WSJ, 05.26.2010

“We’re just going to go through an adjustment period,” said Patrick Newport, an IHS Global Insight economist.

“After it settles, I think the market’s going to start growing sustainably because the [labor] market’s starting to create jobs,” he said.

Take This House and Shove It: The Emotional Drivers of Strategic Default

Posted: May 25th, 2010

PAPER, U OF A SCHOOL OF LAW, 05.14.2010

An increasingly influential view is that strategic defaulters make a rational choice to default because they have substantial negative equity. This article, which is based upon the personal accounts of over 350 individuals, argues that this depiction of strategic defaulters as rational actors is woefully incomplete. Negative equity alone does not drive many strategic defaulters’ decisions to intentionally stop paying their mortgages. Rather, their decisions to default are driven primarily by emotion

House-Price Drops Leave More Underwater

Posted: May 23rd, 2010

![]()

ARTICLE, 05.23.2010

The downturn in home prices has left about 20% of U.S. homeowners owing more on a mortgage than their homes are worth, according to one new study, signaling additional challenges to the Obama administration’s efforts to stabilize the housing market.

The bottom is near — yet so far — for Inland Empire apartments, report says

Posted: May 23rd, 2010

![]()

latimes.com

ARTICLE, LA TIMES, 05.23.2010

Apartment occupancy and rents in the Inland Empire will continue to fall this year before recovering in 2011 and 2012, commercial real estate brokerage Marcus & Millichap said in a report Thursday.

What Kind of Homeowners Choose to Default?

Posted: May 23rd, 2010

![]()

ARTICLE, LA TIMES, 05.23,2010

In fact, he says, their decisions to pull the plug “may not turn out to be economically rational.” But they walk anyway, in large part because they are at the end of their emotional rope. They’ve transitioned from feelings of anxiety and hopelessness to outright anger at their lenders, the government and/or a financial system they consider to be unfair.

Time for Housing to Clear

Posted: May 21st, 2010

![]()

ARTICLE, WSJ, 05.21.2010

In other words, the housing market may yet be allowed to clear. Painful, but inevitable.

Fed Raises U.S. Growth Range, Sees Lower Unemployment

Posted: May 20th, 2010

![]()

ARTICLE, BLOOMBERG BUSINESS WEEK, 05.20.2010

Federal Reserve officials raised their U.S. growth estimates for 2010 and lowered forecasts for unemployment and inflation, according to minutes of the Federal Open Market Committee meeting on April 27-28.

Mortgage delinquencies, foreclosures break records

Posted: May 19th, 2010

![]()

ARTICLE, ASSOC. PRESS, 05.19.2010

More than 10 percent of homeowners had missed at least one mortgage payment in the January-March period, the Mortgage Bankers Association said Wednesday. That number was up from 9.5 percent in the fourth quarter of last year and 9.1 percent a year earlier.

U.S. Mortgage Program Stalling, Data Shows

Posted: May 17th, 2010

![]()

ARTICLE, NY TIMES, 05.17.2010

“The program is dying,” the blog Calculated Risk concluded after examining the data.

But the number of new trials is beginning to level off, leading to worries that the potential pool of eligible households is rapidly diminishing. Furthermore, many borrowers have a great deal of difficulty making it out of the trial period. The number of canceled trial modifications is nearly as large as the number of permanent modifications.

TRICKS OF THE TRADE #14: How to quickly decide if a property is worth investigating

Posted: May 17th, 2010

![]()

TRICKS OF THE TRADE, SEQUOIA INVESTMENT PARTNERS, 05.17.2010

The 1% rule of thumb: How to quickly decide if a property is worth checking out.

JPMorgan Chase Warns Investors About Underwater Homeowners Walking Away

Posted: May 17th, 2010

ARTICLE, HUFFINGTON POST, 05.17.2010

About one in eight defaults in February were strategic, according to an April 29 research note by a team of Morgan Stanley analysts led by Vishwanath Tirupattur. Strategic defaults are those in which the homeowner could have continued to make payments but chose not to.

Foreclosures plateau – finally. Repossessions soar

Posted: May 13th, 2010

![]()

ARTICLE, CNN/MONEY, 05.13.2010

But the number of homes repossessed during April is at an all-time high of 92,432. That is a 45% increase over April 2009. If repossessions continue at this pace, more than 1.1 million homes will be lost in 2010.

Housing Optimists Are “Not Paying Attention” to the Facts, Says Dean Baker

Posted: May 13th, 2010

ARTICLE & VIDEO, YAHOO FINANCE, 05.13.2010

“I think we’re going to see a big fall-off in purchases for the rest of 2010 and even into 2011,” Baker says. “So the idea that somehow the market is stable, that housing prices will rise anytime soon – it’s really hard to make a case for that.”

Housing’s Dark Cloud

Posted: May 10th, 2010

![]()

ARTICLE, BOSTON HERALD, 05.10.2009

Housing experts say the end of the housing tax credit – which could have spurred as much as 70 percent of sales in the last four months – and thousands of homes facing foreclosure, could throw cold water on rising prices and sales. This perfect storm may set up a “double dip” housing recession

60 Minutes: Walking Away (Strategic Defaults/Foreclosures)

Posted: May 10th, 2010

![]()

VIDEO, 60 MINUTES, 05.09.2010

60 Minutes looks at the growing trend of “Strategic Default,” which is when a homeowner who is financially capable of making their mortgage payments finds themselves so far under water that they simply do the math and make the decision to walk away.

Yale’s Robert Shiller Discusses Strategic Defaults

Posted: May 10th, 2010

![]()

VIDEO, 60 MINUTES, 05.09.2010

Yale Economics Professor Robert Shiller developed the widely used Case-Shiller Home Price Index. He talks with Morley Safer of “60 Minutes” about trends in real estate and whether mortgage walkaways are “going viral.”

Would You Have Bought It? Case Study of a Flip: 4832 2nd Ave, Los Angeles CA

Posted: May 9th, 2010

![]()

SEQUOIA STRATEGY, 05.09.2010

It’s not often an REO investment makes the front page of the Sunday edition of a national paper, but that’s exactly what happened on April 25th 2010 in the Los Angeles Times. So we thought it would be a great opportunity to do a quick case study on this particular purchase

Top 20 Foreclosure Filings by City

Posted: May 6th, 2010

‘Strategic’ Mortgage Defaults Jump to 12% of Total

Posted: May 4th, 2010

![]()

ARTICLE, BLOOMBERG, 04.29.2010

About 12 percent of all mortgage defaults in February were “strategic,” up from 4 percent in mid-2007, New York-based Morgan Stanley analysts led by Vishwanath Tirupattur wrote in a report today.

In foreclosure crisis, demand for family homes in Phoenix rises

Posted: May 3rd, 2010

![]()

ARTICLE, ARIZONA REPUBLIC, 05.03.2010

Since September, the number of available rental homes in metropolitan Phoenix has dropped by 40 percent, and probably even more than that when it comes to three- to four-bedroom homes in desirable neighborhoods.

The sharp drop is another ripple effect of the foreclosure crisis.

METRO FORECLOSURE HOT SPOTS BUCK NATIONAL TREND IN FIRST QUARTER WITH ANNUAL DECLINES IN FORECLOSURE ACTIVITY

Posted: May 2nd, 2010

![]()

ARTICLE, REALTYTRAC, 05.02.2010

“The decreasing foreclosure activity in some of the nation’s top foreclosure hot spots in the first quarter is largely the result of government intervention and other non-market influences, and not a sure signal that those areas are out of the woods yet when it comes to foreclosures,”

The Coming Wave of Option-ARM and Alt-A Mortgage Resets

Posted: April 26th, 2010

![]()

STRATEGY, SEQUOIA RESEARCH, 4.22.2010

“We presently find ourselves in the relative calm between two waves.”

Los Angeles House Flipping Hot Spots

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Map of zip codes with the most flipping activity

Flipping houses is back in South Los Angeles

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Along with low prices, real estate investors are drawn to the area because of its proximity to the ports of Los Angeles and Long Beach, Los Angeles International Airport and other job centers, including factories.

In Sour Home Market, Buying Often Beats Renting

Posted: April 22nd, 2010

![]()

ARTICLE, NY TIMES 4.20.2010

In some once bubbly markets, prices have fallen so far that buying a home appears to be a bargain, based on a New York Times analysis of prices and rents in 54 metropolitan areas.

Distressed Home Sales on the Rise

Posted: April 21st, 2010

![]()

ARTICLE, FIRST CORE AMERICAN LOGIC, 04.08.2010

The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales –

accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009.

Just when you thought it was safe: Foreclosures spike

Posted: April 20th, 2010

![]()

ARTICLE, CNN/MONEY 04.15.2010

In the first three months of 2010 foreclosure filings rose 7%, to more than 930,000, compared with the previous quarter, according to the online foreclosure marketing firm RealtyTrac. That is a 16% jump over the first three months of 2009.

Renting: The new American dream?

Posted: April 20th, 2010

![]()

OPINION, PAUL LA MONICA CNN/MONEY

“This is a frugal recovery. People are more reluctant to buy homes as they would in a normal recovery,” Leamer said. “If you don’t have a job or are worrying about your job, you’re not going to buy a home. That’s the ultimate statement of optimism about the future.” Add that up and it’s reasonable to expect a rental boom that could last for some time.

More Incremental Gains for Southland Real Estate Market

Posted: April 19th, 2010

ARTICLE, DATAQUICK, 4.13.2010

Home sales and prices continued their steady but pokey climb up from the bottom in Southern California last month as buyers scrambled to take advantage of low prices and low mortgage interest rates.

California Statewide March Home Sales

Posted: April 19th, 2010

ARTICLE, DATAQUICK 04.15.2010

Indicators of market distress continue to move in different directions. Foreclosure activity is off its peaks reached in the past two years but remains high by historical standards.

U.S. Foreclosure Filings Rise 16% as Bank Seizures Set Record

Posted: April 16th, 2010

ARTICLE, BLOOMBERG 4.15.2010

Foreclosure filings in the U.S. rose 16 percent in the first quarter from a year earlier and bank seizures hit a record as lenders stepped up action against delinquent homeowners, according to RealtyTrac Inc.

Foreclosure activity up sharply despite loan modification program

Posted: April 16th, 2010

![]()

ARTICLE, LA TIMES 04.15.2010

The number of U.S. households caught in the foreclosure process during the first quarter jumped 7% from the prior quarter as activity increased sharply in March, a real estate firm will report Thursday.

The Implosion of the CDO Market and the Pricing of Subprime Mortgage-Backed Securities

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

Because CDO issuance played an important role in the market for subprime mortgage-backed securities (MBS), this striking rise and fall provides an excellent laboratory for studying the interest rate spreads on the underlying subprime MBS collateral.

Watchdog panel says Obama plan to ease foreclosure crisis does too little, comes too late

Posted: April 16th, 2010

ARTICLE, AP, 4.14.2010

A watchdog panel overseeing the financial bailouts says the Obama administration’s flagship mortgage aid program lags well behind the foreclosure crisis and leaves too many families out.

AllianceBernstein Housing Recomendation

Posted: April 15th, 2010

![]()

PAPER 12.2009, AllianceBernstein Research Dept.

“..our analysis indicates it is time to begin looking beyond the near term risks and toward the long-term opportunities.”

Another View of the 2nd Wave of Resets

Posted: April 14th, 2010

CHART, MORTGAGE RESETS

First Came Subprime, Then This

The 2nd Wave of Resetting Mortgages

Posted: April 14th, 2010

![]()

CHART: Here, you can clearly see the second wave of adjustable mortgage resets.

New round of foreclosures threatens housing market

Posted: April 12th, 2010

ARTICLE, WASHINGTON POST 03.12.2010

About 5 million to 7 million properties are potentially eligible for foreclosure but have not yet been repossessed and put up for sale.

“Cash for Keys” Aids Home Borrowers, Investors

Posted: April 12th, 2010

ARTICLE, REUTERS 03.12.2010

Jon Daurio, chief executive officer of mortgage investor Kondaur Capital Corp., recently offered a $4,000 check to Barry Culver for the deed to his Bryan, Ohio house.

No Help in Sight, More Homeowners Walk Away

Posted: April 12th, 2010

ARTICLE, NY TIMES 02.03.2010

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

Don’t Bet the Farm on the Housing Recovery by Robert Shiller of Yale University

Posted: April 12th, 2010

OPINION, By ROBERT J. SHILLER 04.09.2010 Yale University

MUCH hope has been pinned on the recovery in home prices that began about a year ago. A long-lasting housing recovery might provide a balm to households, mortgage lenders and the entire United States economy. But will the recovery be sustained?

Alas, the evidence is equivocal at best.

New wave of foreclosures by end of 2010 is feared

Posted: April 12th, 2010

![]()

ARTICLE, LA TIMES 02.16.2010

Experts fear that a new wave of foreclosures will hit this year as prolonged unemployment makes it difficult for millions of homeowners to pay their mortgages — and many of them aren’t likely to get much help from a federal program aimed at keeping them in their houses.

As Fed’s mortgage purchases end, eyes turn to investors

Posted: April 12th, 2010

ARTICLE, LA Times March 31, 2010

The government’s $1.25-trillion program to prop up the housing market by purchasing mortgages came to an end Wednesday — in a small, messy room at the Federal Reserve Bank of New York with four desks and a Nerf basketball hoop.

Foreclosure auction of Nicolas Cage’s mansion is a flop

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

Nicolas Cage is leaving Bel-Air. And not by choice.

At foreclosure auctions, broken dreams on sale

Posted: April 12th, 2010

ARTICLE 10.15.09

Mortgage Crisis Shuffles Toward Fancier Neighborhoods

Posted: April 12th, 2010

Real Estate Advisor Mortgage Crisis Shuffles Toward Fancier Neighborhoods Bernard Condon, 10.07.09, Has all the good news dribbling in from the housing front masked a new crisis? New home sales have risen for five months now, the latest Case-Shiller figures say prices are rising and homebuilders like Toll Brothers and Pulte Homes are seemingly off [...]

View The Menace of Strategic Default

Posted: April 3rd, 2010

![]()

ARTICLE, CITY JOURNAL, 04.15.2010

Option ARM Borrowers Running Out Of Time

Posted: March 12th, 2010

ARTICLE, REALTYTRAC 03.2010

Of all the mortgage ideas developed during the past few years, none tops the option ARM for sheer awfulness. And now the mortgage mess is about to get far worse as millions of option ARMs begin to recast. Not “reset” — but recast.

Housing Forecast: More Foreclosures, Home-Price Declines

Posted: January 27th, 2010

ARTICLE, TIME/CNN, 01.07.2010

The decimated housing market may get considerably worse before it gets better, according to housing-industry professionals, who expect foreclosures and home-price declines to continue pressuring the sector through at least the first half of 2010.

Case-Shiller Housing White Paper Year in Review 2009

Posted: January 16th, 2010

![]()

PAPER, CASE SHILLER YEAR IN REVIEW 2009

Standard & Poor’s chief economist, David Wyss, has provided us with his forecast for the residential housing market. His team expects housing sales and starts to drop over the winter, but to remain well above their early 2009 lows, and to recover in the spring.

Designing Loan Modifications to Address the Mortgage Crisis and the Making Home Affordable Program

Posted: December 3rd, 2009

PAPER, FEDERAL RESERVE BANK OF D.C., 12.15.2009

This paper presents preliminary findings and is being distributed to economists

and other interested readers solely to stimulate discussion and elicit comments.

Underwater and Not Walking Away…..

Posted: October 10th, 2009

PAPER, U of A SCHOOL OF LAW, OCTOBER 2009

This article suggests that most homeowners choose not to strategically default as a result of two emotional forces: 1) the desire to avoid the shame and guilt of foreclosure; and 2) exaggerated anxiety over foreclosure’s perceived consequences.

Moral and Social Constraints to Strategic Default on Mortgages

Posted: July 15th, 2009

![]()

![]()

PAPER, BOOTH & KELLOGG SCHOOLS OF BUSINESS, 07.15.2009

“That moral attitudes toward default do not change with the percentage of foreclosures in the area suggests that the correlation between willingness to default and percentage of foreclosures is likely to derive from a contagion effect that reduces the social stigma associated with default as defaults become more common.”

Negative Equity and Foreclosure

Posted: June 6th, 2008

PAPER, FEDERAL RESERVE BANK OF BOSTON, 06.05.2008

Christopher L. Foote and Paul S. Willen are senior economists and policy advisors

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy