Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Harvard: Joint Center for Housing Studies

Posted: September 29th, 2015

Projecting Trends in Severely Cost-Burdened Renters: 2015–2025

Author(s): Allison Charette

Chris Herbert

Andrew Jakabovics

Ellen Tracy Marya

Daniel T. McCue

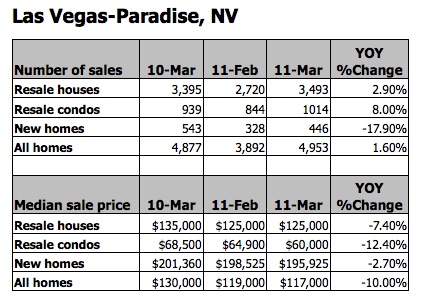

This report by Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners Inc shows that the number of households spending more than 50 percent of their income on rent is expected to rise at least 11 percent from 11.8 million to 13.1 million by 2025. The report projects a growing renter affordability crisis, with the largest increases expected among older adults, Hispanics and single-person households. The findings suggest that even if trends in incomes and rents turn more favorable, a variety of demographic forces—including the rapid growth of minority and senior populations—will exert continued upward pressure on the number of severely cost-burdened renters.

CONCLUSION

Overall, our analysis projects a fairly bleak picture of severe renter burdens across the U.S. for the coming decade. Under nearly all of the scenarios performed, we found that the renter affordability crisis will continue to worsen without intervention. According to our projections, annual income growth would need to exceed annual rent growth by 1 percent in order to reduce the number of severely burdened renters in 10 years. Importantly, that decline would have a net impact on fewer than 200,000 households, only because continued increases in burdens among minorities would be offset by declines among whites. Under the more likely scenario that rents will continue to outpace incomes, the number of severely rent-burdened households would increase by a range of 1.7 – 3 million, depending on the magnitude.

Given these findings, it is critical for policymakers at all levels of government to prioritize the preservation and development of affordable rental housing. Even if the economy continues its slow recovery and income growth improves, there are simply not enough quality, affordable rental units to house the millions of households paying over half their income in rental costs.

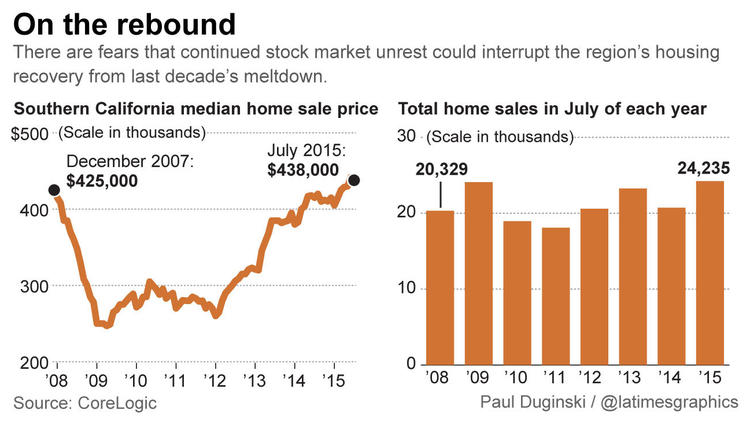

Will Wall Street turmoil affect Southern California housing market?

Posted: September 29th, 2015

Seven years ago when the housing bubble burst, it nearly took down Wall Street and the entire U.S. economy.

This week, the concern was the reverse: That the prospect of an extended dive in the stock market, or even continued volatility, might spook buyers and sellers in Southern California’s housing market — just as it has finally normalized after a bust-and-boom cycle.

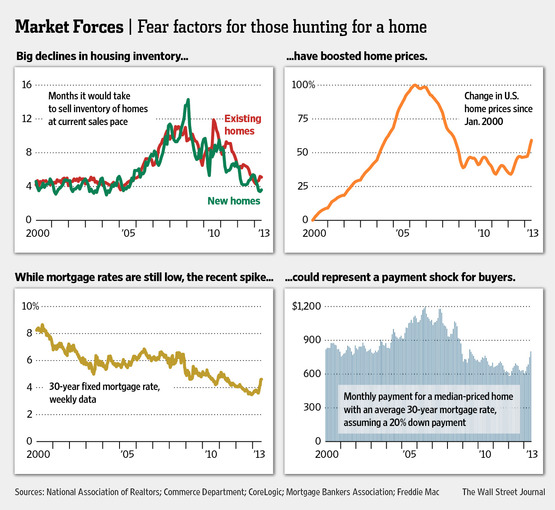

Higher Rates Aren’t Enough to Stall Housing

Posted: July 22nd, 2013

The U.S. housing recovery that began unfolding early last year faces its first serious test: In the span of just two months, mortgage rates have jumped by a full percentage point, something that has happened only twice since 1994.

Mortgage rates, which at the beginning of May stood at 3.59% for the average 30-year fixed-rate loan, jumped to 4.68% during the first two weeks of July, the latest available data, according to the Mortgage Bankers Association. That is the highest level in two years.

Luxury Real-Estate Flippers

Posted: June 28th, 2013

Sequoia Real Estate Partners was interviewed for this article and it contains photos of SREP properties.

By Sanette Tanaka

There is a new breed of quick-change artist on the real-estate front: luxury flippers who focus on high-end properties.

Million-Dollar Flips

Popular before the housing bust, house flipping-where a property is bought, renovated and sold quickly to make a profit-is seeing a comeback nationwide. Rising prices and tight inventory are driving more investors to the upper end of the market. Flips of homes priced at $1 million or more shot up 35% in 2012 compared with 2011, according to market researcher RealtyTrac.

Seven Takeaways on Rising Home Sales

Posted: June 27th, 2013

Thursday’s report from the National Association of Realtors that existing-home sales in May rose by 4.2% adds to an upbeat market trend that has unfolded over the past two years. Here are seven takeaways on the sales data:

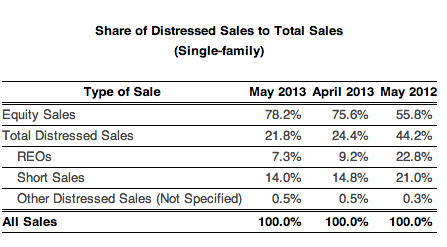

California REO sales hit lowest level in six years

Posted: June 27th, 2013

May sales of real estate-owned properties in California fell into the single digits for the second straight month, descending to the lowest level since October 2007, analysts claim.

The share of REO sales in the state hit 7.2% in May, down from 9.2% in April and also down 22.8% from a year ago, according to the California Association of Realtors.

Meanwhile, the share of equity home sales continued to grow in May, making up nearly four of every five home sales.

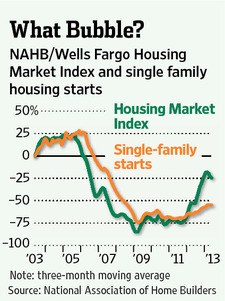

Fears of New Housing Bubble Full of Air

Posted: June 27th, 2013

The outbreak of bidding wars for center-hall colonials, split-levels and ranches all over America is more than a little reminiscent of the mid-2000s. Of course, that innocent era, before people understood that home prices can also fall, never had fixed-rate mortgage rates as low as those seen recently. On appearances alone then, it isn’t surprising to hear warnings that another bubble may be brewing.

Flippers Ride Housing Wave In California, Homes Bought and Resold Quickly Reach Highest Levels Since 2005

Posted: June 27th, 2013

![]()

Rising home prices have fueled the return of a practice that some blamed for inflating the bubble: house flipping.

In California, the number of homes sold in recent months that had been flipped—or bought and resold within six months—has reached the highest levels since late 2005, according to PropertyRadar, a real-estate data firm. About 6,000 homes have been flipped in the state this year through April, or more than 5% of all homes sold statewide.

While flipping is re-emerging nationwide, brokers say it is happening most in California, where home prices have risen sharply over the past year. Six of the 10 largest price gains in major U.S. cities over the past year have been in California, according to Zillow. In April, home values rose by 25% from a year earlier in San Jose, San Francisco and Sacramento, and by 18% in Los Angeles.

Click on the article title to read more

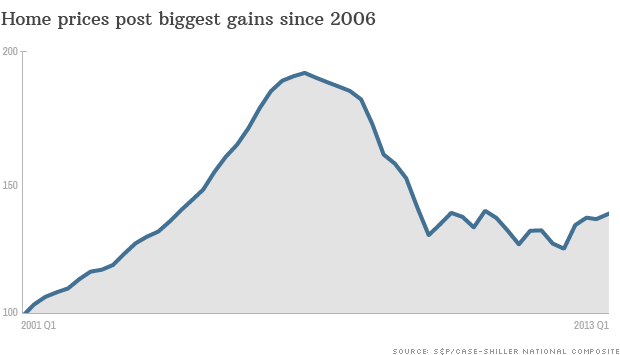

Home prices post strongest gains in 7 years

Posted: June 27th, 2013

Prices on the S&P/Case-Shiller national index rose 10.2% in the first quarter, according to the latest report.

That marked the fourth consecutive quarter of year-over-year gains, says David Blitzer, head of S&P’s index division.

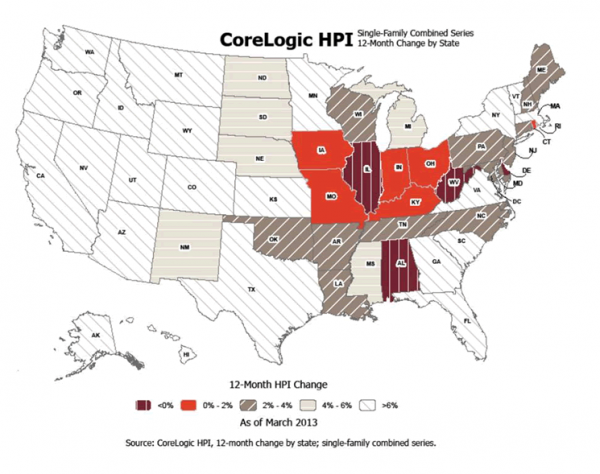

CoreLogic home prices jump more than 10%, but it’s no bubble

Posted: May 22nd, 2013

![]()

The latest CoreLogic home price index jumped a whopping 10.5% nationally, but analysts say values are still far away from creating a housing bubble.

This change represents the biggest year-over-year increase since March 2006 and the 13th consecutive monthly increase in home prices nationally, CoreLogic ($27.39 -0.215%) said in a press release.

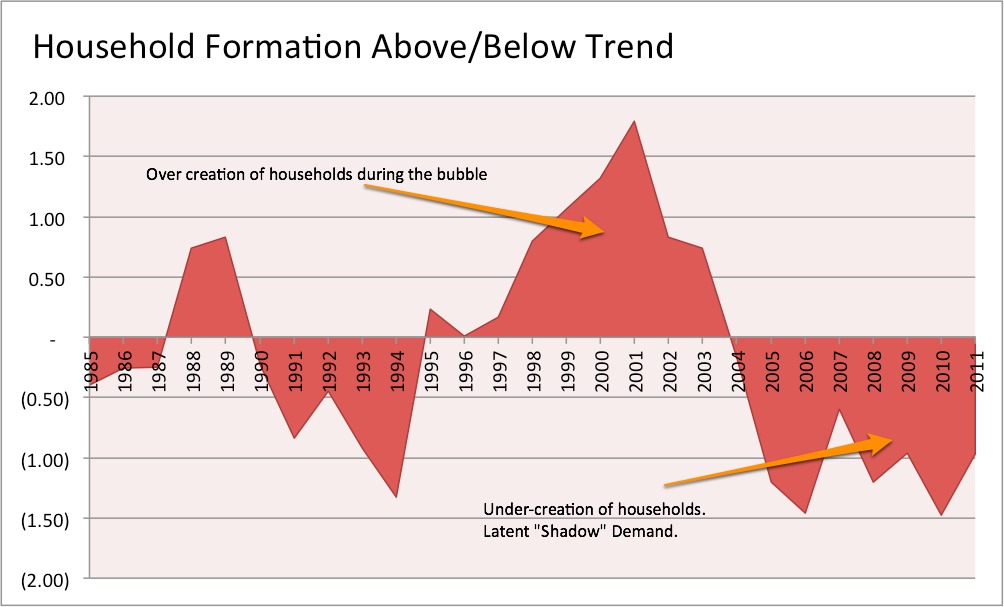

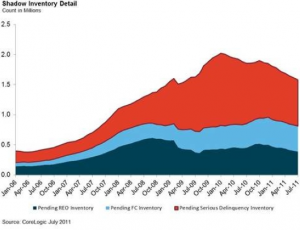

Real Estate Shadow Demand Outweighs its Shadow Inventory

Posted: April 9th, 2013

Quit your yapping about how strong the real estate market is, Simonsen. It’s a fake rally. There is no actual demand.

That’s the bearish argument I’ve been hearing lately. I’m not buying it.

For years we’ve been watching the phenomenon of “Shadow Inventory” of potential homes that need to be sold, and looking for impact on the market. This set of underwater or distressed properties is now shrinking rapidly. The number of homes with underwater mortgages fell by nearly two million last year. According to the Fed, home price gains of 10% will be enough to move 40% of underwater borrowers back above water. These home sellers are highly likely to buy another home in the same or comparable market, off setting new supply with new demand.

Housing’s Shadow Demand

CLICK ON THE TITLE TO READ THE WHOLE STORY

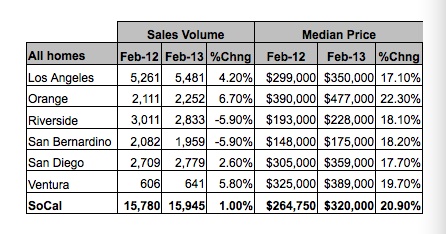

Southland Begins 2013 With Sales and Price Gains Vs. Year Earlier

Posted: April 9th, 2013

Southern California logged the highest February home sales in six years last month amid relatively strong sales of mid- to high-end properties and a record share of homes sold to absentee buyers. The median sale price edged slightly lower from January but rose nearly 21 percent from a year earlier, marking the 11th straight month in which the median has risen year-over-year, a real estate information service reported.

CLICK ON THE TITLE TO READ THE WHOLE STORY

Why Forecasts for the 2013 Housing Market are Too Low

Posted: March 4th, 2013

I’m in Washington DC to talk to the National Association of Business Economics on the state of the housing market. I ran into Lawrence Yun, the chief economist for the National Association of Realtors and he mentioned that he just raised his forecast for 2013 from 4% year over year to 7-8%. That’s pretty bullish. Yun, of course, takes a lot of flack for being an industry cheerleader rather than objective. So he should be bullish, right? I told him he’s still too low.

Click on the title to read the entire article

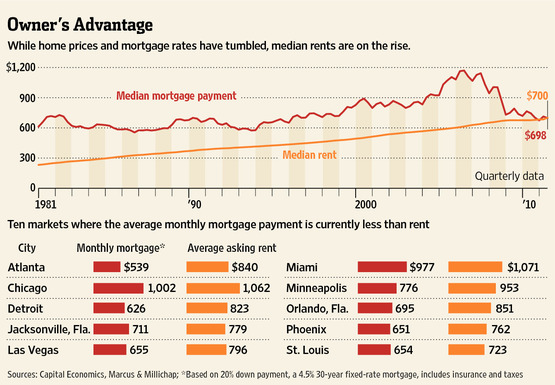

Home Prices Hit a Milestone

Posted: December 27th, 2012

Record-low mortgage rates mean that homeowners have a smaller financial burden for their residences than at any time since the early 1980s.

But here’s the bad news: Rising rents are squeezing many families and leaving them with less to spend.

Several factors have pushed rents up. Rental and apartment housing is in short supply but demand has grown after several years of foreclosures and population growth.

Click on the title to read the entire article

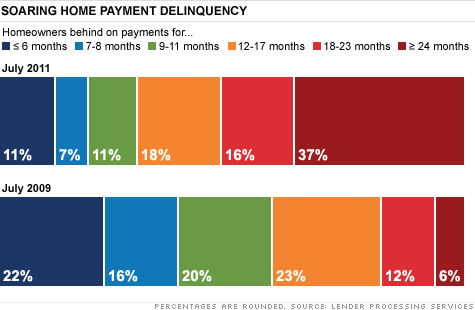

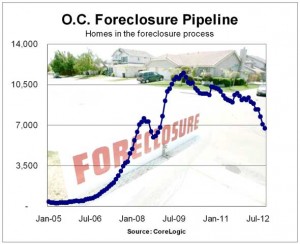

Nearly 7,000 OC homes face foreclosure

Posted: December 19th, 2012

Just more than 6,700 Orange County homes were in some stage of foreclosure in October, figures from housing tracker CoreLogic and the U.S. Census Bureau show.

While that’s down 42 percent from a high of 11,500 homes in the foreclosure pipeline in November 2009, the number of distressed homes still is 20 times greater than before the housing slump hit in 2005.

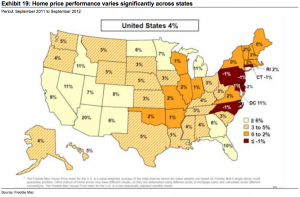

Credit Suisse: Home price appreciation will move into 2013

Posted: December 16th, 2012

Home prices increased by about 4% from September 2011 to this September of this year. The trend in home prices is expected to continue into 2013, with further home price appreciation of about 5%, according to Credit Suisse ($24.56 -0.07%).

The improvement is based on continuation of low mortgage rates, home price performance as well as investor and potential homebuyer confidence in the market.

Home price appreciation varied throughout the nation, with some of the hardest hit areas during the crisis — Arizona, California, Florida and Nevada — posting double-digit gains.

“Broadly speaking, continuing HPA should stimulate the overall refinancing environment by opening up credit availability,” the report said.

Click on the title to read the entire article

Home ‘flippers’ grab an increasing share of Sacramento housing market

Posted: October 31st, 2012

Homebuyers in today’s market are likely to encounter a lot of fresh paint and spruced-up bathrooms.

That’s because flipped houses, renovated and quickly resold for profit, make up a larger share of the Sacramento region’s housing market than at any time in the past decade, including the height of the housing boom.

About one in 12 homes sold in Sacramento County last month was flipped, meaning it was bought and resold within a six-month period, according to real estate information service DataQuick.

“Flipping was up significantly from a year ago,” said DataQuick analyst Andrew LePage.

Investor Q3 Update & Outlook

Posted: October 25th, 2012

The third quarter saw continued improvement in the residential markets, similar to those we have noted in earlier quarterly updates. Nationally, apartment rents increased approximately 0.8% in the third quarter, representing the seventh consecutive quarter of rental growth, while overall vacancy rates dropped to 4.6%. However, the increase in rents represented the slowest rate of growth since the recovery began in 2010. These results are not surprising as improvement in single-family home prices (up 4.6% in August 2012 versus the prior year, the largest year-over-year increase in six years) – buoyed by continued low interest rates, expanding confidence in the economic recovery, and low levels of inventory for sale – absorbed some of the apartment momentum. The surprising strength in the single-family residential market, highlighted by unusually low supply (click to read more) has perhaps been the most interesting story during the quarter…..

Click on the article title above to read further.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Emerging Trends in Commercial Real Estate Report: “Recovery Anchored in Uncertainty” in 2013

Posted: October 17th, 2012

Commercial real estate’s slow recovery will continue in 2013, according to the Emerging Trends in Real Estate 2013 report released today by PwC and the Urban Land Institute at the ULI Fall Conference taking place in Denver.

The report, generated by surveys and interviews with 900 real estate investors, developers, service providers and lenders, shows expectations that trends that have materialized in recent years will continue in 2013. Namely, gateway cities like San Francisco, New York, Boston and Washington, D.C. continue to be the best bets for investment and development—although there are fledgling concerns that pricing has gotten too heated. As a result, secondary cities may receive more of a boost in the coming months. But growth everywhere will continue to be tepid with gradual improvements in occupancies, rents and values for all property types.

CoreLogic: Shadow inventory down 10.2 percent

Posted: October 10th, 2012

The nation’s shadow inventory fell to 2.3 million units in July, down 10.2 percent from last July, according to a monthly report, using a new methodology (see below), from real estate data firm CoreLogic released today.

Getting Warmer: Where Rent Prices are Hot (and Where They’re Cool)

Posted: October 10th, 2012

For those looking to live in a locale with an endless summer, it doesn’t come cheap.

On average, renters in Orange County, Calif. pony up more than $1,650 a month for an average two-bedroom apartment, according to new data from Homes.com and ForRent.com. To cover housing costs alone, residents have to rake in about $32 an hour, no small feat in a wage-depressed economy.

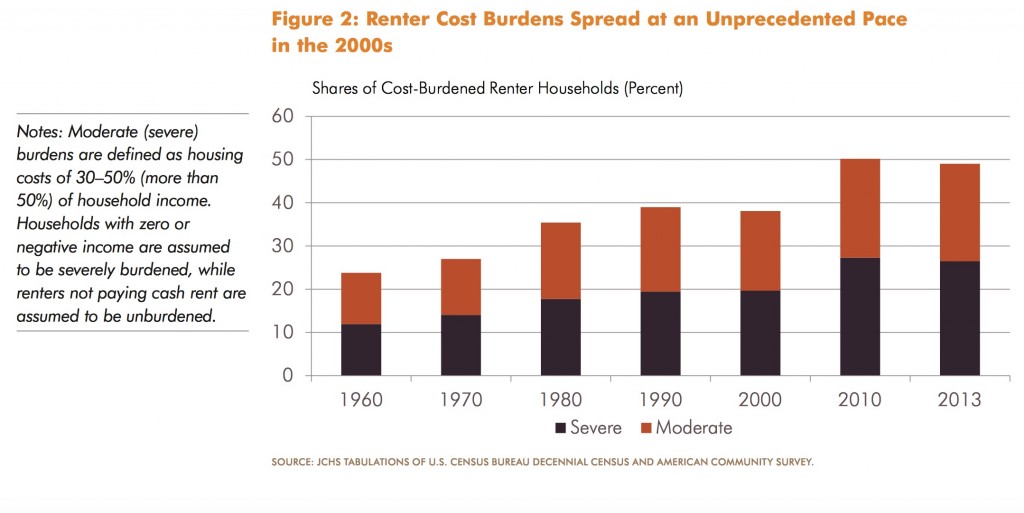

Deutsche Bank claims housing correction complete

Posted: October 10th, 2012

![]()

Recent indicators showed housing has largely corrected back to pre-bubble levels and affordability, according to a note from Deutsche Bank analysts.

Nationally, home prices dropped roughly 40% from the overheated peak in 2006 to a low in 2009. But the analyst said in a note Thursday that prices are still 30% higher than the millennium average. Incomes, while similarly dented by the financial crisis actually recovered more quickly than prices.

Rebuilding the Housing Economy: The Multifamily Boom Will Lead to a Rebound in Homeownership

Posted: August 27th, 2012

We are now in the midst of a boom in multi-family construction, especially in rental apartments. Like housing starts in

general, multi-family starts collapsed from its peak in 2005 of 354,000 units to a nadir of 112,000 units in 2009. Since then starts will have more than doubled to the 260,000 units forecast in 2012. Indeed we would not be surprised to see multi-family starts exceed 400,000 units in 2014. After all the flip side of a falling homeownership rate is a rising rate of home renting.

Fannie Mae paper: What Drives Consumers’ Intentions to Own or Rent

Posted: August 14th, 2012

What Drives Consumers’ Intentions to Own or Rent

“Our analysis found that consumers consider a mix of demographic and

attitudinal drivers in their future “next move” own-rent preferences. Demographics

such as income, age, marital status, and employment status are

the primary drivers of current homeownership status and the own-rent

intention for outright homeowners (those who don’t have a mortgage).

However, attitudes are the key drivers of the own-rent intention for renters

and homeowners with a mortgage – two groups that account for about 80

percent of housing units in the U.S.”

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Southland Home Sales Up; Median Price Almost Back to Year-Ago Level

Posted: April 20th, 2012

La Jolla, CA—Southern California home sales shot up last month from February amid the usual surge in early-spring shopping, but the gain over a year earlier was modest. Sales of $500,000-plus homes, though a bit lower than last year, jumped 36 percent from February, helping to lift the region’s overall median sale price to a six-month high – and to about where it was in March 2011, a real estate information service reported.

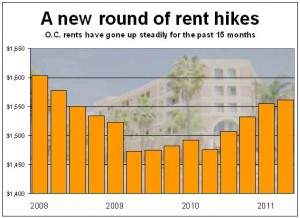

O.C. Apartments see largest rent hikes in 4.5 years

Posted: January 23rd, 2012

Another round of rent hikes occurred at Orange County’s large apartment complexes last fall, reflecting an ever-tightening market as vacancies continued to fall.

The average asking rent for a large-complex unit in Orange County was $1,561 a month, according to apartment tracker RealFacts.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Stronger Lure for Prospective Home Buyers

Posted: December 6th, 2011

![]()

ARTICLE, WALL ST JOURNAL

Home prices and mortgage rates have fallen so far that the monthly cost of owning a home is more affordable than at any point in the past 15 years and is less expensive than renting in a growing number of cities.

Where Housing Is Headed

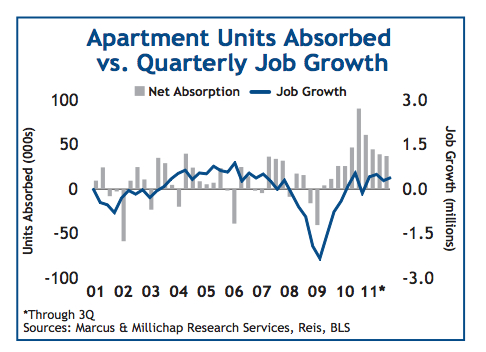

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

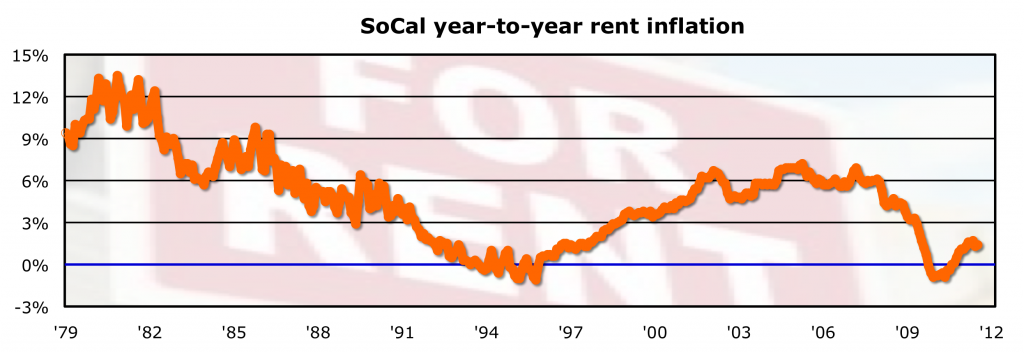

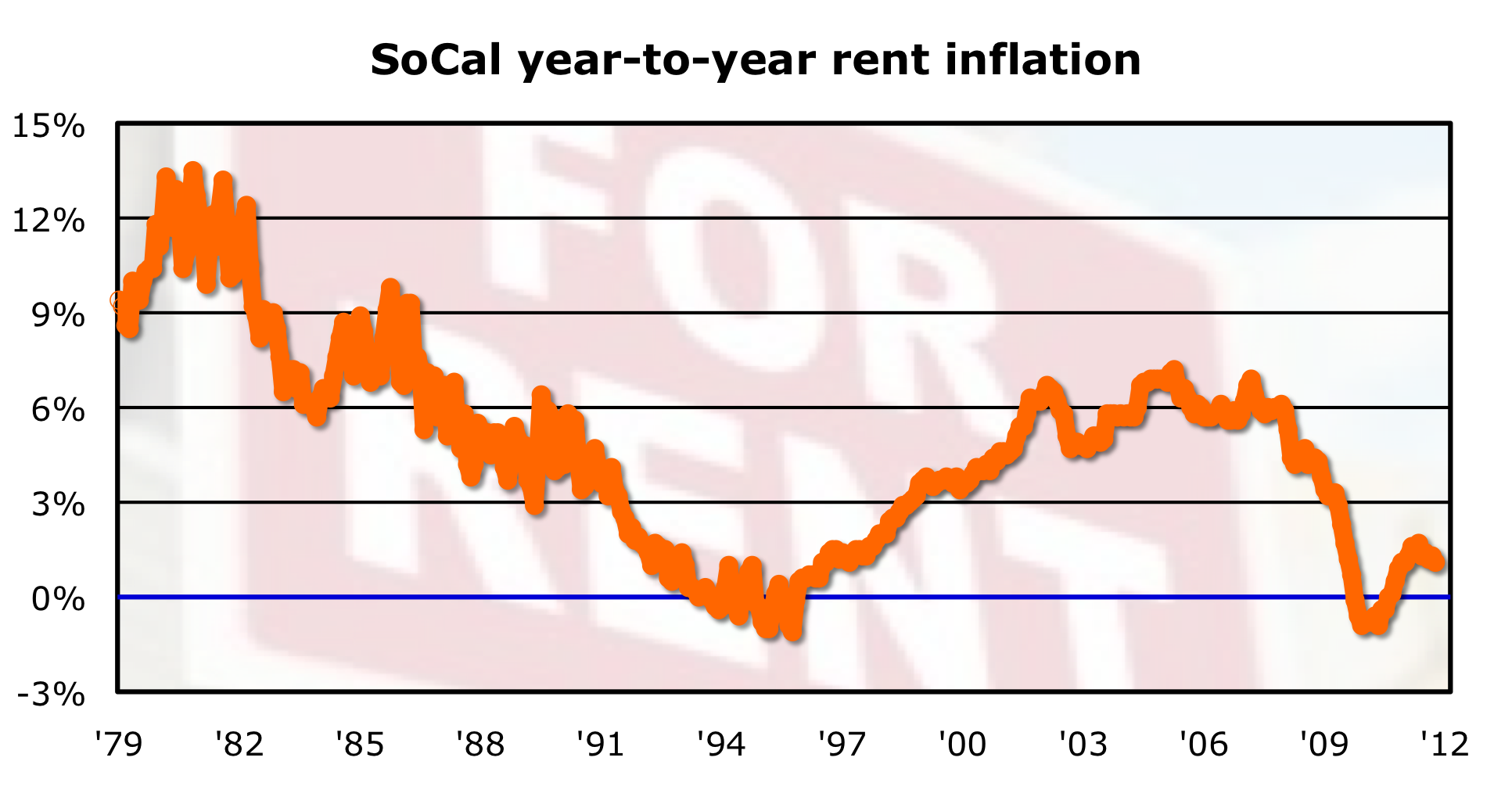

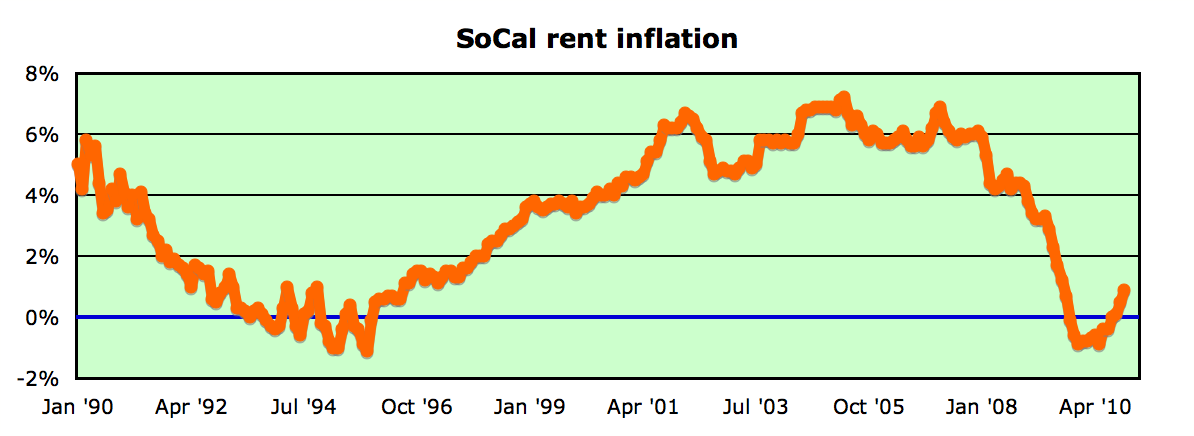

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

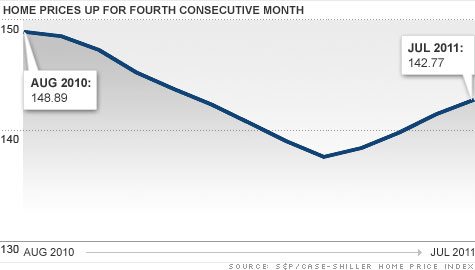

Home prices climb for fourth straight month

Posted: September 27th, 2011

ARTICLE, CNN/MONEY

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose 0.9% in July compared with June, but they’re still 4.1% lower than 12 months ago.

CoreLogic: Shadow inventory declines to five-month supply

Posted: September 27th, 2011

![]()

ARTICLE, HOUSINGWIRE

The nation’s residential shadow inventory as of July declined slightly to 1.6 million units, representing a supply of five months, according to a report from CoreLogic (CLGX: 11.38 -1.73%).

That’s down from 1.9 million units, a supply of six months, from a year ago,

SoCal rents up 11th straight month

Posted: September 1st, 2011

How to rescue the housing market: Foreclosures!

Posted: September 1st, 2011

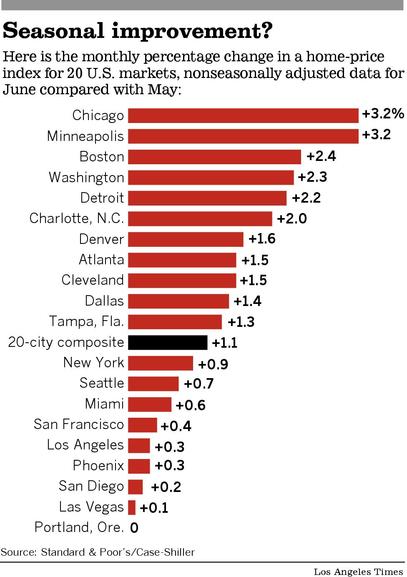

Home prices notch third straight monthly gain

Posted: September 1st, 2011

A key index of home prices in 20 metropolitan areas rose 1.1% from May to June. Real estate experts say the improvement is seasonal and that prices could fall again as sales slow in the fall and winter.

Housing Affordibility by Metro

Posted: August 22nd, 2011

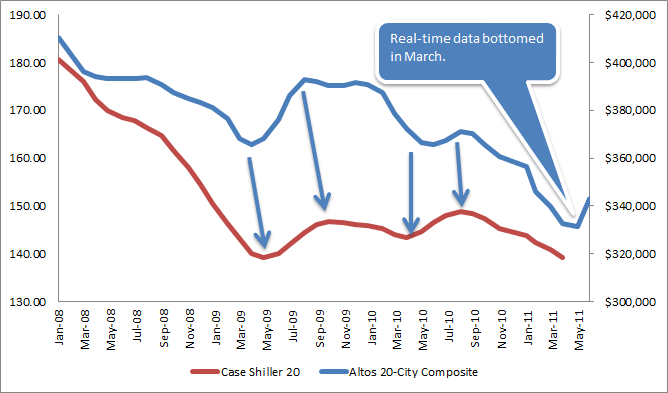

How to Interpret Today’s S&P Case Shiller Home Price Report | Altos Research: Hows the Market?

Posted: June 3rd, 2011

–From our friends at Altos Research

It’s nice to be able to be contrarian AND bullish for once. The real-time data is up. Demand is responding to the low interest rates and years of falling prices. There are deals to be had. And, ironically, despite all the shadow inventory that might come on the market, if you’re buying a home right now, in most places you’ll notice that there aren’t all that many actually on the market for you to choose from! These are bullish, short-term factors for housing. They’re the reason home prices have rebounded since March.

ARTICLE/OPINION, ALTOS RESEARCH

Home prices: ‘Double-dip’ confirmed

Posted: June 2nd, 2011

ARTICLE, CNN

Home prices hit another new low in the first quarter, down 5.1% from a year ago to levels not reached since 2002.

It was the third straight quarterly drop for the S&P/Case-Shiller national home price index, which was released Tuesday.

Prices are now down 32.7% from their peak set five years ago.

“Home prices continue on their downward spiral with no relief in sight,” said David Blitzer, spokesman for Standard and Poor’s.

The index covers 80% of the housing market, and this month’s report confirmed “a double-dip in home prices across much of the nation,” said Blitzer.

The housing market went through a brief recovery period starting in mid-2009, recovering nearly 5% of earlier losses. After homebuyer tax credits expired last April, the slump resumed.

A separate S&P/Case-Shiller index covering 20 major cities also dropped during March, the index’s eighth straight monthly decline

Housing crash is getting worse: report Commentary: But all this bearish news makes me bullish

Posted: May 10th, 2011

![]()

COMMENTARY, WSJ: MARKET WATCH

All the misery makes me think of a great French general, Ferdinand Foch. He’s the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

“Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!”

In other words, when it comes to distressed housing, I’m finding it hard not to be a contrarian bull.

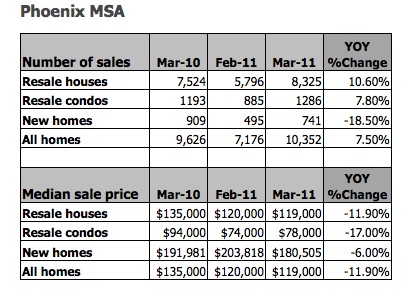

March Home Sales Phoenix & Las Vegas

Posted: May 10th, 2011

Apartment Building Foreclosures Piling Up

Posted: May 10th, 2011

![]()

ARTICLE, WALL ST JOURNAL

For more than three years, Fannie Mae has faced surging foreclosures on deteriorating home loans. Now, it also has to deal with an uptick in souring loans backing apartment buildings made as the market peaked four years ago.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Renew your lease – rents could rise 10%

Posted: March 20th, 2011

![]()

ARTICLE, CNN/MONEY

Renters beware: Double-digit rent hikes may be coming soon.

Already, rental vacancy rates have dipped below the 10% mark, where they had been lodged for most of the past three years.

“The demand for rental housing has already started to increase,” said Peggy Alford, president of Rent.com.

SoCal Rents Biggest Rise in 15 months

Posted: December 16th, 2010

Rents in Southern California — at least, as measured by the local version of the Consumer Price Index — were rising in November at a 0.9% annual rate, according to the Bureau of Labor Statistics. That rise compares to an increase at a 0.5% annual rate in the previous month. It was the third consecutive month of year-over-year increases and the biggest jump since August 2009.

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

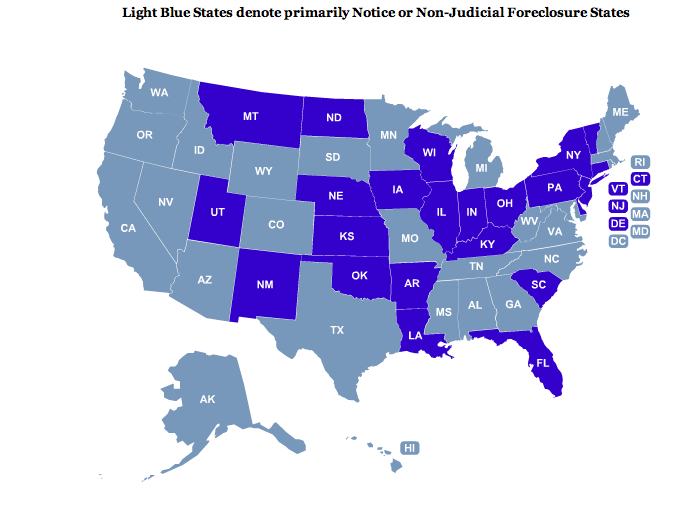

Why Did the Three Banks Temporarily Halt Foreclosures in Only 23 States? Judicial vs. Non-Judicial Foreclosure States

Posted: October 7th, 2010

INSIGHT, SREP, 10.07.2010

Each state in the U.S. handles it’s real estate foreclosures differently, it’s important to understand those differences and know your specific state’s procedures. The terms used and time frames vary greatly from state to state, but the following information provides a general overview of the different processes and considerations.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

Chart: Latest Case Shiller Data

Posted: September 3rd, 2010

![]()

CHART, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

CHART: Office vacancies rise, rents drop in Southland

Posted: July 20th, 2010

![]()

CHART, LA TIMES, 07.20.2010

Office vacancies rise, rents drop in Southland again

Foreclosure Hot Spots

Posted: July 19th, 2010

Core Logic: Commercial Market Monitor

Posted: June 18th, 2010

![]()

PAPER, FIRST AMERICAN CORE LOGIC, 06.2010

In 2010, over $283 billion in commercial mortgages will mature and need to be refi nanced or sold. This forecast is based upon CoreLogic property

records data and is updated on an ongoing monthly basis. All analyses presented herein examine the corollaries between property ownership and

mortgage holder information.

Lengthening the Limbo

Posted: June 1st, 2010

![]()

CHART, NY TIMES, 06.01.2010

The average number of days in each state that it takes to go from default to foreclosure and how that’s changed since 2008.

Chart of Sales Spike as a Funtion of Expiring Tax Credit

Posted: May 18th, 2010

Top 20 Foreclosure Filings by City

Posted: May 6th, 2010

The Coming Wave of Option-ARM and Alt-A Mortgage Resets

Posted: April 26th, 2010

![]()

STRATEGY, SEQUOIA RESEARCH, 4.22.2010

“We presently find ourselves in the relative calm between two waves.”

Los Angeles House Flipping Hot Spots

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Map of zip codes with the most flipping activity

Another View of the 2nd Wave of Resets

Posted: April 14th, 2010

CHART, MORTGAGE RESETS

First Came Subprime, Then This

Job Losses in Different Recessions

Posted: April 14th, 2010

CHART: Job Losses in different recessions

The 2nd Wave of Resetting Mortgages

Posted: April 14th, 2010

![]()

CHART: Here, you can clearly see the second wave of adjustable mortgage resets.

Bob Shiller’s History of Home Prices

Posted: April 14th, 2010

![]()

CHART: Robert Shiller’s History of U.S. Home Prices

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy