Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Home prices signal recovery may be here

Posted: August 28th, 2012

NEW YORK (CNNMoney) — A sharp boost in home prices during the spring could signal a recovery in the long-suffering U.S. housing market, according to an industry report issued Tuesday.

The S&P/Case-Shiller national home price index, which covers more than 80% of the housing market in the United States, climbed 6.9% in the three months ended June 30 compared to the first three months of 2012.

Home prices climb for fourth straight month

Posted: September 27th, 2011

ARTICLE, CNN/MONEY

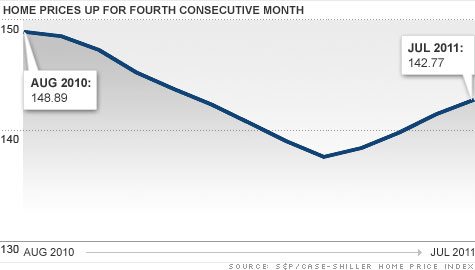

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose 0.9% in July compared with June, but they’re still 4.1% lower than 12 months ago.

Home prices notch third straight monthly gain

Posted: September 1st, 2011

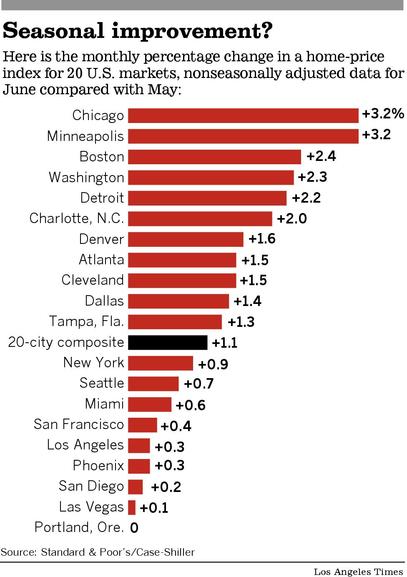

A key index of home prices in 20 metropolitan areas rose 1.1% from May to June. Real estate experts say the improvement is seasonal and that prices could fall again as sales slow in the fall and winter.

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

Home prices rise, snapping 8-month drop streak

Posted: July 13th, 2011

ARTICLE, CNN

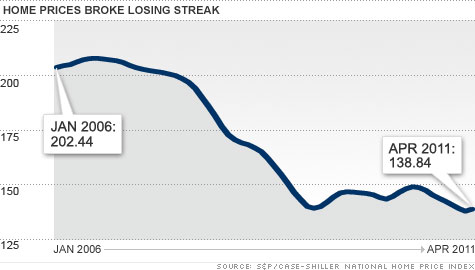

The downward cycle in home prices broke in April after eight consecutive months of decline, according to a survey released Tuesday.

According to the S&P/Case Shiller 20-city index, prices rose 0.7% compared with March, although they fell 0.1% when adjusted for the strong spring selling season. Prices were down 4% year-over-year.

Home prices: ‘Double-dip’ confirmed

Posted: June 2nd, 2011

ARTICLE, CNN

Home prices hit another new low in the first quarter, down 5.1% from a year ago to levels not reached since 2002.

It was the third straight quarterly drop for the S&P/Case-Shiller national home price index, which was released Tuesday.

Prices are now down 32.7% from their peak set five years ago.

“Home prices continue on their downward spiral with no relief in sight,” said David Blitzer, spokesman for Standard and Poor’s.

The index covers 80% of the housing market, and this month’s report confirmed “a double-dip in home prices across much of the nation,” said Blitzer.

The housing market went through a brief recovery period starting in mid-2009, recovering nearly 5% of earlier losses. After homebuyer tax credits expired last April, the slump resumed.

A separate S&P/Case-Shiller index covering 20 major cities also dropped during March, the index’s eighth straight monthly decline

Home price index hits recession-era bottom in February

Posted: April 26th, 2011

ARTICLE, LA TIMES

The Standard & Poor’s/Case-Shiller index for 20 major U.S. cities, released Tuesday, showed prices dropped 3.3% from February 2010 and 1.1% from January amid weak demand for abodes and as foreclosures and other so-called distressed properties made up a large part of the market.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

U.S. Housing Prices Fell Again in January

Posted: March 29th, 2011

![]()

ARTICLE, NY TIMES

Housing prices slid in January for the sixth month in a row, putting them barely above the lows reached in the depths of the recession, according to data released Tuesday.

Fortune: It’s time to buy again

Posted: March 29th, 2011

ARTICLE, FORTUNE

…Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Home prices: The double-dip is near?

Posted: March 17th, 2011

![]()

ARTICLE, CNN/MONEY

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

Posted: December 31st, 2010

![]()

ARTICLE, WALL ST JOURNAL, 12.28.2010

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

U.S. Housing Market Double-Dip Unlikely Next Year, Wharton’s Wachter Says

Posted: December 31st, 2010

ARTICLE, BLOOMBERG, 12.31.2010

The U.S. housing market probably will avoid a “double-dip” next year as a recovery depends on job growth, said Susan Wachter, a real estate professor at the University of Pennsylvania’s Wharton School.

“Nationally, we’ll see a bumpy ride instead of a double- dip,” Wachter said in an interview from Philadelphia today on Bloomberg Television. “Jobs are key.”

Home Prices in U.S. Will `Bounce Along the Bottom,’ Case Says

Posted: December 1st, 2010

ARTICLE, BLOOMBERG, 11.30.2010

U.S. home prices are unlikely to fall much further in the next year even after a “discouraging” report on values in September, said Karl E. Case, the co-creator of the S&P/Case-Shiller Index.

“If I were betting even odds, I’d bet that we don’t have much further decline, but that we bounce along the bottom,” Case, a retired professor of economics at Wellesley College, said today in a Bloomberg Television interview on “Surveillance Midday” with Tom Keene.

Sequoia Investment Partners, December 2010 Investor Market Summary and Forecast

Posted: December 1st, 2010

OPINION, SREP, 12.01.2010

First and foremost, I would like to extend best holiday wishes to Sequoia’s friends, investors, and partners. We would like to wish all of you a healthy and fortuitous holiday season.

While we anticipate that 2011 will witness a continuation and expansion of the economic recovery, we continue to believe that lethargy is likely to define the domestic and global economic scene.

Sequoia Investment Partners, October 2010 Investor Market Summary and Forecast

Posted: October 28th, 2010

OPINION, SREP, 10.28.2010

Not surprisingly, the economic data continues to be mixed, with all eyes on the Federal Reserve, to see what, if any, additional stimulus endeavors they undertake. Most anticipate that they will purchase several hundred billion dollars of U.S. Treasuries in an effort to combat weak economic growth and deflation…..

Case Shiller Points to Housing Stability

Posted: October 28th, 2010

![]()

OPINION, SEEKING ALPHA, 10.27.2010

Taken together, these facts strongly suggest that the housing market stabilization we have observed over the last year or so is the real thing, not just a chimera.

Index Shows That U.S. Home Prices Weakened in August

Posted: October 28th, 2010

ARTICLE, ASSOC. PRESS, 10.26.2010

The Standard & Poor’s Case-Shiller 20-city home price index fell 0.2 percent in August from July. Fifteen of the cities showed monthly price declines. Prices are expected to drop further in the coming months.

Home Prices in U.S. Cooled in July After Tax Credit Expired

Posted: September 28th, 2010

ARTICLE, BLOOMBERG, 09.28.2010

The S&P/Case-Shiller index of property values increased 3.2 percent from July 2009, the smallest year-over-year gain since March, the group said today in New York. The gauge is a three- month average, which means the July data are still being influenced by transactions in May and June that may have benefitted from the government homebuyer incentive.

A Dream House After All: Karl Case Explains Why It’s a Great Time to Buy a Home, or Invest in Housing.

Posted: September 7th, 2010

![]()

OPINION, NY TIMES, 09.07.2010

But housing has perhaps never been a better bargain, and sooner or later buyers will regain faith, inventories will shrink to reasonable levels, prices will rise and we’ll even start building again. The American dream is not dead — it’s just taking a well-deserved rest.

Karl E. Case is a professor emeritus of economics at Wellesley and co-creator of Standard & Poor’s Case-Shiller housing index.

Chart: Latest Case Shiller Data

Posted: September 3rd, 2010

![]()

CHART, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

Home prices rise in June, but a drop may be looming

Posted: September 3rd, 2010

![]()

ARTICLE, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

Home prices tick up 1.3% in May

Posted: July 27th, 2010

![]()

ARTICLE, LA TIMES, 07.27.2010

Home prices tick up 1.3% in May

It was the second straight monthly increase, according to the Standard & Poor’s/Case-Shiller index of 20 U.S. cities, but experts warn it is not likely to last. Los Angeles, San Diego and San Francisco are among the gainers.

Home prices up 3.8% in April – but don’t celebrate

Posted: June 29th, 2010

![]()

ARTICLE, CNN/MONEY, 06.29.2010

That good news is tempered by a couple of factors. First, the one-year comparison was against a low-ebb mark. In April 2009, prices were just above a five-year low. Overall, prices are off 30% from their peak

Is the Housing Market on the Rebound?

Posted: May 26th, 2010

ARTICLE, TIME, 05.26.2010

A recent study of 92 economists by financial-products firm MacroMarkets found that on average housing prices are expected to drop slightly in 2010 and begin rising again next year. That means that for the first time in years someone who buys a house this spring will most likely see their home appreciate in the next year. And rising housing prices, just like falling ones, tend to feed on themselves.

Home Prices Show Softness Again

Posted: May 26th, 2010

![]()

ARTICLE, FORBES, 05.26.2010

The housing market is looking far better than it was a year ago, but there are troubling signs in renewed price weakness.

“It looks a little like a double-dip already,” economist Robert Shiller, the co-creator of the Case-Shiller index, said in an interview with the Associated Press. “There is a very real possibility of some more decline.”

Housing Prices Remain Weak

Posted: May 26th, 2010

![]()

ARTICLE, WSJ, 05.26.2010

“We’re just going to go through an adjustment period,” said Patrick Newport, an IHS Global Insight economist.

“After it settles, I think the market’s going to start growing sustainably because the [labor] market’s starting to create jobs,” he said.

Housing’s Dark Cloud

Posted: May 10th, 2010

![]()

ARTICLE, BOSTON HERALD, 05.10.2009

Housing experts say the end of the housing tax credit – which could have spurred as much as 70 percent of sales in the last four months – and thousands of homes facing foreclosure, could throw cold water on rising prices and sales. This perfect storm may set up a “double dip” housing recession

Bob Shiller’s History of Home Prices

Posted: April 14th, 2010

![]()

CHART: Robert Shiller’s History of U.S. Home Prices

Don’t Bet the Farm on the Housing Recovery by Robert Shiller of Yale University

Posted: April 12th, 2010

OPINION, By ROBERT J. SHILLER 04.09.2010 Yale University

MUCH hope has been pinned on the recovery in home prices that began about a year ago. A long-lasting housing recovery might provide a balm to households, mortgage lenders and the entire United States economy. But will the recovery be sustained?

Alas, the evidence is equivocal at best.

Case-Shiller Housing White Paper Year in Review 2009

Posted: January 16th, 2010

![]()

PAPER, CASE SHILLER YEAR IN REVIEW 2009

Standard & Poor’s chief economist, David Wyss, has provided us with his forecast for the residential housing market. His team expects housing sales and starts to drop over the winter, but to remain well above their early 2009 lows, and to recover in the spring.

The Rent-Price Index in U.S Housing Markets

Posted: February 16th, 2009

PAPER, STANDARD & POORS 02.2009

In this paper, the relationship between house prices and rents across eight major metropolitan areas in the U.S. is examined, and a rentprice index to provide the framework of our analysis is developed.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy