Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Housing industry recovering faster than many economists expected

Posted: October 18th, 2012

Housing is snapping back faster than many economists had expected, with home builders stepping up production of new homes nationally and fresh foreclosures in California falling to their lowest level since the early days of the bust.

To view this entire article, click on its TITLE above.

Homeownership likely to be delayed for ‘Generation Now’ members

Posted: May 27th, 2012

Most consumers in their 20s are stuck in a holding pattern, a retail industry consultant says. ‘Everything is delayed for them,’ she says.

CHICAGO — Maxine Lauer calls the group of consumers 15 to 34 “Generation Now” because they want what they want and they want it now.

Trouble is, “now” isn’t happening for them, especially for those in the middle of that range, their 20s, who might reasonably be expected to be thinking about buying their first homes.

Generally, though, that’s not something they’re doing, because most of them just can’t, said Lauer, whose Sphere Trending retail industry consulting firm in Waterford, Mich., has studied their attitudes in depth. Basically, she said, they’re stuck in a holding pattern.

“Everything is delayed for them,” Lauer said. “Homeownership is delayed, and they will rent longer. They’re delaying marriage, delaying kids. It’s because their peak earning years are being delayed.”

Qualifying for a mortgage has gotten much tougher, analysis shows

Posted: April 15th, 2012

![]()

The average successful applicant for a conventional home purchase mortgage in February had a FICO score of 764, well above what was once the norm, and a down payment of 22%.

WASHINGTON — How do you stack up as a potential mortgage candidate in this year’s increasingly tough underwriting environment? Do you have the right stuff — credit score, debt-to-income ratio, equity or down payment — to get you through the minefield?

A new statistical analysis, based on a large sample of all mortgage applications approved and denied in recent months, offers valuable benchmarks for anyone thinking about financing a home purchase or refinancing an existing loan. The study taps into data from the loan processing software used for roughly one-fifth of all new mortgage applications nationwide, supplied by the technology firm Ellie Mae Inc.

Investors flood Southern California housing market in December

Posted: January 23rd, 2012

A record number of investors and second-home buyers flooded the Southern California real estate market in December, though not enough to give sales in the region a bump over the same month a year earlier.

With the investor dominance, low-cost homes reigned. That helped push the region’s median home price back down to its lowest level in 12 months, according to San Diego real estate firm DataQuick.

Mixed-use project to get underway this month in downtown L.A.

Posted: January 15th, 2012

The $160-million One Santa Fe complex will consist of apartments, offices, shops and public outdoor spaces on Santa Fe Avenue between 1st and 4th streets.

Construction will begin this month on One Santa Fe, a long-anticipated $160-million apartment, office and retail development in the arts district of downtown Los Angeles.

The 790,000-square-foot complex will rise on four acres of land on Santa Fe Avenue between 1st and 4th streets that was leased from the Los Angeles County Metropolitan Transportation Authority.

Foreclosures expected to rise, pushing home prices lower

Posted: January 15th, 2012

Banks are getting more aggressive with the 3.5 million U.S. homes with seriously delinquent mortgages, setting the stage for a big wave of foreclosure action this year.

By E. Scott Reckard, Los Angeles Times

California and other states are likely to see an enormous wave of long-delayed foreclosure action in the coming year as banks deal more aggressively with 3.5 million seriously delinquent mortgages.

Scheduled foreclosure auctions soar in California

Posted: December 24th, 2011

Banks in November scheduled more than 26,000 homes to be sold at California foreclosure auctions, a 63% increase from October and a sign that a surge in discounted, bank-owned properties is on track to hit the market next year.

Stalled Hollywood Condo Project Reborn as Luxury Rentals

Posted: December 19th, 2011

ARTICLE, LA TIMES

A failed Hollywood condominium development that once symbolized the housing market collapse has been reborn as a $120-million upscale apartment and retail complex.

Construction on the former Madrone came to a halt around the end of 2009 even though the shell of the project was mostly complete. Developer John Laing Homes filed for bankruptcy and the scaffolding-swathed husk of the Madrone was left to weather the elements behind locked gates.

Historic United Artists building sells for $11 million. Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

Posted: October 17th, 2011

ARTICLE, LA TIMES

A storied Los Angeles theater and office complex built by silent film stars that was later owned by one of the city’s most popular televangelists has been purchased by East Coast investors.

Also: A luxury housing complex near USC is bought, and a study of CBRE Group’s portfolio finds that environmentally sustainable office buildings generate stronger investment returns.

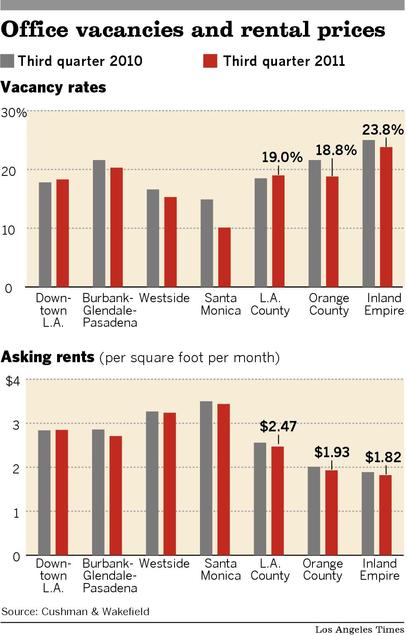

Southland office rents, occupancy rates stay low

Posted: October 16th, 2011

ARTICLE, LA TIMES

It was another stale quarter for most Southern California office landlords as rents and occupancy remained stalled at low levels, except in neighborhoods favored by technology and digital media companies.

The soft market was a boon for tenants willing to sign leases. But few companies are finding the need to expand their quarters with the economy tepid and hiring at a standstill.

Business bosses “have gone on a personnel diet,” said Jim Kruse of CBRE Group Inc., the real estate brokerage formerly known as CB Richard Ellis. “They are trying to get through and maintain as much market share as they can without putting a lot of cash into operations.”

Dot-coms want the beach in their address

Posted: October 16th, 2011

ARTICLE, LA TIMES

The commercial real estate rental market is booming in Santa Monica, where the office vacancy rate is a fraction of the L.A. County average. Tech and entertainment firms like the lifestyle.

Compared with most of the region’s white-collar office market, the less corporate environs of Santa Monica and Venice are looking sharp.

Technology and entertainment companies that long ago mastered the knack of making money without dressing up are now paying top dollar to rent space in some of Southern California’s most desirable neighborhoods.

Home foreclosure proceedings on the rise again

Posted: October 13th, 2011

ARTICLE, LA TIMES

After months of a foreclosure slowdown caused by investigations into improper practices, the nation’s home-repossession machinery is beginning to move again — particularly in states such as California where courts don’t oversee the process.

The number of homes entering the foreclosure process surged 19% in the third quarter compared with the previous quarter in states where foreclosures take place largely outside of the courtroom, according to RealtyTrac, an Irvine information firm. These nonjudicial states include California, Nevada, Arizona, Oregon and Washington.

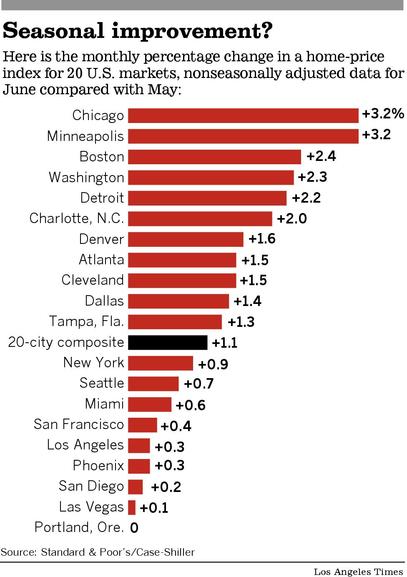

Home prices notch third straight monthly gain

Posted: September 1st, 2011

A key index of home prices in 20 metropolitan areas rose 1.1% from May to June. Real estate experts say the improvement is seasonal and that prices could fall again as sales slow in the fall and winter.

Foreclosure reforms may be coming to a head

Posted: August 18th, 2011

Getting banks, investors and borrowers together to work out a solution that benefits them all is the most promising idea to emerge since the housing market first crashed.

Home prices rise again, but experts are unimpressed

Posted: July 28th, 2011

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

San Pedro apartment tower sells for $80.1 million, almost $100 million less than cost.

Posted: June 8th, 2011

The Vue, at 5th and Palos Verdes streets, was completed at a cost of $175 million in 2008 before the real estate crisis. The building was acquired by San Francisco investors after the developers lost it to foreclosure.

ARTICLE, LA TIMES

Home price index hits recession-era bottom in February

Posted: April 26th, 2011

ARTICLE, LA TIMES

The Standard & Poor’s/Case-Shiller index for 20 major U.S. cities, released Tuesday, showed prices dropped 3.3% from February 2010 and 1.1% from January amid weak demand for abodes and as foreclosures and other so-called distressed properties made up a large part of the market.

KB Home unexpectedly reports profit, has eye on California

Posted: January 14th, 2011

ARTICLE, LA TIMES

Despite a challenging period for the nation’s home builders, Los Angeles-based KB Home unexpectedly reported a profit for its fiscal fourth quarter and predicted that California would be a key part of its strategy in 2011.

Luxury home prices are still heading down

Posted: December 14th, 2010

![]()

While Southland housing values overall have rebounded from recent lows, those in the upper end of the market may not yet have hit bottom. Some experts don’t see a turnaround for at least another year.

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

Percent of Americans likely to rent their next home grows, survey indicates

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

The percentage of Americans who said their next home would probably be a rental has grown to 33% from 30% since a similar survey came out in April. And 60% of those who rent said they’d continue to do that rather than buy a house if they were to move, up 6 points from April.

‘Shadow’ supply of 2.1 million homes potentially looms

Posted: November 23rd, 2010

![]()

ARTICLE, LA TIMES, 11.22.2010

This “shadow inventory” of residential real estate — in which the property is either in foreclosure, has a loan 90 days past due or has been taken back by a lender and is not listed for sale — stood at an eight-month supply at the end of August, according to the Santa Ana mortgage research firm CoreLogic, which released the data. That was an increase from 1.9 million, a five-month supply, a year earlier.

Foreclosure activity up across most US metro areas

Posted: October 29th, 2010

![]()

ARTICLE, LA TIMES, 10.28.2010

The foreclosure crisis intensified across a majority of large U.S. metropolitan areas this summer, with Chicago and Seattle — cities outside of the states that have shouldered the worst of the housing downturn — seeing a sharp increase in foreclosure warnings.

Chart: Latest Case Shiller Data

Posted: September 3rd, 2010

![]()

CHART, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

Home prices rise in June, but a drop may be looming

Posted: September 3rd, 2010

![]()

ARTICLE, LA TIMES, 09.03.2010

The Standard & Poor’s/Case-Shiller index shows a modest 1% gain over May figures, with prices in Los Angeles, San Diego and San Francisco increasing. However, some experts predict that the expiration of federal tax credits will have a negative effect.

California leading employment indicator shows growth to come

Posted: August 5th, 2010

![]()

ARTICLE, LA TIMES, 08.05.2010

…..an employment indicator released Wednesday by Chapman University’s A. Gary Anderson Center for Economic Research shows that employment in California will continue to tick up this year. It indicates that year-over-year job growth will turn positive in the fourth quarter this year, something that hasn’t happened consistently in the state since 2007.

Mortgage defaults in California at 3-year low

Posted: July 23rd, 2010

![]()

ARTICLE, LA TIMES, 07.23.2010

Banks are pushing alternatives such as loan modification programs and short sales ….. “The most important thing is the housing market has stabilized, that house prices are up and not down anymore,” said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business.

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

Commercial real estate development stalled until 2012, architects say

Posted: July 19th, 2010

![]()

ARTICLE, LA TIMES, 07.19.2010

With vacancies still on the rise in commercial properties in most parts of the U.S., construction of new buildings is expected to be rare this year and next, the American Institute of Architects said Wednesday.

Deeds-in-lieu gain favor with lenders as alternative to foreclosure

Posted: June 29th, 2010

![]()

ARTICLE, LA TIMES, 06.28.2010

….a simple message: Let’s bypass all the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home and we’ll call it a deal. We won’t come after you to collect any deficiency between what you owe us on the mortgage and what we obtain from the home sale. We might even be able to wrap up the whole transaction in as little as 30 to 45 days. How about it?

The bottom is near — yet so far — for Inland Empire apartments, report says

Posted: May 23rd, 2010

![]()

latimes.com

ARTICLE, LA TIMES, 05.23.2010

Apartment occupancy and rents in the Inland Empire will continue to fall this year before recovering in 2011 and 2012, commercial real estate brokerage Marcus & Millichap said in a report Thursday.

What Kind of Homeowners Choose to Default?

Posted: May 23rd, 2010

![]()

ARTICLE, LA TIMES, 05.23,2010

In fact, he says, their decisions to pull the plug “may not turn out to be economically rational.” But they walk anyway, in large part because they are at the end of their emotional rope. They’ve transitioned from feelings of anxiety and hopelessness to outright anger at their lenders, the government and/or a financial system they consider to be unfair.

L.A. Should Abandon Rent Control

Posted: May 21st, 2010

![]()

OPINION, LA TIMES, 05.21.2010

Politicians should work with the private sector to encourage affordable housing and rent stability through productive incentives.

By Eric Sussman of Sequoia’s Board of Advisors

Chart of Sales Spike as a Funtion of Expiring Tax Credit

Posted: May 18th, 2010

New-home buyers reemerge in Southern California

Posted: May 17th, 2010

![]()

ARTICLE, LA TIMES, 05.13.2010

Location is also key — buyers don’t want extremely long commutes, analysts say.

Would You Have Bought It? Case Study of a Flip: 4832 2nd Ave, Los Angeles CA

Posted: May 9th, 2010

![]()

SEQUOIA STRATEGY, 05.09.2010

It’s not often an REO investment makes the front page of the Sunday edition of a national paper, but that’s exactly what happened on April 25th 2010 in the Los Angeles Times. So we thought it would be a great opportunity to do a quick case study on this particular purchase

California added 393,000 people in 2009

Posted: April 30th, 2010

![]()

ARTICLE, LA TIMES 04.30.2010

Officials said the state’s housing growth in 2009 underscored the severity of the housing downturn. Only 62,300 new homes were added in California in 2009

Los Angeles House Flipping Hot Spots

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Map of zip codes with the most flipping activity

Flipping houses is back in South Los Angeles

Posted: April 26th, 2010

![]()

ARTICLE, LA TIMES, 4.25.2010

Along with low prices, real estate investors are drawn to the area because of its proximity to the ports of Los Angeles and Long Beach, Los Angeles International Airport and other job centers, including factories.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

Foreclosure activity up sharply despite loan modification program

Posted: April 16th, 2010

![]()

ARTICLE, LA TIMES 04.15.2010

The number of U.S. households caught in the foreclosure process during the first quarter jumped 7% from the prior quarter as activity increased sharply in March, a real estate firm will report Thursday.

New wave of foreclosures by end of 2010 is feared

Posted: April 12th, 2010

![]()

ARTICLE, LA TIMES 02.16.2010

Experts fear that a new wave of foreclosures will hit this year as prolonged unemployment makes it difficult for millions of homeowners to pay their mortgages — and many of them aren’t likely to get much help from a federal program aimed at keeping them in their houses.

As Fed’s mortgage purchases end, eyes turn to investors

Posted: April 12th, 2010

ARTICLE, LA Times March 31, 2010

The government’s $1.25-trillion program to prop up the housing market by purchasing mortgages came to an end Wednesday — in a small, messy room at the Federal Reserve Bank of New York with four desks and a Nerf basketball hoop.

Foreclosure auction of Nicolas Cage’s mansion is a flop

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

Nicolas Cage is leaving Bel-Air. And not by choice.

Southern California apartment rents are expected to keep falling

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

A study shows the average cost dropping as much as 3.5% in L.A. County this year, 2.4% in Orange County and less than 1% in San Bernardino and Riverside counties but inching up in San Diego County.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy