Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Getting Warmer: Where Rent Prices are Hot (and Where They’re Cool)

Posted: October 10th, 2012

For those looking to live in a locale with an endless summer, it doesn’t come cheap.

On average, renters in Orange County, Calif. pony up more than $1,650 a month for an average two-bedroom apartment, according to new data from Homes.com and ForRent.com. To cover housing costs alone, residents have to rake in about $32 an hour, no small feat in a wage-depressed economy.

Eric Sussman Cover Interview in GlobeSt.com

Posted: August 23rd, 2012

EXCLUSIVE

How to Capitalize on Multifamily Investment

LOS ANGELES-The high tide of single-family home foreclosures has turned five million homeowners to renters, and likely longer-term, if not permanent, renters. So says Eric Sussman, managing partner at Sequoia Real Estate Partners. Sussman recently chatted with GlobeSt.com on the subject of multifamily investment and how investors can capitalize.

Finally, It Is Time to Buy a House

Posted: August 13th, 2012

Warren Buffett famously once said: “Be fearful when others are greedy, be greedy when others are fearful.”

And if you’re not instinctively scared of the housing market, then global warming, saturated fat, running with scissors and the bogeyman probably aren’t keeping you awake at night, either.

The fact that everyone is scared to dabble in—much less commit to—housing makes it a close-to-perfect investment based on Mr. Buffett’s principle. But buying real estate is a good long-term investment for many more reasons, some of which have only become apparent in recent weeks.

Harvard 2012 State of the Nation’s Housing

Posted: June 14th, 2012

logo.jpg”>

After several false starts, there is reason to believe that 2012 will mark the beginning of a true housing market recovery. Sustained employment growth remains key, providing the stimulus for stronger household growth and bringing relief to some distressed homeowners.

Many rental markets have already turned the corner, giving a lift to multifamily construction but also eroding affordability for many low-income households. While gaining ground, the homeowner market still faces multiple challenges. If the broader economy weakens in the short term, the housing rebound could again stall.

New American Dream Is Renting to Get Rich

Posted: February 18th, 2012

Examining 250 properties around the U.S., and going through close to 40 client files to project the financial impact of owning real estate versus liquidating it, Arzaga, an adjunct professor in personal finance at the University of California at Berkeley, found that, “100 percent of the time it was better to rent, rather than own.”

That’s right: 100 percent.

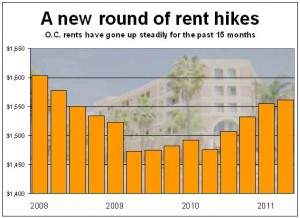

O.C. Apartments see largest rent hikes in 4.5 years

Posted: January 23rd, 2012

Another round of rent hikes occurred at Orange County’s large apartment complexes last fall, reflecting an ever-tightening market as vacancies continued to fall.

The average asking rent for a large-complex unit in Orange County was $1,561 a month, according to apartment tracker RealFacts.

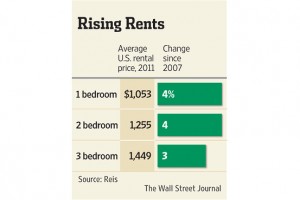

Navigating a Tight Rental Market

Posted: January 23rd, 2012

The rental market is the tightest it’s been in more than a decade, with only 5.2% of apartments nationwide vacant at the end of 2011, down from a high of 8% in 2009, according to real-estate data firm Reis.

Demand is up as the housing crisis and tighter lending standards have left many people unable to or wary of purchasing a home. And higher demand means average rents are rising, too.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

A Market Builds for Single-Family Rentals

Posted: January 14th, 2012

![]()

Waypoint purchased this Antioch, Calif., home for $140,000 and is marketing the rental at $2,049 a month.

SREP: The big money is starting to figure it out. This rental generates over 10% a year in net cash flow.

Private-Equity Fund GI Partners Is Investing in Waypoint, Which Buys Foreclosed Homes and Then Rents Them Out

A private-equity fund that generated big profits by scooping up empty data centers after the technology-stock bust in 2000 is now making a big bet on foreclosed homes.

The fund, GI Partners in Menlo Park, Calif., plans to announce on Wednesday a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the nascent single-family rental space.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

Big Developers Dabble in Apartment Market

Posted: December 24th, 2011

![]()

SREP Note: SREP Funds typically acquire and reposition properties for less than the cost of replacement.

ARTICLE, WSJ

Some of the leading U.S. developers of malls and office properties are moving into the apartment business, where demand for new projects is stronger than any other commercial-real-estate sector.

Fueled by the decline in home ownership, the boom in apartment building is attracting commercial-property companies such as Boston Properties Inc., Mack-Cali Realty Corp., SL Green Realty Corp., Simon Property Group Inc. and Macerich Co. They all have either acquired, completed or broken ground on apartment buildings in recent months, or plan to do so next year.

Multifamily Construction Drives Housing Starts Jump

Posted: December 24th, 2011

![]()

ARTICLE, WSJ

SREP Note: We feel this article is important for investors to note because typically SREP funds acquire and reposition properties for less than their replacement cost.

U.S. home building climbed to the highest level in 19 months during November and construction permits grew, with most of the increase in housing starts coming from multifamily construction.

Home construction last month increased 9.3% to a seasonally adjusted annual rate of 685,000 from October, the Commerce Department said Tuesday. The results were better than forecast. Economists surveyed by Dow Jones Newswires expected housing starts would rise by 0.3% to an annual rate of 630,000.

The increase in November was driven by a 25.3% increase in multi-family homes with at least two units, a volatile part of the market. Construction of single-family homes, which made up about 65% percent of the market, rose only 2.3%.

The Return of Rehab

Posted: December 24th, 2011

ARTICLE, MULTIFAMILY EXECUTIVE

Value-add deals resume as rents trend higher.

With the benefit of hindsight, the idea of “trending rents” was viewed as a deadly sin throughout the downturn.

The irrational exuberance of the last boom period inspired some wildly inaccurate underwriting on rent growth, which often culminated in delinquencies and default. Over the last year, however, value-add rehabs have come back into the spotlight as rent growth resumed in earnest. And that rebound in fundamentals over the last year has been so swift it’s defied upside expectations and inspired further confidence to again start banking on rent growth.

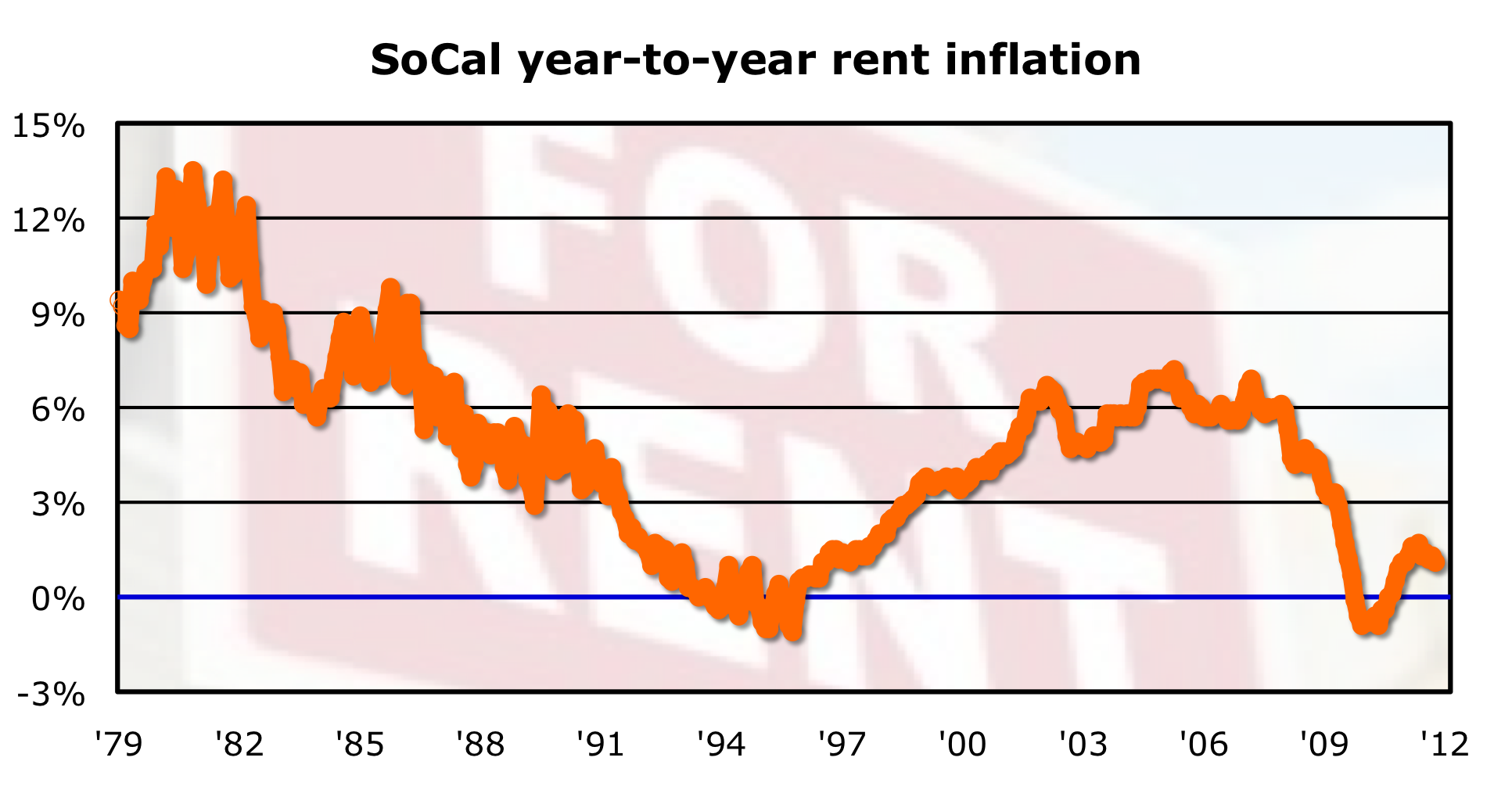

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

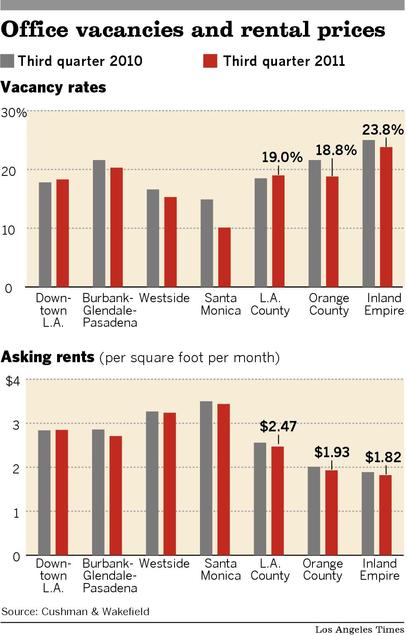

Southland office rents, occupancy rates stay low

Posted: October 16th, 2011

ARTICLE, LA TIMES

It was another stale quarter for most Southern California office landlords as rents and occupancy remained stalled at low levels, except in neighborhoods favored by technology and digital media companies.

The soft market was a boon for tenants willing to sign leases. But few companies are finding the need to expand their quarters with the economy tepid and hiring at a standstill.

Business bosses “have gone on a personnel diet,” said Jim Kruse of CBRE Group Inc., the real estate brokerage formerly known as CB Richard Ellis. “They are trying to get through and maintain as much market share as they can without putting a lot of cash into operations.”

Dot-coms want the beach in their address

Posted: October 16th, 2011

ARTICLE, LA TIMES

The commercial real estate rental market is booming in Santa Monica, where the office vacancy rate is a fraction of the L.A. County average. Tech and entertainment firms like the lifestyle.

Compared with most of the region’s white-collar office market, the less corporate environs of Santa Monica and Venice are looking sharp.

Technology and entertainment companies that long ago mastered the knack of making money without dressing up are now paying top dollar to rent space in some of Southern California’s most desirable neighborhoods.

Home ownership: Biggest drop since Great Depression

Posted: October 13th, 2011

ARTICLE, CNN MONEY

The percentage of Americans who owned their homes has seen its biggest decline since the Great Depression, according to the U.S. Census Bureau.

The rate of home ownership fell to 65.1% in April 2010, 1.1 percentage points lower than it was in 2000. The decline was the biggest drop since the 1930s, when home ownership plunged 4.2%.

The most recent decade-over-decade drop, however, only tells half the story.

Demand For Apartments Rises All Over, Despite Economy

Posted: September 16th, 2011

ARTICLE, INVESTORS BUSINESS DAILY

Rising renter demand is filling apartment buildings around the U.S., in defiance of the economic malaise.

Vacancy rates are shrinking all over, in tight markets such as Minneapolis and loose ones like Phoenix.

Buying real estate a better deal than renting in 74% of major US cities

Posted: August 18th, 2011

Buying real estate continues to be cheaper than renting in the vast majority of major U.S. cities, according to a quarterly rent vs. buy index from real estate search and marketing site Trulia.

The index compared the median list price and the median annualized rent on a two-bedroom apartment, condominium or townhouse in the country’s 50 most populous cities. According to the index, the cost of buying was less than renting in 37 of the 50 cities (74 percent) as of July 1, 2011. About the same share, 78 percent, favored buying over renting in Trulia’s last index report, released in April.

Sequoia Real Estate Partners, Q3 2011 Investor Market Summary and Forecast

Posted: July 13th, 2011

OPINION, SREP

It is not surprising, therefore, that the fundamentals surrounding multi-family residential properties continue to improve, with continued increases in occupancy rates in nearly all markets. While rental growth has been modest, reflecting the high levels of unemployment and stagnant levels of household income, we believe that rents will eventually need to increase along with the drop in vacancy rates and, perhaps more critically, the significant lack of new supply coming on line.

National rental prices climb in June

Posted: July 13th, 2011

ARTICLE, INMAN NEWS

Rental listing prices nationwide rose 6.7 percent year-over-year in June, according to a report from real estate search site HotPads.

The report was based on the median listing prices of 500,000 rentals on HotPads.com across major U.S. metro areas between June 2010 and June 2011.

San Francisco’s rent riot

Posted: July 13th, 2011

![]()

ARTICLE, FORTUNE

Whether we’re living through another tech bubble remains hotly contested, but there’s no denying its impact on one market: rental apartments in San Francisco. With Twitter, Zynga, and numerous other local startups hiring in droves, all those newbies need somewhere to live.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Renew your lease – rents could rise 10%

Posted: March 20th, 2011

![]()

ARTICLE, CNN/MONEY

Renters beware: Double-digit rent hikes may be coming soon.

Already, rental vacancy rates have dipped below the 10% mark, where they had been lodged for most of the past three years.

“The demand for rental housing has already started to increase,” said Peggy Alford, president of Rent.com.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

A Dream House After All: Karl Case Explains Why It’s a Great Time to Buy a Home, or Invest in Housing.

Posted: September 7th, 2010

![]()

OPINION, NY TIMES, 09.07.2010

But housing has perhaps never been a better bargain, and sooner or later buyers will regain faith, inventories will shrink to reasonable levels, prices will rise and we’ll even start building again. The American dream is not dead — it’s just taking a well-deserved rest.

Karl E. Case is a professor emeritus of economics at Wellesley and co-creator of Standard & Poor’s Case-Shiller housing index.

Sequoia Investment Partners, August 2010 Investor Market Summary and Forecast

Posted: August 18th, 2010

OPINION, SREP, 08.18.2010

So what does this mean for residential real estate? Modestly lower prices, as slackening demand and continued foreclosures are offset by historically low rates and available financing. Meanwhile, rents have stabilized, reflecting an improving economy (even a modest recovery translates into a stronger rental market). In short, we are finally seeing some promising investment opportunities in both the multi- and single-family markets…….

Apartment owners see light at the end of the tunnel

Posted: August 10th, 2010

INTERVIEW, OC REGISTER, 08.10.2010

Q: When will the market turn around?

A: The market has to bottom first. Effective rents in O.C. started getting choppy as far back 2007 and peaked in Q4’07 at $1,685 per month. They were at $1,508 per month for Q2’10, so we would have to see almost 12 percent rent growth to get back to the prior peak. The market data would suggest that we have bottomed and should start to see some growth going forward.

Sequoia Investment Partners, July 2010 Investor Market Summary and Forecast

Posted: July 6th, 2010

OPINION, SREP, 07.07.2010

However, in times like these I am always reminded of Warren Buffett’s sage advice to be “greedy when others are fearful, and fearful when others are greedy.” That is, with so much uncertainty comes substantial opportunity, and it is my view that longer-term trends are very favorable for those willing to commit capital to value-add residential real estate, despite the likelihood for continued volatility and anemic economic growth at best during the next couple of years. These trends are as follows: …..

L.A. Should Abandon Rent Control

Posted: May 21st, 2010

![]()

OPINION, LA TIMES, 05.21.2010

Politicians should work with the private sector to encourage affordable housing and rent stability through productive incentives.

By Eric Sussman of Sequoia’s Board of Advisors

In foreclosure crisis, demand for family homes in Phoenix rises

Posted: May 3rd, 2010

![]()

ARTICLE, ARIZONA REPUBLIC, 05.03.2010

Since September, the number of available rental homes in metropolitan Phoenix has dropped by 40 percent, and probably even more than that when it comes to three- to four-bedroom homes in desirable neighborhoods.

The sharp drop is another ripple effect of the foreclosure crisis.

In Sour Home Market, Buying Often Beats Renting

Posted: April 22nd, 2010

![]()

ARTICLE, NY TIMES 4.20.2010

In some once bubbly markets, prices have fallen so far that buying a home appears to be a bargain, based on a New York Times analysis of prices and rents in 54 metropolitan areas.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

Renting: The new American dream?

Posted: April 20th, 2010

![]()

OPINION, PAUL LA MONICA CNN/MONEY

“This is a frugal recovery. People are more reluctant to buy homes as they would in a normal recovery,” Leamer said. “If you don’t have a job or are worrying about your job, you’re not going to buy a home. That’s the ultimate statement of optimism about the future.” Add that up and it’s reasonable to expect a rental boom that could last for some time.

Using REITS to asses the risk and return performance of real estate

Posted: April 16th, 2010

![]()

PAPER, UCLA ZIMAN CENTER FOR REAL ESTATE

“We find that the analyses based on REITs give notably different results from those based on SCS. In particular, real estate investment returns are higher and more volatile, and both the associated market and idiosyncratic risk are higher.”

Rent-Price Ratios and the Earnings Yield on Housing

Posted: April 16th, 2010

PAPER, USC

Rent-Price Ratios and the Earnings Yield on Housing

“I Understand” by Tom Barrack jr. of Colony Capital

Posted: April 15th, 2010

OPINION: However, the most salient and timeless answer echoes from the soft and timid voice of Chance the Gardener, Peter Sellers’ character in the famous movie “Being There.”

“Cash for Keys” Aids Home Borrowers, Investors

Posted: April 12th, 2010

ARTICLE, REUTERS 03.12.2010

Jon Daurio, chief executive officer of mortgage investor Kondaur Capital Corp., recently offered a $4,000 check to Barry Culver for the deed to his Bryan, Ohio house.

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Southern California apartment rents are expected to keep falling

Posted: April 12th, 2010

ARTICLE, LA Times 04.08.2010

A study shows the average cost dropping as much as 3.5% in L.A. County this year, 2.4% in Orange County and less than 1% in San Bernardino and Riverside counties but inching up in San Diego County.

The Rent-Price Index in U.S Housing Markets

Posted: February 16th, 2009

PAPER, STANDARD & POORS 02.2009

In this paper, the relationship between house prices and rents across eight major metropolitan areas in the U.S. is examined, and a rentprice index to provide the framework of our analysis is developed.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy