Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Archstone buys apartment complexes in Venice, Marina del Rey

Posted: October 17th, 2012

Archstone adds to its Southern California portfolio, spending more than $100 million on the two properties that combined provide 275 units.

Colorado apartment landlord Archstone broadened its Southern California empire this month by spending more than $100 million on seaside properties in Venice and Marina del Rey.

Archstone, which operates upscale apartments in coastal markets, bought the Frank, a 70-unit complex on Rose Avenue in Venice, for $56.2 million. It also purchased the Bay Club, which has 205 units — and 207 boat slips — on Tahiti Way in Marina del Rey for $43.95 million.

Rents soar as foreclosure victims, young workers seek housing

Posted: May 7th, 2012

Few new units and tight standards for home loans add to the pressure. The average monthly U.S. rent is at an all-time high, and a 10% jump in Los Angeles County over the next two years is forecast.

Urban Land Institute, 2012 Emerging Trends in Real Estate

Posted: January 19th, 2012

Interviewees go totally gaga over apartments: buy class A, value-enhance class B, develop from scratch, purchase in infill areas, acquire in gateway cities, or hold in lower-growth markets. “Even buy class C and upgrade, spend a little more, hold a little longer—demand will be there.”

Jones Lang & Lasalle, Apartment Outlook Survey 2012

Posted: January 19th, 2012

Multifamily is, and will remain, the belle of the ball in the commercial real estate sector in the year ahead, according to the respondents of our Apartments Outlook 2012 Survey.

Marcus & Millshap 2012 National Apartment Report

Posted: January 19th, 2012

Proven sustainability in apartment performance, confidence in property values, and access to low cost debt spurred investors to seek arbitrage through value-add strategies.

Mixed-use project to get underway this month in downtown L.A.

Posted: January 15th, 2012

The $160-million One Santa Fe complex will consist of apartments, offices, shops and public outdoor spaces on Santa Fe Avenue between 1st and 4th streets.

Construction will begin this month on One Santa Fe, a long-anticipated $160-million apartment, office and retail development in the arts district of downtown Los Angeles.

The 790,000-square-foot complex will rise on four acres of land on Santa Fe Avenue between 1st and 4th streets that was leased from the Los Angeles County Metropolitan Transportation Authority.

2011 Q4 Update and 2012 Forecast

Posted: December 31st, 2011

UPDATE & OPINION

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another single-family home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows:

Meeting the Demand in Multifamily: The Investment Mentality

Posted: December 24th, 2011

SREP Note: An important market signal.

Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey—the experts weigh in

Rising rental rates combined with declining home ownership rates are sounding a clarion call for continued investment in the multifamily sector, according to respondents of Jones Lang LaSalle/RealShare APARTMENTS Outlook 2012 Survey. The survey, completed by more than 150 private investors, real estate brokers, developers, REIT and institutional investors, was conducted in conjunction with RealShare APARTMENTS 2011 Conference, held recently in Los Angeles.

Multifamily Construction Drives Housing Starts Jump

Posted: December 24th, 2011

![]()

ARTICLE, WSJ

SREP Note: We feel this article is important for investors to note because typically SREP funds acquire and reposition properties for less than their replacement cost.

U.S. home building climbed to the highest level in 19 months during November and construction permits grew, with most of the increase in housing starts coming from multifamily construction.

Home construction last month increased 9.3% to a seasonally adjusted annual rate of 685,000 from October, the Commerce Department said Tuesday. The results were better than forecast. Economists surveyed by Dow Jones Newswires expected housing starts would rise by 0.3% to an annual rate of 630,000.

The increase in November was driven by a 25.3% increase in multi-family homes with at least two units, a volatile part of the market. Construction of single-family homes, which made up about 65% percent of the market, rose only 2.3%.

The Return of Rehab

Posted: December 24th, 2011

ARTICLE, MULTIFAMILY EXECUTIVE

Value-add deals resume as rents trend higher.

With the benefit of hindsight, the idea of “trending rents” was viewed as a deadly sin throughout the downturn.

The irrational exuberance of the last boom period inspired some wildly inaccurate underwriting on rent growth, which often culminated in delinquencies and default. Over the last year, however, value-add rehabs have come back into the spotlight as rent growth resumed in earnest. And that rebound in fundamentals over the last year has been so swift it’s defied upside expectations and inspired further confidence to again start banking on rent growth.

Stalled Hollywood Condo Project Reborn as Luxury Rentals

Posted: December 19th, 2011

ARTICLE, LA TIMES

A failed Hollywood condominium development that once symbolized the housing market collapse has been reborn as a $120-million upscale apartment and retail complex.

Construction on the former Madrone came to a halt around the end of 2009 even though the shell of the project was mostly complete. Developer John Laing Homes filed for bankruptcy and the scaffolding-swathed husk of the Madrone was left to weather the elements behind locked gates.

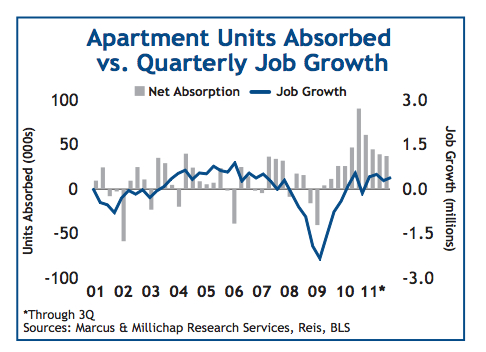

Apartments Surmount Economic Headwinds to Enter Full Expansion Cycle

Posted: November 18th, 2011

RESEARCH, MARCUS & MILLICHAP

Apartments undeterred by slower economic growth, post universal gains in net absorption. The apartment sector is benefitting from the convergence of several macro demand trends energizing rental markets across the country. The sector largely powered through the summer’s economic pause as net absorption recorded strong gains in the third quarter. Leasing activity did lose some pace from the second quarter, but given the weakness of the labor market and the uncertainty wrought by anemic GDP and crises on both domestic and international fronts, the sector secured enough traction to drive lower vacancy and solid rent growth. Tight

supply conditions will continue to bolster apartment performance, similar to other property sectors, but apartments are thriving from profound shifts in demographic, economic and social patterns.

California housing starts up 10% on multifamily strength

Posted: October 31st, 2011

![]()

California housing starts rose 10% in September from a year earlier as apartment and condominium construction surged, offsetting a decline in single-family homes, according to data from the California Building Industry Association.

Permits for single-family homes fell 16% from September 2010, totaling 1,463, while multifamily permits rose 45% from a year earlier, to 1,828, statistics compiled by the Construction Industry Research Board show.

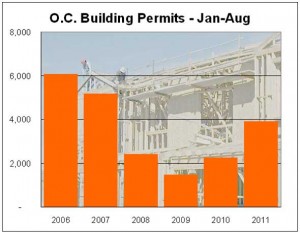

Apartments push O.C. homebuilding up 74%

Posted: September 27th, 2011

ARTICLE, OC REGISTER

Homebuilders have received permits to build 3,901 housing units in Orange County this year so far, up 73.7% from the same period in 2010, Construction Industry Research Board figures show.

In dollar terms, the estimated value of proposed homebuilding this year totaled $694 million through August, a 38.3% jump from 2010 levels for that period.

Coming Next: The Landlord’s Rental Market

Posted: September 12th, 2011

![]()

Apartment landlords appear to be among the only commercial property owners able to sign new tenants amid the sluggish economy.

FHA multifamily loan originations at record high

Posted: September 12th, 2011

ARTILCE, REUTERS

The Federal Housing Administration has backed a record $10.5 billion in multifamily rental housing loans during its 2011 fiscal year, the agency said on Tuesday.

The rise in loans for multifamily units reflects an underlying trend in demand for rental property.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy