Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

U.S. home prices make biggest jump in 6 years

Posted: September 4th, 2012

Nationwide home prices shot up 3.8% in July, making their largest year-over-year leap since 2006, according to real estate data provider CoreLogic.

The gain marks the fifth straight rise in the gauge, part of a positive swing following a year and a half of slumps. The last time prices rose so much was in August 2006, when they jumped 4.1%.

Prices in California bounded up 4.4%. Without distressed sales – including foreclosures and short sales – national prices were up 4.3% compared with last July.

Shortage of homes for sale creates fierce competition

Posted: June 10th, 2012

The newest problem for the slowly improving housing market isn’t a shortage of serious buyers, it’s a shortage of good homes.

Would-be buyers are packing open houses and scrambling to make offers on properties before they are even listed. Bidding wars are erupting. And real estate agents are vying fiercely to represent the few sellers that do exist.

The Economics and Opportunities in Multifamily Real Estate

Posted: May 17th, 2012

VIDEO

Eric Sussman, Managing Partner Sequoia Real Estate Partners and Senior Lecturer in Real Estate and Advanced Accounting at UCLA’s Anderson School of Management discusses the economics and trends that have created tremendous opportunity in the Multifamily (apartment) market and how to best capitalize on it.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

Mixed-use project to get underway this month in downtown L.A.

Posted: January 15th, 2012

The $160-million One Santa Fe complex will consist of apartments, offices, shops and public outdoor spaces on Santa Fe Avenue between 1st and 4th streets.

Construction will begin this month on One Santa Fe, a long-anticipated $160-million apartment, office and retail development in the arts district of downtown Los Angeles.

The 790,000-square-foot complex will rise on four acres of land on Santa Fe Avenue between 1st and 4th streets that was leased from the Los Angeles County Metropolitan Transportation Authority.

Scheduled foreclosure auctions soar in California

Posted: December 24th, 2011

Banks in November scheduled more than 26,000 homes to be sold at California foreclosure auctions, a 63% increase from October and a sign that a surge in discounted, bank-owned properties is on track to hit the market next year.

SoCal rents rise for 14th straight month

Posted: November 16th, 2011

ARTICLE, OC REGISTER

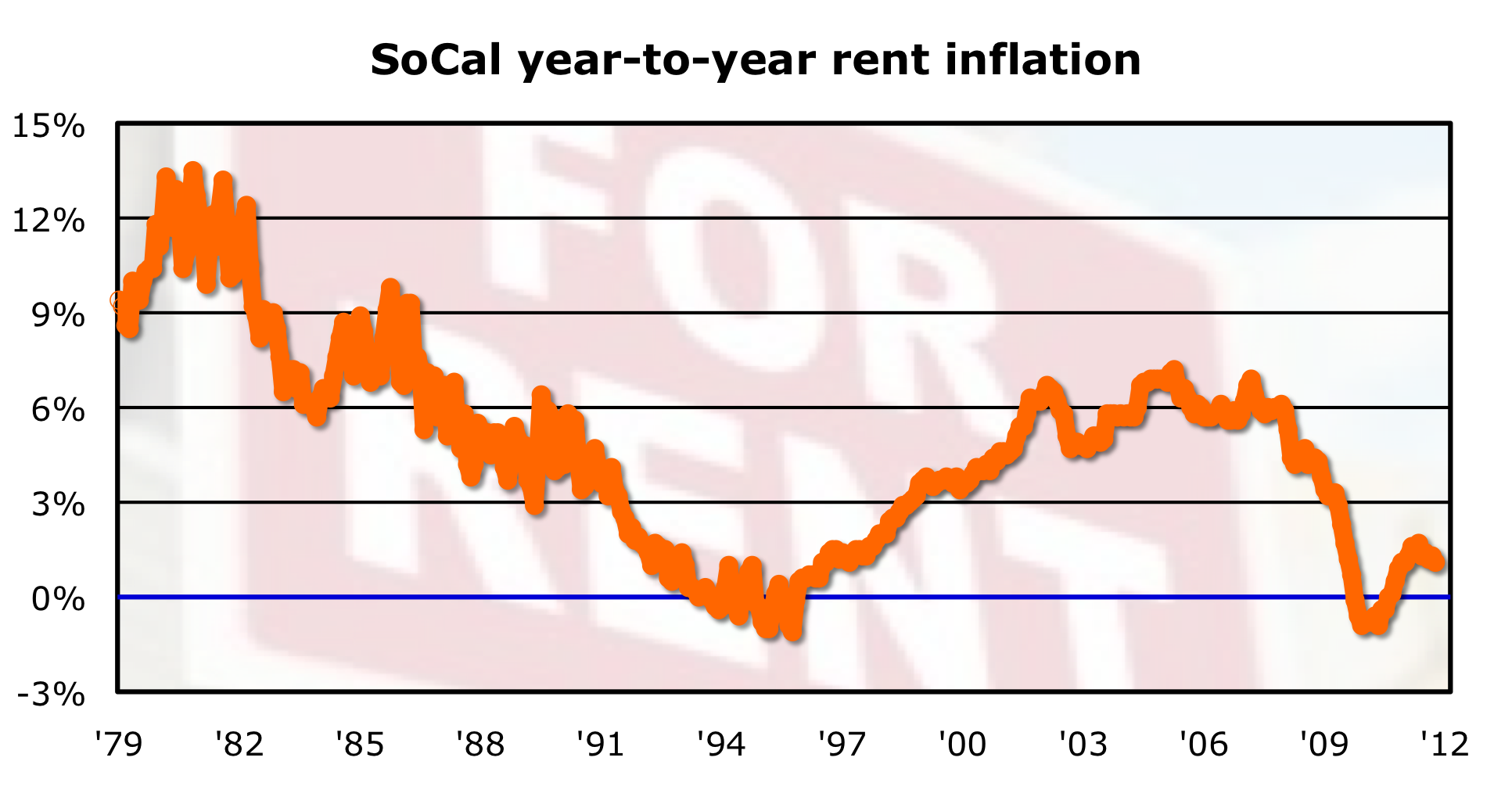

Rents in Southern California rose on an annual basis for the 14th consecutive month, the U.S. Bureau of Labor Statistics reports.

The rent slice of the regional Consumer Price Index shows “rent of primary residence” rising in October at 1.1% annual rate. Local rents fell 0.2% last year — first decline since the mid-1990s. But that trend turned quickly, as regional rents rose at an annual rate of 1.4% in 2011′s first half. We’ll note that October’s advance compares to the local reners’ CPI rising at an annual rate in September of 1.3% and is the smallest rental inflation rate since January. (SoCal rents have averaged 1.1% annual rate of gain the past three years and 4.4% over the past decade. Since 1979, SoCal rents have averaged 4.8% annualized increases.)

UCLA: O.C. home prices to rise 35%

Posted: November 16th, 2011

ARTICLE, OC REGISTER

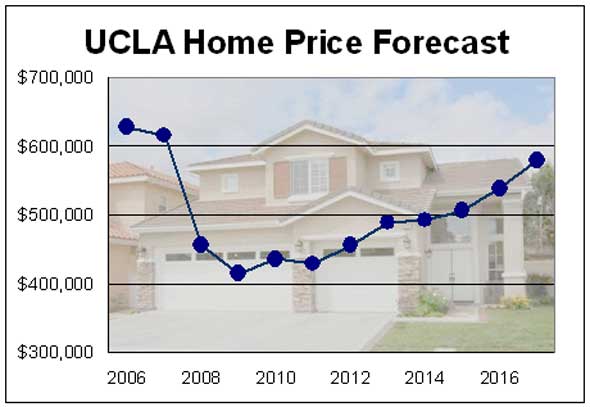

If you bought a home during housing’s price peak in 2006 or 2007, don’t expect to see its value to get back to what you paid for it by 2017.

But if you buy this year, you could see your home’s value rise around 34.6% within the next six years — a gain of about $149,000 on a median priced home.

That’s the forecast for Orange County home prices unveiled this week by the UCLA Anderson Forecast.

California Foreclosure Activity Back Up

Posted: October 21st, 2011

PRESS RELEASE, DATA QUICK

After dropping to a three-year low in the second quarter of this year, the number of California homeowners being pulled into the foreclosure process snapped back to prior levels over the last three months, a real estate information service reported.

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Posted: October 17th, 2011

PRESS RELEASE, DATAQUICK

Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

Southland office rents, occupancy rates stay low

Posted: October 16th, 2011

ARTICLE, LA TIMES

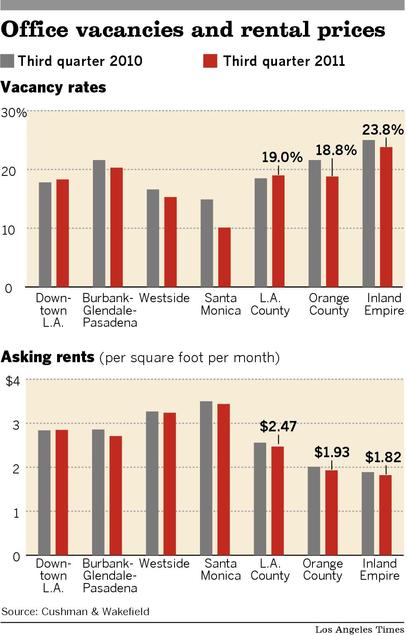

It was another stale quarter for most Southern California office landlords as rents and occupancy remained stalled at low levels, except in neighborhoods favored by technology and digital media companies.

The soft market was a boon for tenants willing to sign leases. But few companies are finding the need to expand their quarters with the economy tepid and hiring at a standstill.

Business bosses “have gone on a personnel diet,” said Jim Kruse of CBRE Group Inc., the real estate brokerage formerly known as CB Richard Ellis. “They are trying to get through and maintain as much market share as they can without putting a lot of cash into operations.”

Q4 2011 Investor Update and Outlook

Posted: October 3rd, 2011

OPINION, INVESTOR UPDATE, SREP

Given the extraordinary focus on the economy and financial markets in just about every nook and cranny of the media, I figured that I would start this quarterly missive a little differently – and more optimistically – by reviewing the assets in the Pacific Value Opportunities Fund I portfolio and our future plans. As you will recall, the premise of the Fund was that rental housing – both apartments and single-family residences converted to rental property – had a very bright future given short-term and secular market trends. Previous quarterly reports have laid out our thoughts on this matter, and recent economic data only reinforces these beliefs.

Southland home sale report

Posted: September 19th, 2011

PRESS RELEASE, DATAQUICK

Southland August Home Sales Climb, Median Price Falls Again

Southland Housing Market’s Vital Signs Remain Weak

Posted: August 18th, 2011

Southern California home sales fell last month to the lowest level for a July in four years, though the decline from a year earlier was the smallest in 13 months. The drop in sales from June was more pronounced, especially for $500,000-plus homes, as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, a real estate information service reported.

Southland Home Sales Quicken, Median Price Highest This Year

Posted: July 13th, 2011

PRESS RELEASE, MDA DATAQUICK

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges, a real estate information service reported.

Investors to the rescue of housing market

Posted: July 13th, 2011

ARTICLE, LA TIMES

Real estate investors will outnumber traditional borrowers 3 to 1 during the next two years, a new survey says, helping clear millions of repossessed properties from banks’ books and pave the way for a recovery.

May Southern California Home Sales Report

Posted: June 26th, 2011

ARTICLE, MDA DATAQUICK

Southern California home sales held at a three-year low last month amid a sluggish move-up market and record-low sales of newly built homes. The median sale price fell year-over-year by the largest amount in 20 months as buyer uncertainty, tight credit and lackluster hiring continued to restrain housing demand, Dataquick reported.

For Apartments, a Hot Winter

Posted: January 14th, 2011

![]()

ARTICLE, WALL ST JOURNAL

The nation’s apartment market remained robust in the fourth quarter with vacancies falling below 7% for the first time in two years, according to new data.

Southland Home Sales Dip; Prices Change Little

Posted: December 15th, 2010

La Jolla, CA—Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. The median price paid for a home rose above a year earlier for the 12th consecutive month, though November’s gain was the tiniest yet, a real estate information service reported.

Luxury home prices are still heading down

Posted: December 14th, 2010

![]()

While Southland housing values overall have rebounded from recent lows, those in the upper end of the market may not yet have hit bottom. Some experts don’t see a turnaround for at least another year.

Los Angeles apartment renters returning to market

Posted: December 1st, 2010

![]()

ARTICLE, LA TIMES, 11.30.2010

Many Los Angeles County renters who doubled up during the recession are regaining the confidence to get their own apartments, a real estate brokerage said Tuesday.

The “de-bundling” of households prompted leasing of empty units in the third quarter, fueling one of the strongest periods of apartment absorption on record in the county, real estate investment company Marcus & Millichap said in an apartment industry report.

Southland Home Sales Fall, Prices Flat

Posted: November 19th, 2010

ARTICLE, MDA DATAQUICK, 11.18.2010

La Jolla, CA—Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives. The median price paid for a home rose on a year-over-year basis for the 11th consecutive month, but at this year’s slowest pace, a real estate information service reported.

Southern California Home Sales Fall in August; Median Price Dips

Posted: September 15th, 2010

ARTICLE, DATAQUICK, 10.15.2010

Southland home sales fell last month to the lowest level for an August in three years and the second-lowest in 18, the result of a worrisome job market and a lost sense of urgency among home shoppers. The median price paid remained higher than a year ago but continued to erode on a month-to-month basis

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Penthouse Offices Sit Vacant as High Flying Corporate Opulence Goes Out of Style

Posted: July 19th, 2010

![]() Offices at the top are going empty

Offices at the top are going empty

ARTICLE, LA TIMES, 07.19.2010

Penthouse floors are vacant in some of the best office buildings in Los Angeles County, a sign of the troubled economic times and the gulf between asking prices and what tenants are willing to pay.

Fannie Mae gets tough on homeowners who walk away

Posted: June 24th, 2010

![]()

ARTICLE, LA TIMES, 06.24.2010

The mortgage giant plans to go to court against those who can afford to make their payments but decide it’s not worth it. It also will limit their access to future loans.

LA Times: COMMERCIAL REAL ESTATE QUARTERLY

Posted: April 20th, 2010

![]()

ARTICLE, LA TIMES 04.19.2010

Vacancies are increasing and rents are falling. The trend is tough for landlords but great for tenants who are looking for new space or negotiating to renew their existing leases.

More Incremental Gains for Southland Real Estate Market

Posted: April 19th, 2010

ARTICLE, DATAQUICK, 4.13.2010

Home sales and prices continued their steady but pokey climb up from the bottom in Southern California last month as buyers scrambled to take advantage of low prices and low mortgage interest rates.

Commercial property buyers and sellers remain far apart

Posted: April 12th, 2010

![]()

ARTICLE, LA Times 04.05.2010

Despite some improvements in the economy, potential buyers and sellers of Los Angeles-area commercial real estate are still far apart in their perceptions of what prices should be, an investment bank said Monday.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy