Research

Here you can find articles & video with the latest news that's important to real estate investors, charts to make the information clear and papers from the best minds in the industry. Click on the headlines to open the full story.

Interest rates are low, but it’s still hard to get a mortgage

Posted: October 10th, 2012

WASHINGTON — With 30-year mortgage rates hitting new lows and recent borrowers’ payment performance the best by far in decades, you’d think that banks and other lenders might be loosening up on their hyper-strict underwriting standards.

But new national data from inside the industry suggest this is not happening. In fact, in some key areas, standards appear to be tightening even further, and the time needed to close a loan is getting longer.

Uncle Sam wants you to rent out its foreclosed homes

Posted: March 4th, 2012

NEW YORK (CNNMoney) — Want to become a landlord in one of the nation’s hardest-hit foreclosure neighborhoods? Well, Uncle Sam has a deal for you.

Fannie Mae (FNMA, Fortune 500) will offer up nearly 2,500 distressed properties in eight locations to investors who are willing to buy them in bulk and rent them out for a set number of years.

The properties, which are located in Atlanta, Phoenix, Las Vegas, Los Angeles/Riverside, and three Florida regions, include all types of housing units, from single-family homes to co-op apartment buildings.

Q&A: What Homeowners Need to Know on the Deal

Posted: February 10th, 2012

![]()

The $25 billion foreclosure settlement unveiled Thursday is expected to help many borrowers who are struggling to make their loan payments, owe more than their homes are worth or have lost their homes to foreclosure.

But the rules of the deal are complicated and banks have three years to meet their obligations.

The questions and answers below should help borrowers figure out if they qualify for help and what to expect from the process.

Who does the settlement cover?

Mortgage deal could bring billions in relief

Posted: February 10th, 2012

In the largest deal to date aimed at addressing the housing meltdown, federal and state officials on Thursday announced a $26 billion foreclosure settlement with five of the largest home lenders.

The deal settles potential state charges about allegations of improper foreclosures based on robosigning, seizures made without proper paperwork.

Freddie Mac: Rental housing rises in 2011

Posted: October 21st, 2011

![]()

ARTICLE, HOUSINGWIRE

Despite the most affordable buying market in decades, households across the country are slowly choosing rentals versus homeownership, signaling a positive economic trajectory for the multifamily sector, according to Freddie Mac’s October 2011 economic outlook report released Monday.

FHA multifamily loan originations at record high

Posted: September 12th, 2011

ARTILCE, REUTERS

The Federal Housing Administration has backed a record $10.5 billion in multifamily rental housing loans during its 2011 fiscal year, the agency said on Tuesday.

The rise in loans for multifamily units reflects an underlying trend in demand for rental property.

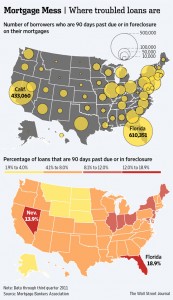

Foreclosure reforms may be coming to a head

Posted: August 18th, 2011

Getting banks, investors and borrowers together to work out a solution that benefits them all is the most promising idea to emerge since the housing market first crashed.

Mortgage Rates Keep Falling

Posted: August 18th, 2011

ARTICLE, CNN

Just when it seemed mortgage rates weren’t going to get any lower, they started testing new lows.

In the tumultuous days following Standard & Poor’s debt downgrades, rates on 30-year fixed mortgages fell to 4.32%, down from 4.39% last week and closed in on a record low of 4.17% set last November, according to Freddie Mac’s Primary Mortgage Market Survey.

Rates on 15-year fixed mortgages set a new record for the second week in a row, falling to 3.5%, down from 3.54% last week.

Freddie Mac sells record number of REO in 1Q

Posted: May 10th, 2011

![]()

ARTICLE, HOUSINGWIRE

Freddie Mac sold roughly 31,000 previously foreclosed and repossessed homes in the first quarter, a new record for the company as both government-sponsored enterprises shed inventory from the end of last year.

Blackstone Leads Buyout Firms Expanding Into Property

Posted: April 22nd, 2011

ARTICLE, BLOOMBERG

Blackstone Group LP and Carlyle Group are leading a record number of private-equity managers aiming to raise real estate funds as the world’s top buyout firms accelerate an expansion beyond corporate takeovers.

Blackstone, the biggest private-equity firm, is planning to raise its next real estate fund, with a target of about $10 billion, later this year. Carlyle is in the process of raising a new fund for U.S. property deals, said a person briefed on the plan who asked not to be named because the fund is private.

The two are among 439 private-equity real estate funds seeking a combined $160 billion, the largest number on record, according to London-based researcher Preqin Ltd. KKR & Co.

Sequoia Real Estate Partners, Q1 2011 Investor Market Summary and Forecast

Posted: April 5th, 2011

OPINION, SREP

In the same week the sobering Case-Shiller housing data is released, Fortune Magazine’s cover reads, “The Return of Real Estate”, with the accompanying story captioned “Real Estate: It’s Time to Buy Again”. And, if that were not enough to cause confusion, my beloved Costco Connection (yes, I am an Executive Member) runs a story, “What’s Up with Real Estate”, the article’s central premise being that now might be a good time to buy a home.

Indeed, 2011 has thus far been a “head scratcher,” with nobody, especially economists and the so-called market analysts able to agree on what all this contradictory information means. Frankly, I am not sure I am in any better position to do so. However, what I can say, without equivocation, is that my views on the residential rental market, including the buy/hold/rent strategy of single-family residences, remain unchanged. With the continued fear and uncertainty in the real estate market I am just as bullish as I was back in 2010, when we started the Sequoia Fund.

Housing prices to hit bottom this spring: Freddie Mac

Posted: January 14th, 2011

ARTICLE, REUTERS

U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

Posted: December 31st, 2010

![]()

ARTICLE, WALL ST JOURNAL, 12.28.2010

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

Home Prices in U.S. Will `Bounce Along the Bottom,’ Case Says

Posted: December 1st, 2010

ARTICLE, BLOOMBERG, 11.30.2010

U.S. home prices are unlikely to fall much further in the next year even after a “discouraging” report on values in September, said Karl E. Case, the co-creator of the S&P/Case-Shiller Index.

“If I were betting even odds, I’d bet that we don’t have much further decline, but that we bounce along the bottom,” Case, a retired professor of economics at Wellesley College, said today in a Bloomberg Television interview on “Surveillance Midday” with Tom Keene.

In Bond Frenzy, Investors Bet on Inflation

Posted: October 28th, 2010

![]()

ARTICLE, NY TIMES, 10.25.2010

The investors who took part in the $10 billion auction are betting that inflation, now at about 1 percent annually, will rise to a level that more than compensates for the premium they paid.

Home Prices in U.S. Cooled in July After Tax Credit Expired

Posted: September 28th, 2010

ARTICLE, BLOOMBERG, 09.28.2010

The S&P/Case-Shiller index of property values increased 3.2 percent from July 2009, the smallest year-over-year gain since March, the group said today in New York. The gauge is a three- month average, which means the July data are still being influenced by transactions in May and June that may have benefitted from the government homebuyer incentive.

U.S. Housing Starts in August Topped Forecasts

Posted: September 21st, 2010

![]()

ARTICLE, NY TIMES, 09.21.2010

Housing starts in the United States increased more than expected in August to their highest level in four months and permits for residential construction also rose, government data showed on Tuesday, suggesting that the embattled market was starting to stabilize following the end of a tax credit.

US home repossessions spike in August to highest level since start of mortgage crisis

Posted: September 16th, 2010

ARTICLE, ASSOC. PRESS, 09.16.2010

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can’t afford to simply dump the properties on the market.

How Wall Street Reform Benefits Foreclosure Buyers

Posted: September 13th, 2010

![]()

ARTICLE, REALTYTRAC, 09.13.2010

In many markets there’s a fusion of discounted acquisition costs, historically-low interest levels, falling vacancy rates and rising rental rates. This doesn’t mean specific real estate investments are attractive everywhere or for all buyers, but in areas where such trends exist and seem likely to continue this may well be an unusually good time to consider short sales and foreclosures, two ways to acquire discounted real estate.

FDIC sells another $760 million in REO

Posted: September 3rd, 2010

![]()

ARTICLE, REO INSIDER, 09.03.2010

Mariner Real Estate Management (MREM), a real estate investment and management firm based in Kansas, closed a deal to acquire a $760 million portfolio of residential and commercial loans and REO properties from the Federal Deposit Insurance Corp. (FDIC).

Private venture to buy $1.7bn portfolio of REO properties and nonperforming loans

Posted: August 18th, 2010

![]()

ARTICLE, REO INSIDER, 08.18.2010

PMO Loan Acquisition Venture, a partnership among several firms, will purchase a $1.7bn portfolio of nonperforming loans and REO properties previously owned by AmTrust Bank before it failed in December 2009.

Southern California Home Sales and Median Price Dip in July

Posted: August 18th, 2010

ARTICLE, MDA DATAQUICK, 08.18.2010

Southland home sales saw their biggest year-over-year drop in more than two years last month as the market lost most of the boost from the federal home buyer tax credits. The median sale price dipped for the second month in a row, the result of a shaky economic recovery, continued uncertainty about jobs, and the expiring tax breaks, a real estate information service reported.

Flooded with housing inventory, Freddie Mac REO sales surge despite foreclosure alternatives

Posted: August 10th, 2010

![]()

ARTICLE, REO INSIDER, 08.10.2010

The number of Freddie Mac “foreclosure alternatives” completed in the first half of 2010 increased 123% from the same period in 2009, but for all its efforts, the government-sponsored enterprise (GSE) is still taking on record numbers of housing inventory.

Fed sees weakening of western real estate market from spring

Posted: July 29th, 2010

![]()

PAPER, FEDERAL RESERVE, 07.28.2010

Demand for housing in the District appeared to deteriorate somewhat from the previous period, while demand for commercial real estate was largely unchanged at very low levels. The pace of home sales remained mixed across areas but appeared to decline on net, even as home prices edged up further in some parts of the District.

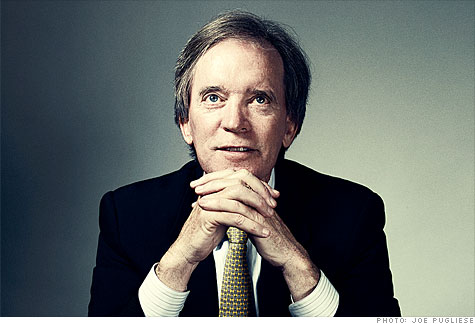

What the bond guru sees coming

Posted: July 20th, 2010

ARTICLE, MONEY, 07.20.2010

The important thing to recognize is that if you’re looking for 10% returns (from stocks or bonds) to pay for college or to retire on, they’re not going to be there. We’ve been an asset-growth-based economy for so long. We’ve skimmed off the top, living off second and third mortgages on homes, and capital gains on stocks and even on bonds. Now instead of having money work for you, you’ve got to work for your money.

U.S. Home Construction Declined 5% in June

Posted: July 20th, 2010

![]()

ARTICLE, NY TIMES, 07.20.2010

“Financial distress on the part of many households, ongoing labor market weakness and vicious competition from an enormous overhang of existing homes all point to a very tough slog for homebuilders in the months and quarters ahead,” Joshua Shapiro, the chief United States economist for MFR Inc., said

Sales of U.S. New Homes Plunged to Record Low in May

Posted: June 23rd, 2010

![]()

ARTICLE, BLOOMBERG, 06.23.2010

The median sales price decreased 9.6 percent from the same month last year, to $200,900, today’s report showed.

Purchases dropped in all four U.S. regions last month, led by a record 53 percent drop in the West.

U.S. Housing Starts Declined 10% in May

Posted: June 16th, 2010

![]()

ARTICLE, ASSOC. PRESS, 06.16.2010

Home construction plunged in May to its lowest level since December, as builders scaled back after a federal tax credit to lure buyers expired.

Don’t get buffeted by changing winds. The housing recovery is real.

Posted: May 28th, 2010

![]()

ARTICLE, KIPLINGER, 05.2702010

The housing market rebound that began a year ago is very much intact, so don’t get sidetracked or confused by recent and almost unprecedented volatility due mostly to on-again, off-again tax incentives.

Think housing is recovering? Think again.

Posted: May 25th, 2010

![]()

ARTICLE, FORTUNE, 05.25.2010

we’re coming off of an artificial bump from the first time home buyer credit, which expired last month. He predicts the second half of this year will see sluggish economic growth and that housing prices, at best, will be flat for the next few months, while commercial real estate “is likely to see significant declines.”

Chart of Sales Spike as a Funtion of Expiring Tax Credit

Posted: May 18th, 2010

U.S. Mortgage Program Stalling, Data Shows

Posted: May 17th, 2010

![]()

ARTICLE, NY TIMES, 05.17.2010

“The program is dying,” the blog Calculated Risk concluded after examining the data.

But the number of new trials is beginning to level off, leading to worries that the potential pool of eligible households is rapidly diminishing. Furthermore, many borrowers have a great deal of difficulty making it out of the trial period. The number of canceled trial modifications is nearly as large as the number of permanent modifications.

Housing Optimists Are “Not Paying Attention” to the Facts, Says Dean Baker

Posted: May 13th, 2010

ARTICLE & VIDEO, YAHOO FINANCE, 05.13.2010

“I think we’re going to see a big fall-off in purchases for the rest of 2010 and even into 2011,” Baker says. “So the idea that somehow the market is stable, that housing prices will rise anytime soon – it’s really hard to make a case for that.”

Housing’s Dark Cloud

Posted: May 10th, 2010

![]()

ARTICLE, BOSTON HERALD, 05.10.2009

Housing experts say the end of the housing tax credit – which could have spurred as much as 70 percent of sales in the last four months – and thousands of homes facing foreclosure, could throw cold water on rising prices and sales. This perfect storm may set up a “double dip” housing recession

METRO FORECLOSURE HOT SPOTS BUCK NATIONAL TREND IN FIRST QUARTER WITH ANNUAL DECLINES IN FORECLOSURE ACTIVITY

Posted: May 2nd, 2010

![]()

ARTICLE, REALTYTRAC, 05.02.2010

“The decreasing foreclosure activity in some of the nation’s top foreclosure hot spots in the first quarter is largely the result of government intervention and other non-market influences, and not a sure signal that those areas are out of the woods yet when it comes to foreclosures,”

The Coming Wave of Option-ARM and Alt-A Mortgage Resets

Posted: April 26th, 2010

![]()

STRATEGY, SEQUOIA RESEARCH, 4.22.2010

“We presently find ourselves in the relative calm between two waves.”

Watchdog panel says Obama plan to ease foreclosure crisis does too little, comes too late

Posted: April 16th, 2010

ARTICLE, AP, 4.14.2010

A watchdog panel overseeing the financial bailouts says the Obama administration’s flagship mortgage aid program lags well behind the foreclosure crisis and leaves too many families out.

New wave of foreclosures by end of 2010 is feared

Posted: April 12th, 2010

![]()

ARTICLE, LA TIMES 02.16.2010

Experts fear that a new wave of foreclosures will hit this year as prolonged unemployment makes it difficult for millions of homeowners to pay their mortgages — and many of them aren’t likely to get much help from a federal program aimed at keeping them in their houses.

As Fed’s mortgage purchases end, eyes turn to investors

Posted: April 12th, 2010

ARTICLE, LA Times March 31, 2010

The government’s $1.25-trillion program to prop up the housing market by purchasing mortgages came to an end Wednesday — in a small, messy room at the Federal Reserve Bank of New York with four desks and a Nerf basketball hoop.

View The Menace of Strategic Default

Posted: April 3rd, 2010

![]()

ARTICLE, CITY JOURNAL, 04.15.2010

Designing Loan Modifications to Address the Mortgage Crisis and the Making Home Affordable Program

Posted: December 3rd, 2009

PAPER, FEDERAL RESERVE BANK OF D.C., 12.15.2009

This paper presents preliminary findings and is being distributed to economists

and other interested readers solely to stimulate discussion and elicit comments.

Categories:

ArticlesCharts

Most Recent News

Opinion

Papers

Sequoia Favorites

Sequoia Strategy